Analysis: the best home insurance

Everyone agrees that a good home insurance provider should offer good coverage options, transparency, impeccable customer service and fair prices. However, the reality of the market is far from this almost utopian vision. The new, fully digital insurers have arrived with the intention of modernising the sector. We compare coverage and prices from various providers to help you choose the best option for your particular circumstances.

According to Unespa data, almost 80% of Catalan households have insurance that protects them in the event of a claim, surpassing even the popularity of car insurance. In this case, only 76% of Catalans have an insured vehicle, possibly due to the concentration of population in urban centres, where private cars are not so necessary. This means that around 20% of homes do not have insurance to protect them against a possible claim.

A study published by ICEA indicates that the average cost of a home repair is around 200 euros, while a policy can cost, on average, 140 euros per year. And it should be borne in mind that other mishaps, such as a burglary or damage to third parties due to a water leak, can push up the repair or loss figure considerably.

Therefore, when comparing insurance, it is important to bear in mind the transparency and scope of cover to avoid last-minute surprises. The reality, however, is that often the complication of small print and paperwork makes it difficult for us to know what coverages we are taking out and to what extent our insurance protects us. This is precisely why insurtechs are taking advantage of the digital transformation to simplify this procedure, adjust prices and offer policies that are better adapted to the needs of each client.

Most common coverages and claims

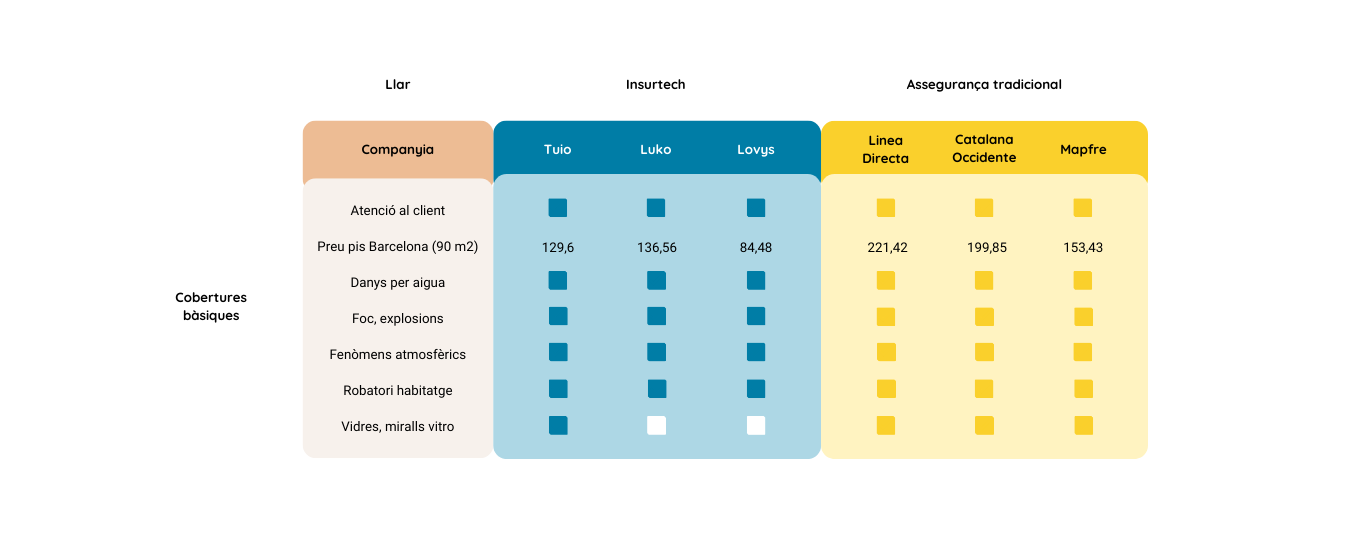

The price of insurance depends on several factors: the year of construction of the property and the square metres it has, as well as the location, the number of people living in the home or whether we insure only the contents or also the building can substantially vary the premium of the policy. Even so, there are some basic concepts of coverage that should be included in any insurance policy, regardless of the price.

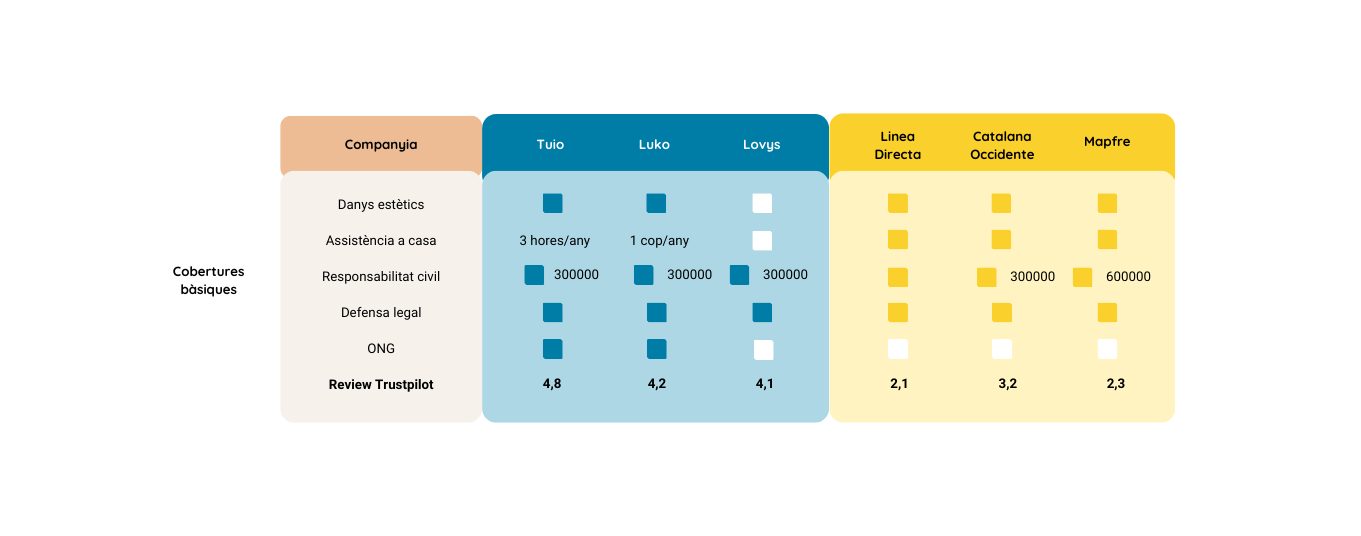

The covers most requested by clients tend to coincide with the most common claims. Thus, burglary, damage caused by water leaks, and the repair of household appliances should be among the essential covers of an insurance policy. Even so, it is important to bear in mind the differences that can be found between the insurances that offer these coverages. For example, do they include a home assistance service, do they cover labour in the event of repairing electrical appliances, aesthetic damage?, glass?

These details are significant and can make the difference between the small inconvenience of having to claim an incident from the insurer who pays for the costs, or finding out that we have to cover a significant part of the charges out of our pocket. In the comparison table below, we present a compilation of some of the best policies on the market, including new digital insurers that even consider their impact on society by investing a large part of their profits in NGOs of your choice.

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

Leave a Reply

You must be logged in to post a comment.

gràciess

Gràcies a tu, Joan!!!

Sempre va bé ampliar i formació

Gràcies

Oi tant que sí, i moltes gràcies pel teu comentari, Alícia!!!

Ho miraré.

Molt bé, Pere, gràcies!!!

👍

Gràcies, Manuel! 😉