11Onze’s gold corrects inflation

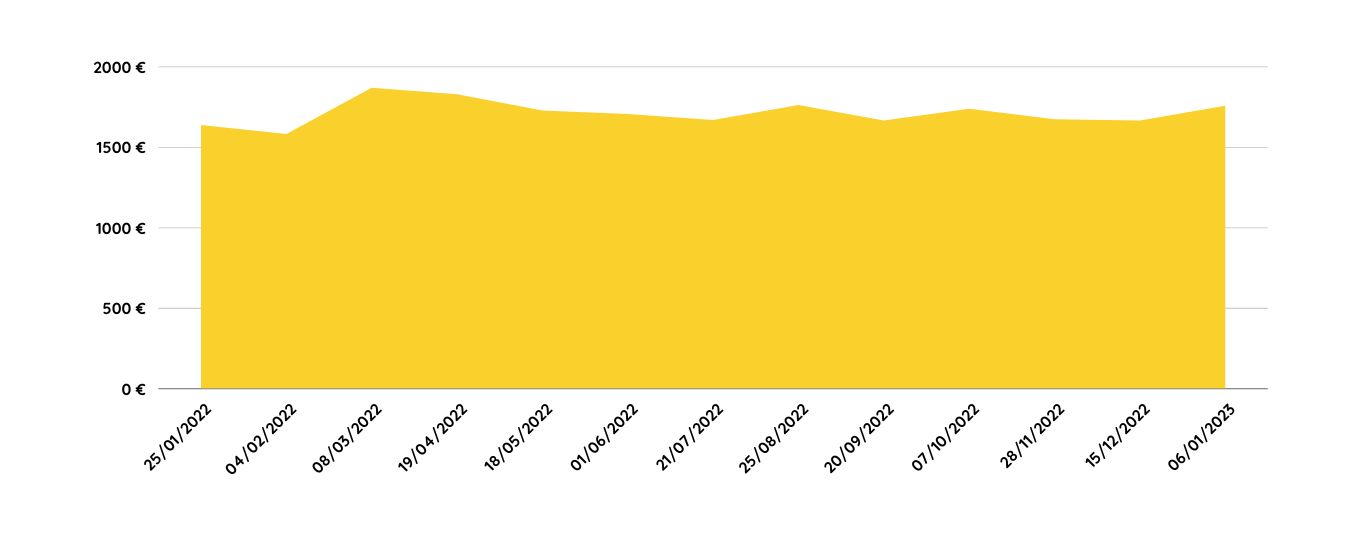

Year-on-year inflation in Spain in 2022 was 8.4%. Preciosos 11Onze gold has appreciated by 9.5%. In February 2022 we launched Preciosos 11Onze, offering members of our community to buy gold to protect themselves against inflation. Almost a year later, the gold price confirms the forecast.

It is no secret that an analysis of the historical evolution of the value of gold shows that, despite some occasional downward fluctuations, it is a real safe-haven asset that protects our savings, especially in times of economic crisis. This was obvious during the three-year period of the sanitary crisis, when gold prices increased by 40%.

After the return to ‘normality’, 2022 was seen as the year to consolidate the economic recovery. Even so, geopolitical uncertainty and the energy crisis, together with high inflation and currency tension due to the loss of value of the euro against the dollar, caused many families to lose much of their purchasing power.

A safe haven in the face of uncertainty

In this context, buying gold was not an investment or an instrument of speculation, but one of the few options people had to safeguard their money. That is why we launched Preciosos 11Onze, as a tool for our community to protect their savings in an extremely turbulent context.

The strength of the dollar and uncertainty about the possible rise in interest rates contributed to the fluctuation in the price of gold during 2021, but by early 2022 a new upward trend was confirmed. So, since then, has it maintained its reputation as a safe-haven asset? Without a shadow of a doubt, yes. When we launched Preciosos 11Onze, an ounce of gold was trading at €1.599, and today it is priced at €1.749, a rise in value of almost 9.5%.

This means that in the face of the depreciation of the euro due to inflation and competition from the dollar, having your money in gold would not only have prevented the loss of its value, but would have increased it considerably. Of course, it should be borne in mind that historical returns are not indicative of future returns and that any purchase of precious metals carries some risk, but as we have seen, leaving your money in the bank can be much worse.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Quina gran idea vareu tenir d’oferir or a ça comunitat,era impensable que un ciutadà de a peu ,pugues fer una inversió en or

Gràcies Alicia! 💛

Gràcies

Gràcies, Joan!!!

Gràcies per oferir-nos aquest producte d’inversio💛

Celebrem que us pugui ser d’utilitat 😉

Que bé 👌🎉

Gràcies, Carles!!!

Fantàstic 👍

Moltes gràcies, Jordi!!!

La Intel·ligència dels gestors i el veure-les venir és un valor afegit a l’hora de confiar en una empresa de nova creació.

Si hi afegim la concepció del projecte com un servei a la comunitat, el resultat és 👌👌.

Gràcies

Gràcies per les teves paraules, Mercè!