Holiday ideas for singles

L’anglicisme “single” fa referència a totes aquelles persones solteres, separades, divorciades, o vídues, independentment de si tenen fills o no, que viuen soles i que no tenen parella. En català potser en podríem dir “vacances monoparentals”.

Aquest article no pretén ser exhaustiu; tot just volem donar a conèixer diferents opcions, tradicionals o innovadores, que puguin fer servei a totes aquelles persones que hagin de decidir les seves vacances singles d’enguany.

Vacances amb mainada

D’oferta de vacances per a singles amb criatures n’hi ha per triar i remenar: càmping, colònies, viatges -més o menys organitzades, més o menys convencionals, més properes o més exòtiques-, estades sense organitzar en allotjaments rurals, càmpings, hotels… La llista és inacabable.

Atès que amb la quitxalla és molt fàcil que qui acabi gaudint les vacances siguin només ells i elles, les solucions de tipus colònies sempre solen ser un bon recurs i a casa nostra en sabem un niu d’això.

N’hi ha de lleure educatiu, com Eix Estels, amb activitats de relaxament i tonificació, com ara ioga, tirolina, bicicletes el·líptiques, strong by fitness, parc acrobàtic sobre els arbres, aquagym, via ferrada, mindfulness, zumba, tir amb arc, rocòdrom…

Si el que ens amoïna en particular és tenir cura de l’alimentació, podem optar per Fundesplai, amb menús basats en la dieta mediterrània, cuina saludable i tipologies de dietes que tenen en compte al·lèrgies i intoleràncies. També ens ofereixen activitats pels infants, com ara, curses d’orientació, olimpíades, “petits científics”, gimcana aquàtica … Activitats per mares i pares, per exemple, aquagym, naturioga, tast de vins i embotits, visites culturals … I activitats conjuntes com parc d’aventura, tir amb arc, rocòdrom, taller de cuina vegetariana, pàdel-surf, caiac …

També podem trobar-ne que fomenten l’autoconeixement, la creativitat i l’equilibri emocional, com ara, Lleuredosmil. Quant a activitats, hi podrem gaudir de les anomenades “familiars de benestar”, que serien ioga en família, banys de bosc (shinrin yoku), mindfulness en família, tallers a la natura, risoteràpia, etc.

Més enllà de l’opció de les colònies, podem trobar empreses especialitzades en viatges i activitats d’oci exclusivament per a famílies monoparentals, com Op & Kids, que, a més, operen més enllà del nostre país i que promouen i incentiven les activitats tradicionals, culturals i naturals.

També hi ha agències de viatges especialitzades, o bé, d’altres que ja han incorporat la modalitat monoparental a la seva cartera de serveis.

Vacances “singles” sense mainada

Si som singles sense criatures, o bé, som de vacances i les criatures són amb algú altre, ens trobem en una situació molt menys restrictiva, que ofereix un ventall d’alternatives encara més gran.

Si som partidaris de no recórrer a res d’organitzat, sempre podem crear el nostre propi grup de singles i planificar activitats de tota mena, on el límit serà només la nostra imaginació.

Aquí podríem plantejar-nos viatges amb un alt component d’aventura, on només cal establir una o més destinacions -o bé, un determinat itinerari-, dates i previsió d’equipatge i de despeses. La resta, pot deixar-se en mans de l’aventura.

Fins i tot cal no descartar l’opció valenta d’engegar un viatge en solitari, més o menys planificat, per itineraris o indrets encara inexplorats per nosaltres on, a més de descobrir llocs desconeguts, de ben segur que acabarem relacionant-nos amb més persones que no ens pensem, perquè, sovint, allò que fa la diferència sol ser una mera qüestió d’actitud.

Si aquestes alternatives ens fan una certa mandra, a Internet podem trobar força grups de singles dedicats a tota mena d’activitats: culturals, esportives, lúdiques, etc.

Per exemple, podem trobar viatges culturals i de natura al Centre Europeu de Barcelona, un centre cultural especialitzat en viatges per a singles i compromès amb el turisme sostenible.

Cal no oblidar les opcions organitzades més tradicionals, que ofereixen des de viatges convencionals fins a creuers, passant per tota mena de rutes.

Si tant se val, llavors… Siguem originals!

En aquest apartat us proposem idees per vacances singles que admeten tant l’opció amb mainada, com sense.

L’opció de viatjar en caravana o autocaravana dona molta llibertat, autonomia i flexibilitat, i es pot escollir fer-la en companyia de qui nosaltres vulguem. Per contra, demana estar molt pendents de tots els detalls logístics i legals: abastiment, rutes, disponibilitat de temps, climatologia, facilitats i requisits d’acampada o aparcament, etc.

Fer travesses a peu o en bicicleta de muntanya també és una opció que té molta volada actualment. A banda del requisit -obligatori- d’un bon estat de forma física, aquesta alternativa passa per una acurada planificació inicial de la logística i la intendència, amb el benentès que les travesses, fins i tot les més curtes, impliquen uns quants dies a la intempèrie i, habitualment, en indrets poc o gens poblats.

Una altra opció interessant és l’anomenat xàrter nàutic, que és l’activitat de lloguer d’embarcacions d’esbarjo, amb patró o sense. Aquesta alternativa permet gaudir de paisatges marins que només són accessibles des del mar, aprendre una mica de navegació i tasques de bord, i gaudir d’una pau i un silenci que difícilment trobarem a cap altre lloc. Amb sort, també podrem albirar cetacis i banyar-nos en aigües on potser no ho ha fet ningú abans. El més recomanable és escollir una embarcació de vela; així, no contaminem l’ecosistema marí i, de retruc, estalviem contaminació sonora a les nostres oïdes.

El sector del xàrter nàutic està en plena evolució, especialment pel que fa a la comercialització a través d’Internet. Hi ha companyies que utilitzen eines com ara, aprenentatge automàtic, enregistraments en 360° i chatbots, entre altres innovacions.

Sigui quina sigui l’opció per la qual ens decantem finalment, la nostra recomanació és que en sigui una de respectuosa amb les persones i ambientalment sostenible. I cal no oblidar eventuals restriccions i riscos COVID-19 en funció de les zones i països del nostre itinerari.

11Onze és la comunitat fintech de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!

En un país on les pensions pengen d’un fil i les crisis econòmiques van i venen, qui decidirà la nostra vellesa? Podem planificar-la o dependrem dels fills o familiars? 11Onze es fa ressò d’una iniciativa que pretén planificar una vellesa a mida, amb autonomia i qualitat de vida.

La població d’entre 50 i 60 anys avança cap a la vellesa amb més incògnites que garanties pel que fa a la seva jubilació i les condicions en què podran passar la tercera i quarta edat. Tanmateix, un nou projecte pretén donar solució a aquest neguit i assegurar que tothom pot viure una vellesa digna, amb autonomia i tranquil·litat.

Xavier Resa i Pascual Flores han creat una iniciativa basada en la idea de cohousing. Tal com explica Resa al podcast, aquest projecte, que inicialment havia batejat amb el nom d’El Somni dels Faraons, consisteix a habilitar zones rurals en vies de despoblament per a acollir-hi unitats familiars o persones que vulguin viure la tercera i quarta edat en un ambient de tranquil·litat, amb tota mena de serveis, i sobretot amb qualitat de vida.

Què vols ser de gran?

Cal tenir en compte que, actualment, a Catalunya, el col·lectiu d’entre 50 i 60 anys aplega més d’un milió de persones. Si hi afegim les persones de fins a 80 anys, la xifra es dispara en més de dos milions i mig, segons xifres de l’Idescat. De fet, l’Estat espanyol és un dels països del món amb més longevitat.

I, tanmateix, el cert és que socialment hi ha un rebuig i un malestar quan es pensa en la gent gran. La principal incògnita per a molts és: què passarà quan arribi a la vellesa? Seré una càrrega per als fills? Acabaré en una residència? La por a la soledat i a què decideixin per tu són alguns dels pensaments més freqüents a l’hora d’imaginar aquesta etapa de la vida.

Per això, projectes com el de Resa i Flores, com ho són altres iniciatives com les de Sostre Cívic, afavoreixen, tant econòmicament com en estil de vida, a tot aquest col·lectiu de persones que aviat entraran en la vellesa. I, alhora, beneficien els prop de 200 pobles de Catalunya que necessiten urgentment més població i un nou impuls en l’activitat econòmica. El Somni dels Faraons és un projecte complex, però pensat al detall, tal com assevera Resa, i amb un objectiu clar: buscar el bé comú i assegurar que tothom té accés a una vellesa digna.

Vols ser el primer a rebre les últimes notícies sobre 11Onze? Clica aquí per subscriure’t al nostre canal de Telegram

L’estiu és un temps que ens permet fer coses en família, compartir i gaudir d’uns dies de vacances. La pandèmia que ens va tenir tancats a casa l’any passat està remetent i són moltes les famílies que es plantegen sortir de vacances uns quants dies.

Planificar

Planificar les vacances és una feina que cal fer, especialment, si es viatja amb infants. Buscar un lloc adequat per a ells i, alhora, agradable per als adults, no és tasca fàcil. No totes les destinacions turístiques estan pensades per anar-hi amb infants. Per tant, cal cercar destinacions preparades per acollir famílies, amb espais i activitats pensats per a menuts i grans. De fet, cada vegada més el sector turístic s’especialitza segons les necessitats del client.

Catalunya és un país ple d’oportunitats. Destinació turística per excel·lència, ha sabut diversificar la seva oferta. El turisme familiar n’és una i, avui dia, hi ha una àmplia llista de propostes que s’adapten a tota mena de famílies: nombroses, monoparentals, amb un, dos fills…

A l’hora de triar una destinació s’ha de tenir en compte, entre altres aspectes, el pressupost, els gustos i les edats dels diferents membres de la família, la durada, la distància, etcètera.

Triar un lloc adaptat a les necessitats dels menuts i dels adults és clau. Catalunya té destinacions de qualitat que compleixen amb un seguit de requisits considerats adients per al turisme familiar, als quals l’Agència Catalana de Turisme atorga la marca de Turisme Familiar. Aquest distintiu els acredita com a destinacions que proporcionen una oferta diversificada d’establiments d’allotjament, restauració i d’oci i lleure adreçats als més petits.

Mar o muntanya?

Concretament són 27 les destinacions que tenen la marca de Turisme familiar. Aquestes són dividides en dos grups: les destinacions de mar i les destinacions de muntanya.

Les destinacions de mar tenen el distintiu de Platja en família. Dinou municipis de la costa el tenen. Hi trobem Pineda de Mar, Castelldefels, Vilanova i la Geltrú, Salou o Cambrils, entre d’altres. Serveis de socorrista, de restauració amb menús infantils, activitats a la sorra, a l’aigua, i un llarg etcètera, pensats per menuts i grans, ajuden a fer passar l’estona amb més facilitat per a tots.

Quant a les famílies que prefereixen les activitats de muntanya, hi ha 8 municipis amb la Marca Natura i Muntanya en família. Els amants de la natura hi trobaran una àmplia oferta lúdica: centres didàctics, esports d’aventura, estacions d’esquí obertes a l’estiu, etcètera.

A més, tant a les destinacions de mar com a les de muntanya hi trobarem allotjaments preparats per acollir famílies: hotels, càmpings o apartaments que fins i tot t’ofereixen servei de cotxet, bressol i cadireta perquè no s’hagin de carregar en l’equipatge; servei de guarderia; activitats complementàries; monitors; etcètera.

Viatjar en família és una oportunitat que se’ns presenta quan podem gaudir d’uns dies de vacances. Planificar-les bé i triar un lloc adequat segons l’edat i els gustos dels més petits de la casa ens garantirà l’èxit de l’estada.

11Onze és la comunitat fintech de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!

Amid the debate on the changes that need to be made in education to reverse the low standards of Catalan students, 11Onze’s Director of Content and Media, Toni Mata, poses a new question: why aren’t the citizens of the future being educated financially?

So much has been said about the poor results of Catalan students in the PISA report that it seems the only solution will be to keep talking. Parole, parole, parole, as Xavier Massó of “Profesores de Secundaria” paraphrased a few days ago on Rac1. The truth is that suddenly, the country seems to be worried that young people don’t understand what they read. Is it a surprise? Is anyone interested in the new citizens learning something that will make them capable of living a fruitful life, as free and happy as possible? If this were the case, surely the educational curriculum would be quite different and financial education would surely play a central role.

In Catalonia, young people leave secondary school and high school without knowing how to read a payslip. Without understanding how taxes are calculated or what they do. Without having the remotest idea of how unemployment benefits or sick leave are calculated. Not understanding how money is created, what inflation is or how interest on a loan is calculated. How can our children be free citizens if they are unable to understand how to manage a commodity as essential to their lives as money? Some will say that in the humanistic and social baccalaureate, there is a subject of economics. And that is true. Well, not to worry then, I’m sure these students will teach it to the students of the other modalities.

And the adults?

They do not fare very well. According to OECD studies, only 34% of European adults have a minimum knowledge of financial literacy. It is most probably this widespread lack of knowledge that makes it possible for us to give so little importance to financial education. Secondary schools can indeed ask to participate in the financial education programme in schools. But here we are: which schools will ask about it if it is optional? How many workshops will be offered? And, above all, who will teach them? Behind the financial education programme in schools offered by the Generalitat, there are all the big Spanish and Spanish banks (formerly Catalan and Spanish). Are we really going to entrust the financial education of our sons and daughters to workshops given by bankers? And to what extent will the bankers be interested in our sons and daughters questioning whether the current model is acceptable?

It is disheartening to see the citizens of the future being denied basic tools for adult life: what do they know about financial education?

It is frankly disheartening to see how the Department of Education fails to provide our children with the minimum tools to understand the world and to flourish by themselves. But all of this makes great systemic sense because it guarantees generations of dependent and therefore very complacent citizens. If you don’t know how the world works, it is impossible to change it.

But everybody relax! The Department of Education announced the creation of a commission of experts where, for sure, there will be representatives of prestigious foundations which in turn are full of more experts and which are very well-endowed with grants. So when they meet in this commission they will be very happy and no one will raise their hand to ask if they have to hire experts, commissions and foundations to do the work of the Department of Education, what exactly is the Department of Education for? So we could go back to financial education, and we would realise that knowing how public money is managed is also a dangerous subject because someone might ask these kinds of questions that are not in anybody’s interest.

Let’s try to find a solution

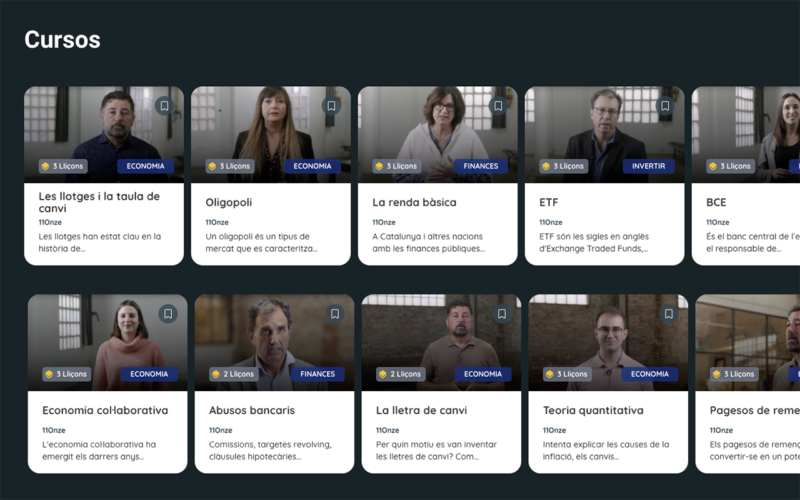

At 11Onze, we have been committed to financial education since the beginning. There are courses available in Learn, we started to roll out the 11Onze School project, we launched the series El Diner, and we continue to educate and inform about economics and finance every day through 11Onze Magazine. We try to make the economy understandable so that citizens can make informed decisions.

But the absolute truth is that we citizens are on our own. And that the years go by and the feeling of loneliness increases. And that there is only one way forward: to come together and make an effort. Hence, 11Onze’s desire to create a financially educated community. Only education will set us free. And quite clearly, this is the problem.

11Onze és la fintech comunitària de Catalunya. Obre un compte descarregant l’app El Canut per Android o iOS. Uneix-te a la revolució!

They say that you are not so much what you say as what you do, and in this sense the Catalans do many things, and the most important thing is that they do them together. There are 74,438 associations in Catalonia, according to data from the Department of Justice in 2020. A figure that serves to understand the magnitude of this network in the social sphere. Self-organisation marks and defines Catalan society

As a concept, associationism refers to the voluntary organisation of people seeking a common interest, be it cultural, political, sporting, social assistance, leisure or any other field. The essential point is that this activity is done on a non-profit basis and for the benefit of society.

From clandestinity to the creation of a social fabric

Historically, the term associationism was born in the 19th century as a result of the theories of utopian socialism and although guilds and brotherhoods were already created in medieval times with the intention of defending common interests, it was not until the era of the Industrial Revolution that associations as such proliferated. The purpose has always been the same: to look after the needs of society. As the economic and business system moved towards incipient capitalism, the emergence of organised labour became necessary.

Throughout the 19th and 20th centuries, Catalan society created associations in different spheres, such as athenaeums, schools, cooperatives and trade unions. The emergence of many of these entities corresponded to the lack of these basic services, such as schooling, health or the defence of workers’ labour interests. In areas where there was no social protection, it was society itself that sought mechanisms to protect itself. It was also in these decades that the movement for the recovery of national consciousness emerged in an attempt to reclaim Catalonia’s own personality and fight for its preservation. A milestone that was blurred in the Franco era, when all Catalan national institutions and the network of associations were persecuted and repressed. In this context, the right of association was practically disqualified, but Catalan associations survived underground.

“The emergence of many of these entities corresponded to the lack of these basic services, such as schooling, health or the defence of workers’ labour interests.”

Associationism as a reflection of the Catalan people

The values of associationism mark the path towards a more committed and less individualistic society. In fact, if we analyse some basic elements of Catalan culture, we can see that this idea is in tune with the cultural reality. Pilgrimages, sardanes, local festivals, Sant Jordi? All involve getting together, organising, living together and sharing. It is no coincidence, therefore, that most Catalans spend part of their free time in associative or social activities with the aim of improving the quality of life of the country as a whole.

Variety is the spice of life, and when it comes to organisations, there is something for everyone. Any Catalan can nowadays find an association that is of interest to him or her, and where he or she can contribute his or her grain of sand. Sporting, historical, food-related, scientific, academic and social welfare concerns? Everything has a place in the Catalan associative fabric because everyone has a place in the associative fabric.

Beyond the reach of public bodies, this network of unstoppable people can actively and significantly contribute to creating opportunities and ensuring the benefit of all groups; no one can be left behind from a social point of view. In particular, associations have done and continue to do essential work focused on excluded groups, social emergencies, people with fewer resources, those affected by banking or systemic abuses, minority illnesses, support groups, and a long etcetera. Entities that have had to organise themselves internally and, in many cases, without public support, to meet the basic needs of citizens, both physical and psychological, in order to improve their quality of life.

A task that has never received the support it deserves and which, in many cases, is financed through donations and aid from citizens. Fortunately, social awareness is becoming more and more important and cooperation goes beyond the association itself to open up to all citizens in a circumstance in which the support of each one of the collaborators is essential. This shows that the associative fabric has a double aspect: active participation from within or collaboration from outside, so that the whole of society becomes part of it.

“Social awareness is becoming more and more important, and cooperation goes beyond the association itself to open up to all citizens.”

Culture, a basic pillar of development

In Catalonia, the culture of an entire people has been maintained over the years in the face of all kinds of social and political situations, thanks in large part to the associations and their work to preserve and strengthen the cultural fabric. To give us an idea of the importance of this, of the 74,438 associations mentioned above, 34,261 are of a cultural nature. The result is that Catalan society is committed to culture, and thus to knowledge, freedom of expression and the promotion of critical thinking.

Culture plays a key role in the development of a territory and becomes an essential part of citizens’ lives. Beyond books, series or museums, culture is also the language, the way we relate to others and to the environment, the customs that make us live in a certain way, celebrating specific dates or giving value to a feeling of belonging to a territory. Social solidarity and cooperation are two values that are also highly influenced by culture and which, in turn, can have a great influence on the social functioning of a people. Culture is practically everything, and associations take on the role of preserving this identity value through organisations and activities that promote its preservation.

“Culture plays a key role in the development of a territory and becomes an essential part of citizens’ lives.”

Social cooperation, a commitment to value

Associations understand the creation of a community on the basis of inclusion and with the aim of strengthening these links so that working together allows society to advance more and to advance better. In no case, however, should this union of people work on the basis of exclusion towards all those who are not part of it. This could lead to negative feelings on the part of the rest of the citizens and is far removed from the raison d’être of this type of organisation, where respect and teamwork mark its existence. Losing this essence would mean individualising the movement and condemning it to disappear.

The feeling of identity can have a great impact on a society and can be a determining factor in its development. A territory that believes in its people, that wants to defend culture and that promotes all kinds of activities based on self-organisation and voluntary work is, without a doubt, a territory with a desire to constantly evolve. In Catalonia, the associative fabric is witness to this desire and is growing every day with its sights set on the future, but without losing sight of its origins. Working collectively for a future with a fairer and more committed society is a commitment to people and to ensure that, from the associations, their welfare and that of the territory will be looked after.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Gold mines exist on every continent except Antarctica, often in remote and impoverished areas. World Gold Council data show that responsible gold mining contributes to the economic and social development of many local communities.

Gold has been a unique precious metal with great emotional, cultural and financial value throughout history. In addition, gold has an increasing number of technological applications, including in mobile phones, medical test kits and airbags for vehicles.

Gold resources are also a key source of opportunities in many developing countries. As a World Gold Council report shows, responsible gold mining generates numerous jobs, facilitates the construction of infrastructure and contributes to the development of local communities, as well as bringing in substantial revenues through taxes and royalties.

Well-paid employment

Analysis of the operations of 31 of the 32 member companies of the World Gold Council shows that in 2020 they were responsible for nearly 200,000 direct jobs and 1.2 million indirect jobs in 38 countries. In addition, the reuse of wages earned in the gold supply chain supports a further 700,000 jobs in the wider economy.

Workers in the gold industry are well paid, averaging six times the national average wage. And it should be noted that 95 % of the employees belong to the country where the mine is located. The percentage of expatriates has halved in the last seven years.

Development of local communities

Companies in the sector recognise the mutual benefits of integrating as much as possible into the local economy, using indigenous people and supply chains. This underpins their “licence to operate” and allows the community to benefit from the economic and social development of the mine.

Indeed, operating in an isolated enclave with the local community’s back turned is no longer a viable option for any mining company. To be successful, they must generate sustainable benefits for local people, especially in the poorest and most remote locations, where there are often few alternative avenues for economic activity and community progress.

This has meant that by 2020 the World Gold Council’s member companies spent more than €430 million on community investment. In addition to meeting the needs of a gold mine, it is clear that investments in roads, water, and electricity supply are of long-term benefit to businesses and communities in the area.

We must add €7.6 billion paid in taxes and royalties, which go back into improving public services, education, health, and infrastructure in the countries where the mines are located. In many developing countries, these taxes constitute a significant proportion of the national tax base and benefit both mining and non-mining areas.

A significant contribution to GDP

In total, the contribution of these companies to the GDP of the 38 countries where they operate is estimated at around 40 billion euros. For every euro of gold production, at least 63 cents ended up as wages, taxes, or income for local business owners.

While historically mining operations have not always led to improvements in the human and social development of local communities, there is a growing trend towards strict environmental, governance and social protocols as a condition of operating. As a result, the gold industry is becoming an important economic and social driver for many countries around the world.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Have you ever had the feeling that you are wasting time while attending a meeting with your teammates and/or your boss? You are in the meeting, but are you thinking about other things? Can these sensations be avoided by making meetings more efficient? We try to explain how.

According to team building and leadership specialists, one of the essential issues is to be clear about why you are calling a meeting. Sometimes, we have the feeling that we are in that room, simply because you have been told to or because it’s on the calendar, without a defined objective.

Nowadays, and after everything that has happened in the last year, there are also those who distinguish between the organisation of face-to-face meetings and virtual meetings, given that the latter are not always easy to control, either because everyone is talking at the same time or because the attendees’ connections start to fail.

But in any case, the essential guidelines are the same:

- Before convening a meeting, whether it is face-to-face or virtual, we must be clear about the objective: What do we want to achieve? Is it really necessary?

- If possible, it should be planned with enough time to inform the interested parties, so that they can prepare for the meeting as well as the convenor, and so that the time is used to the maximum. Similarly, if necessary, it is advisable to provide attendees with the necessary documentation.

- The invitation should only reach the essential people. There is no point in having 20 people attending if only 5 are really interested and/or affected. For the company, time is money, and it is not productive to have a lot of people as forced spectators.

- Calculating the duration of the meeting is also important to avoid it taking longer than necessary, and obviously you have to be punctual in order to keep to the timetable. When calculating the duration of the meeting, we must think about setting aside time for requests and questions that can be asked at the end of the meeting.

- The space where the meeting is held, in the case of face-to-face meetings, must be adequate for the number of people convened, and must have all the technological and analogue tools necessary to clearly set out all the issues to be discussed.

- Once in the meeting, we have to assign the “role” that each of the attendees has to assume, if the interventions have to be marked. What is clear is that there must be a moderator, who will usually be the convenor, to avoid diluting the objective for which we are meeting.

- For a correct development, before starting, the moderator must read the agenda in order to be clear about the issues to be discussed or resolved, and make clear the reason for the meeting. From this point onwards, he or she must ensure that the time allocated to each of the topics and speakers is respected, so that the established timetable is adhered to and everyone can make their points.

- Once all the scheduled interventions have been completed, it is time for Q&A, in order to polish the topics dealt with, resolve any doubts that may have arisen, and decide whether any new contributions should be made before ending the session.

- In the closing session, it is important to define the conclusions drawn, as well as the solutions to the problems that have arisen during the meeting, and the deadlines for carrying out the actions to be undertaken.

- Finally, it is important to draw up a summary or a record of the minutes that includes everything that has been presented, interventions, conclusions, and even details the decisions that have been taken and the actions that must be carried out from now on.

The achievement of all these premises should guarantee effective and efficient internal meetings, meetings with suppliers and meetings with clients, so that we do not end up with a feeling of wasted time. It is especially important to make the most of time in order to achieve productivity and efficiency objectives that generate the economic benefits necessary for the survival of an organisation, thus guaranteeing the professional and personal stability of all those involved.

Do you want to be the first to receive the latest news about 11Onze? Click here to subscribe to our Telegram channel

A UNHCR report on education and its importance in social inclusion shows that one of the most significant challenges facing refugee children is unequal access to education.

A common denominator of refugee crises is that, regardless of location, when families are forced to leave their homes, the stability of children’s lives is inevitably disrupted. Likewise, loss of security, dignity and access to education are among the most immediate consequences affecting displaced people.

A report was not necessary to understand the importance of ensuring that refugee children and youth have access to the education system, but it is important to know the numbers beyond the generic slogans that blur the problem. Specifically, to be able to provide the resources and tools needed to address the issues.

Talent is universal, education is not

The UNHCR report draws on data from more than 40 countries around the world and emphasises that, even before the pandemic, the proportion of 10-year-olds who cannot read or understand simple text was estimated at 57% in low- and middle-income countries, and 86% in sub-Saharan Africa, where millions of refugees live: “Poor quality education and lack of access to schools and colleges affect hundreds of millions of children. But there is no doubt that young refugees suffer most acutely”.

Data indicates how refugee children are falling behind non-refugee children in terms of access to quality education. The enrolment rate in kindergartens is only 42%, while primary education stands at 68%. Secondary education is significantly lower, at 37%, and superior education is only 6%, well below world levels, especially in richer countries.

By promoting an inclusive vision of education we can work towards a reality where all children, including refugees, have the same opportunities to grow, learn and aspire to a better future. This requires a collective solidarity effort that involves the participation of the whole of society, regardless of borders.

11Onze Rolls Up its Sleeves

From 11Onze we have decided to roll up our sleeves, and we want to build 50 Shelter Schools for the children of Northern Syria so that we can help 1,750 children. To make this possible, we need 100,000 euros that 11Onze Rolls Up its Sleeves will send to Better Shelter to carry out the action on the ground. Can we count on you?

És sostenible el sistema de pensions? Com hauria de canviar la seguretat social per poder suportar l’envelliment de la població? Podem confiar que l’Estat seguirà pagant les pensions? És bona idea dependre de la decisió del govern de torn? Tot plegat ho respon el catedràtic d’Ecomomia Política Jesús Huerta de Soto a la sèrie documental ‘Ni justicia ni social’.

A 11Onze la nostra voluntat és apropar el coneixement econòmic a la població perquè tothom sigui conscient del que passa i pugui pensar què cal fer. Aquest dimarts, us recomanem una producció que Value School ha estrenat recentment. Es tracta de la sèrie documental ‘Ni justicia ni social’, dirigida per Jesús Huerta de Soto, catedràtic d’Economia Política de la Universitat Rey Juan Carlos de Madrid.

Dependre de l’Estat

El sistema de pensions públiques el va crear Otto von Bismarck, pare de l’Alemanya moderna i el seu primer canceller. L’any 1889 va fundar el primer sistema de jubilacions de la història. I ho va fer per motius polítics. En aquell moment, necessitava aturar l’avenç del socialisme i, amb aquesta mesura es va guanyar el favor dels treballadors. Aleshores, Bismarck tenia un objectiu claríssim a llarg termini: fer que els ciutadans fossin dependents de l’Estat.

Aquella mesura política va fer fortuna i es va escampar pel món. El 1935 el president dels Estats Units, Franklin Delano Roosevelt (el pare del ‘New Deal’) va crear la Seguretat Social moderna. Apostava per un sistema de pensions de repartiment, no de capitalització. Quina diferència hi ha? El sistema de capitalització fa que cada treballador aparti una part del seu sou de manera nominal i la recuperi en jubilar-se. Com una mena de pla de pensions públic: et generes la teva pròpia pensió.

En canvi, el sistema de repartiment aposta perquè siguin els treballadors actuals els que paguin les pensions actuals. És a dir, l’Estat té una entrada i una sortida de diners. Això, el 1935, no era problema perquè als Estats Units hi havia 52 treballadors per cada jubilat. Actualment, però, la mitjana europea i nord-americana és de dos treballadors per cada jubilat. I, per tant, el sistema s’enfonsa. Més encara si es té en compte que les pensions són superiors als salaris dels treballadors. Això vol dir que mantenir el sistema de pensions actual suposa destruir l’estalvi i, per tant, la capacitat econòmica dels treballadors.

Però el sistema de repartiment de pensions té el problema que crea dependència per part dels treballadors quan es jubilen. S’ha destruït l’estalvi, perquè no tenen capacitat d’estalviar i perquè, a més, es refien que l’Estat els pagarà una pensió. En l’actualitat, el 70% dels jubilats espanyols depenen de la seva pensió. Aleshores què cal fer?

Recuperar el model de la Segona República

A Espanya, abans del cop d’Estat que va dur a la Guerra Civil i la dictadura, ja existia el que s’anomenava “Régimen de capitalización en el retiro obrero”. És a dir, un sistema de capitalització nominal per als treballadors. Franco va apostar pel sistema de repartiment i ho va fer, evidentment, gastant els diners acumulats pel sistema de capitalització. Allò el va fer molt popular, però acabava d’hipotecar el futur de les pensions.

En aquest capítol de ‘Ni justicia ni social’, Huerta de Soto aposta per tornar al sistema de capitalització de pensions. I troba una manera per evitar que el canvi d’un sistema a l’altre impacti directament en el deute públic. Un joc de mans econòmic que depèn exclusivament de canviar el sistema financer. Novament, la banca privada està al mig del problema, però amb polítics valents també podria estar a mig camí de la solució.

Capítol 1 de ‘Ni justicia ni social’. Les pensions.

11Onze és la comunitat fintech de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!

Technology, digitalisation, sustainability and the holistic well-being of workers will play a key role in shaping many jobs in the next five years. Analytical and creative thinking will continue to be the most important skills for employees in this evolving workplace.

The World Economic Forum’s latest Future of Jobs Report analyses how socio-economic and technology trends will shape the workplace of the near future. It brings together the perspectives of 803 companies employing more than 11.3 million people across 45 countries throughout the world.

The pandemic spurred a transformation of the workplace through teleworking, remote team management, migration of information to the cloud, implementation of new cybersecurity measures and online sales and customer service. Changing worker and consumer expectations and the urgent need for a green and energy transition are also reshaping the composition of the workforce and stimulating demand for new occupations and skills.

IT and technology professionals have led the change over the past three years. Job profiles within the ecosystem of Big Data, machine learning and the constant implementation of new digital solutions are assured to be in demand.

Regardless, one of the main conclusions of the study is that while the adoption of new technologies will continue to be the key driver of business transformation over the next five years, any investment in technology made by companies needs to be matched by an equivalent investment in people.

Macrotrends and technology adoption

The fastest-growing jobs will continue to be those related to new technologies. Specifically, artificial intelligence and machine learning experts top the list, followed by sustainability specialists, business intelligence analysts and information security analysts.

The sustainability sector will also play a prominent role. Jobs in renewable energy engineering and solar energy systems installations will continue to experience relatively rapid growth as economies accelerate their transformation to renewable energy.

On the other hand, the evolution of new technologies and digitalisation will negatively affect some office jobs, such as secretarial jobs, bank tellers, postal services, ticket agents and data entry jobs. Relatively repetitive jobs that require little creativity and can be replaced by artificial intelligence.

Analytical and creative thinking

Analytical thinking is considered a core competency by more companies than any other competency and constitutes, on average, 9% of the core competencies desired by companies. It is followed by creative thinking, ahead of personal performance-related skills such as resilience, flexibility and agility.

Reliability and attention to detail come in seventh place, behind technological literacy. Finally, the list is completed by skills related to working as a team; empathy, listening to others, leadership and social influence.

In this context, the majority of companies surveyed agree that investment in on-the-job learning and training and process automation are the most common people strategies they will adopt to achieve their organisations’ business goals.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!