The heart of economics: how to move money around

At 11Onze we want people to become financially empowered. You can start doing so with the series El Diner.

El Diner is an animated series that you can find in La Plaça, with the aim of explaining the world of economics in an entertaining and simple way. The series consists of nine chapters, with lessons such as “The history of money”, “The creation of money” and “The concentration of wealth”. At the end of each chapter, there is a questionnaire to check if we have understood all the concepts. But what is the definition of money and of the economy?

Money is the heart of our economy: it is the tool that enables us to exchange goods (the food we buy, a house, a computer, or a bicycle) and services (the time we pay for the time someone has spent doing something: a doctor, a lawyer, a schoolteacher, a mechanic…) by means of a currency.

This currency usually takes the form of a material central currency (in the form of banknotes and coins, the money we can touch and carry in our wallets), also known as manual, liquid, or cash currency. These coins are manufactured at the European Central Bank (ECB), as well as enabling the economy to function.

The other currency with which we can pay for goods and services is scriptural or secondary currency, i.e. our current account numbers, which do not exist physically and only exist within our bank’s computerised accounting system. This money is managed by private commercial banks, those that work directly with the public and that we find in our city or in our neighbourhood. They are the ones that distribute the coins and banknotes created by the ECB.

Satisfying supply and demand

If we follow the lesson “Learn to evaluate the economy”, in the learning section of La Plaça, we will also understand why the economy is a system of distribution and management of limited resources to satisfy people’s demands.

But the term economy goes beyond that, as we all contribute to making it possible. Our actions are reflected in what we consume, the hours we work, the goods we own, the money we can save. The sum of the actions taken individually by all citizens is the fate of the global economy. In other words, the economy is the result of our choices.

We hope that this short introduction to the El Diner series, and the summary of its concepts, has made you want to learn about the economy and the world of finance. As they say: “In life, sometimes you win, sometimes you learn”.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

After the good reception of 11Onze Segurs home insurance, our community asked us to offer a new product to insure their vehicles. We got down to work, and now we can present the zero-mile insurance.

The team responsible for 11Onze Segurs is always analysing the various options offered by the insurance market to find products that meet the level of quality, service and transparency that we demand of ourselves and that are aligned with the values of 11Onze.

With our home insurance proposal, we demonstrated that it was possible to offer a good product at a good price and in a socially responsible way. Now, at 11Onze Segurs we also make it easy for you to take out the best insurance for your vehicle.

Zero-mile insurance

To offer great customer service, in our own language and from here, to meet the needs of customers in the Països Catalans. That is why 11Onze Segurs has reached an agreement with the Catalan mutual company Mussap. Born in 1932 in Barcelona as Mútua d’Accidents del Treball Agrícola and 90 years later still offering a quality service with a physical presence in the Catalan territory.

A direct benefit for the 11Onze community

Unlike other entities, a mutual insurance company such as Mussap is not for profit, the mutual members are co-owners and the profits are reinvested in the same entity to improve the services and the contributions of its members. In addition, 11Onze has obtained an additional 5% discount for the community if you take it out through 11Onze Segurs.

The most complete insurance policies

We offer you three types of third-party insurance (third-party, third-party with windscreen cover and extended third-party), but unlike other insurers, we include medical assistance, appeals against fines and travel assistance from the most basic option. If you are interested in Comprehensive insurance, let us know and an 11Onze Segurs agent will contact you.

11Onze customer service is always by your side

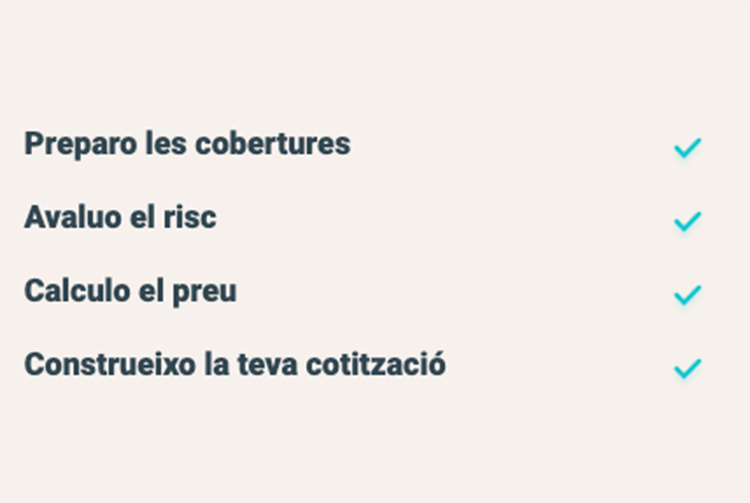

Although we provide an insurance simulator so that you can simply and swiftly obtain a quote by yourself, 11Onze agents are available 24 hours a day to answer any questions or resolve any doubts you may have. Also, you still have the option of having an agent do the simulation for you.

If you want to discover the best insurance for your vehicle, go to 11Onze Segurs, insurances with 11Onze values.

UK News Group and New York-based Litigation Finance Journal, leading publications covering business and finance news, have echoed the launch of Litigation Funding’s latest product, by 11Onze Recommends.

“On the back of its successful launch of litigation funding, 11Onze Recommends, Europe’s leading community fintech has added housing litigation to enhance its funding offer. 11Onze has also lowered the entry requirement for the product to €10,000 (from €25,000) to widen its access to more members. The housing claims are for housing disrepair, especially in social housing. “

You can read the original articles at:

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

We spoke to 11Onze’s CEO, James Sène, with an eye on the Investors’ Information Assembly to be held on 11 October. Now that El Canut has been up and running for two years, we analyse the situation and the next steps to be taken by an entity that many have given up for dead several times.

“It’s been a tough year for fintechs around the world, we know that. What have we done? We’ve cut our costs, but we’ve kept working,” explains James Sène on 11Onze’s Podcast. “The news from 11Onze is that it’s all still working,” he stresses.

We haven’t heard from 11Onze’s CEO for months, as the company has strategically kept a low communication profile. Working, resizing and consolidating an entity that is in optimal conditions to face the growth of the coming years. As James Sène explains: “We are where we wanted to be. We have not lost sight of our objective, which is to be dominant in the region in 5 years. But sometimes you have to adapt to reach your goal.

Thanks to the work we’ve done, we can see the results in the current accounts or products such as gold, insurance, Monthly Return, Litigation Funding or cryptocurrencies… but also in La Plaça where we have consolidated 15,000 unique monthly users who choose 11Onze Magazine to find out about the economy and everything that revolves around money. “We’re past that moment,” says James Sène, “when people asked us what a fintech was. Now everyone knows what we do.

11Onze continues

All this is happening in an economic context in which large corporations are suffering and in which, in the financial sector, we have seen the disappearance of Crédit Suisse or the debacle of Silicon Valley Bank. Have we been left for dead? James Sène replies: “If we are dead, that’s alright. Two years ago, they said 11Onze was impossible. Now that we exist, they say we’re finished. When it becomes clear that we’re not, it will be something else. But in this country, we have been hearing for 10 or 15 years that there will be a financial institution in the country, and we are still waiting for the Institut Català de Finances (ICF). All the initiatives that there have been are no longer in place or have taken a different shape, and 11Onze continues”.

On 11 October, therefore, investors will find out what 11Onze has done with their contribution, what is the exact picture of the company’s present and future and also what has happened during this time. “We have spoken to everyone in this country,” says James Sène, “and the time has come to explain everything. There are things that we have not been able to explain in the documentaries for legal and strategic reasons. Now is the time.

You can listen to the conversation with the CEO of 11Onze about the Investor Briefing on the 11Onze Podcast.

We continue to expand the savings options for the community. After the good reception of Litigation Funding, the same provider proposes Monthly Return, how to make your savings generate an income every month.

A few months ago, 11Onze Recommends offered a savings product from a British provider, Litigation Funding. With an initial contribution of 10,000 euros, you could earn 9% at the end of the contract, i.e. 1 or 2 years depending on the case and the amount.

Since then, the community has demanded a product that would provide a monthly income from savings and, for this reason, we have worked on a new product exclusively for the 11Onze community. This is Monthly Return, designed for large savers and companies that contribute a minimum of 100,000 euros. Customers will see their savings grow by 22.5% over the duration of the contract (24 months). However, it is important to bear in mind that the monthly income begins to arrive after the seventh month.

Farhaan Mir, 11Onze’s Chief Financial Officer, says: “We listened to our community and tried to bring in what fits their needs. People had asked for monthly returns, so we talked to our supplier to get them on board”.

In this sense, the 11Onze Recommends slogan will have to be updated. Until now, we used to say If it doesn’t exist, we create it. If it exists, 11Onze Recommends. In this case, 11Onze has asked for this exclusive product to be created for our community.

There is no other product that offers these returns, combining security and liquidity.

So, in a context where banking remunerates savings very poorly and where inflation continues to depreciate money, Monthly Return is shaping up as an excellent option for those who want to make their savings profitable. And the returns are very high, 22.5% accumulated in 2 years is a figure unparalleled in the market. According to Mir, “As far as I know, there is no other product that offers these returns, combining security and liquidity”. All this while remembering that the initial capital is covered by insurance, so it is a low-risk product.

How is it possible?

For more information about Monthly Return you can visit the 11Onze Recommends webpage and if you are interested, you can contact the provider. To receive all the information you need to complete the self-certification as a qualified investor. It should be noted that completing the self-certification does not commit you to carry out the operation, as explained in this article.

Savings for all pockets

With this new 11Onze Recommends product, 11Onze offers saving products for all budgets. From 3,000 euros you can participate in Gold Seed or Gold Patrimony, from 10,000 euros with Litigation Funding and now Monthly Return is aimed at savers and businesses with capital from 100,000 euros. As we at 11Onze have been warning for some time, all to avoid losing purchasing power in a context of inflation that has become structural.

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

Leading publications in the international fintech community echo the launch of Litigation Funding, which 11Onze recommends. TheFintechTimes and FintechFinanceNews from the UK are joined for the first time by OxNews from China and Technewscomboost from India.

“11Onze, a community fintech in Europe, enters the litigation funding arena in the UK with Litigation Funding from 11Onze Recommends, which promises to shield savings from inflation devaluation. Explaining the rationale behind the launch, James Sène, chairman, said, “Our litigation funds are mainly focused on lawsuits against banks. This not only helps in seeking justice; it also offers great returns on your savings above inflation thanks to the compensation the banks will have to pay.””

You can read the articles and mentions here:

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

We are rolling up our sleeves to build 50 Shelter Schools for 1,750 children affected by last February’s earthquakes in Turkey and Syria. 11Onze has a vocation of operational transformation, that’s why we are launching a new service: 11Onze Rolls Up its Sleeves.

In journalism, we often talk about news waves. That is to say, for a while, a topic is trending, it is talked about everywhere. But little by little it fades away, and a new topic comes along and occupies the news window, repeating the process. Therefore, the news media is not interested in explaining what is happening in the world or in ranking the importance of the issues to be solved. They simply compete for clicks.

But this does not mean that the problems go away

On 6 February 2023, an earthquake measuring 7.8 on the Richter scale devastated parts of Turkey and Syria. And when there is such a catastrophe, the media all over the world cover the story. Until the death and injury count is over. There is no more news when there are no more aftershocks and the casualty rates are no longer moving up. Therefore, there is no more news and the topic changes.

It’s time to roll up our sleeves

UNICEF put the number of children displaced by the earthquakes at 850,000. Children living in refugee camps, trying to regain some semblance of normality. 11Onze is rolling up its sleeves and will help them by providing Shelter Schools so that they can return to school as soon as possible. At 11Onze we know that education is the most powerful tool to create a future. It gives students the chance to recover lost routines, for a few hours, it will take their minds off from the drama they are immersed in, and it will give them hope and tools. Will you roll up your sleeves? Someone has to do it!

How will we do it? With Better Shelter!

We want to raise 100,000 euros to build 50 shelter classrooms, which will help 1,750 students. We are perfectly aware that we won’t solve 100% of the problem, but if we don’t start rolling up our sleeves, nothing will be solved.

For this reason, 11Onze has established a partnership with the Swedish Better Shelter Foundation, which builds shelters designed by the Ikea Foundation. They are sturdy Shelter Schools, built to last, which can be assembled in two hours and cost around 2,333 euros. From 11Onze Rolls Up its Sleeves you can make a donation of any amount you wish. The money will be transferred in the aggregate to Better Shelter so that it can act on the ground. 11Onze will monitor the destination and impact of the contributions made by the people of La Plaça, regularly updating them on the progress.

If you can, give us a hand. 11Onze Rolls Up its Sleeves. Because someone has to do it.

11Onze Rolls Up its Sleeves is 11Onze’s service to help other people around the world.

On 22 April 2021, we launched La Plaça, the town square where the 11Onze community is located. Since then, what have we done?

La Plaça of 11Onze was born with the aim of helping all citizens to understand and manage their money more efficiently. For this reason, financial education and the creation of useful products for the community have always been at the heart of La Plaça.

Innovative products

The first product, with free registration, was La Plaça. A content platform for financial information and education recognised with numerous international awards and has more than 1,000 articles, 800 videos, 150 podcasts and 35 courses. Currently, La Plaça already has 15,000 registered users and more than 12,000 unique monthly visitors.

Next, 11Onze launched the El Canut application, which lets you open safe accounts, anticipating the turbulence that traditional banking is currently experiencing. El Canut also allows free instant transfers within the 11Onze community, makes it possible to use Mastercard cards, add other bank accounts thanks to PSD2 regulations and can be integrated with Google Wallet and Apple Pay. Since its launch in October 2021, El Canut has not had any security issues and has been recognised internationally.

Along the same lines, in order to offer the community the possibility to protect their savings by gaining purchasing power, Preciosos 11Onze was created. For the first time, a financial institution facilitates aggregate purchases of physical gold. This service has become one of the flagships of 11Onze.

Steady growth

Since then, the product portfolio has grown steadily. 11Onze Recommends has provided high-return, low-risk savings products such as Guaranteed Funds and Litigation Finance. 11Onze Segurs offers socially responsible insurance at a very competitive price. Our marketplace has also provided products that allow saving and living in a more sustainable way, such as Tappwater water filters or Natulim detergent, with special conditions for the community.

Other added services are 11Onze School, 11Onze Check or 11Onze at Home, which allows 24-hour video call attention. All are available, at no extra cost, for La Plaça users.

Next steps for 11Onze

After 2 years, the most complicated stage for any start-up, the obvious question is… What next? Well, 11Onze is looking to the future with great optimism, with a community, a company and workers ready to grow the first community fintech in the Catalan countries. 11Onze is ready to offer more innovative products and scale its business with the security that comes from good results. We are ready!

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut on Android and Apple and join the revolution!

Make a profit by buying and selling the king metal. A way to make savings grow in times of uncertainty: at 11Onze, it rains golden ears.

11Onze takes another step forward in its desire to offer its community safe products that allow them to gain purchasing power. And it does so, once again, with gold. At a time of dangerous turbulence in the international banking system, gold is once again one of the safe havens par excellence.

What is Gold Seed?

Preciosos 11Onze’s new product is designed to generate profits. The idea is simple: the customer buys as much physical gold as he wishes, but it is neither sent to him nor held in custody. The gold will be used for one year to buy and sell at the best times of the market. After the year, everything is liquidated and the harvest is delivered to you!

This is why it is called Gold Seed, because you buy it with the aim that it will grow and bear fruit. The economic context gives good prospects for the purchase and sale of physical gold, although the final results will depend on the evolution of the market. In any case, as can be seen in the attached table, in recent years this product has already generated profits far in excess of those achieved with investment funds. A recent study shows that in 15 years (2006-2021) Spanish investment funds have generated an average return of 1.91%.

Now is the time for savers!

Protecting savings with physical gold has been one of 11Onze’s main contributions to its community, and now the range of products is expanding. Therefore, in the face of volatility, high inflation and the growing crisis of confidence in the banking system, gold is once again strengthening its position as a safe-haven asset. Now is the time for savers.

You will find all the information about Gold Seed at Preciosos 11Onze.

11Onze Recommends Finança Litigis, a product that allows you to profit from the compensation that banks in the UK have to pay for having committed wrongdoing against their clients. We explain how it works.

A few weeks ago, 11Onze Recommends presented Finança Litigis to its community for the first time. Now, it is time to publicise this amazing product throughout La Plaça. What is it about? Profit by fighting the abuses committed by the big banks.

The first location to do this is the UK where, for years, banks sold personal insurance policies to their customers using all kinds of malpractice. Those abuses have already been condemned by the courts and have opened the door to more than 60 billion euros in claims with a success rate of more than 90%. Shocking figures for the banking industry.

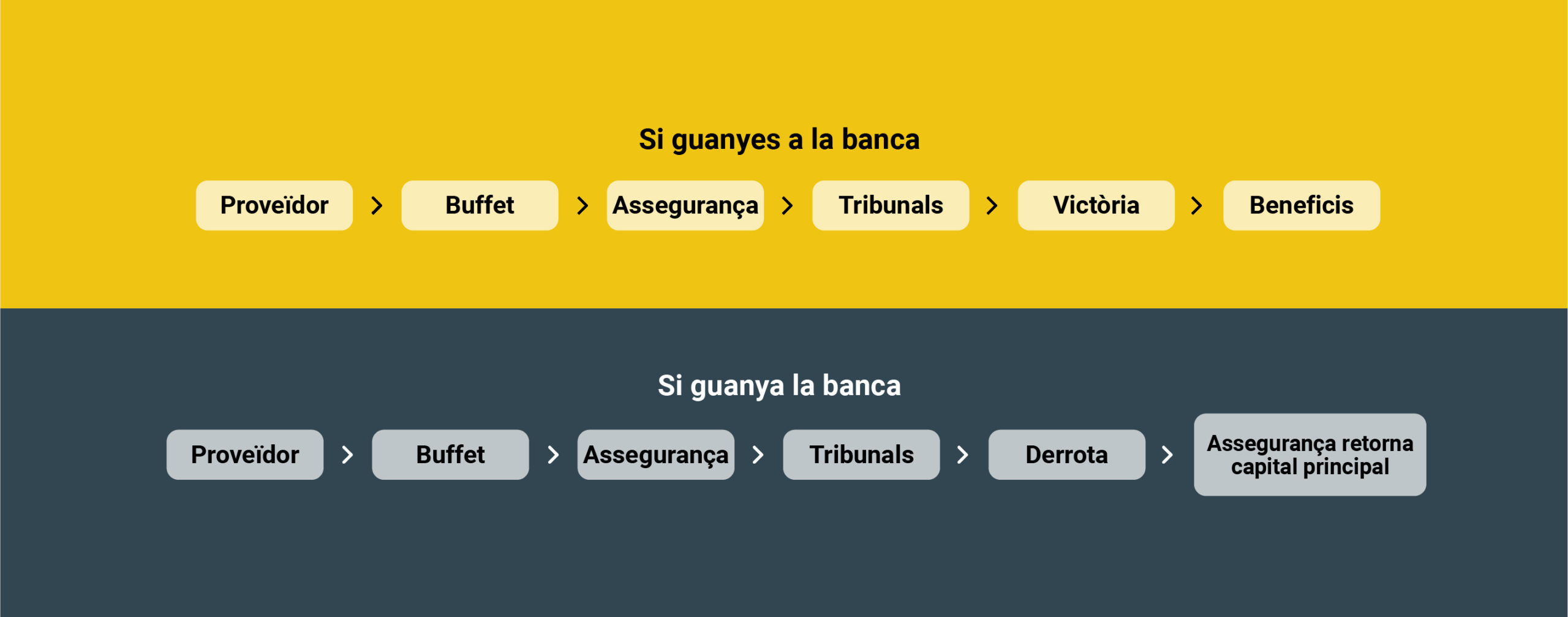

In this context, 11Onze Recommends works with an English provider that offers financing to the law firms that carry out these lawsuits, in exchange for part of the profits. You thought that the banks would always win? Well, not any more!

What profits can be obtained?

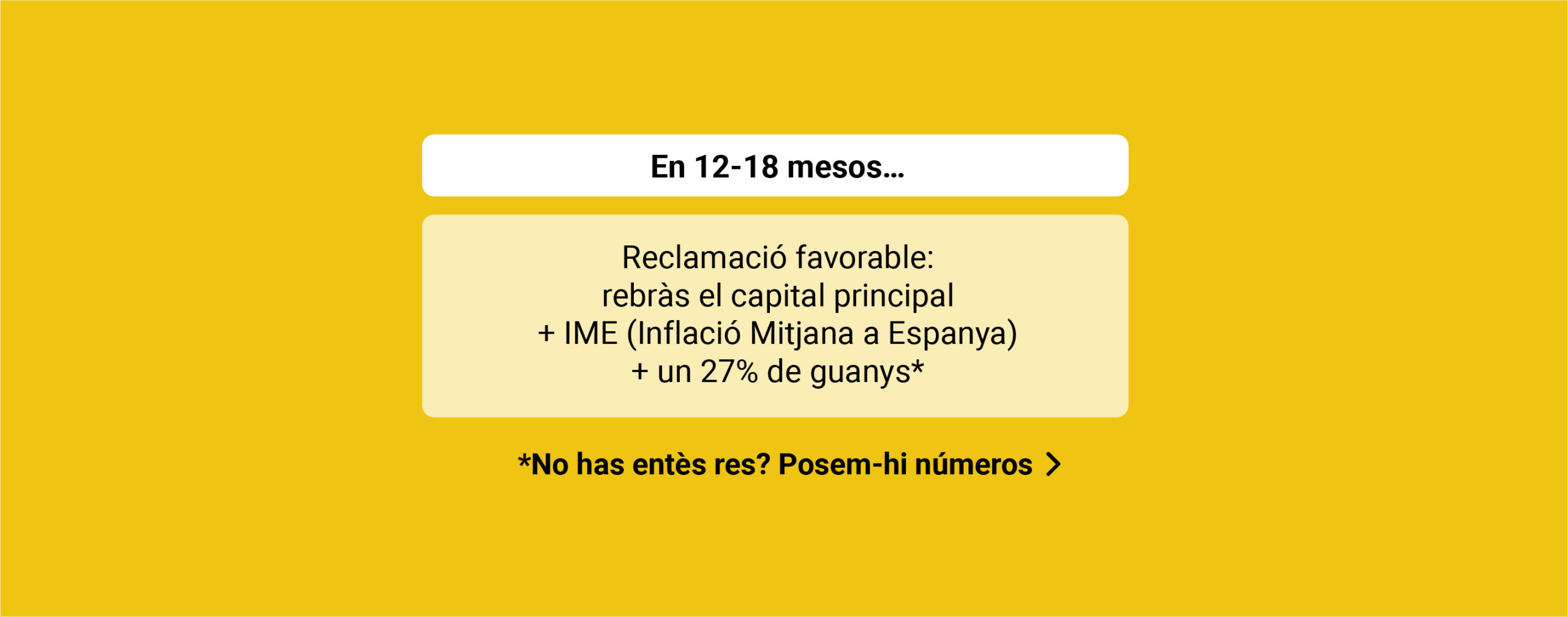

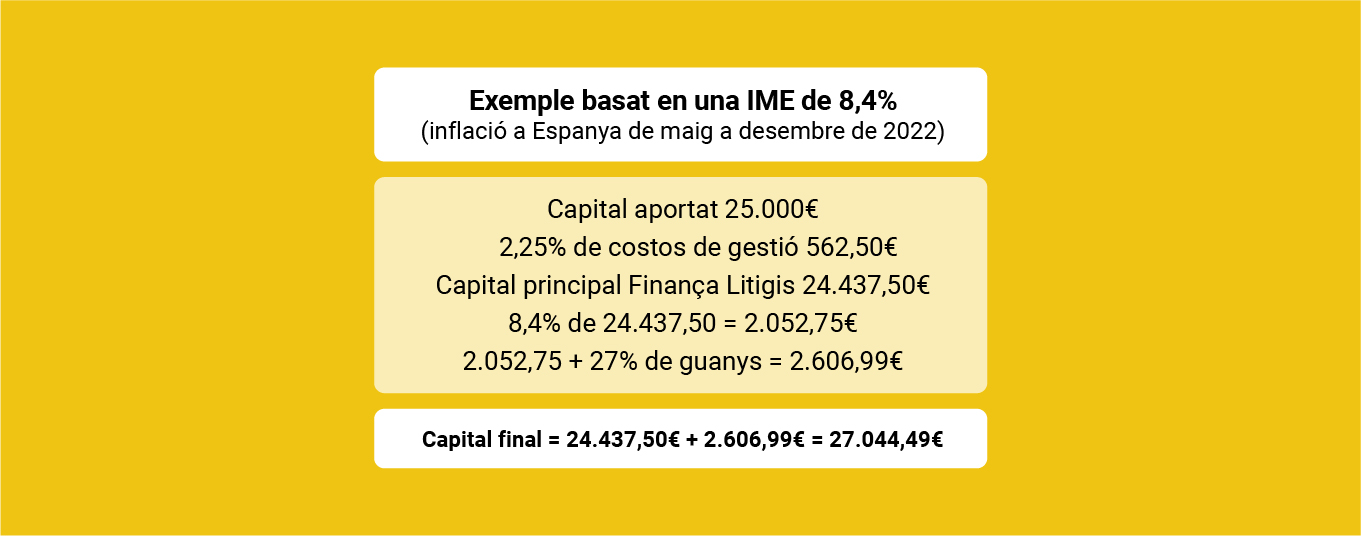

You can find all the information about Finança Litigis on the 11Onze Recommends website. The objective is to achieve a profit of more than 27% in relation to the average inflation in Spain. It is, therefore, a product that lets your money appreciate much more than inflation, allowing you to gain purchasing power. All this, in a context of low profitability and high volatility, which makes Finança Litigis a very valuable product. Standard & Poor’s A insurance covers the litigation capital.

All the information about Finança Litigis can be found at 11Onze Recommends.