Soaring inflation eats into savings

Households reduce savings accumulated during the pandemic to sustain spending in the face of sharp price rises. The fall in the savings rate is reflected in the decline in household financial wealth.

While rising prices have been strangling families for months, the rise in central bank interest rates to try to curb inflation is pushing up mortgage prices, adding up to a perfect storm, forcing households to use the savings accumulated during the sanitary crisis to maintain the same level of consumption at much higher prices.

Data collected by the Bank of Spain and the National Statistics Institute (INE) suggest that households saved some 269 billion euros during the peak phases of the pandemic. Even so, the gradual reopening of the economy and the rising cost of living has caused a large part of these accumulated savings to evaporate.

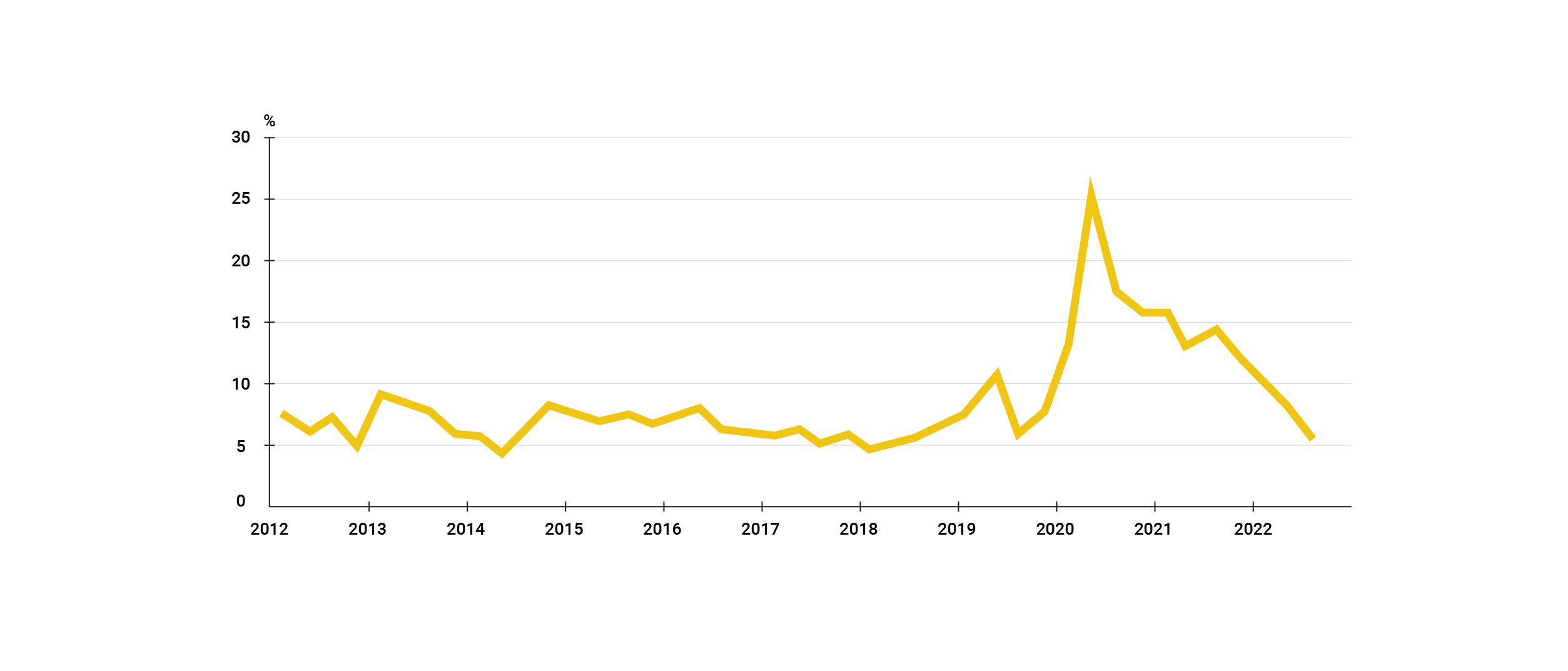

The INE report shows that in the third quarter of 2022, the household savings rate stood at 5.7% of disposable income, the lowest figure in four years. It should be borne in mind that this rate is calculated by eliminating seasonal and calendar effects, due to the fact that savings tend to fall in the first and third quarters and rise in the other two. If we disregard these seasonal adjustments, the data show a negative savings rate of -3.2% compared with 6.4% in the same quarter of the previous year.

Less saving and less investment

Although the Bank of Spain has improved its GDP growth forecast by three-tenths of a percentage point to 1.6%, the forecast for private consumption falls by seven-tenths of a percentage point from 1.9% to 1.2%. On the one hand, the rise in the cost of living has ‘artificially’ increased consumption figures, but, on the other hand, the rise in interest rates and the reduction in the accumulated savings pool mean that the increase in household spending is expected to be weak. A slowdown in consumption could directly affect economic activity as it is a fundamental component of GDP.

Another consequence of the increase in spending and the reduction in savings capacity caused by inflation is reflected in a decrease in the household investment rate. The stock of household financial assets, whether in equity and investment fund (IF) holdings or a reduction in bank deposits, has been reduced by 53,431 million euros, or -2%, a fall not seen since the early 2020s.

In this context, the latest macroeconomic projections of the European Central Bank (ECB) indicate that although real household consumption is expected to recover gradually as the fall in real household income due to inflation and energy supply problems subside, the household saving rate will continue to fall this year to a level close to that recorded before the pandemic.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Leave a Reply

You must be logged in to post a comment.

Els rics seguiran augmentant la seva riquesa ,esaquestaxmena de planificació neolliberal que fa que els pobles ho diguin més encara

Sempre ha sigut així, Alícia, de fet, els diners, ben gestionats i administrats, fan més diners… Moltes gràcies pel teu comentari!!!

👍

Gràcies, Manel!!!

Gràcies per mantindre’ns informats

Gràcies a tu per seguir-nos, Jordi!

Gràcies!

🙏