Traditional bank accounts are covered for up to €100,000, provided there is enough money in the Guarantee Fund in the country where you have the account. Litigation Funding insures 100% of the capital contributed for litigation, regardless of the amount.

Litigation Funding

11Onze Recommends

Grow your money faster than inflation with the Litigation Funding. Take part in the denunciations against the deceptions of the big banks. First country: United Kingdom. Win at the bank, get justice!

11Onze Recomana presents you with a very special product. Prevent your money from being devalued by inflation in your checking account. The Litigation Funding offers the possibility of increasing your capital by more than the average inflation increased by 27%.

What are your returns?

- 9% 2 years for €10,000

- 9% 1 year for €25,000

- 10% 1 year for €50,000

- 11% 1 year for €100,000

Litigation Funding, social justice!

Litigation Funding offers liquidity to pursue socially just claims.

Housing Litigation

Many UK councils and Social Housing Associations own homes which they offer to people on social benefits on a reduced rent basis. Landlords have a duty to maintain these homes so that they are safe and liveable. This often does not happen, violating the rights of the tenants. Therefore, there are claims against these entities, which are being forced to compensate tenants and the lawyers who represent them for deficiencies in their homes.

Litigation against banks

UK banks have had to set aside more than 60 billion euros to cover claims from their customers for illegal practices. Between 1990 and 2000, UK banks mis-sold 64 million Payment Protection Insurance (PPI) policies.

Fund socially just claims – seek justice and get returns on your savings!

Social justice!

Litigation Funding is a true social justice product. People file lawsuits against banks and the administration when they have been wronged by them.

Higher returns

Litigation Funding offers much higher returns than any Investment Fund – and with much less risk! In 15 years, Investment Funds in Spain have generated an average return of 1.91%. Litigation Funding offers a minimum of 9%.

Litigation Funding

Litigation capital is 100% covered by an insurer rated Excellent by AM Best.

It has been proven that UK banks regularly mis-sold payment protection insurance.

It has also been demonstrated that administrations have neglected their council housing.

The minimum capital requirement is €10,000.

On this amount, the client bears a management fee of 2.25% per year.

Even so, the profits are already calculated taking these costs into account, so that 100% of the contributed capital plus the profits are returned.

FAQs

The UK is where more and clearer cases have appeared, so far. If in the future there may be conditions for a similar litigation fund in Spain, 11Onze Recomana will assess it.

Between 1990 and 2010, 64 million policies were sold with improper practices such as the following:

- Selling through high-pressure call centers with a commission-based sales force.

- Single premium added to the loan.

- Clients were informed that the PPI policy was a required part of the loan.

- Clients were not informed about the expiration of the insurance policy.

- The adequacy of the policy was not disclosed.

As a result of this, many claims management companies were created and after demonstrating that these insurances were contracted with improper practices and abusive commissions, it was decreed that in order to claim this type of insurance a judicial procedure must be initiated through a law firm.

The law firm has been working on it for years, its success rate is over 90%. The provider will maintain the anonymity of the law firm.

To start with yes, but later on the intention is to work with more.

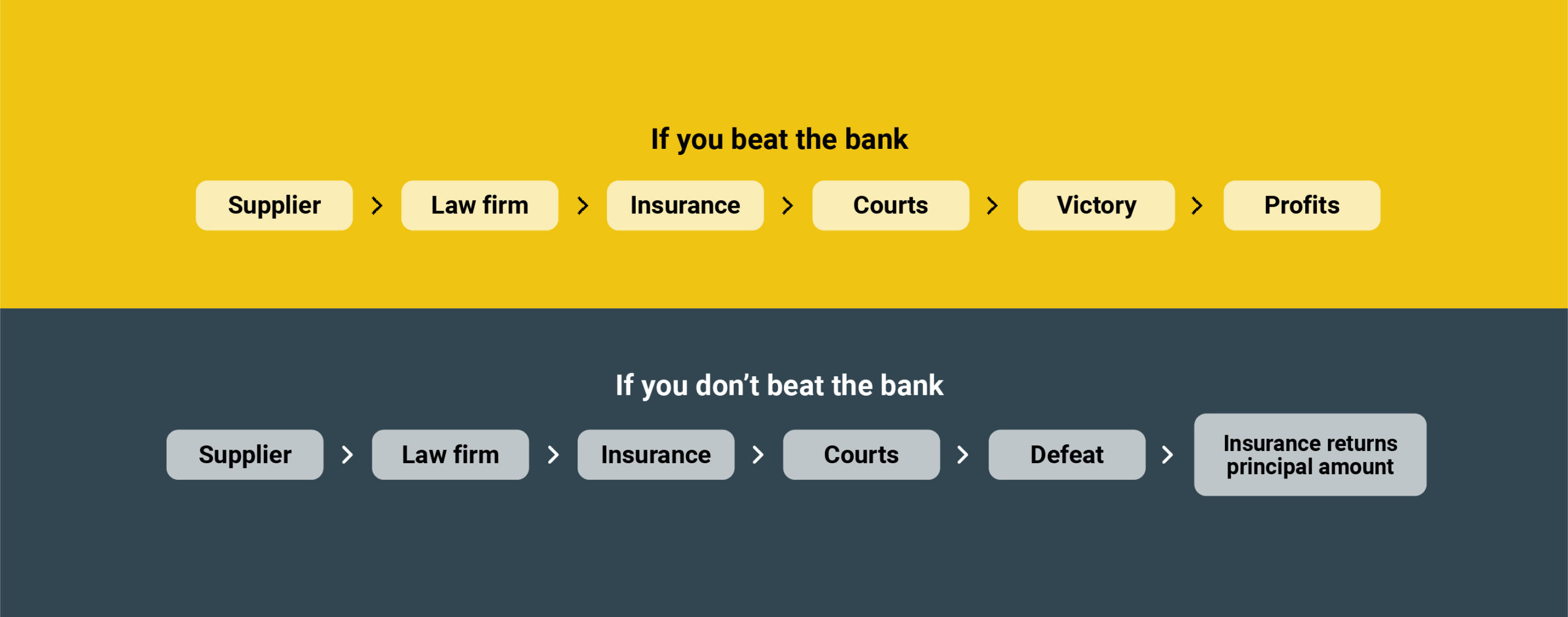

The insurance covers all the capital of unfavorable cases.

No. The capital is insured by the insurer.

Yes. You will receive monthly reports.

The provider will inform you of everything and offer you all the documentation.