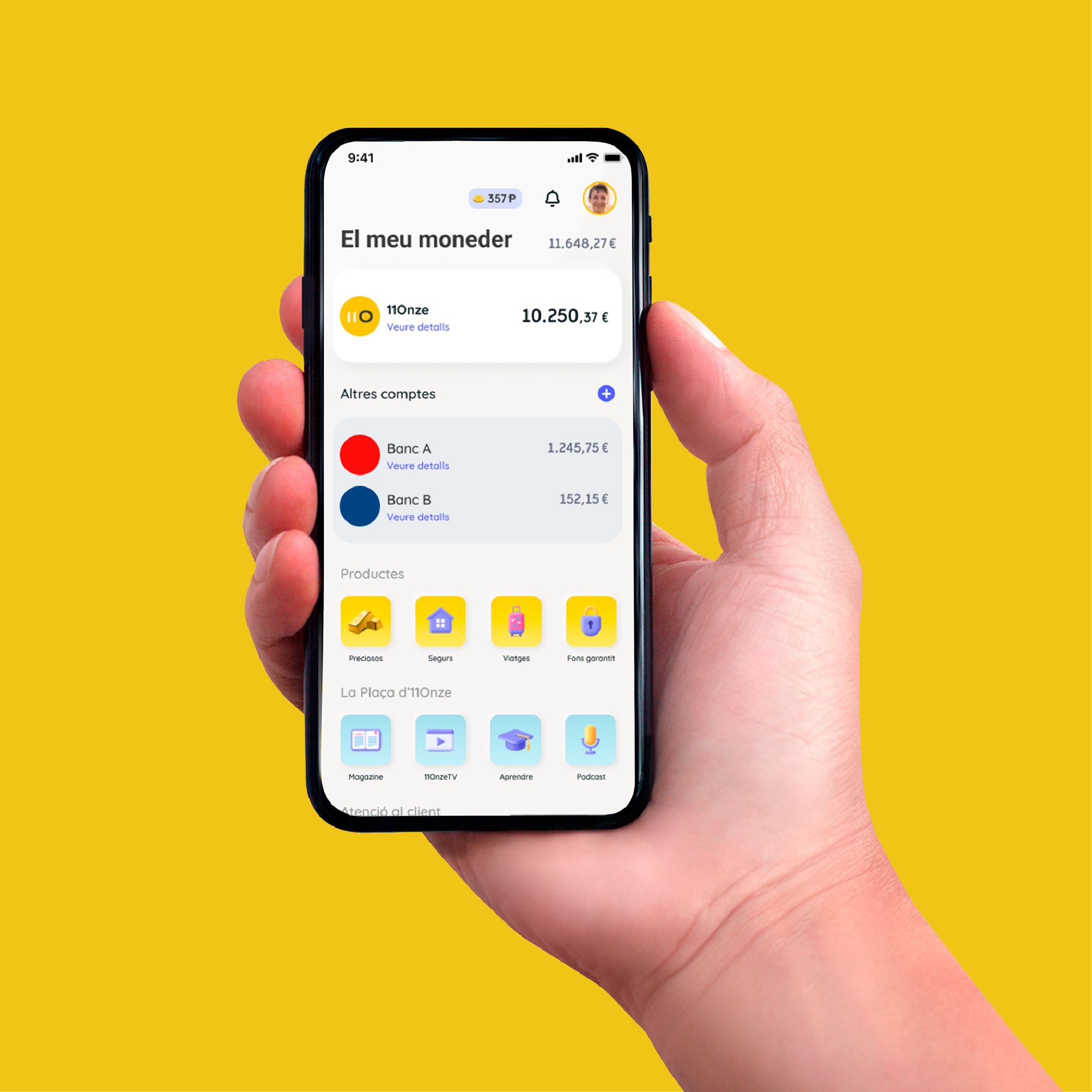

The first version of El Canut, the future financial super app, currently includes the following products:

Open an account with El Canut

11Onze Personal

Where are we?

Here you will find our current product status and upcoming products that will be available soon.

Already available!

El Canut 1.3

- PSD2. European legislation that allows information on payment accounts, cards and products to be stored and managed centrally. Provided by Truelayer.

- European IBAN. You will obtain a payments account with European IBAN within the SEPA area. Our first IBAN is from BG, provided by Paynetics.

- Virtual card. You can create multiple virtual cards to make payments digitally. Provided by Paynetics and Mastercard.

- Physical card. You will receive a physical card with an exclusive design, made of eco-friendly and recyclable PVC of maximum quality. Provided by Paynetics and Mastercard.

- Payments with Google Wallet and Apple Pay. Now you can register your 11Onze cards in your smartphone to make payments at different establishments using Google Wallet or Apple Pay. Virtual cards provided by Paynetics.

- Guaranteed Funds. If you have sold a house, if you have received an inheritance, if you have been saving for a long time… the Guaranteed Fund is a good option to get a return on that money, to prevent it from being unproductive. Provided by Laurion Group.

- Preciosos 11Onze. Buy physical gold through 11Onze to protect your savings. Provided by Preciosos 11Onze.

- 11Onze Segurs. Insure your home at the best price and be socially responsible by giving the insurer’s profits to an NGO. Provided by Tuio.

- 11Onze Viatges. Travel while saving on hotels around the world. You will have access to a private platform that is 25% cheaper on average than other booking sites.

- 11Onze at Home. Make a face-to-face appointment by video call with our agents, they will answer all your questions!

- Access La Plaça. Enjoy La Plaça directly from El Canut. Be informed, learn and share with 11Onze Magazine, 11Onze TV, 11Onze Podcast and Learn.

- 24/7 Customer Service. 11Onze agents are available by phone and chat 24 hours a day. You can contact them from El Canut.

Check El Canut’s prices here.

Coming soon!👇

11Onze Payments

- 11OnzeCash: you can withdraw and deposit cash into your account through 11Onze’s retail partners using a simple barcode.

- 11OnzePay: independent payment infrastructure. You can make payments to establishments or friends by scanning the 11Onze QR code.

Investment

At 11Onze we will offer you one of the best products on the market to make your capital profitable:

- ETFs: an exchange-traded fund (ETF) is a set of assets listed on the stock exchange. ETFs are vehicles that help you diversify your investments at a low cost.

- Stocks: we will give you access to the main stock markets to buy shares in your favourite companies.

- Crypto: you can buy and sell the main cryptocurrencies on the market.

Accounts

With 11Onze you can choose to have accounts based in several European regions. IBANs available soon:

- BE (Belgium)

- ES (Spain)

- FR (France)

- EE (Estonia)

- DE (Germany)

Deposits

At 11Onze you will be able to invest your savings in exchange for an agreed return over time. A widely used tool by most conservative investors.

Credit

- Loans: we will give you the possibility to obtain loans at competitive interest and conditions.

- Buy Now, Pay Later: we will allow you to postpone payments at a low-interest rate on purchases made in our future marketplace.

- Mortgages: we will help you get the best mortgages available on the market.

Rental opportunities

A further option to recover the costs of some day-to-day assets, based on long-term rental.

Community

- Crowdfunding: Give you the ability to invest in interesting projects.

- New P2P Lending: you can lend money to members of the 11Onze community to make a profit.

Cash management

We want to give you the best control tools to manage your personal finances.

- Pockets.

- Subscription management.

- Economic objectives.

- Personal cash management.

11Onze Personal Account Information

The 11Onze account for individuals is a payment account denominated in euros, and provided by Paynetics. It is a non-deposit, non-interest bearing account associated with a Card or Cards and maintained for the purpose of enabling Payment transactions. The Paynetics account shall only be used for loading of funds to the Card.

The 11Onze Account for individuals has a duration equivalent to the validity period of the card or cards requested, but a notification to 11Onze, in writing or by reliable means, is sufficient to terminate your relationship with us. You must notify 11Onze at least one month in advance.

To close your account, you must settle all charges for contracted services: fees, commissions and/or maintenance.

To access the 11Onze account for individuals and start the registration process, you will need to have access to the Internet and download the El Canut App on your device. Accept the Terms and Conditions and legal documents that apply to your relationship with 11Onze and its partners, including Paynetics, and start the registration process to create an account.

You can only have one 11Onze Personal Account.

This account does not allow co-holders.

Be over 18 years of age and have full capacity to act.

Present a legally valid identity document. The accepted documents are:

- Spanish Identity Document (DNI) or Passport for those born in Spain, and one accepted proof of address.

- Passport and two accepted proof of address, for foreign residents.

Owning a smartphone compatible with the mobile app; Android or iOS.

The accepted documents to present as your proof of address can be bills (electricity, water, etc.), a bank statement showing your current address, etc… These documents must not be older than three months.

Once you have successfully completed the identification process, you will be provided with an IBAN (International Bank Account Number) with 22 characters; a series of alphanumeric characters that identify a specific bank account in a financial institution anywhere in the world.

This account has a BG IBAN (Bulgaria) and it is the identifier which will execute payment orders and transfers sent and received.

About outgoing wire transfers; 11Onze will not be responsible or liable for non execution or defective execution in case you have entered the IBAN data and / or PAN number (in the case of cards) incorrectly.

To activate your account, we ask that you deposit a minimum amount of €20 into your account.

You can top up your 11Onze account in several ways:

- By SEPA bank transfer between SEPA area accounts. These transfers can take up to three days to process.

- By transfers between 11Onze accounts. This top-up method is instantaneous.

The options to deposit cash into your account or make a debit card payment are currently unavailable.

Spending Limits by card

- Maximum ATM withdrawal per day – €1.000

- Maximum ATM withdrawal per month – €20.000

- Maximum amount spend per day – €1.000

- Maximum amount spend per month – €20.000

- Maximum amount spend per year – €40.000

- Maximum number of transactions per day – 20

Transfers in / Account Loading Limits

- Minimum initial load – €20

- Maximum amount in account – €50.000

- Maximum load limit per day – €14.999*

- Maximum number of loads per day – 10

- Maximum load per month (30 natural days) – €14.999*

* Check the procedure to follow when the €14.999 transfer is exceeded HERE.

Top-up limits by card

- Minimum amount of daily top-ups – €20

- Maximum amount of daily top-ups – €200

- Maximum amount of monthly top-ups – €500

- Maximum number of deposits per day – 2

You can check your balance and see the movements of your account through the mobile App.

Overdrafts are not allowed using this account. It is your responsibility to ensure that the fees for contracted services, interest, commissions and / or maintenance are met on their due date.

In the event that the fees for contracted services, interest, commissions and / or maintenance have not been settled, you will be required to make a payment to the account as soon as possible.

Personalised customer service 24/7

We have more than 40 agents at your disposal. We want every interaction with us to be a pleasant, meaningful and value-added experience through all possible digital channels.