What can you get for €5?

The rise in food prices has reached record highs in the last year. Filling the shopping basket has become much more expensive. Despite this, doing without basic foodstuffs is not a savings option that we can contemplate. Likewise, there are other fixed household expenses that we cannot eliminate, but which we can reduce. Here at 11Onze we have a savings proposal that you may not be aware of.

Although inflation seems to have peaked after two consecutive months of decline, prices are still totally out of control and the main foodstuffs that make up the shopping basket continue to get more expensive. According to data from the National Statistics Institute (INE), the year-on-year rate of food and non-alcoholic beverages prices has risen by 14.4% in one year, the highest since 1994, when the statistical series began.

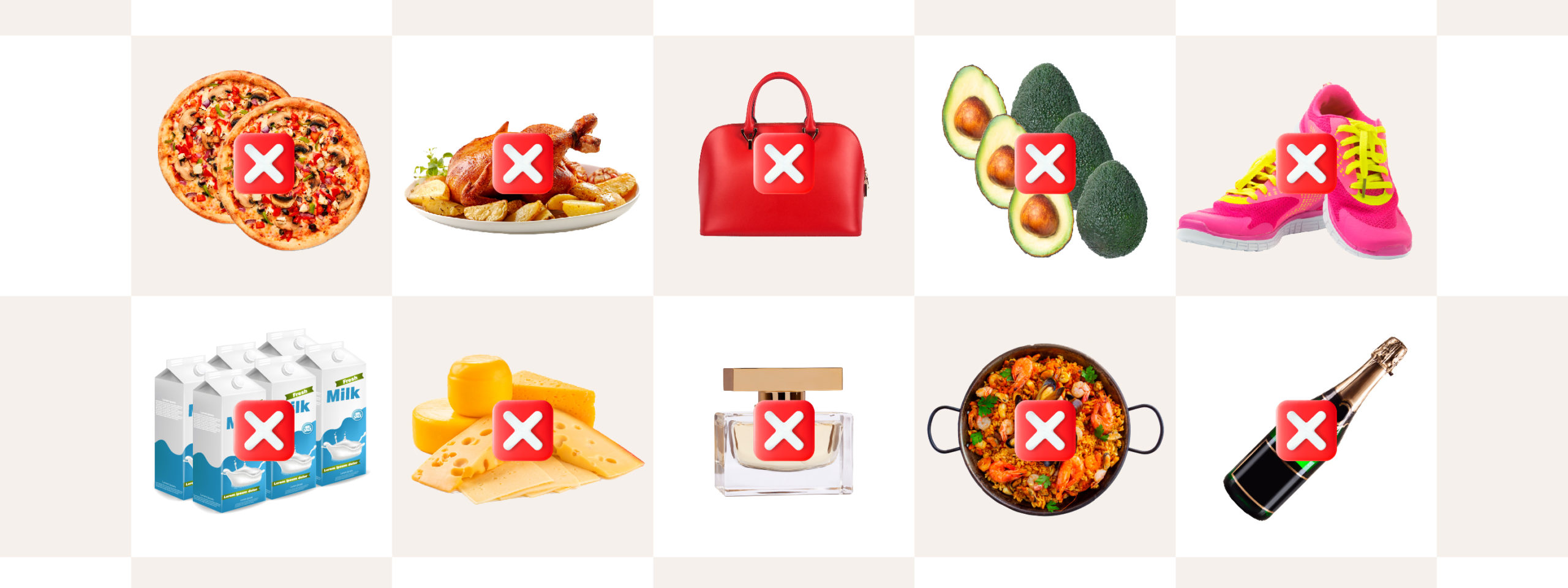

The INE report tells us that the list of foods with the highest price increases is headed by oils, whether sunflower, corn or olive oil, which have shot up by 66%, followed by basic products such as cereals, butter, pasta or sauces and condiments, which have risen by almost 30%.

The causes are many and varied: the increase in production, transport and distribution costs, the rise in the price of raw materials, fuel and energy, but the end result is that no product has fallen in price or even maintained its price. It’s no secret, the cost of living has risen dramatically, and you have to make savings wherever you can.

Optimising fixed costs

Although it is true that we have little room for manoeuvre if we want to reduce essential expenses such as food, it is also true that there are other fixed expenses that, although necessary, can be negotiable, or we can optimise them by contracting suppliers that are more in line with our needs.

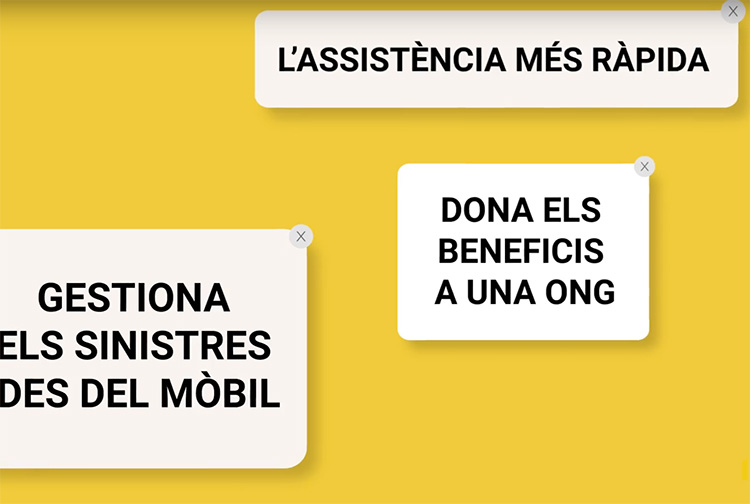

This category includes products and services such as household supplies, the mobility option and insurance. The home insurance sector offers us a wide range of providers with coverage and prices that adapt to our particular circumstances. This is where we can reduce costs without having to do without the essentials. Would it surprise you to know that with 11Onze Segurs you can insure your own home for as little as €5 a month?

From £5 a month? Yes, at 11Onze Segurs we do away with paper contracts, physical agencies, management fees, cancellation and contract change fees, which is already a considerable saving, but we also allow you to modify and adapt the coverage to your needs at any time, before and after signing the contract.

In this way we ensure that you don’t overpay for your insurance, offering a monthly or annual fee, without permanence, between 15%-20% cheaper than with traditional insurers. What is the monthly cost of your current home insurance? Do you want to know how much you could save? Try our price simulator by entering some basic data, and you will get your no-obligation quote immediately.

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

Leave a Reply

You must be logged in to post a comment.

Gràcies!

Molt bons preus! El simulador dona opcións de tot tipus i el preu es fantàstic👏👏👏👏la meua més sincera enhorabona!

Agrair-te les bones paraules cap a nosaltres i també el teu comentari, Jordi.