11Onze: not one step back

Pursuing the 11Onze project has become an obsession for the banks, which, in our opinion, harks back to the unsuccessful pursuit of the ballot boxes on 1 October 2017. They try to put obstacles in our way, but in the end, the community always wins.

From time to time, as members of the 11Onze community have noticed, we opt for a low-key communication profile. ‘Why?’ our followers often ask us, eager for us to explain our every move. The answer is simple: whenever we communicate important news, we are attacked. When this happens, we are forced into a period of silent work to overcome the obstacles placed in our way by the banks. Lately, what has triggered the attacks against Once… has been gold.

May: ORIgen

On 8 May, we announced the launch of ORigen. Preciosos 11Onze is now able to sell large quantities of gold directly from mines in Africa. This places the company at the centre of the global gold market and positions it as a rival to the big banks which, unlike 11Onze, only sell gold to high net worth individuals. Until last May, Preciosos 11Onze only sold physical gold at retail to users who do not have access to the channels available to large fortunes. ORigen, therefore, opens up a new segment for us, competing in a key field for the big banks.

Events then unfolded rapidly: Weavr announced the closure of El Canut in a month’s time, causing undeniable reputational damage to 11Onze. Even today, Weavr’s unilateral decision is surprising because it could not achieve anything positive: they have now had to unblock all the money they had retained without reason from 11Onze users, they have lost a business that was operating normally, and they are facing claims to the Financial Conduct Authority (FCA) for the damage caused. All this seems to have no other purpose than to cause mistrust of 11Onze’s products.

Who would buy gold from an entity that sees Canut being shut down? Fortunately, our community knows what happens when Catalans try to go against the grain. And the response was to come out in defence of Once, just as they defended the ballot boxes years ago.

June – July: Precious Days and Golden Farmers

The closure of Canut in mid-June did not affect 11Onze’s main objective: to help its community achieve financial freedom. 11Onze did not earn money with Canut, nor did it intend to, because its business model is ‘if the user earns money, so do we’. It is not about extracting profit from managing current accounts through commissions. This extractive model is not what 11Onze is looking for; rather, we seek to create wealth and grow together.

So, in June and July, Preciosos 11Onze launched two campaigns aimed at generating profits for the community and for the organisation. ‘Precious Days’ at the end of June and ‘Golden Farmers’ at the end of July. The first, from Gold Patrimony, sold out the physical gold we had in stock in less than ten days. The second, Gold Seed, which began on 23 July, achieved a record for ‘Golden Farmers’ in one week. The 11Onze community has once again demonstrated that it is alive and well and that it understands the strategic importance of the products we offer.

And on 24 July… Caixa d’Enginyers

The ‘Golden Farmers’ campaign was launched on 23 July via an email to the community. It was not even launched openly in 11Onze Magazine, but in a communication that 11Onze sent directly to its subscribers. Since December 2022, the bank where 11Onze’s companies had accounts to carry out these and other operations was Caixa d’Enginyers. Thus, the Catalan bank was fully informed of the operations because it saw the movements in the account and regularly received all the necessary supporting documentation. They knew, for example, that ‘Precious Days’ had been a resounding success and were perfectly aware that a new campaign, ‘Golden Farmers’, was about to begin.

The campaign was launched on 23 July and the following day, 24 July, Caixa d’Enginyers sent two damning notifications. Invoking the anti-money laundering law, they requested supporting documentation for all transactions carried out by Preciosos 11Onze during 2024 and 2025. To leave no doubt as to their intention, they warned that if the documentation was not provided within two days, they would close the account. An incomprehensible abuse.

All this is happening at a time when the account is in full swing with the ‘Golden Farmers’ campaign and with only a few days of holidays left. This is an impossible and unfounded request, as Preciosos 11Onze has always provided the necessary documentation to justify its movements. But this time the decision has been made. Although 11Onze’s financial director, Oriol Tafanell, tries to contact Caixa d’Enginyers, it is not possible to speak to him and time is running out. Two days later, they close the account, blocking Preciosos 11Onze’s activity.

At the same time, and even more surprisingly, Caixa d’Enginyers sent a similar notification to another 11Onze Holdings company that had nothing to do with gold management. The mission was clear: to attack everything related to 11Onze in order to cause maximum reputational damage to the entity, even if it meant skirting the limits of legality. 11Onze immediately contacted all the banks operating in Spain with the aim of opening an account to operate with Preciosos 11Onze. The response was negative in all cases. The operation, of course, is very well coordinated.

New course, new operations

Now that we have reached 1 October, we are more mindful than ever of our mission. We no longer have Canut, which would have celebrated its fourth anniversary on this very day. We no longer have accounts with Banco Sabadell or Caixa d’Enginyers. But that’s okay: we are still operating. We won’t explain how, but we always find a way. Today, the obstacles have been overcome and 11Onze’s mission remains as relevant as ever: to guarantee the economic independence of our community and provide the necessary financial tools to the people of our country. As for Canut, 11Onze will reactivate it, and it will not come alone. When Canut returns, it will be accompanied by Sereno.

And let no one be discouraged. 11Once was specifically designed to withstand the attacks we have received since our inception. We will soon reveal all the details of what has happened, just as we did with the documentary ‘En 4 dies’. The group’s legal structure, which is decentralised and involves several countries, is designed to always move forward. Sometimes we have to remain silent and work quietly, but make no mistake: at 11Onze, we never take a step backwards.

At 11Onze Segurs we have launched a new model of socially fair insurance. And from now on, you can use our simulator to get a home insurance policy adapted to your needs and at the best price. Here’s how to do it!

Calculating the price of your home insurance with our simulator is very easy. We will ask you for some information about your home: such as an address, type of home, square metres, if you have an alarm… And depending on this information, in just 3 minutes we will show you the monthly quote of a home insurance policy adapted to your needs. You will discover that 11Onze Segurs’ prices are very competitive, especially in urban areas.

In the simulator, you will see a list of all the covered amounts, which can be extended, in the basic covers. Even so, if you have valuable belongings with an individual value of more than €2,000 (coverage limit of the basic policy), you can add them to your policy for full coverage.

Additional cover

We will also show you various options for extending your insurance cover to suit your individual needs. For example, you can add other people who live with you but are not immediate family.

If you want to go on holiday with peace of mind, you can add legal costs in the event of a squat in your home. Or cover for theft outside the home, which even covers you if you are mugged in the street, within the whole of the European Union.

We also offer you the option of being protected against any accident. With an excess of only 90 euros per claim, you will have total protection for accidental damage to the building and contents of your home.

Although the simulation process is designed so that you can obtain a quote yourself, in a simple and quick way, 11Onze agents are available 24 hours a day to answer any questions or resolve any doubts you may have. In addition, if you wish to, you still have the option of having an agent do the simulation for you.

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

Investment coins, also known as bullion coins, are minted in precious metals, usually gold and silver. There are several gold investment coins available on the market, but the Britannia and Krugerrand are among the most popular and coveted in the world. We explain their history and what makes them special.

Krugerrand

The Krugerrand was first minted on the 3rd of July 1967 to market the vast amount of gold produced in South Africa around the world. The Krugerrand was a pioneer in establishing the new concept of the one-ounce bullion coin measure, a standard that is now recognised worldwide. It was also the first legal tender gold coin issued after World War II, in large part laying the foundation for the creation of gold coins later issued by other countries.

The obverse of the coin features the bust of Paul Kruger, President of the Republic of South Africa from 9 May 1883 to 31 May 1902. His surname, Kruger, and the rand, the South African unit of currency, are combined to give the coin its name. A gazelle, the national animal of South Africa, is engraved on the reverse, beneath which is the legend: “one ounce of fine gold”, in English and Afrikaans, a Dutch-derived language spoken mainly in South Africa.

Although Krugerrand coins are 22-carat gold, i.e. 91.67% pure, unlike most one-ounce coins issued by other countries, which are usually 99.99% pure gold, 24 carats, the Krugerrand compensates for this lower grade with more weight (1.09 ounces).

It is an extremely popular coin that attracts many gold investors. Because of this, the Krugerrand usually commands a lower premium over the price of gold than other 1-ounce coins or, indeed, any gold product of similar size.

Britannia

The gold Britannia was born in Europe in 1987 and was the first gold investment coin to be minted in all four weights (1, ½, ¼, and 1/10 of an ounce of gold). It gets its name from Latin, when in the 2nd century a female figure, wielding a spear in one hand and a shield in the other, appeared on coins minted in southern Britain during the occupation of the Roman Empire.

This design remained the same until 2000, with the obverse of the coin showing the image of Queen Elizabeth II and the face value in sterling, a design common to all Commonwealth gold coins. Subsequently, The British Royal Mint introduced a new design of the female figure for the odd years, keeping the previous one for even years. Further variations with the image accompanied by a lion, or the seated Britannia, were minted in later issues.

The marketing of this 24-carat gold coin is as popular in the UK as it is in the rest of the world. Most issues of Britannia coins are readily available, but buying a Britannia from a specific year can be quite expensive due to scarcity. Therefore, buying a current issue in the hope of seeing the value increase beyond the possible upward fluctuation of gold is a factor that cannot be ruled out.

Up to now, with Preciosos 11Onze, it has been possible to purchase gold bullion. From now on, we also offer the option of buying Krugerrand and Britannia gold coins. Gift gold, for tomorrow’s future.

Economic experts have been warning for some time about a reality affecting the Spanish banking system. The deposit guarantee fund, which is supposed to protect our savings in the event of a bank failure, could be insufficient. How can we secure our finances?

In theory, a deposit guarantee fund (DGF) protects the savings we have in the country’s banks by imposing a fixed term of up to a maximum of 100,000 euros per individual or legal entity. In this way, if a bank were to fail and could not meet its obligations to its customers, the country’s DGF would be responsible for compensating account holders for their savings up to a maximum of 100,000 euros. Even so, if you had more than 100,000 euros in a single current account, the DGF would not cover the difference.

This is the theory, but in practice, economic experts warn that this DGF, in Spain, has a black hole that would prevent it from covering losses. At this point, it is necessary to ask how the DGF gets its resources. All the banks that are registered in the State Register of Banks and State Banks, and which have access to financing from the Bank of Spain, have to make contributions to the DGF. Thus, as recommended by the European Central Bank, the DGF’s resources should be at least 1% of the total deposits contracted by the country’s banks.

Therefore, according to the calculations made by experts, Spain’s DGF should have between 5,500 and 8,250 million euros at its disposal. Even so, prestigious economists such as Santiago Niño Becerra consider that this figure falls short in the event that some of the main banking operators of the Spanish State go bankrupt. And, as if that were not enough, they warn that the DGF does not even have these 8,250 million, because it is still recovering from the contributions it had to make during the bank bailout due to the economic crisis of 2008. If the DGF’s figures are negative, they warn, it is necessary to take a cautious approach. This is why banks have complimentary insurance: where the DGF does not reach, insurance must reach.

EMIs, a safe bet

For this reason, experts recommend opening current accounts in banks that have insured customer deposits through Electronic Money Institutions (EMI), as 11Onze does. EMIs are regulated companies that are authorized to issue electronic money as a digital equivalent to cash. EMI licenses are issued by the Central Banks of each country, and in order to operate in the European Union they are required to have a very high capital.

EMIs, unlike traditional banks, are not allowed to sell unsound banking products, promote investment products or recommend credit-risky transactions to customers. This last condition is possibly the most important, because when a client deposits his money in a traditional bank, he is taking a risk. This is because banks are allowed to use customer deposits for lending. EMIs, on the other hand, are not authorized to do so and, therefore, offer zero risk and ensure that your savings are 100% safe.

In addition, these EMIs are required to insure 100% of the deposits received with insurance policies, regardless of the amount. In addition, the money cannot be deposited in just any bank: it has to be a bank of recognized solvency and classified among the Globally Systemic Important Banks (GSIB). Finally, customer deposits insured by an EMI are not part of the balance sheet of the EMI itself and are, therefore, off the balance sheet in case of bankruptcy of the EMI, i.e. they are still protected by the insurance, which guarantees full recovery of the savings.

All the information about Finança Litigis can be found at 11Onze Recommends.

Transferring your account from one bank to another may seem like a complicated procedure, but since the introduction of the new regulations on the transfer of payment accounts, changing banks has become much simpler. Here are the steps you need to follow.

Gone are the days when, if you wanted to switch banks, you had to take care of all the paperwork and waste time transferring recurring deposits and direct debit bills from one account to another. With the entry into force of the new regulations on the transfer of payment accounts, switching bank accounts has become a much quicker and simpler process. Moreover, this procedure will be free of charge for both you and the new bank.

How to move my account from one bank to another

First, you have to go to the new bank and request the transfer. If you share the account with another person, any of the account holders can initiate the request, but all the account holders will have to sign the document for the process to go ahead.

You will then be provided with an account transfer application form which, among other things, will inform you of the roles of both your current and your future bank. You will also be asked for authorisation to carry out the necessary procedures to transfer the payments and deposits you have chosen automatically.

It will also detail the maximum time limit for completing the different steps and specify the date from which standing orders and direct debits are transferred to the new bank (receiving payment service provider).

When your old bank receives your account portability form, it will have two working days to send the necessary information to make the transfer. Once it has received all this information, the new bank will have six working days to take the necessary steps to maintain the transfer orders and direct debits that were on the old account and to provide the details of the new account to those who made regular transfers to you, such as your salary or pension.

Although the vast majority of the procedures will be carried out by the new bank to which the account is transferred, there is the possibility that the customer, as the account holder, will have to take care of those that correspond to the transfer of direct debits for payments from gyms, schools, small businesses, etc. In these cases, the customer will have to personally contact the persons or entities that issue these bills to inform them of the change of account and provide them with the new number to which they will have to transfer them.

What happens to my old account?

Keep in mind that the old bank will not be able to block your debit or credit cards before the date you have indicated in the application. Remember that this is an express cancellation process.

Similarly, if you have asked to close your account, it will be closed on the date you have indicated, as long as you have no outstanding payments. On the other hand, many people consider it sufficient to get rid of the bank card and leave the account empty. Even so, remember that this does not mean that it has been closed, the bank could continue to charge fees on this account and if one day it wants to close it, demand all outstanding charges.

Don’t forget that as an account holder you are responsible for the payments and you should be the first to contact your bank to complete the closure process if you are no longer going to use the account. Only after 20 years without the account holder having made any movements can the bank consider the account ‘abandoned’ and transfer the balance to the State.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!

One of the founding objectives of 11Onze is to offer tools so that our community can reduce costs by managing their money more effectively. Some might think that this is just a marketing slogan, a nice phrase that sounds good and that’s it. Therefore, we have contacted some of our 11Onze Segurs customers to let their testimonials speak for themselves.

Offering a good product at a reasonable price is not an easy job. At 11Onze Segurs we analysed the different options provided by the home insurance market for months, as well as carrying out studies of insurance costs through surveys of members of our community who are homeowners.

The objective was clear: to be able to offer our clients the best home insurance, comparing coverage from various providers to find the best option that adapted to the particular circumstances of each one, and at a more than competitive price, from €5 per month.

But the price is not everything. From the outset, it was clear to us that we had to reduce the amount of paperwork and small print that accompanies any insurance policy. Simplicity and transparency in the scope of the cover we are taking out give us more peace of mind and avoid last-minute surprises.

“Very happy with the decision to change insurance. I’m saving €55 on my premium, which will help me cover other expenses, as everything is getting more expensive!”

The result of a job well done

The effort has been worth it, and we believe we have succeeded. At 11Onze Segurs you can take out and manage your home insurance from your mobile phone, streamlining procedures, paying a monthly or annual fee, with no permanence, between 15% and 20% cheaper than with traditional insurance companies, and without forgetting our commitment to society as a certified B Corp company.

“I save €350 a year, which I will reinvest in 11Onze!”

But it is not just us telling you, Vincenç Aguilà, from Sabadell, explains that he was clearly overpaying for his home insurance. By switching to 11Onze Segurs he saves €350 a year. And when we asked him what he intended to do with the money he saved: “Reinvest it in 11Onze!

“With the €100 I’ve saved I’ve bought a new Bluetooth speaker!”

From Roquetes, Gemma Monllau explains that she is “delighted with the decision to change insurance”, she has saved €55 in the policy fee, which will help her to cover “other expenses, as everything is getting more expensive!“. Xavier Tornos, from Terrassa, had no doubts, with the €100 he has saved by switching to 11Onze Segurs, he has bought “a new Bluetooth speaker!

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

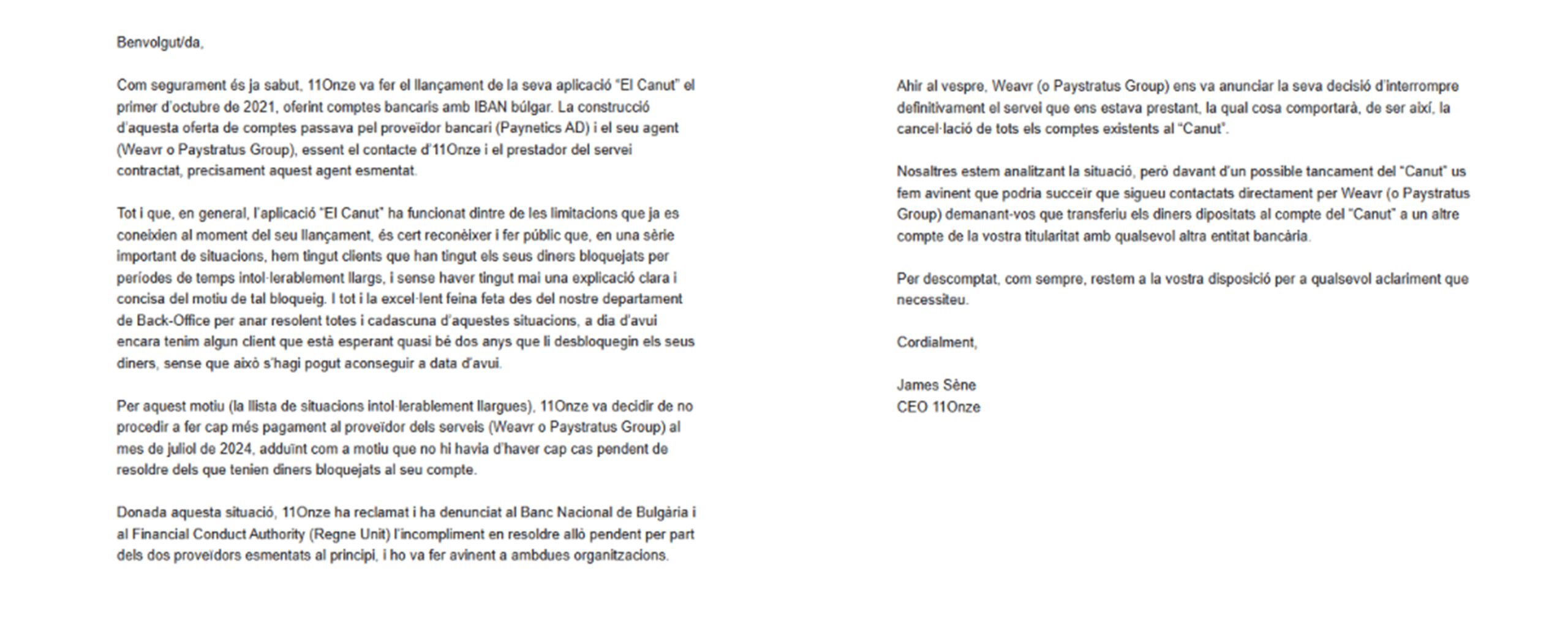

11Onze users have received a communication from Weavr-Paynetics, providers of the El Canut accounts, announcing the unilateral decision to terminate the service by mid-June. Why is this happening now?

It’s very straightforward: Weavr-Paynetics has been failing in its service, blocking the money of several 11Onze users without any justification. 11Onze has since stood up for its customers, stopped payments to Weavr until the outstanding cases are resolved, and has lodged a complaint with the Bulgarian Central Bank and the UK’s Financial Conduct Authority. 11Onze will not allow any user to have their rights violated without consequences.

“They will not be paid if they do not return our users’ money. We will not negotiate anything other than this. It is precisely the community that must serve to defend the rights of each of its members with the strength of the group”, said James Sène, President of 11Onze, to his employees after Weavr-Paynetics sent a notice of termination of service to all El Canut users. An action, that of directly addressing the users of 11Onze, which seeks to cause reputational damage to the Catalan entity, to double it in this case. 11Onze’s response, however, has been unambiguous: it has given Weavr 7 days to retract the service’s termination and to unblock El Canut users’ funds.

Who is who

First, it is important to be clear who is who in this matter. Paynetics is the financial entity that offers the Bulgarian IBAN and is the depository of the accounts, while Weavr is the British agent that provides the service so that 11Onze can offer it to its community. In other words, when there is a registration, 11Onze compiles the user’s documentation, Weavr verifies it and authorises the creation of an account for Paynetics. This means that every time there is an incident, the 11Onze Back-Office team manages it with Weavr.

“They won’t get paid if they don’t return our users’ money. We will not negotiate anything other than this!”

Chronology of events

The European Union’s Anti-Money Laundering Act obliges financial institutions to prove the lawful origin of the funds deposited by their customers. It is a standardised procedure to which all institutions are subject. 11Onze and its users have always complied by providing the required documentation, but even so, Weavr has unjustifiably blocked the money of some 11Onze users. As 11Onze’s financial director, Oriol Tafanell, explains: ‘given the intolerable delays in unblocking these deposits (we are talking about months and years in some cases), we decided to stop paying for services that were not being provided as of July 2024’. In other words, 11Onze’s response was crystal clear: fulfil your obligations properly, then we will go back to paying for your services, as we had been doing until now.

“Weavr’s delays in unblocking the deposits is intolerable.”

According to Tafanell, “since then, some deposits have been unblocked, but, to date, there are still others that have not been so lucky, even though we and our clients have complied with every one of the requirements, some of them surreal, that have been asked of us to unblock them. This stalemate, our refusal to pay unless all deposits are unblocked, led us to write to the Bulgarian National Bank (Paynetics AD’s supervisor) and the UK Financial Conduct Authority (supervisor of banking practices).”

Mea culpa from Weavr

What did Weavr say about all this when he demanded that 11Onze return to regular payments? That it was true, that they had failed in their services. In a 25 February 2025 email to 11Onze, Weavr’s Deputy CEO, Jon Burrell, said: “I am aware that there have been a number of historical operational issues, including one outstanding long-running case. Please be assured that I am now personally overseeing the level of service that is delivered to you, including escalation of the aforementioned long-running issue to ensure the swiftest possible resolution.” Two months later, they still haven’t unlocked this 11Onze user’s money. Now it’s just one case. An 11Onze user who has had his money unjustifiably blocked for far too long. And 11Onze’s response is the same as we would give to any individual user of the entity: to defend the members of the community against any bank abuse. From 11Onze, we deeply regret that this abuse comes from one of our providers, and we announce requests to the relevant authorities (European Banking Authority, Financial Conduct Authority UK, Central Bank of Bulgaria) to make the necessary intermediation or sanction Weavr.

“I don’t care whether it’s 10 euros and 35 cents or 30,000 euros. It belongs to the customers, full stop.”

The unacceptable proposal

Currently, the money unpaid by 11Onze to Weavr is double the amount withheld by Weavr from its customers. This has come to this point because 11Onze withheld payments to the value of the blocked deposits. Many months have passed since then, and Weavr has not unblocked all the funds. Finally, the entity made an unacceptable proposal by 11Onze: that the entity should pay 50% of the accumulated charge and that we should forget about the withheld deposits. The response from James Sène, President of 11Onze, is straightforward: “What Weavr does not understand is that we do not want to exchange euros wrongfully withheld from our customers for euros of your billing to 11Onze. We will not entertain this exchange because it puts any member of 11Onze at risk; we will not agree to trade with the rights of our people. We will NEVER do it, no matter what, we have not come all this way to give up our rights. What made us get up off the couch to create 11Onze was the idea of guaranteeing the freedom of the people to manage their money. I don’t care whether it’s 10 euros and 35 cents or 30,000 euros. It belongs to the customers, full stop.”

Below, to be transparent with 11Onze users, we share the key messages in this conflict between Weavr-Paynetics and 11Onze. Through 11Onze Magazine and our newsletter, we will continue to report on this case and will continue to publish relevant documentation for the community.

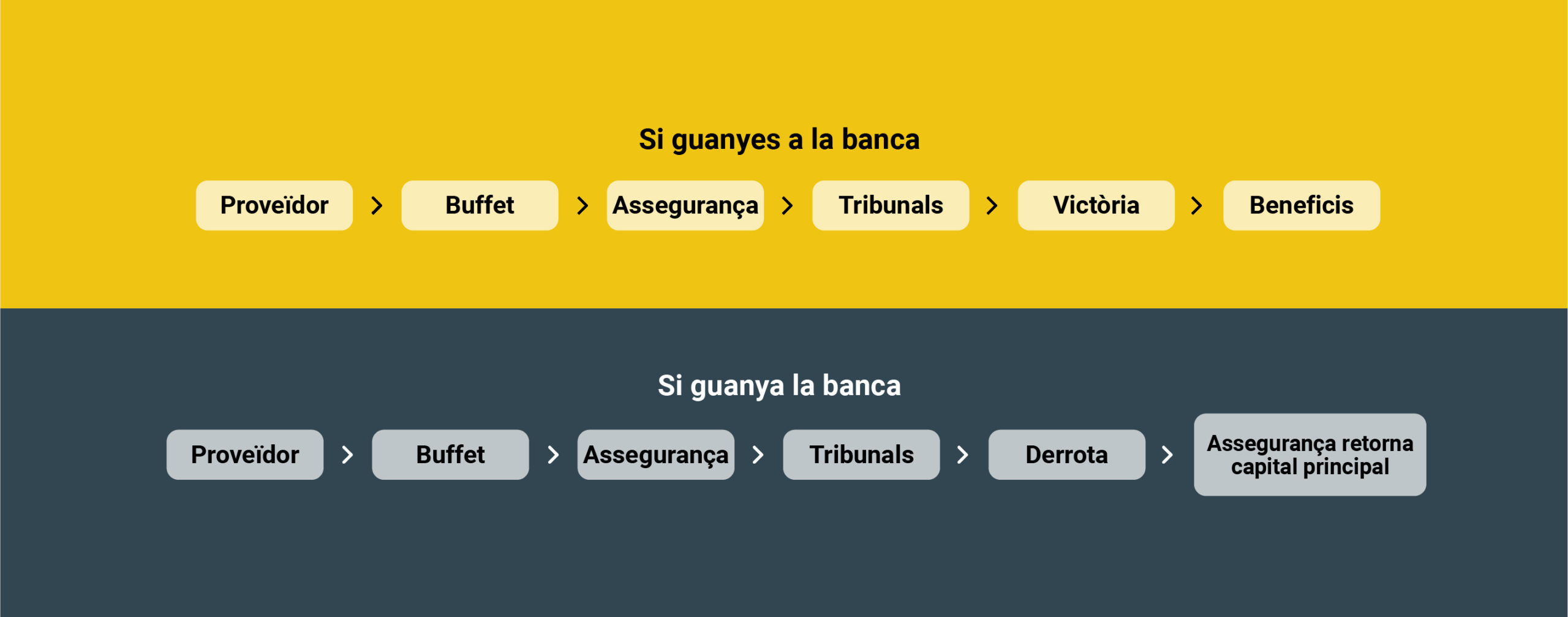

It’s been a year since the launch of Litigation Funding, one of 11Onze Recommends’ flagship products that offers returns of between 9 and 11% by financing lawsuits against banks and institutions that have used illegal practices against their clients. How has it performed so far? Are our clients satisfied? Farhaan Mir, CTO of 11Onze, gives us an update.

In the inflationary economic environment we have experienced in recent years, people have not only seen their purchasing power eroded but have also experienced a loss in the value of their savings. It is in this context that Litigation Funding that 11Onze Recommends was born, to shield the savings of our community members against runaway inflation.

Litigation Funding offers returns ranging from 9% to 11%, depending on the amount contributed, financing the legal costs of law firms pursuing claims against banks and institutions that have used illegal practices against their clients. This social justice product offers high returns at very low risk. And that’s all well and good, but have these objectives been met a year after its launch?

A unique product in the market

As a general rule, investments that offer high returns come with high risk, while low-risk investments offer more stable, but potentially lower, returns.

This is not the case with Litigation Funding, as Farhaan Mir explains, “In this case, the risk is managed by an insurance that covers the clients’ capital“. Even so, in the first year, there has been a 100% success rate in the lawsuits, and it has not been necessary to use insurance.

A recurring investment

Perhaps the metric that most exemplifies the success and good performance of Litigation Funding is that almost 100% of clients have reinvested their money in the same product. “Clients are very happy with the returns and, apart from one person who needed the money for personal matters, everyone has reinvested their capital.”

Litigation Funding has been structured exclusively for members of the 11Onze community, offering two ways to participate: a product that returns your capital and possible profits after one year, or another option where your capital works for a few years and provides you with a monthly return after six months. As Mir points out, “The longer the period, the greater the returns for investors”.

Fund lawsuits against banks. Get justice and returns on your savings above inflation thanks to the compensation the banks will have to pay. All the information about Litigation Funding can be found at 11Onze Recommends.

One of 11Onze Recommend’s star products generates high yields by financing the litigations of law firms that pursue claims from citizens who were misled by banks. You can now participate as a group, reducing the amount of capital contributed individually but keeping the percentage of the profits. Farhaan Mir, CFO of 11Onze, explains how it works.

The success of Litigation Funding comes from the concept of providing social justice while obtaining high returns with a low-risk product thanks to the insurance that covers the funds provided by the clients. Since its launch, we have been expanding its scope, while reducing the minimum amount of access capital.

From the minimum initial capital of 25,000 euros, we were able to get our provider to reduce it to 10,000 euros, making this product accessible to a larger number of people in the 11Onze community.

Obviously, the higher the amount of capital provided, the higher the returns. That is why, at the request of our community, we are now also offering the possibility of a group contribution, either among family or friends, so that the financing can be shared while maintaining the percentage of the profits.

“If you have two people who put in 25,000 euros each, this is considered a contribution of 50,000. And the two people get the benefits of the 50,000.”

Group contributions

Litigation Funding generates returns of between 9% and 11%, well above what traditional banks offer for our savings. Even so, not everyone can afford to make a capital contribution of 25,000 or 50,000 euros to obtain maximum returns. By offering the option to contribute money collectively, we multiply the benefits.

As Farhaan Mir explains, “If you have two people who put in 25,000 euros each, that’s considered a 50,000-euro contribution. And the two people get the benefits of the 50,000”. Therefore, instead of getting a return of 9%, which would correspond to 25,000 euros, you will generate profits of 10%, from a contribution of 50,000 euros.

“Any contribution against the cases we are funding is guaranteed. So we have full security for the funds we are providing to the law firm.”

Unfavourable cases covered by insurance

The success rate of the cases to which Litigation Funding has provided funds exceeds 90%. Even so, if there is an unfavourable case, the funds contributed by our clients are covered by insurance, regardless of the amount contributed.

It is therefore a low-risk product. “Any contribution against the cases we are funding is guaranteed. So we have full security for the funds we are providing to the law firm,” says Mir.

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

11Onze Podcast launches a series of chapters to find out all about banking abuses, conversations with Arcadi Sala-Planell, Head of Legal at 11Onze. First chapter: les comissions.

“All traditional banks have jumped on the commissions’ bandwagon to make money, because banks can’t survive”, explains Sala-Planell in the first chapter of Abusos Bancaris. In several chapters, the lawyer will go through the abuses most commonly suffered by users of the banking system, in conversation with the Head of Contents of 11Onze Toni Mata.

“Banking commissions are regulated, but in practice financial institutions bypass this regulation“, says Sala-Planell, who recommends checking on the Bank of Spain’s website whether the commissions are irregular or not. “The banks abuse people because they know they won’t go to court for a commission,” says the CLO of 11Onze.

More 11Onze Podcast

In addition to the chapters on banking abuses, 11Onze Podcast will increase its content offering. It will do so with conversations on topics of interest around the world of money that will feature 11Onze agents and some of its managers.

Do you want to be the first to receive the latest news about 11Onze? Click here to subscribe to our Telegram channel