Conscious consumption: key to changing the world

Can we change the world? What is our real capacity to impact the environment? Lara de Castro, HR Business Partner at 11Onze, explains what conscious consumption is and how we can contribute to the sustainability of the planet with our daily purchasing decisions.

We often underestimate the impact that our individual actions have on the surrounding environment. But all actions, no matter how small, contribute to shaping the world. Lara de Castro explains it in the following video with a very obvious example.

As she warns, there are many people who think that an individual act is often “too weak” to have a significant impact on the environment, “but this is not the case”. Every action counts and has consequences that can add up to those of the rest of the community. The reality is that “our daily decisions are relevant, no matter how small“. In this sense, the role that all purchasing decisions play if we are conscious consumers is very obvious.

What is conscious consumption?

Conscious consumers are people who choose products and services with criteria that go “beyond value for money,” as they include environmental and social impact as a decisive element in their purchasing habits. One consequence is the commitment to local commerce, which “is a way of supporting local producers and avoiding the economic and environmental impact of transportation,” as Lara de Castro explains.

Another example of conscious consumption can be found in water. If we want to reduce pollution on the planet, we can replace the consumption of bottled water, “with all the drawbacks that we know plastic has,” with tap water treated with sustainable filters.

As Lara de Castro points out at the end of the video, if we all become more conscious “in the small details of everyday life” the reality is that “we can change the world.” The decision is ours.

If you want to discover how to drink the best water, save money and help the planet, go to 11Onze Essentials.

Moltes llars tenen joies d’or o altres peces d’aquest metall preciós que amb el pas dels anys han perdut la seva brillantor. L’or gairebé no s’oxida, però la brutícia acumulada pel contacte amb la pell i cosmètics pot malmetre el seu aspecte. T’expliquem com netejar i cuidar les teves joies d’or amb productes naturals.

L’or pot perdre la seva lluentor natural pel contacte amb el pH de la nostra pell o per reaccions amb substàncies líquides, com el clor de la piscina o altres agents nocius. Per a mantenir l’esplendor de les peces d’or, es recomana netejar-les amb un drap blanc de cotó, com fan els joiers a l’hora de manipular-les, evitant així que el contacte amb la pell els hi resti lluentor. Existeixen moltes maneres tradicionals, naturals i efectives de netejar les teves peces d’or. A continuació t’expliquem alguns dels trucs clàssics per retornar la brillantor a aquest metall preciós:

Netejar amb sabó

- Barrejar unes gotes de sabó de rentar plats suau amb aigua tèbia en un recipient.

- Submergir la peça d’or al recipient durant uns quinze minuts una vegada estigui llesta la mescla. Veuràs que les impureses es desincrusten soles.

- Retirar la peça d’or del recipient i esbandir bé amb aigua tèbia.

- Assecar-la bé amb un drap suau.

- Repetir aquest procés tantes vegades com creguis necessari.

Recuperar la lluentor amb vinagre

- Barrejar en un recipient ½ tassa de vinagre blanc i 2 cullerades de bicarbonat de sodi

- Submergir les peces d’or que estiguin brutes o hagin perdut la seva lluentor, durant dues hores.

- Esbandir les joies d’or amb aigua freda i assecar-les amb un drap suau. També es pot fer servir una camusa abrillantadora.

Preservar la brillantor amb bicarbonat de sodi

- Barrejar tres cullerades de bicarbonat en un recipient amb un dit d’aigua tèbia. Remoure fins a formar una mescla consistent.

- Aplicar aquesta mescla sobre les peces d’or que vulguis netejar.

- Un cop aplicada la mescla sobre les joies, tirar un raig de vinagre per activar l’efervescència que desprengui la brutícia de les joies.

- Esperar uns minuts i retirar la mescla

- Esbandir amb abundant aigua tèbia, assecar les peces d’or acuradament amb un drap suau.

Or blanc o amb acabat mat

En cas que tinguis una peça d’or blanc o or amb acabat mat, has d’evitar fer servir una camussa per donar brillantor. L’or blanc consisteix en un aliatge d’or pur, de color groguenc, i altres metalls preciosos més blanquinosos, com poden ser el platí, níquel, etc., als que s’hi afegeix un bany de rodi. Per tant, netejant aquestes peces amb una camussa, podries eliminar el bany de rodi o aconseguir una brillantor no desitjada en una peça amb acabat mat.

Guarda or amb or, no barregis metalls preciosos

Per a preservar la lluentor de les teves peces i joies d’or no les guardis al costat d’altres joies o peces en plata o un altre metall. Guarda i classifica les teves peces de valor segons la composició del metall: or amb or, platí amb platí… Evitaràs que l’or o altres metalls s’enfosqueixin i així també faràs que es conservin millor, amb tota la seva lluentor.

Lingots d’or i monedes de col·leccionisme

Els lingots d’or, com els que pots comprar amb Preciosos 11Onze, acostumen a venir precintats o empaquetats amb un blíster termo-segellat que porta un codi certificant el seu origen i autenticitat. Això es fa per certificar i preservar el seu valor, tant quan els compres com a l’hora de vendre’ls. Tot i que pot ser temptador trencar el blíster per tocar la peça amb les nostres mans, no és recomanable.

Les monedes d’or comprades com a inversió també venen empaquetades, però rarament precintades. Així i tot, no és recomanable la seva manipulació per la possible contaminació de la peça i risc de malmetre la moneda quan es neteja. A més, cal tenir en compte que les monedes de col·leccionisme, especialment monedes antigues, poden perdre una bona part del seu valor si es netegen i perden la seva pàtina original.

Si vols descobrir la millor opció per protegir els teus estalvis, entra a Preciosos 11Onze. T’ajudarem a comprar al millor preu el valor refugi per excel·lència: l’or físic.

Spain is the second country in the European Union where its population has the most money saved without remuneration. A large part of Spaniards’ savings is in current accounts and deposits that give very low returns that do not compensate for inflation. Are we investing too little and poorly?

Families have drawn on the almost 270,000 million euros saved during the worst phases of the pandemic to sustain spending in the face of the sharp price rises of the last two years. Even so, the gradual reopening of the economy and the rising cost of living have caused a large part of this accumulated savings pool to evaporate.

Even so, after the erosion suffered in 2022, the household savings rate has been recovering. It stood at 6.2% of their gross disposable income in the first quarter of the year, an increase of 83% compared with the same period a year ago. If seasonal and calendar effects are removed, it is equivalent to 14.2% of their disposable income, 1.2 points higher than in the previous quarter and the highest since the third quarter of 2021, according to the latest data published by the National Statistics Institute (INE).

In total, this is an increase to 14,119 million euros, while investment remained at 14,200 million euros, 1.3% less than the previous year. On the other hand, a financing requirement of 773 million euros was recorded, compared with an estimated financing requirement of 7,312 million euros for the same quarter of 2023.

Low-yielding financial instruments

Fixed-term deposits (38%), direct investment (32%), investment funds (15%) and Treasury bills and variable-term bonds, among others (11%), are the main options chosen by households seeking to make their savings profitable and protect themselves from the general increase in costs. The problem is that many of these options offer low returns that do not compensate for inflation.

Therefore, even though as a percentage of GDP, net financial assets represent 144.7%, a ratio 3.4 points higher than in the previous year, many people do not want or do not know how to generate wealth with their savings, which are being consumed by high inflation.

In Spain, there is almost a trillion euros in current accounts or cash, without remuneration and that even, in some cases, entails maintenance costs. Rodrigo Buenaventura, president of the National Securities Market Commission (CNMV), pointed out two months ago in an appearance at the Congress of Deputies, “Our citizens invest their savings in a way that can be manifestly improved”.

How to increase the return on savings

As a general rule, investments that offer high returns come with high risk, while low-risk investments offer more stable, but potentially lower, returns. However, at 11Onze we have shown that this does not always have to be the case.

Saving with 11Onze is always based on one maxim: they have to be safe propositions. That is why we have made a firm commitment to gold, because of its historic role as a store of value. We offer you gold bars in two formats: Gold Patrimony and Gold Seed. Bearing in mind that gold has doubled in value in the last five years and that its price rose by 15% in 2023, it has established itself as an excellent option for dealing with inflation.

Social justice does not have to be at odds with generating returns on your savings. Thanks to Litigation Funding, you can help others who have been abused by banks or the government while earning returns of between 9% and 11% on your money.

It is a product that has been structured exclusively for members of the 11Onze community, offering two ways to participate: an option that returns your capital and possible profits after one year, or another option in which your capital works for a few years and provides you with a monthly return in six months.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Here we present 10 recommendations for you to enjoy your holiday and save on bookings and many other things.

This year, many people are expected to go on holidays in July, but will we have money for our much-desired holiday? I am sure we are all thinking about summer and, therefore, on the holiday; many of you already have in your mind the place where you want to travel, but you are waiting for new recommendations on whether we will finally be able to take a plane and enjoy a well-earned disconnection.

Holidays are necessary to reset ourselves, to enjoy our beloved ones’ presence, which is very necessary, and to recharge the batteries to get back to work with a clear head. It is also a time when we try not to pay so much attention to expenses: we usually eat too much, we buy things we know we will not find in our city, and we go to that hotel that we desired so much. That is why we are telling you some tips for saving on holidays, so that the return in September is more tolerable and free of headaches.

- Start saving a year earlier if you can. The first recommended step is to create an estimated budget of the amount you want to invest in your next destination so that you can create a savings plan a year earlier. The most comfortable method is opening a savings account or wallet at your bank and making a recurring automatic monthly transfer; this way, before you start your holiday, you will have the saved amount you need to avoid unforeseen expenses.

- Book in advance. The online world provides us with a huge price variety. Besides, if you can have the dates for your confirmed holiday at the start of the year, you can save a lot of money, you will get better prices on your plane or train ticket, etc. The earlier you book it, the better! And the same thing will happen with the hotel; we even recommend that you book a table in that restaurant you’ve been following on Instagram using applications that offer very interesting discounts, even 50%. It is important that you check cancellation costs on your bookings, in case it is necessary.

- Take advantage of breakfast. Everyone knows breakfast is the most significant meal of the day, and it is necessary for large walks. Make use of breakfast if it’s included in your hotel nights; get ready and eat like a king; take advantage and grab a fruit for mid-morning, in case you get hungry before lunch.

- Schedule sites. If you love making a presentation of your next trip and sharing it with the rest of your travelling companions, you’re lucky, because this is another way to save money. If you list the sites you want to visit, you have the option to visit their website and make the reservation. You can find promotions and, if you are several people, you can benefit from group discounts. In addition, if you purchase the ticket in advance, you may even avoid long queues.

- Currency exchange. Even though currency prices cannot be controlled, before exchanging currency, check with your trusted bank a few weeks before your trip, to know if it is better to wait till the day before the departure. In many cases, the recommendation will be to do so at the airport, as exchange houses try to offer the best prices. One important thing: if you want to make credit card purchases during your trip, exchange an amount, even if it’s small, in case any unforeseen event arises (train ticket, tips, etc.).

- Use cards moderately. As we mentioned before, when you’re on holiday, the last thing you want to think about is how much you’re spending, but we almost always exceed ourselves… Try to implement the recommendations that we have made so far and try to avoid the use of credit cards as much as possible if it is not planned in your priorities. At that moment, it will be an impulsive purchase, but later, it will become a significant amount of spent money.

- Road trip. If your holiday option is to take the car and go to some nearby villages, use GPS, which always recommends the best route to avoid making unnecessary miles and thus save on petrol. Visiting destinations near home is a highly recommended option; we often forget the wonderful places we have neared our city that we can visit without taking a plane.

- Avoid restaurants for tourists. Plan your time well and, when you visit some particular place, if it is in a tourist area, avoid rush hours for lunch or dinner: normally, restaurants in these areas are of poor quality and high cost. It is preferable to walk four steps and look for alternative places that are frequented by locals, to ask the hotel receptionist, the taxi driver, and, of course, to look at the options Internet searchers provide.

- Hire free tours. Find them in the centre of big cities or ask that friend who travels a lot, who has certainly used them. They’re tour guides that take you around the city and tell you a lot of very interesting things without a specific fee. If you like it, it’s optional to leave a tip.

- Finance your holiday. If it has been a difficult year, and you cannot follow some of the advice that we have mentioned, such as planning in advance, do not give up to a few well-earned days of rest, find your closest travel agency, and finance that trip you are so excited about; you can also consult your bank and extend your credit card so that you can cope with your expenses or borrow a small loan that you will return comfortably month by month.

Summer is here. Use these recommendations and start daydreaming. And remember, split the amount established for your pleasure throughout your holidays and do not spend more than expected.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!

Throughout history, gold has remained the ultimate store of value precisely because it maintains or increases in value during periods of economic uncertainty. That is why buying physical gold is an excellent investment option that is usually safe and profitable. However, it can also carry risks if some basic precautions are not taken into account.

Its long-term profitability, the possibility of diversifying and reducing the risk of our investment portfolios and its great liquidity that allows us to quickly recover the money invested in case of need, make gold a very attractive asset for any investor or person who wants to protect their savings in an inflationary period or in times of economic crisis.

In the last five years, it has experienced a spectacular increase in value, doubling in price and reasserting itself as the most valuable asset on the market. However, it is advisable to take certain precautions and avoid making certain mistakes when acquiring this golden metal, which we detail below:

Ignoring the purity of gold

Gold bullion must be at least 99.5% pure, although 99.99% pure gold bullion is common, while coins must be at least 80% pure. Bullion and coins that do not meet these purity standards will be subject to the standard VAT rate of 21%, which applies to the purchase of other precious metals. Preciosos 11Onze gold guarantees the highest purity (999.99 out of 1,000).

Confusing physical gold with digital gold

It is essential to be very clear that physical gold is a raw material that, once acquired, automatically becomes the property of the customer. On the other hand, digital gold, usually in the form of ETFs, are exchange-traded funds run by a fund manager, which operate on a system of leverage, so that not all the gold that is represented in the ETF’s holdings have physical gold behind them to support them.

Disregarding buy-backs

One of the first questions to ask the trader or platform that has sold us the gold is whether, if we want to sell it, he offers a buy-back service. If not, we must be suspicious of the selling price and the reliability of the trader. At 11Onze we make it easy for our customers who store their gold at home to find a buyer at the best possible price for the customer, or we sell it on their behalf if they have contracted a custody service with us.

Not planning for storage

Physical gold needs secure storage such as safes or professional storage services. Not having a safe place can expose your investment to theft. By contracting a safekeeping service, you ensure that your gold is protected and insured by a professional storage company specialised in precious metals.

If you want to discover the best option to protect your savings, go to Preciosos 11Onze. We will help you buy at the best price the ultimate safe-haven asset: physical gold.

Are you an individual saver or an institutional investor? Do you think about adding value to your savings in the long term or obtaining returns in the short term? Are you conservative, moderate or aggressive? At 11Onze we take a look at the different profiles of savers. Which one do you fit into?

In the financial markets, there are all kinds of people. We have already explained this at La Plaça: when we manage our money, there is a very strong emotional component, but there are also motivations, objectives and challenges that spur us on. It is important that we know what our attitude towards money responds to if we want to have good financial health and, of course, if we want to learn how to manage our savings in the most appropriate way.

Do you work for yourself or for others?

- The born saver. This is a natural or legal person who trades for his or her own account, i.e. to move a particular investment, often to make a return on savings.

- The institutional investor. They usually act for the capital of many investors, such as investment funds, pension funds or insurance companies. This institutional investor tends to have a lot of influence, because they do work for many shareholders at the same time.

Long horizons or immediate goals?

- The strategist. The saver who sets long-term strategies is the one who has a horizon in which he foresees giving value to a company or portfolio. For this reason, this profile tends to look for market niches that they know well, where they feel secure.

- The instinctive. On the other hand, the more financial profile aims to generate profitability in the short and medium term and, for this reason, is committed to initial investments. They do not usually intervene directly in the companies in which they invest, nor do they know them particularly well.

Conservative, moderate or aggressive?

- Conservatives save. Conservative savers tend to take decisions that are very low risk, in assets where the income is fixed, such as government bonds and equity assets with a lot of strength, such as gold.

- Moderate investors are neither black nor white. The moderate investor, on the other hand, seeks risk rather than stability, and therefore tends to combine fixed income assets and other more volatile assets.

- The aggressive, risk-loving investor. Finally, we find the aggressive investor, who does not think so much about increasing savings, but is motivated by risk. Their investments are very volatile, with a diversified portfolio, in order to maximise returns. This profile tends to have a lot of experience in financial markets.

How you move money, explain who you are

- The philanthropist of friends and family. What we invest our savings in also explains who we are. There are, for example, those who only think about investing, not so much to save, but out of confidence in a project that is close to them, friends or family.

- The angels who give. There are also the so-called ‘business angels’, who decide that, with their money, they want to invest in a sector they know a lot about and in which they firmly believe.

- The asset manager. In the market we also find all those investors who work for large family estates, whether for a single family or for many.

- The adventurer. There are also all those investors, often aggressive, who have decided to enter directly into the shareholding of companies, either looking for a bit of adventure, because they are leading ‘startups’ that can turn out to be a good business in a short time or for more consolidated private capital.

- The sustainable investor. And finally, there is the saver who has decided, out of ecological awareness, not to give up the financial market, but to do so in sustainable investments and with ESG criteria.

11Onze is the fintech community of Catalonia. Open an account by downloading the super app El Canut on Android and Apple and join the revolution!

Learning to manage how we spend our money is paramount when it comes to reducing household expenses, and small outlays can end up weighing down our finances more than we realise.

The Scottish-American businessman Andrew Carnegie (1835-1919) formulated the old saying: “Take care of the pennies and the pounds will take care of themselves“, to remind his employees of the need to control small expenses. Even so, these small outlays can end up weighing down our household finances.

We refer to as ant expenses to a series of small payments for services or products, sometimes unnecessary, that we make on a daily basis, almost unconsciously, but which little by little reduce an important part of our budget at the end of the year. How many times have we asked ourselves: “Where have I spent all my money on this month?

Normally, we don’t pay much attention to these everyday expenses because of their relatively low cost, but identifying and reducing them can mean the difference between not making ends meet, or having a budget that allows us to save and go on holiday.

Reducing invisible expenses

We are all aware of the costs of electricity, telephone, gas, and water bills and take them for granted. Even so, out of laziness, or to avoid problems, we rarely consider changing suppliers to reduce the price of the monthly bill. A small effort that could mean hundreds of euros saved at the end of the year.

Coffee, croissants, the lunch menu, are small treats that make our day, but a perfect example of micro-expenditure, although not always dispensable, that we can reduce the cost of. Bringing home-cooked food or shopping at the supermarket instead of going to the pub every day only saves a few euros a week, but you will no doubt be surprised at the savings you can make by calculating how much these micro-expenses add to your annual bill.

Bank charges and credit card fees are expenses that we don’t give much thought to, but they add up. Some banks take advantage of the fact that these small fees will not be seen or claimed by customers. Reducing or eliminating the number of credit cards, and opting for a deferred payment method at the end of the month that avoids paying interest, are options that only require a minimum of effort on our part.

Change consumption habits

Looking at everyday shopping, comparing prices between establishments, or taking advantage of offers can save us a significant amount of money, but changing our consumption habits is equally important. Not buying bottled water, which is often overpriced, and drinking tap water or using filters can save us a considerable amount of money while at the same time helping to reduce plastic waste in the environment.

Still, how often do we take the car for short distances? And how much time and money do we waste looking for parking? Perhaps we can consider whether a walk, taking public transport or using a bike is more appropriate for some of these journeys. Our wallet, our health, and the planet will thank us for it.

Rethinking our consumption habits and reducing our expenses does not have to lead us to live a monastic life of austerity, on the contrary, it can help us to have a good budget to enjoy the whims that enrich our lives, while eliminating expenses that make it more difficult for us.

If you want to wash your clothes without polluting the planet, 11Onze recommends Natulim.

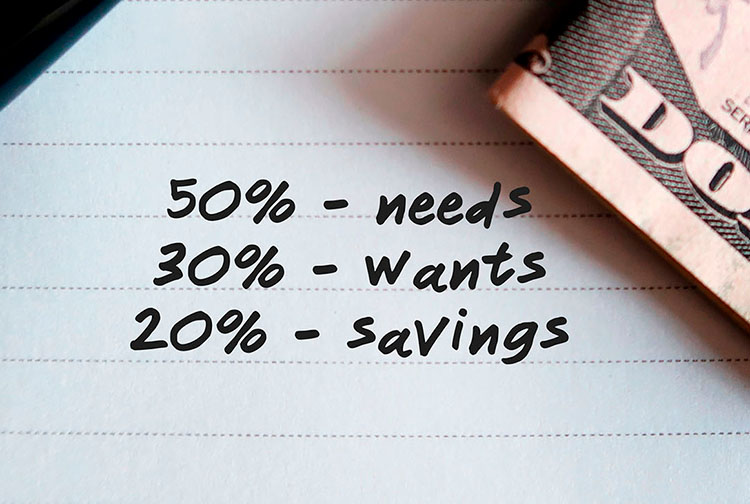

Tot i que qualsevol moment de l’any és bo per començar a estalviar, també és veritat que fàcilment podem trobar una excusa per no fer-ho mai. La pèrdua de poder adquisitiu per la inflació desbocada, els sous baixos, les rebaixes, el Black Friday! No obstant això, hi ha mètodes d’estalvi que requereixen un mínim esforç i estan a l’abast de quasi tothom. Càrol Rafales, de l’equip de producte d’11Onze, ens en presenta un de ben senzill de seguir.

Són moltes les persones que tracten d’estalviar per fer front a imprevistos, preveure futures compres o planificar unes bones vacances. Tantes com les que no saben com fer-ho, o que comencen a estalviar tot animades, però ho deixen córrer al cap de poc temps. Potser la clau està en anar pas a pas i començar a estalviar petites quantitats. Com apunta Rafales, “veritat que si us dic d’estalviar un euro la primera setmana, i dos la segona, no us sembla tan difícil?”.

Doncs en això es basa el repte d’estalvi de les 52 setmanes. Un mètode per estalviar fàcilment que consisteix a posar una quantitat de diners, durant 52 setmanes, en una guardiola, pot o el que t’agradi més, equivalent al número de la setmana que toqui.

De mica en mica s’omple la pica

Estalviar un euro la primera setmana, dos la segona, i així successivament, ens pot semblar ridícul, però si tenim en compte que al cap de l’any haurem estalviat 1.387 €, estem parlant d’una xifra que no és gens menyspreable. I que en tot cas, si tens un nivell d’ingressos prou elevat, “pots començar amb una xifra més elevada de” per exemple “21 €, per aconseguir més de 2.300 € al final de l’any”, explica Rafales.

Si no ens en refiem de la nostra constància en seguir aquest mètode, sempre podem programar una transferència setmanal a un compte d’estalvi, que fins i to ens pot donar uns interessos. A més, d’aquesta manera ens assegurem que aquests diners siguin de difícil accés ràpid, evitant temptacions de trencar la guardiola.

Si vols descobrir com beure la millor aigua, estalviar diners i ajudar al planeta, entra a Imprescindibles 11Onze.

Since the beginning of 11Onze, we have been informing our community that gold is a great tool to protect savings and that its price would continue to rise. Time has proven us right. In the last five years, it has experienced a spectacular increase in value, doubling its price and reaffirming itself as the most valuable asset on the market.

The price of gold has consolidated above 2,150 euros per ounce after the third consecutive month of upward movement, despite the slight drop in price in mid-May. The strength of its price during the first five months of the year has been caused by strong demand from central banks in emerging economies due to geopolitical tensions and persistent inflation.

Since the beginning of the year, gold has risen 17%, following the upward trend of 2023 when, although it experienced some fluctuations during the year, it rose 15% on the back of the US banking crisis, geopolitical tensions, military conflicts and the US Federal Reserve’s monetary policy.

John Reade, chief market strategist for Europe and Asia at the World Gold Council, noted a month ago that gold prices have experienced a remarkable rally, doubling over the past five years since 2019. What’s more, Reade pointed out that the gold metal’s price performance has been largely independent of that of the US dollar, which is usually one of the biggest drivers of gold prices.

Developing economies lead the way

The WGC analyst explained that emerging markets, particularly India and China, already account for half of the global gold market share after experiencing an increase in production and trade in the precious metal. Furthermore, he expects the price of gold to rise substantially soon, citing continued buying by central banks as the main driver behind the upward trend.

‘We urge investors to incorporate gold into their financial and investment portfolios and to seek diversification. Gold not only diversifies, but also stabilises financial portfolios. Moreover, any reduction in US interest rates is likely to have a favourable impact on gold prices,’ Reade advised.

Other analysts, such as those at Bank of America, expect the rally to continue and believe that a price of 3,000 dollars per ounce is possible by the end of the year. Economic uncertainty, expansionary monetary policies, inflation, and currency devaluation continue to be as relevant today as they were a few months ago and could continue to drive the price of gold in the near future.

Preciosos 11Onze makes it easy to buy gold, at the best price and with total security. Give us a call and speak to one of our agents without any obligation to clarify any doubts you may have and protect yourself from economic crises with the ultimate safe-haven asset: gold. If you want your savings to keep or increase their value, Gold Patrimony.

Amb l’actual inflació, els diners al banc no fan més que perdre valor dia rere dia. Però sempre és necessari mantenir una mica de liquiditat per si sorgeix algun imprevist. Per això els experts recomanen tenir un “matalàs” d’efectiu en els teus comptes d’estalvi que cobreixi com a mínim tres mesos de despeses.

La vida està plagada d’imprevistos. També en el pla econòmic. A vegades són positius, com un augment de sou, però a vegades hem d’afrontar sorpreses desagradables que fan mossa en la nostra butxaca. Pot ser des d’una despesa puntual extraordinària, com quan hem de reposar un electrodomèstic vell de casa, fins una cosa més seriosa, com patir una malaltia incapacitant o quedar-nos sense treball.

Per fer front a aquestes eventualitats, és necessari disposar d’un fons d’emergència. L’antic costum de guardar els diners en el matalàs o en qualsevol altre amagatall de la casa et permet disposar d’ells de manera immediata, però és poc recomanable pel risc de robatori i la nul·la rendibilitat.

És preferible recórrer a les entitats bancàries, tot i que has de tenir en compte el límit del Fons de Garantia de Dipòsits d’Entitats de Crèdit per a que els teus diners sempre estiguin protegits.

Assegura els teus estalvis

Com detalla el seu web, aquest organisme “té per objecte garantir els dipòsits en diners i en valors o altres instruments financers constituïts en les entitats de crèdit, amb el límit de 100.000 euros per als dipòsits en diners”.

Això desaconsella tenir més de 100.000 euros en comptes i dipòsits a termini d’una mateixa entitat, ja que el fons només cobrirà fins a 100.000 euros per titular en cas que el teu banc faci fallida.

Si, per exemple, tinguessis 120.000 euros en una entitat que ha fet fallida, encara que fora en diversos comptes o dipòsits, aquest organisme només et retornaria 100.000 i perdries els altres 20.000. D’aquí la conveniència de repartir els diners entre diverses entitats per a que els comptes i dipòsits no superin el límit garantit en cap d’elles.

De quant parlem?

Només en casos molt excepcionals el nostre fons d’emergència hauria d’assolir aquests 100.000 euros, especialment en un moment com aquest, en el qual l’elevada inflació fa que els diners dipositats al banc perdin valor mes rere mes. De totes maneres, l’import òptim dependrà en última instància de les nostres circumstàncies personals: bàsicament, quines són les nostres despeses previstes i amb quins ingressos podríem comptar en cas d’un esdeveniment negatiu.

Els experts solen recomanar que el coixí financer cobreixi com a mínim tres mesos de despeses. Cal tenir en compte que mantenir un saldo massa baix en el nostre compte ens pot fer entrar en números vermells amb facilitat, la qual cosa generaria despeses financeres pel descobert.

L’OCU, per exemple, indica que una quantitat prudent en els comptes corrents “pot ser l’equivalent a tres mesos del teu salari”. No recomana més perquè aquests comptes “no són el millor lloc per a mantenir els nostres estalvis, ja que pràcticament cap entitat les premia amb interessos”.

Quant al màxim, no sol recomanar-se més del necessari per a cobrir sis mesos de despeses. De fet, el portal ‘Finances per a tots’, una iniciativa del Banc d’Espanya, la Comissió Nacional del Mercat de Valors i el Ministeri d’Assumptes Econòmics i Transformació Digital, aconsella “acumular un fons equivalent a entre tres i sis mesos de despeses”. A partir d’aquí es tracta de buscar inversions que garanteixin una bona rendibilitat.

11Onze és la fintech comunitària de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!