How to prevent burglary during the holidays

Catalonia suffers a high rate of home burglaries, a problem that worsens during holiday periods. Gemma Vallet, director of 11Onze District, reminds us of the most important tips to protect our homes correctly or minimise the consequences in the event of a burglary.

Fortunately, home burglaries were reduced by 23% during the pandemic, but the Mossos d’Esquadra have been warning for some months of an increase, which could be accentuated during the holiday period. Moreover, it should be borne in mind, as Gemma Vallet points out, that Catalonia “leads the ranking of thefts” in Spain.

According to data from insurance companies, the average value of thefts is 800 euros and the municipalities with the highest value stolen in each incident are Girona and Sant Cugat del Vallès. As for shops, the most affected are those in Reus, Mataró and Lleida.

Guidelines to avoid unpleasant surprises

The director of 11Onze District offers a series of tips to protect yourself from theft or minimise its consequences:

- Leave objects of more material or sentimental value in a safe place.

- Install an alarm.

- Check all accesses, doors and windows, as burglars are increasingly using more elaborate systems to gain access to homes.

- Be discreet about your absence, being careful about what you post on social media, as this can alert burglars to your location.

- Ask someone to visit the home regularly, collect correspondence and check that nothing unusual is going on.

- Do not leave messages on the answering machine indicating that you are away.

- If you hear any noise or detect the presence of a stranger, alert the Mossos d’Esquadra immediately, without confronting them.

- If you have taken out insurance, make an inventory of your property so that you can claim the corresponding compensation in the event of theft.

In addition to theft, Gemma Vallet warns that it is advisable to take measures to avoid problems with windows and water and electricity installations during your holiday absence.

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

It’s been a year since the launch of Litigation Funding, one of 11Onze Recommends’ flagship products that offers returns of between 9 and 11% by financing lawsuits against banks and institutions that have used illegal practices against their clients. How has it performed so far? Are our clients satisfied? Farhaan Mir, CTO of 11Onze, gives us an update.

In the inflationary economic environment we have experienced in recent years, people have not only seen their purchasing power eroded but have also experienced a loss in the value of their savings. It is in this context that Litigation Funding that 11Onze Recommends was born, to shield the savings of our community members against runaway inflation.

Litigation Funding offers returns ranging from 9% to 11%, depending on the amount contributed, financing the legal costs of law firms pursuing claims against banks and institutions that have used illegal practices against their clients. This social justice product offers high returns at very low risk. And that’s all well and good, but have these objectives been met a year after its launch?

A unique product in the market

As a general rule, investments that offer high returns come with high risk, while low-risk investments offer more stable, but potentially lower, returns.

This is not the case with Litigation Funding, as Farhaan Mir explains, “In this case, the risk is managed by an insurance that covers the clients’ capital“. Even so, in the first year, there has been a 100% success rate in the lawsuits, and it has not been necessary to use insurance.

A recurring investment

Perhaps the metric that most exemplifies the success and good performance of Litigation Funding is that almost 100% of clients have reinvested their money in the same product. “Clients are very happy with the returns and, apart from one person who needed the money for personal matters, everyone has reinvested their capital.”

Litigation Funding has been structured exclusively for members of the 11Onze community, offering two ways to participate: a product that returns your capital and possible profits after one year, or another option where your capital works for a few years and provides you with a monthly return after six months. As Mir points out, “The longer the period, the greater the returns for investors”.

Fund lawsuits against banks. Get justice and returns on your savings above inflation thanks to the compensation the banks will have to pay. All the information about Litigation Funding can be found at 11Onze Recommends.

In this edition of the 11Onze Podcast, we have once again invited Oriol Blanch, Affiliate Marketer at Bitvavo, to review the latest news in the world of cryptocurrencies. We talk about the buying options in the current bear market and the approval given by the Bank of Spain to Bitvavo.

Fluctuations in Bitcoin and the cryptocurrency market in general are nothing new. In fact, bitcoin has experienced some corrections after reaching an all-time high above $73,700 last March, taking it to just below $60,000 when writing this piece.

Although these bitcoin corrections are not surprising and are part of a certain normality, “all altcoins and other cryptocurrencies that are not bitcoin have had more significant corrections that have caused more than one scare to some“, points out Oriol Blanch.

At the very least, this confirms that bitcoin continues to be one of the safest crypto assets, partly thanks to its market capitalisation and, as Blanch indicates, “Looking at it from a long-term perspective, these corrections are minuscule and we continue to bet on this market because it looks like it will continue to rise”.

A good opportunity to enter the market?

A bear market can be a good opportunity to buy, but nobody has a crystal ball. On the other hand, we must take into account the “halving” event, which in previous cycles has behaved very positively, but as Blanch stresses, “it is not an immediate effect, it may take between six and eight months to really see a parabolic rise in the price of bitcoin”.

In any case, Blanch advises its family members to “make regular purchases”. Bitvavo offers the option of setting up a recurring buy, so you can buy the cryptocurrency you want to accumulate once a month or on a specific day. However, the affiliate marketer recommends placing buy or sell orders with a price limit, so that if the market rises or falls, the buy or sell order is automatically executed.

Bitvavo, more reliable than ever

Bitvavo’s ambition to become Europe’s leading cryptocurrency exchange has been reinforced by receiving approval for registration as a Virtual Asset Service Provider from the Bank of Spain, allowing the exchange to offer cryptocurrency products and services in the Spanish market. Previously, it had already obtained registration from regulators in Austria and France.

These authorisations are important because they mark the process of implementing the Markets in Crypto-Assets Regulation (MiCA), the first global regulation governing the crypto-assets market, establishing obligations for both issuers and cryptocurrency service providers. Blanch explains, “These regulations will apply to all crypto asset providers and, as a user, you have to be careful not to fall into the trap of using an exchange located in the Cayman Islands, because there you would have no protection whatsoever”.

11Onze Recommends Bitvavo, cryptocurrency trading made easy, safe and at a good value.

At the end of April 2022, 11Onze started shipping gold to Preciosos 11Onze customers. We explain the whole process from the moment the gold arrives at the refinery until it is ready to be shipped to the end customer.

The first shipment of gold from the 11Onze community was delivered at the end of April 2022. It will be this week. The international situation had caused a peak in demand for gold, and 11Onze delayed the collective purchase, waiting for the right time. The company then supervised every step of the process: from the purchase of the raw gold, to the ingot-plating and serial marking of each piece. Since then, Preciosos 11Onze has continued to manage gold purchases.

The gold that community members receive is 11Onze bullion gold. This means that it is not gold from another entity marketed by our company, but 11Onze gold. The pieces are of 50, 100, 500 grams or 1 kilo and customers can choose to receive them or leave them in custody.

Gold production at the refinery

From the time the gold of the 11Onze community arrives at the refinery until it is ready to be sent to the end customer, there are a series of processes to be carried out. We explain them to you.

- Weighing: the gold arrives in sheets. It is checked for the correct weight and the sheets to be melted are prepared for each customer.

- Rolling: if the sheet is too thick, it cannot be cut. Therefore, thinner sheets are made with a press.

- Casting: gold becomes liquid at 1,000 °C and above. For pieces of a certain size, it is melted in the furnace; for smaller pieces (25 or 50 grams), it is done manually, with a blowtorch.

- Solidification: when it is very liquid, the gold is poured into a mould to form the ingot. A blowtorch is used to cool it progressively so that it hardens.

- Cleaning: once solidified, the gold is immersed in a nitric acid solution to clean it.

- Quality control and weight verification: the gold is re-weighed to ensure that nothing has been lost. In any case, the pieces are usually weighed slightly heavier to compensate for any possible loss.

- Marking: once everything has been checked for correctness, the bar is marked with the serial number and is ready for delivery to the customer.

Preciosos 11Onze gold guarantees the highest purity (999.99 out of 1,000), is purchased at the best price thanks to collective orders and helps the community to protect their savings from inflation.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Un dels objectius fundacionals d’11Onze és oferir eines perquè la nostra comunitat pugui reduir despeses, gestionant els seus diners de manera més efectiva. Algú podria pensar que això és un simple eslògan de màrqueting, una frase bonica que sona molt bé i prou. Per tant, hem contactat amb alguns dels clients d’11Onze Segurs perquè els seus testimonis parlin per si sols.

Oferir un bon producte a un bon preu no és feina fàcil. Des d’11Onze Segurs vàrem analitzar les diferents opcions que oferia el mercat de les assegurances de la llar durant mesos, així com realitzar estudis dels costos de les assegurances a través d’enquestes als membres de la nostra comunitat que són propietaris d’un habitatge.

L’objectiu era prou clar: poder oferir als nostres clients la millor assegurança de la llar, comparant cobertures de diversos proveïdors per trobar la millor opció que s’adaptés a les circumstàncies particulars de cadascú, i a un preu més que competitiu, des de 5 € mensuals.

Però el preu no ho és tot. Des d’un bon principi teníem clar que havíem de reduir la quantitat de paperassa i lletra petita que acompanya qualsevol pòlissa d’assegurança. La simplicitat i transparència en l’abast de les cobertures que estem contractant ens donen més tranquil·litat i eviten sorpreses d’última hora.

“Molt contenta amb la decisió de canviar d’assegurança. M’estalvio 55 € de la quota, que m’ajudaran a cobrir altres despeses, tal com s’està encarint tot!”

El resultat d’una feina ben feta

L’esforç ha valgut la pena i creiem que ho hem aconseguit. A 11Onze Segurs pots contractar i gestionar la teva assegurança de la llar des del mòbil, agilitzant els tràmits, abonant una quota mensual o anual, sense permanència, entre un 15% i un 20% més barata que amb les companyies asseguradores tradicionals, i sense oblidar-nos del compromís amb la societat com a empresa B Corp certificada.

“M’estalvio 350 € anuals, que reinvertiré en 11Onze!”

Però no t’ho diem nosaltres, t’ho diu Vincenç Aguilà, de Sabadell, que tenia clar que estava pagant de més per la seva assegurança de la llar. Fent el canvi a 11Onze Segurs s’estalvia 350 € anuals. I quan li preguntem què pensa fer amb els diners estalviats: “Reinvertir-los a 11Onze!”.

“Amb els 100 € que m’he estalviat m’he comprat un altaveu de Bluetooth nou!”

Des de Roquetes, Gemma Monllau ens explica que està “molt contenta amb la decisió de canviar d’assegurança”, s’ha estalviat 55 € en la quota de la pòlissa, que l’ajudaran a cobrir “altres despeses, tal com s’està encarint tot!”. Xavier Tornos, de Terrassa, ho tenia clar, amb els 100 € que s’ha estalviat en passar-se a 11Onze Segurs, s’ha comprat “un altaveu de Bluetooth nou!”.

Si vols conèixer una assegurança justa per a la teva llar i per a la societat, descobreix 11Onze Segurs.

Litigation Funding, which 11Onze recommends, gives you returns on your savings that are much higher than those offered by traditional banks and with total security. It is not us telling you, it is our clients, such as Carme Masó.

Diversifying our savings in safe-haven assets such as precious metals or in low-risk investments that help us fight inflation is essential if we want to protect our capital.

Although bank deposits are starting to improve their returns thanks to rising interest rates, they are still not sufficient to compensate for the loss of purchasing power caused by high inflation. Similarly, over the last 15 years, investment funds in Spain have only generated an average return of 1.91%, well below inflation.

In this economic context, Litigation Funding offers yields ranging from 9% to 11% depending on the amount contributed and gives you a fixed return with a success rate of over 90%. Furthermore, it gives you total security, since the capital of 11Onze’s clients is 100% insured if the legal process does not go as planned.

“The money is insured, you never lose it, at most you’ll stay the same as you are, but you won’t lose it.”

A safe and highly profitable proposal

If we want to protect our savings, it is not easy to find a low-risk product that offers good returns. As a general rule, the higher the returns, the higher the risk.

This is not the case with Litigation Funding and this is what attracted Carme Masó: “The first thing that caught my attention was the interest they offered, fixed and much higher than other options“, and she stresses the importance of insurance, “The money is insured, you never lose it, at most you will stay the same as you are, but you will not lose it”.

A self-certified qualified investor

When you ask for information to assess whether to invest, the first step is to sign a document certifying you as a qualified investor. In other words, the investor tells the investment company or platform that he/she knows what he/she is doing and that he/she feels comfortable being informed of the risks involved in the investment.

This document does not compel you to make any investment, but it is often a legal requirement to get the information. In the case of Litigation Funding, our UK provider is obliged to comply with UK regulations. Therefore, before you can provide full details of the product, you have to fill out what is known as a Self-Certified Sophisticated Investor document.

Carme was not surprised to see this document, “I had to sign a similar one when I bought gold with 11Onze Preciosos, and they had already explained to me what it was all about“. In any case, the process is very transparent and all the documentation is translated into Catalan.

“This year the investment has finished, and they have given me the interest. The money, which I could have collected, I have invested it again in Litigation Funding.”

Would you recommend Litigation Funding?

At the request of our community, we have worked with our provider to lower the barrier to entry to Litigation Funding by offering the option to contribute money as a group, so that more members of our community can participate.

But more importantly, would clients who already have experience with this product recommend it? Masó has no doubts, “It has worked for me. “This year the investment has finished and they have given me the interest. The money, which I could have collected, I have invested it again in Litigation Funding”.

Fund lawsuits against banks. Get justice done and returns on your savings above inflation thanks to the compensation the banks will have to pay. All the information about Litigation Funding can be found at 11Onze Recommends.

One of 11Onze Recommend’s star products generates high yields by financing the litigations of law firms that pursue claims from citizens who were misled by banks. You can now participate as a group, reducing the amount of capital contributed individually but keeping the percentage of the profits. Farhaan Mir, CFO of 11Onze, explains how it works.

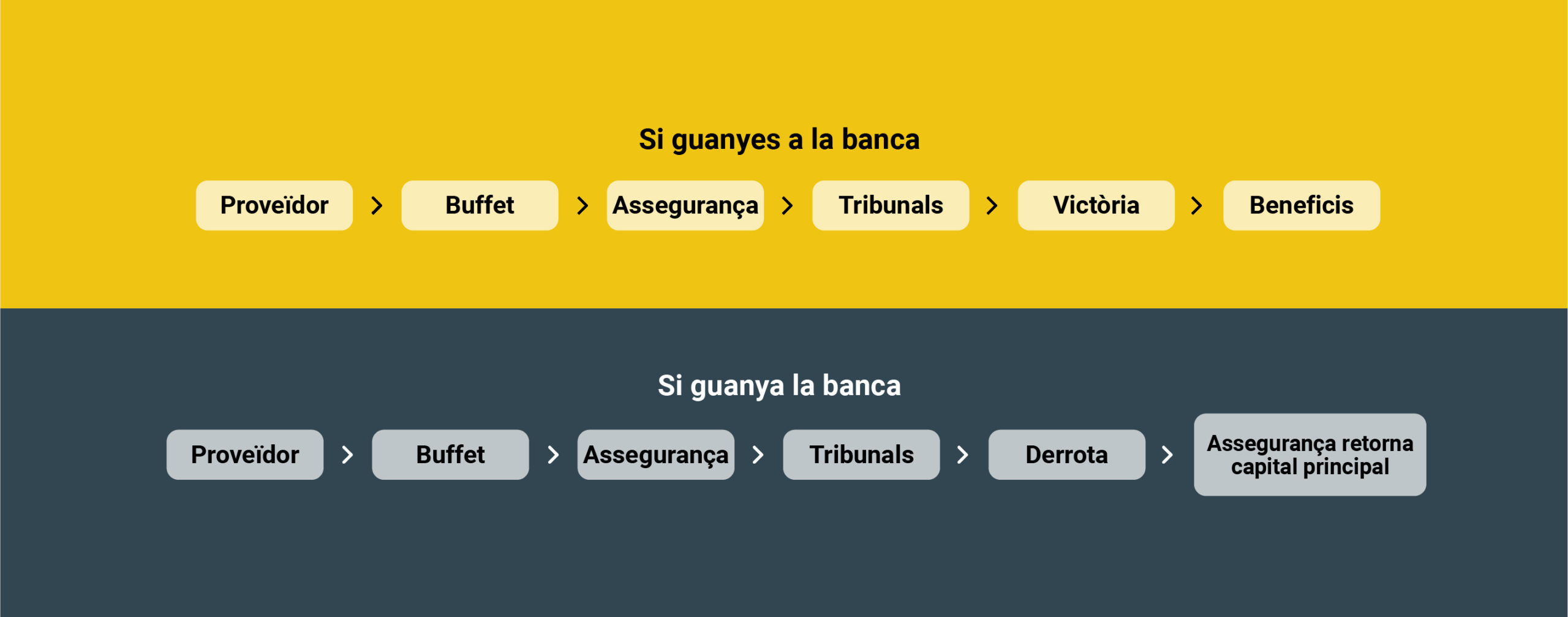

The success of Litigation Funding comes from the concept of providing social justice while obtaining high returns with a low-risk product thanks to the insurance that covers the funds provided by the clients. Since its launch, we have been expanding its scope, while reducing the minimum amount of access capital.

From the minimum initial capital of 25,000 euros, we were able to get our provider to reduce it to 10,000 euros, making this product accessible to a larger number of people in the 11Onze community.

Obviously, the higher the amount of capital provided, the higher the returns. That is why, at the request of our community, we are now also offering the possibility of a group contribution, either among family or friends, so that the financing can be shared while maintaining the percentage of the profits.

“If you have two people who put in 25,000 euros each, this is considered a contribution of 50,000. And the two people get the benefits of the 50,000.”

Group contributions

Litigation Funding generates returns of between 9% and 11%, well above what traditional banks offer for our savings. Even so, not everyone can afford to make a capital contribution of 25,000 or 50,000 euros to obtain maximum returns. By offering the option to contribute money collectively, we multiply the benefits.

As Farhaan Mir explains, “If you have two people who put in 25,000 euros each, that’s considered a 50,000-euro contribution. And the two people get the benefits of the 50,000”. Therefore, instead of getting a return of 9%, which would correspond to 25,000 euros, you will generate profits of 10%, from a contribution of 50,000 euros.

“Any contribution against the cases we are funding is guaranteed. So we have full security for the funds we are providing to the law firm.”

Unfavourable cases covered by insurance

The success rate of the cases to which Litigation Funding has provided funds exceeds 90%. Even so, if there is an unfavourable case, the funds contributed by our clients are covered by insurance, regardless of the amount contributed.

It is therefore a low-risk product. “Any contribution against the cases we are funding is guaranteed. So we have full security for the funds we are providing to the law firm,” says Mir.

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

The members of our community who invested in Litigation Funding a year ago have already obtained their returns of between 9% and 11%. How was the process? Would they recommend it? Dolors Tomàs, a client of 11Onze, tells us about her experience.

It is just over a year since 11Onze Recommends launched Litigation Funding through one of our providers in the United Kingdom, offering the possibility of obtaining returns of between 9 and 11% for your money by financing the legal costs of law firms that pursue claims from citizens who were misled by banks or housing authorities.

With the capital 100% insured and a success rate on more than 90% of the litigations, the launch of this product has been a great success. But it’s one thing for us to tell you about it and another for our customers to tell you about their experience. Dolors Tomàs, a member of the 11Onze community, has invested because she trusts us and is satisfied with the results.

Social justice and high returns

For 11Onze, it is key to find feasible ways to offer socially conscious wealth creation opportunities for its community. Litigation Funding by 11Onze Recommends promises a good investment option. As James Sène, President of 11Onze explained: “Our litigation funds focus primarily on lawsuits against banks. This not only helps to deliver social justice; it also offers high returns above inflation thanks to the compensation the banks will have to pay”.

“If I found myself misled by a bank, I would not mind paying a high fee to lawyers to get justice done.”

This concept of doing social justice was one of the main reasons why Dolors decided to put her money towards Litigation Funding: “I saw that it was something that appealed to me and that was necessary. As a customer, I wouldn’t mind paying a high fee to lawyers to get a return if I was a victim of bank fraud.”

“It has worked very well. Litigation progress has been consistent through the initial formal steps by the law firm and to the point where most cases are being settled.”

How has Litigation Funding generated these profits?

Litigation Funding generates profits by funding the legal work of a law firm that focuses on lawsuits against the most delinquent municipalities and banks. As Farhaan Mir, 11Onze’s CFO, explains, “It has worked very well. The progress of litigation has been consistent through the initial formal steps by the law firm and to the point where most cases are being settled.”

“The capital is guaranteed by insurance, meaning that if the judicial process does not go as expected, and you don’t win the trial, you can get your money back”.

Dolors confirms that “everything has worked out very well” and adds that one of the reasons why she lost her fear of investing is that “the capital is guaranteed by insurance, meaning that iif the judicial process does not go as expected and you don’t win the trial, you can get your money back”. That is why 11Onze recommends this product, which is considered a unique and low-risk opportunity.

Fund lawsuits against banks. Get justice and returns on your savings above inflation thanks to the compensation the banks will have to pay. All the information about Litigation Funding can be found at 11Onze Recommends.

At 11Onze we have been announcing for some time that the price of gold will continue to rise and that it is a great tool for protecting our savings. That is why we launched 11Onze Preciosos in February 2022 and, since then, we have been reporting on the gold market regularly. Now the forecasts are confirmed, gold continues to break records and the mainstream media is also talking about it.

TV3 explains how many establishments that buy and sell gold are doubling or tripling their operations by accepting old gold jewellery as part of payment. In this way, they are helping to counteract the rise in gold prices.

Gold at an all-time high: resale of antique jewellery is on the rise and lower-carat pieces are being bought.

“According to analysts, the gold rush still has a way to go. Speculative investment is growing, as is the interest of individuals in buying gold on the Internet. Even some American supermarkets, such as the Costco chain, already sell gold bars, with a variety of prices to suit all budgets”.

La Vanguardia reports how the armed conflicts in Ukraine and Palestine have spurred gold purchases by the central banks of Russia, China and Turkey and have pushed the price of the golden metal to record highs.

Gold has risen 25% since the Hamas attacks and hits an all-time high

“If time is money, gold is living one of its best times. The yellow metal has been hitting record highs for several days in a row. After new consecutive monthly gains, it is close to 2,300 dollars an ounce, a figure never seen before”.

El Periódico echoes the new all-time high in the price of gold and notes that analysts attribute the price rise to the possibility of lower interest rates and the continuation of purchases by central banks.

Gold returns to all-time highs and nears $2,300 per ounce

“The precious metal continues its bullish rally of the last few days: the price of the golden metal is up 0.40% this Wednesday and is up 10.60% this year and 12.50% in the last twelve months, according to Bloomberg data.”

On Economia, the economic daily of El Nacional, notes that the boom in this precious metal on international markets has caused the Bank of Spain’s gold reserves to increase in value by 33% since October.

The gold rally makes the Bank of Spain ‘win’ 5,080 million in 6 months

“Price rises that have allowed the Spanish central bank’s gold reserves to gain 5,080 million euros since October, 33%, which, annualised, has yielded 65%.”

Ara analyses the reasons behind gold’s meteoric rise over the last five years, in which it has appreciated by 80%, and by 10% in the last month alone.

The new gold rush: strong central bank demand drives up the price of the precious metal

“The situation of economic uncertainty, with the strong inflation of recent years and the expectation of a rate cut, also boosts the price of gold. “Having gold protects you from inflation because it maintains a certain stability. Therefore, the more uncertainty, the more the price of gold rises,” Casanovas points out.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Extreme weather events are becoming more and more frequent. It can rain too much or not even a drop for months. As Coral Santacruz, a chemical engineer and member of the 11Onze marketing team, argues, rational water consumption is necessary to guarantee water supply and contribute to slowing down climate change.

Rainfall in March and April is making the situation of the reservoirs in Catalonia improve “a little” after a few abnormal months in which “it has hardly rained at all.” This is what Coral Santacruz explains in a new chapter of Territori 17.

Despite this improvement, the chemical engineer and member of the 11Onze marketing team stresses that we must not forget the responsibility that each one of us has when it comes to conserving such a precious resource as water: “It is just as important that it rains, as it is that we are conscious of the way we consume that water.”

Although it is true that in Catalonia the industrial and domestic sectors “consume approximately 20% of water and the remaining 80% is consumed in the agricultural sector”, we can all do our bit to avoid wasting water at home, reasons Santacruz: “We think thato our personal consumption doesn’t have a global effect, but if everyone adopts certain habits, we can significantly help in countering climate change.”

The binomial of water and plastic

As the chemical engineer explains, one problem linked to water consumption is all the plastic generated by bottled water. To give us an idea of the extent of the environmental tragedy, she gives a shocking statistic: “In the last 70 years we have dumped more than 150 million tonnes of plastic into our rivers, seas and oceans.”

In fact, if we don’t put a stop to it, “there will come a time when there will be more plastic than fish in the sea.” And it should be borne in mind that “plastic takes a long time to degrade.” Moreover, these plastics can even reach our bodies because fish and other animals in the marine ecosystem “end up ingesting microplastics,” says Santacruz.

The option of filtered water

To help reduce the generation of plastics, the chemical engineer advocates replacing bottled water consumption with filtered tap water, as the filters allow “many impurities” to be eliminated. Moreover, as Coral Santacruz explains, “they retain chlorine and lime, the main impurities that cause the bad taste of tap water.”

The member of the 11Onze marketing team also stresses the impact that this saving of water and plastic has on the domestic economy thanks to the use of filters: “If we really did the calculation, we would realise how much we save per year” because of “all these bottles” of water that are no longer purchased.

The reality is that the economic factor and the environmental issue are increasingly linked. As Coral Santacruz says, “in the end everything counts, everything is related.”

If you want to discover how to drink the best water, save money and help the planet, go to 11Onze Essentials.