11Onze: savings for all budgets

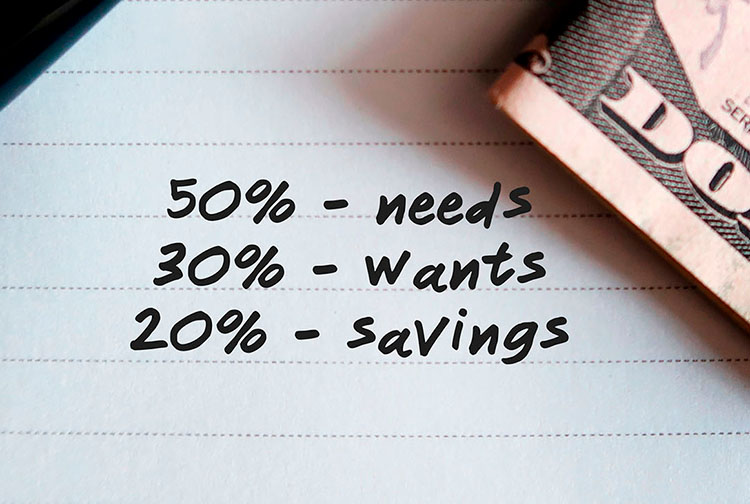

The low yields offered by traditional bank deposits are pushing people to look for safe alternatives to avoid money depreciation. 11Onze offers savings ranging from small to large amounts, always with very low risk.

One of 11Onze’s objectives is to help its community protect their savings and purchasing power. This means trying to get a return on their money, and doing it safely. Currently, 11Onze accumulates proposals that allow you to save from €225 to more than €125,000. We review all the options in a conversation with 11Onze’s product manager, Isaac Sène. In this podcast, we discover not only the current products, but also the three new products that will be made available to the community.

Savings options for everyone

Which savings option suits you best? Choose one based on the minimum capital.

- €222. This is the cost of the Vienna Philharmonic gold coins.

- €3.000. Buy gold from Preciosos 11Onze. Bullion in custody or at home. In the first year of pooled purchases, Preciosos 11Onze has proven that it is able to protect savings from inflation.

- €3.000. Investing in 11Onze, as El Gran Salt investors did.

- €4.000. Available soon. A new product linked to gold. Discover it by listening to the podcast.

- €25.000. Available soon. New product from an external supplier. All the information soon on 11Onze Recommends. Find out more clues about this fund with the principal sum insured and returns above inflation.

- €125.000. On 11Onze Recommends, you can find all the information about Guaranteed Funds. Yields between 2.5% and 165%.

Security at the core

Saving with 11Onze is always based on one maxim: they must be safe propositions. That is why we have made a firm commitment to gold, because of its historical role as a store of value. The fact that money cannot be lost is also clear with the products selected by 11Onze Recommends, funds that guarantee the capital invested. But the clearest proof that security is at the core is provided by El Canut. The 11Onze current account does not work like a normal bank account, which can use the money from the deposits for its expenses. The 11Onze accounts are off-balance sheet, because that is how Electronic Money Institutions (EMI) are regulated. In addition, there is an insurance that guarantees 100% of the amount in the accounts.

What else will 11Onze bring to your community in the near future? The product manager, Isaac Sène, warns that “the next step will be crypto”. Of course, as always, with security at its core.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

If you liked this article, we recommend you read:

The Annual Percentage Rate or APR is the interest charged for borrowing that represents the actual and effective cost of the loan expressed as a percentage, since all the costs associated with taking out the loan are considered. We explain how it is calculated.

If you want to compare mortgages or any type of loan, it is essential to know what the Annual Percentage Rate or APR is. In Spain, this indicator must appear in the advertising and documentation of financial products that refer to a loan. This will help you compare the real cost of two or more loans over a specific term.

The several lending options that you can find on the financial products market have two interest rates associated with them, the NIR and the APR, both of which financial institutions are legally obliged to inform customers about before they give out a loan. Although they are closely related, there are important differences that must be known to know the effective cost of a loan.

Differences between the NIR and the APR

The NIR or Nominal Interest Rate is a fixed percentage that the bank establishes for the provision of money and which represents the sum of the Euribor plus the differential applied. In other words, it is the amount to be paid to the financial institution in exchange for the capital loaned. This cost can vary depending on the amount of the loan, the repayment period and our economic profile. However, the NIR does not include the costs associated with the mortgage and, unlike the APR, it does not have to be calculated annually.

The APR takes into account all the costs associated with taking out the loan, so it includes the NIR and any fees related to the loan, such as the arrangement fee, the transaction costs borne by the consumer and the frequency of payments. However, we should keep in mind that the APR does not include the cost of some concepts, such as notary fees or insurance premiums and other products linked to the transaction.

It is also important to remember that in the case of variable interest rate loans, it is not possible to determine their future evolution, so the calculation of the APR is just indicative. In any case, it is the most reliable indicator when it comes to determining the real cost of a loan, beyond the commercial technique behind the APR announced in the headlines of the offers and promotions presented by financial institutions.

How to calculate the APR

The APR interest rate is calculated using a mathematical formula (APR = (1 + NIR/f)f – 1) that takes into account four factors: the amount of the loan; the NIR; the repayment terms; and all the costs related to the loan. You can use one of the APR calculators on the Internet, such as this one from the OCU, or enter the data in the mortgage or personal loan simulator offered on the Bank of Spain’s website.

Remember that before carrying out any simulation, it is necessary to have these data to obtain the most realistic percentage possible: initial capital, NIR, constitution and periodic mortgage costs, notary, agency and land registry fees. The periodicity of the repayment, i.e., if you are going to pay monthly, quarterly, etc. As well as the repayment period of the mortgage.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze or have a look at the products that 11Onze recommends in our Marketplace.

La limitació del preu del gas ha fet baixar el preu de l’electricitat i el gas respecte el 2022. Tot i això, el consum energètic és una de les despeses fixes més costoses per a les llars catalanes, per això proposem idees per reduir el consum.

Deixem enrere les festes i l’hivern comença a treure tímidament el cap. Aquesta combinació obliga a plantejar-se com estalviar en calefacció, perquè les butxaques estan més escurades que mai a l’inici d’any. Per aquest motiu, des d’11Onze la cap d’agents Mireia Cano us planteja 5 trucs per escalfar la casa estalviant al màxim.

- Evita canvis bruscos. Quan escalfis la casa o una habitació, sigui amb estufa o calefacció, fes-ho gradualment. Posa una temperatura baixa i ves pujant a mesura que l’habitació s’escalfi. Si poses la temperatura molt alta de cop, la demanda energètica serà molt més alta.

- Aprofita les hores de sol. Ho fem poc a l’hivern, però és important. Durant les hores de sol, treu les cortines. Si al migdia no fa fred aprofita per obrir també les finestres. Els raigs de sol escalfaran el terra i les parets interiors de la casa. No és molt, però tot ajuda!

- Aïlla bé. Cal tenir bons aïllaments, si no és així pots perdre el 30% de l’escalfor de la casa. Són clau les finestres i les portes. Al video, la Mireia Cano et proposa algunes idees casolanes que et poden ajudar. Una cosa ben senzilla i important, és baixar les persianes cada nit perquè la fredor no radiï a través dels vidres.

- Escalfa de manera eficient. No cal escalfar tota la casa si no fas servir totes les habitacions. Et cal el menjador? El dormitori? El lavabo? Doncs escalfa aquests espais. És evident que la circul·lació de l’aire tendirà a equilibrar la temperatura, per això el que has de fer és tancar les portes de les habitacions que no necessitis.

- Inverteix en teixits. Si no vols que es refredi, abriga la casa. Què vol dir això? Que els teixits retenen molt bé la calor, per tant, estores i cortines ens ajudaran a tenir una llar més càlida.

I per últim, Mireia Cano es afegeix un consell extra: escalfar el llit a la manera dels nostres avis, amb bosses d’aigua calenta. O, si es vol, amb bosses de llavors que s’escalfen al microones. Estalviar és clau, per a la butxaca i per al planeta. Aplicar aquests trucs no us farà pas rics, però segur que estalviareu una mica. I com diu la dita, tota pedra fa paret.

11Onze és la fintech comunitària de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!

Fixed-term deposits, Treasury bills and mutual funds are the three main options chosen by households seeking to increase the returns on their savings to fight inflation. Even so, which alternatives offer better returns?

Despite the low remuneration for savings still offered by large banks, according to data published in December by the Bank of Spain, households have moved more than 50,000 million euros to fixed-term deposits since the beginning of 2023, for a cumulative total of more than 115,000 million euros in these products at the end of November.

The Spanish banking sector has shown itself to be one of the slowest in the European Union to reflect the European Central Bank’s interest rate hike with a better return on savings. The Spanish average of 2.45% remuneration on deposits of up to one year is still well below the 3.27% of the eurozone.

While Spanish banks suffered the worst flight of bank deposits in Europe during the first two quarters of the year, the public increased its investment in the Treasury to more than 28 billion euros in 2023, an unprecedented record. The high yield offered by short-term public debt has reached 4% (3.7% in the last auction) compared to the 2.45% average traditional banks offer for deposits.

On the other hand, households have also sought to make the most of their savings through guaranteed fixed-income investment funds, which promise investors, as of the maturity date, the recovery of the initial capital and also a predetermined fixed return. The low risk associated with these funds often comes with a low return, but in the current context, they can still be a good alternative to the fixed-term deposits offered by banks.

The savings options that 11Onze Recommends

Saving with 11Onze is always based on one maxim: they must be safe propositions. That is why we have decidedly opted for gold, because of its historic role as a store of value. With Preciosos 11Onze you can buy gold bars from £3,000 or Vienna Philharmonic gold coins from £225. We offer gold bullion in two formats that have counteracted the effect of inflation over the past two years: Gold Patrimony and Gold Seed.

A Guaranteed Fund with full security and an accrued interest of between 2.5% and 165%. The capital and returns are 100% insured by one of the world’s leading insurers. Therefore, you avoid market fluctuations and know for certain that you will get up to 35% interest on your money in 10 years.

If you want your savings to generate monthly income, 11Onze Recommends Monthly Return, a product that yields 22% in 2 years. It is a high-return, low-risk product, with the funds covered by insurance.

Social justice does not have to be at odds with generating returns on your savings. Thanks to Litigation Funding, you can help others who have been deceived by banks or the government, while earning returns of between 9% and 11% on your money.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze or have a look at the products that 11Onze recommends in our Marketplace.

The best gift of the festive season comes from 11Onze, and the procedure for buying it is very simple. We explain how to do it in a podcast!

If you want to give a present for tomorrow’s future that won’t lose its value, the best option is gold.

In this conversation with Càrol Rafales and Coral Santacruz, product managers at 11Onze, they explain the procedure for purchasing the Krugerrand and Britannia coins that we offered last year, the same process you have to follow to buy the Vienna Philharmonic coin that we have available this year.

If you would like more information about buying gold coins for tomorrow’s future, you can fill in this form and an 11Onze agent will contact you. “Once everything is done, payment can be made directly by credit card,” explains Rafales. The customer can choose the Vienna Philharmonic coin (€225) and, immediately afterwards, will start preparing the shipment.

All the information about the history of this mythical coin can be found here. All the information about the history of these mythical coins can be found here. Shipping costs €9.99, except for El Canut users, who get free shipping.

What will we receive at home?

A few days later you will receive the 11Onze Christmas card for tomorrow’s future, the gold coins and a gold voucher for each final recipient. “The gold voucher is personalised with the value of the purchase, the name of the buyer and for whom it is for”, says Art Director Laia Gubern. In this way, each child, grandchild or nephew, will have an exclusive gold voucher that confirms the purchase that has been made for him or her.

For tomorrow’s future is an exclusive 11Onze campaign designed to protect the future savings of the next generation. In the context of the depreciation of the euro due to inflation and competition from the dollar, with a growing distrust of fiat currencies, we had to find a way to give something away for the same purpose. If up to now we have been giving away money for tomorrow’s future, logic suggests that perhaps the best thing to do now is to give away gold.

With Preciosos 11Onze you can buy gold bars and Vienna Philharmonic gold coins. For what lies ahead, gold.

After a 2023 in which the value of the golden metal has risen to record highs, financial analysts expect the value of gold to continue to rise during 2024, thanks to falling interest rates and strong demand from central banks.

So far in 2023, the price of gold has risen by 13% compared to the same period last year, exceeding expectations in a high-interest rate environment. This is a much higher return than other low-risk savings or investment options, such as fixed-term deposits or Treasury bills.

The US banking crisis, geopolitical tensions, military conflicts and the US Federal Reserve’s stance on maintaining interest rates have been some of the main factors contributing to the fact that gold continued to be a safe-haven asset for investors throughout the year.

Although gold prices started in a downward trend in October – after falling during September – the outbreak of a new armed conflict between Palestine and Israel pushed the price of the precious metal up by more than 10%, surpassing the mythical figure of $2,000 on the 4th of September, when it reached $2,130.2 per ounce, thus offsetting the losses that had occurred since the highs of May.

Gold prices are likely to remain high through 2024

According to a Reuters survey of 30 analysts and market participants, the price of gold will rise during 2024 from this year’s average. Specifically, they forecast an average price of $1,986.5 per ounce in 2024, up from this year’s forecast of $1,925.

This is based on the assumption that global central banks will begin to loosen monetary policy and the fact that tensions in the Middle East continue to drive gold as a safe-haven asset for investors. “Gold has had a long history of being a geopolitical hedging instrument and has performed true to its reputation,” said Nitesh Shah, commodity strategist at WisdomTree.

Most economists agree that the Federal Reserve will end its interest rate hikes and start cutting rates in the first half of 2024, encouraging a revaluation of gold. Marko Kolanovic, head of markets at JPMorgan, advises investors to bet on safe-haven assets such as gold and bonds as tensions in the Middle East escalate, while Goldman Sachs expects commodity yields such as gold to rise over the next 12 months.

Still, as Carsten Menke of Julius Baer (an international reference in wealth management) says, “A return towards record-highs should only be possible in case of a severe slowdown of the U.S. economy, leading into a longer-lasting and broader-based recession.”

Preciosos 11Onze makes it easy to buy gold, at the best price and with total security. Protect yourself from economic crises with the ultimate safe-haven asset: gold. If you want your savings to keep or increase their value, Gold Patrimony.

In the last tender of the year, retail investors have turned to buying government debt. Households are seeking a return on their savings above the low remuneration offered by large banks for deposits, and are increasing their holdings of these assets to record highs. But are there other options that offer higher returns?

The last auction of the year of Treasury bills leaves 30% of government debt in the hands of individuals seeking a better return on their savings than that offered by banks for deposits. Although persistent inflation and rising interest rates have evaporated a large part of the savings accumulated by households during the sanitary crisis, the high yield on short-term government bonds has spurred the purchase of these assets.

While during the first two quarters of the year, Spanish banks suffered the biggest drain of deposits in Europe, the public increased its investment in the Treasury to over 28 billion euros in 2023, an unprecedented record. For the first time, Spanish households have become the main owners of Treasury bills, which account for almost one out of every three euros invested.

The high yield offered by short-term government bonds has reached 4% (3.7% in the last auction) compared to the 2.45% average offered by traditional banks for deposits. As for ten-year debt bonds, the yield surpassed 4% given the forecast that central banks would keep interest rates high for longer than expected.

A better return on your savings

The boom in the purchase of public debt is because, on the one hand, it responds to the needs of consumers at a time when traditional banks are not offering sufficiently attractive returns on savings and, on the other, to an apparent lack of alternatives readily available to the public.

This, however, is not exactly true. A product such as Litigation Funding, which 11Onze recommends, offers a higher fixed annual return than bank deposits and Treasury bills. In the short term, 1 or 2 years depending on the amount, it generates returns of between 9% and 11% with the peace of mind that an insurer covers our clients’ capital.

In this context, we should mention the safe-haven asset par excellence, gold. On 4 December, it reached its highest price ever, 2,100 dollars per ounce, and in the last 12 months, it has gone up by almost 11%, confirming itself as one of the best options for protecting our savings. Preciosos 11Onze makes it easy to buy gold, at the best price and with total security.

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

Despite the digitalisation of the economy, in many households, there is still the custom of keeping cash to deal with possible emergencies. This is why the Bank of Spain has issued a series of recommendations on the amount of cash it is advisable to keep at home.

Although digital payment methods are becoming increasingly popular, paying in cash for day-to-day expenses and keeping cash at home are still widespread practices among a large part of the population. In fact, according to a report by the Bank of Spain, the use of banknotes and coins continues to be the most widely used means of payment daily (65%) by Spaniards in physical establishments.

While people generally keep their savings in a bank account or protect them from economic uncertainty by buying safe-haven assets such as gold, they also tend to keep a certain amount of cash at home to deal with possible unforeseen events or payments that still need to be made in cash.

Currently, there is no regulation limiting the amount of cash that citizens can keep at home. The Bank of Spain clarifies that there is no maximum amount of money that we can keep at home and that it is a legal practice, as long as the origin of the money is legal and has been previously declared to the Tax Agency.

The Bank of Spain itself recommends that citizens keep cash at home for emergencies. It also stresses the importance of physical money for the population as a whole, pointing out that it is “within everyone’s reach and allows those who do not have bank accounts to make payments”.

As for the amount of money we should keep at home, this depends on the circumstances of each household. Therefore, personal needs and fixed expenses in areas such as housing, food and transport, among others, must be taken into account. The Bank of Spain does not give a specific figure but recommends that this amount should cover between 6 and 12 months of fixed monthly expenses.

Risks of keeping cash at home

Security is one of the main factors to consider if you keep cash at home. No matter how well-hidden our money is, there is always the possibility of theft. In this context, it is essential to take out home insurance to cover these possible losses.

Another variable to bear in mind is inflation. The Bank of Spain warns that, while keeping money at home is entirely legitimate, inflation can devalue the amount of money we keep at home over time. In other words, money will not grow at the same rate as inflation if we keep it under the mattress.

On the other hand, when it comes to using the money we keep at home, we must keep in mind that, for more than two years now, cash payments are limited to a maximum of €1000. Although the law allows for certain exceptions, exceeding this legal limit will result in a hefty fine from the tax authorities.

To discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy the safe-haven asset par excellence at the best price: physical gold.

Amb l’actual inflació, els diners al banc no fan més que perdre valor dia rere dia. Però sempre és necessari mantenir una mica de liquiditat per si sorgeix algun imprevist. Per això els experts recomanen tenir un “matalàs” d’efectiu en els teus comptes d’estalvi que cobreixi com a mínim tres mesos de despeses.

La vida està plagada d’imprevistos. També en el pla econòmic. A vegades són positius, com un augment de sou, però a vegades hem d’afrontar sorpreses desagradables que fan mossa en la nostra butxaca. Pot ser des d’una despesa puntual extraordinària, com quan hem de reposar un electrodomèstic vell de casa, fins una cosa més seriosa, com patir una malaltia incapacitant o quedar-nos sense treball.

Per fer front a aquestes eventualitats, és necessari disposar d’un fons d’emergència. L’antic costum de guardar els diners en el matalàs o en qualsevol altre amagatall de la casa et permet disposar d’ells de manera immediata, però és poc recomanable pel risc de robatori i la nul·la rendibilitat.

És preferible recórrer a les entitats bancàries, tot i que has de tenir en compte el límit del Fons de Garantia de Dipòsits d’Entitats de Crèdit per a que els teus diners sempre estiguin protegits.

Assegura els teus estalvis

Com detalla el seu web, aquest organisme “té per objecte garantir els dipòsits en diners i en valors o altres instruments financers constituïts en les entitats de crèdit, amb el límit de 100.000 euros per als dipòsits en diners”.

Això desaconsella tenir més de 100.000 euros en comptes i dipòsits a termini d’una mateixa entitat, ja que el fons només cobrirà fins a 100.000 euros per titular en cas que el teu banc faci fallida.

Si, per exemple, tinguessis 120.000 euros en una entitat que ha fet fallida, encara que fora en diversos comptes o dipòsits, aquest organisme només et retornaria 100.000 i perdries els altres 20.000. D’aquí la conveniència de repartir els diners entre diverses entitats per a que els comptes i dipòsits no superin el límit garantit en cap d’elles.

De quant parlem?

Només en casos molt excepcionals el nostre fons d’emergència hauria d’assolir aquests 100.000 euros, especialment en un moment com aquest, en el qual l’elevada inflació fa que els diners dipositats al banc perdin valor mes rere mes. De totes maneres, l’import òptim dependrà en última instància de les nostres circumstàncies personals: bàsicament, quines són les nostres despeses previstes i amb quins ingressos podríem comptar en cas d’un esdeveniment negatiu.

Els experts solen recomanar que el coixí financer cobreixi com a mínim tres mesos de despeses. Cal tenir en compte que mantenir un saldo massa baix en el nostre compte ens pot fer entrar en números vermells amb facilitat, la qual cosa generaria despeses financeres pel descobert.

L’OCU, per exemple, indica que una quantitat prudent en els comptes corrents “pot ser l’equivalent a tres mesos del teu salari”. No recomana més perquè aquests comptes “no són el millor lloc per a mantenir els nostres estalvis, ja que pràcticament cap entitat les premia amb interessos”.

Quant al màxim, no sol recomanar-se més del necessari per a cobrir sis mesos de despeses. De fet, el portal ‘Finances per a tots’, una iniciativa del Banc d’Espanya, la Comissió Nacional del Mercat de Valors i el Ministeri d’Assumptes Econòmics i Transformació Digital, aconsella “acumular un fons equivalent a entre tres i sis mesos de despeses”. A partir d’aquí es tracta de buscar inversions que garanteixin una bona rendibilitat.

11Onze és la fintech comunitària de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!

Although the major international economic organisations try to send a reassuring message about controlling inflation, the UK’s experience in the 1970s raises serious doubts. Gold appears to be an interesting option to protect against the depreciation of money amid a “bear market” cycle that could last longer.

For months now, inflation has been far exceeding the optimistic forecasts of the major international economic organisations. The harsh reality means that time and again these institutions are forced to recalculate their forecasts upwards.

They all coincide in sending out a reassuring message. The mantra is that this year’s out-of-control rates will tend to moderate in 2023 and that by 2024 a rate close to the desired 2 % will be restored. The interest rate hikes by the major central banks should make a decisive contribution to this.

The latest to make this point is the International Monetary Fund, which, in a report, predicts that wage restraint will prevent a dangerous inflationary spiral.

Learning from the past

However, some economists warn that there are parallels between the current situation and the stagflation experienced in the UK half a century ago. Since 1970, the British government had been doping the economy with expansionary budgets and lower interest rates. As a result, inflation soared to 9.1 % in 1973, similar to today’s rate.

As now, interest rates had started to rise. Between June and November 1973 they rose from 7.5 % to 13 %, which led to the bursting of the housing bubble and the ensuing banking crisis. Moreover, between May 1972 and January 1975, the main stock market index lost 74 % of its value. The economic slowdown did not prevent inflation from spiralling out of control: it reached 16% in 1974 and a whopping 24.2% in 1975.

The big concern is that history will repeat itself. The bad news is that the spread between the inflation rate and interest rates is now much wider than it was then, so the monetary policy correction could have a much more devastating effect on the economy. The overall contraction in bank credit will be severe and many firms will become insolvent.

At current inflation rates, interest rates and the cost of government debt would logically soar. And, predictably, central banks will do what they have always done in the past to deal with this type of crisis: print more banknotes, which will further reduce their real value.

Gold, a safe-haven asset

The rise in interest rates in the early 1970s was no obstacle to the appreciation of gold: it went from less than £18 per ounce when interest rates were 6% to more than £40 when they rose to 13% in November 1974. For, as the founder of J.P. Morgan said, “gold is really money, everything else is credit”.

Since the suspension of the Bretton Woods agreements in 1971, which meant abandoning the gold standard, the sum of banknotes and commercial bank credit has increased more than 30-fold, which is equivalent to its devaluation. In fact, middle-class single-earner households were common before 1970 and are now a utopia. Buying a house or even a car without going into debt has become a privilege only within the reach of a few rich people.

Gold, on the other hand, has taken the opposite path to that of the money supply and its value has increased 38-fold. In fact, since December 2015, gold has appreciated by more than 40% against the euro.

Endorsed by the biggest hedge fund

Hence, the recommendation by Bridgewater Associates, the world’s largest hedge fund, to buy physical gold is not surprising, despite the fact that many investors see the current depreciation of many other financial assets as a buying opportunity.

Rebecca Patterson, chief investment strategist at Bridgewater, says the reason for going into gold is the need to protect against a “bear market” phase that is set to continue over time. Consequently, the logic of buying assets in the economic downturn, when prices are low, only to sell when the economy expands and rises again may not hold true this time around.

Moreover, both the Chinese and Indian economies are regaining their historical appetite for gold, which will contribute to gold prices in the short term.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.