Gold, a safe-haven asset when facing a crisis

With inflation continuing to rise, gold’s resilience throughout history as a store of safe-haven investment value cannot be underestimated. Even so, it is not the only precious metal in which we can invest our savings; silver, platinum or palladium can be good alternatives. But which metals offer the best returns?

The ability of precious metals to maintain much of their value during crisis periods, and to offer inflation protection based on their intrinsic value, makes them a must-buy if we want to diversify and make our savings more profitable. However, there are differences in the returns offered by different metals. In this analysis we do not make forecasts for the future, we simply focus on the evolution of the prices of these four assets: gold, silver, platinum, and palladium, over the last year and the last three years, so that we can easily see which have been the most profitable.

Performance over the last three years

The combined historical performance of the metals over the last three years is very positive, and attributable to the global pandemic, which caused a shortage of resources in the industry, rising inflation and unstable markets.

Gold and silver have experienced growth of over 40% in the face of the economic uncertainty caused by the pandemic, and are consolidating their position as safe-havens in the event of a crisis. Even so, it should be kept in mind that investors tend to increase their exposure to gold and silver when interest rates are low and inflation high in order to protect the value of their money, and in the absence of interest payments. A situation that can be reversed if inflation turns out to be transitory and interest rates rise.

The continued demand for platinum keeps its value on an upward trend with almost 27% appreciation, but palladium is growing at a spectacular rate of 75%, as it is a scarce metal in high demand by industry. Even taking into account its progression, it is not highly recommended for long-term investment due to its price volatility, and the fact that the trend towards electrification of the automobile industry means that the demand for catalysts is likely to decrease.

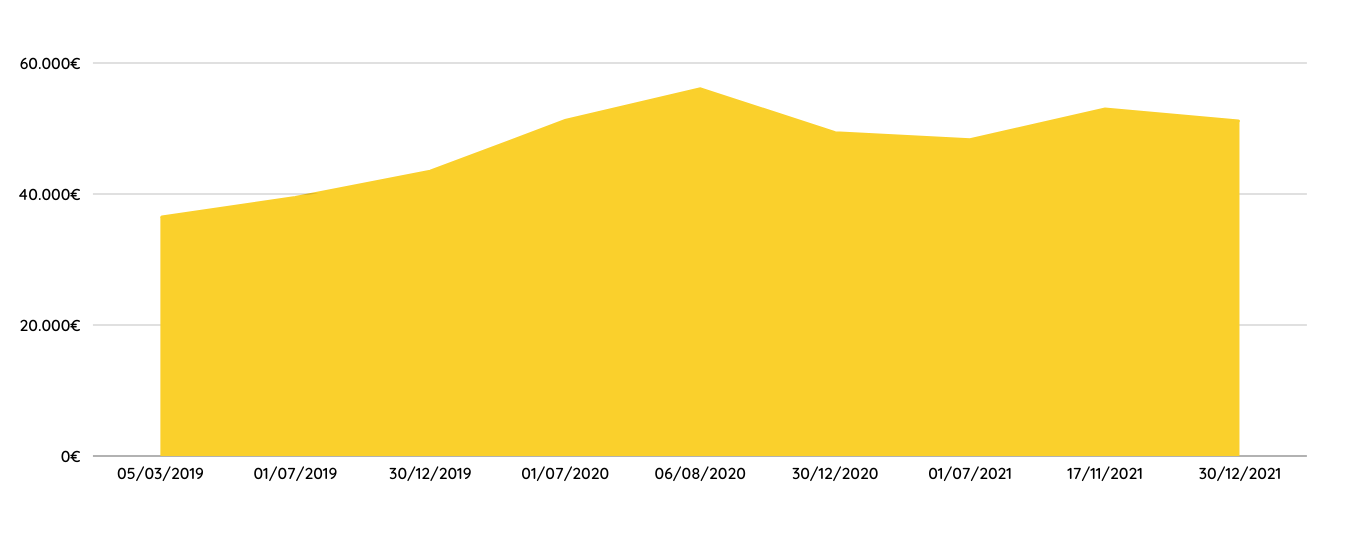

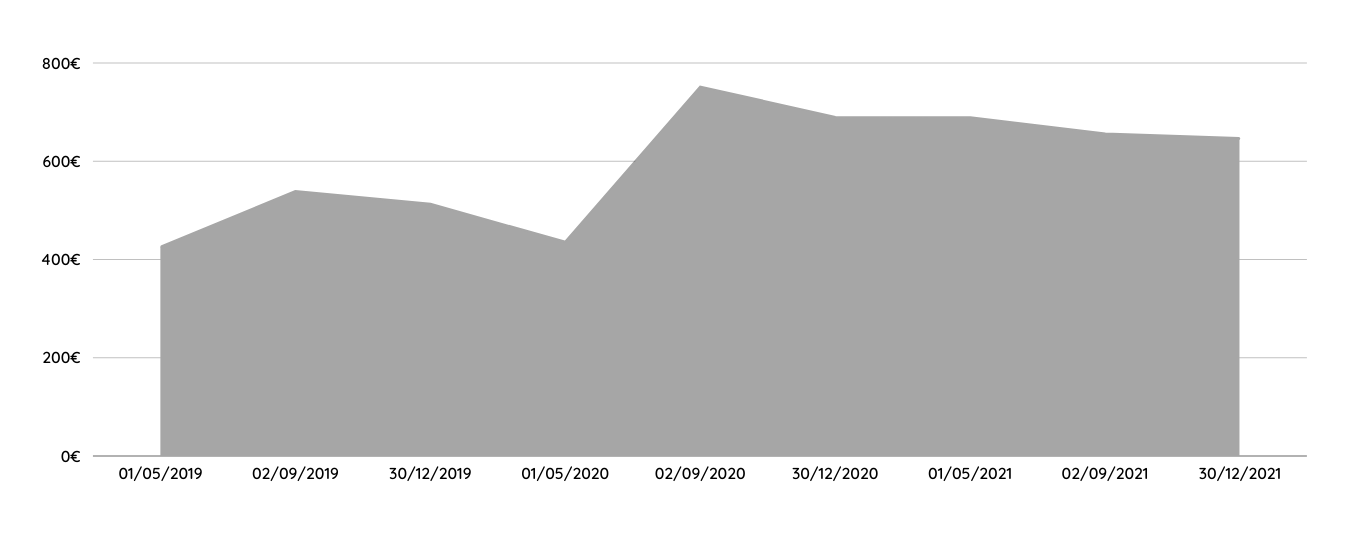

If we look at the following graph of the price evolution over the last three years, we see that gold has appreciated by more than 40% and silver by almost 47%. If we take into account that inflation in Spain in 2021 rose to 6.55%, we can affirm that people who bought gold and silver more than avoided the devaluation of savings suffered by people who had euros in their current accounts.

Evolution of the last year

During 2021, the fluctuation of the prices of precious metals has been different. All metals, except silver, recorded a positive, albeit moderate, price increase. Gold is the most stable of the metals, with price rises and falls always tending towards stability, but during the first quarter of the year, it suffered a loss in value. A fall in price linked to the economic stimulus of 1.9 billion dollars by the Biden administration, which would be repeated every time the US government announced a new package of measures to combat the pandemic, but still ending the year in positive territory.

Despite silver‘s upward trend at the start of 2021, it recorded a significant drop in price at year-end, contrary to predictions, because of declining industrial demand. While platinum and palladium prices also initially plummeted due to weak demand for autocatalysts, thanks to falling sales, platinum stabilised and ended the year in positive, and palladium ended the year on the unstoppable growth trend seen in previous years.

Whether we decide to invest in one metal or another, we must bear in mind that historical performance is not indicative of future performance and that any purchase involves a certain risk of loss of value. A risk that we assume whether we buy precious metals or not, because the value of the money we have in the bank depends directly on the decisions of the powers that be to print more currency (devaluing the currency in circulation) or not.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Gràcies

Gràcies a tu, per ser-hi i per seguir-nos, Joan!!!

Fins ara només heu esmentat la possibilitat de comprar or, però Jo no he llegit, encara, com i/o quan es podrà comprar altres Preciosos ( plata, platí, etc.)

Com tu dius Santiago, de moment tenim la campanya de l’Or, com que ets seguidor de La Plaça, quan surti una nova campanya de metalls preciosos, ho sabràs dels primers.

Gràcies

Gràcies a tu, Daniela!

Bon dia,

Trobo a faltar títol als gràfics. Tal com estan no se sap si reflecteixen l’evolució d’un metall en concret o del promig de valors de tots els metalls que esmenteu.

Al text es comenta la informació presentada als gràfics, però recollim el teu suggeriment. Gràcies, Olga, per ser-hi i per ajudar-nos a millorar!

Gràcies per donar opcions d’inversió. Quedo a l’espera de quan es podrà començar. Merci

A tu Ricard! Continua atent a La Plaça per saber-ho!

Tota inversió comporta els seus riscos. Gràcies per l’article i expectant en veure les diverses ofertes q ens oferireu. ✊✊

Gràcies, Manuel pel teu comentari i la teva expectació!

No obstant, hi ha discrepància que els metalls preciosos siguin una inversió, millor llegir-ho en aquest enllaç: https://finance.yahoo.com/news/gold-not-investment-not-inflation-081126966.html

Bona reflexió, Anselm!

L’or, com qualsevol altra matèria primera, és objecte d’inversions de tota mena (ETF, futurs, opcions, accions de companyies mineres, etc). En l’article del teu enllaç, s’està comparant constantment el valor de l’or amb el preu del dòlar i s’explica com una mateixa unça d’or va pujant de preu al llarg de les dècades, però que, malgrat això, com que el dòlar es deprecia, no és tan gran el guany.

A 11Onze oferirem compra d’or físic, perquè considerem que ofereix protecció enfront de la inflació i és una molt bona manera d’impedir que els nostres estalvis perdin valor per aquest motiu.

Perfecta l’explicació amb els seus pros i contres ,ja et dona prou per decidir que fer.

Gràcies

Gràcies per la teva apreciació, Alícia!

Aquesta és la idea: informar i formar; després, la decisió és encara més lliure.

Molt bona recomanació. Gràcies equip!

Gràcies a tu per la teva bona valoració, Jordi!

Aquests darrers anys de crisis vendre collarets i braçalets d’or ha solucionat més d’un problema econòmic. Com a inversió ho trobo fantàstic. Comprar or a preu d’or, no a preu d’una joia. i vendre´l en el moment precís que es necesita o perquè vols, o no vendre.

Què millor que comprar a través d’11onze, sense més intermediaris.

Molt bé que aviseu de que la rendibilitat no està garantida. El “em vas dir” o “em vau dir” es el primer que surt quan les coses no s´han entès bé i es torcen.

I tant, Mercè! És ben bé així.

L’equip d’11Onze treballa molt per a aconseguir aquells productes i serveis més adients a la nostra comunitat. De mica en mica.

Molt Bo 👍

Gràcies, Josep!

Molt bona explicació que recull comportament i trajectòria d’aquests valors. Serà interessant estudiar les opcions que podeu oferir i estudiar la viabilitat. Gràcies.

Gràcies, Pere pel teu comentari!