Gold Patrimony

Gold for a bright future

To own gold is to have assets capable of withstanding recessions and periods of inflation. The global economic uncertainty resulting from excessive debt, rising interest rates and currency depreciation has boosted the demand for gold. During 2022, demand increased by 18% to 4,741 tonnes. Why? Because central banks have not bought so much gold for 55 years.

➡️ Buy bullion from 2.5 grams. We send the gold to your home, or we keep it in custody. The aim is that you know you always have your gold in your possession, gaining value for you.

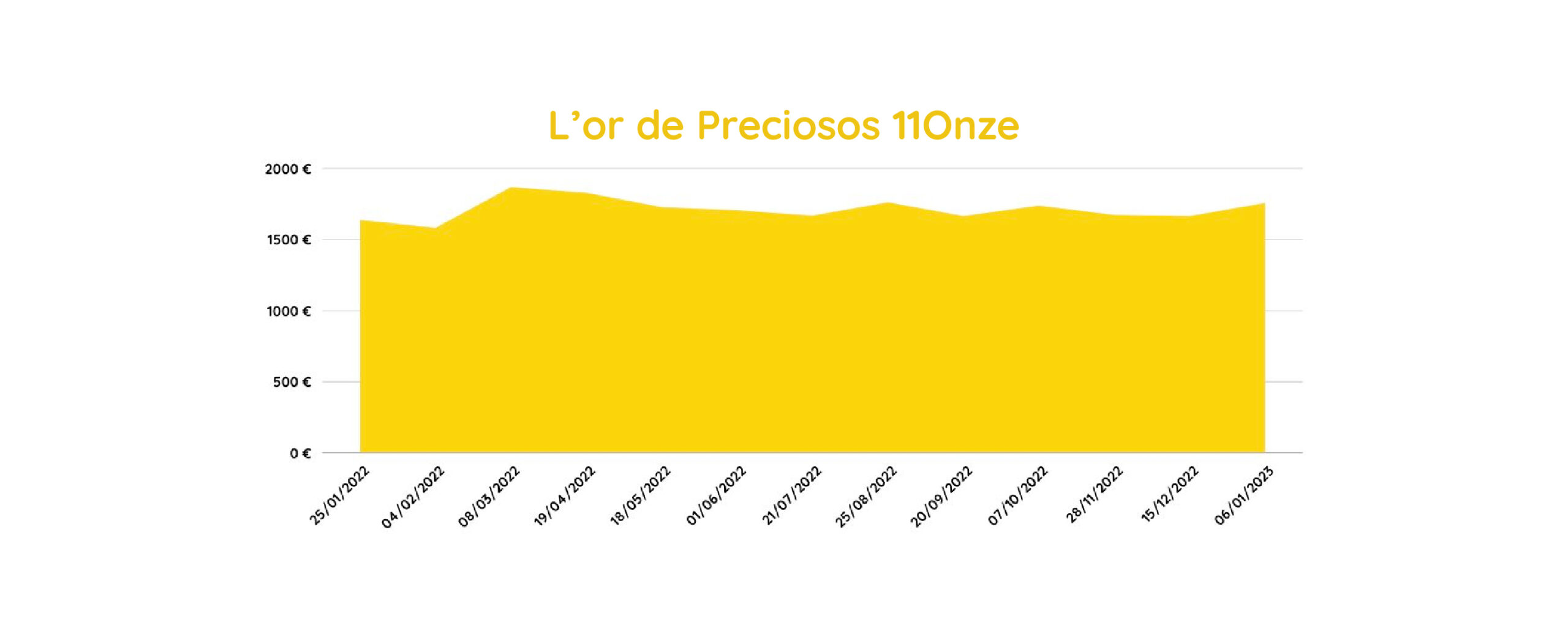

Above inflation

During 2022, Preciosos 11Onze gold managed to rise in value above inflation.

Here's how it works!

GOLD, THE GOOD ONE

Gold comes from the most prestigious and reputable refineries in the sector.

- Our gold has a minimum purity of 999.99

- Minimum purchase: €3.000

You will receive investment gold bullion ingot for your purchase.

GOLD BEHAVIOUR

Gold is a precious metal with a low risk of devaluation. Its value tends to rise because it is a limited resource. In times of economic instability or high inflation, its price rises more sharply. In recent years, it has accumulated an increase in value of more than 40%.

GOLD AT HOME OR IN CUSTODY

You will not buy digital gold nor an investment in the value of gold. No, we will help you buy physical gold, real gold.

So real that, if you want it, it will be delivered to your home. And if you don’t want it at home, it can be stored in a vault at a security company specialising in the safekeeping of precious metals.

THE POWER OF THE COMMUNITY

11Onze wants to offer the best conditions and service for a reason you know all too well: the 11Onze community. It allows us to have more strength when contacting refineries and to get the best possible price according to the offer and market situation.

THE CONTEXT

In recent years, the continuous printing of money has caused too much money to circulate, which devalues it.

We see this with inflation: with the same money, we can buy fewer things. The money in our current accounts, therefore, loses value.

SELL GOLD

When the time comes, you can choose whether to keep the gold, sell it or wait a little longer.

The advantage is that gold can always be sold, is highly liquid and has a low risk of devaluation, because it is finite and always in demand.

More information

The more gold is bought, the better conditions we can get, depending on market conditions. Therefore, a collective purchase will always be more advantageous, as we can get the best possible deal for all the members of the community.

The minimum purity of investment gold is 999.99. Our gold comes from refineries that certify this required purity, and is marked with the serial number, year of production and producer.

Investment gold is exempt from V.A.T., and in the event of a capital gain on its sale, it is taxed as Capital Gains.

No, never. At 11Onze we require that all the funds deposited come from a source that has been verified by a bank. 11Onze only accepts money from the client’s original bank account and only transfers money to this same bank account.

The minimum purchase amount for gold is €3,000. We set a minimum monetary amount and not a minimum weight because in this way, through collective buying, we can manage the purchase of gold at the best possible market conditions.

While physical gold is tangible and can be touched, digital gold is a financial asset that replicates the price of gold. This is usually in the form of an ETF or through derivatives.

When you buy physical gold, you own the metal, whereas when you invest in digital gold, you have a right or an option. Also, because it is not a book entry, you cannot suspend payments. Its value is intrinsic, gold can always be on hand, whereas financial assets can suspend payments and have no intrinsic value.

At 11Onze We work with gold in ingots, as the price-volume ratio in the gold market is better in the case of bullion ingots.

We try to buy by making the most appropriate combinations of bullion, always seeking the best result for the client, taking into account the purchase amount and the market situation.

The owner of the gold is always the buyer. 11Onze processes the sale in order to obtain the best prices on the market. We can take custody of the customer’s gold for security, but the owner of the gold is always the customer.

After depositing the gold in the vaults, we will send the customer the collection note provided by the custody company, together with photographs of the gold bars with their corresponding serial number.

With the safekeeping service, your gold will be protected and insured by the level of service and reliability offered by the best security and custody companies in the industry.

Furthermore, by purchasing the safekeeping service, on expiry of the order form you can choose to renew the safekeeping service, have 11Onze sell your gold at the best price possible, or have the gold sent to you for safekeeping.

From 11Onze we make it easier for our customers to find a buyer at the best possible price for the client.

To access this service when the customer has been responsible for the safekeeping of the gold, the metal must be sent to the custody company, with the cost of returning the gold being borne by the customer. The gold must be returned in the same condition in which it was received.

It is important to bear in mind that the shipping costs may vary depending on the delivery address, the weight of the goods, and the logistics company selected.