Bullion coins, a precious commodity

What are the advantages and disadvantages of bullion coins compared to gold bars? What is their history? What does their value depend on? Here are the answers you need.

The first official coins were minted around the 7th century BC in Lydia, in present-day Turkey. They were made of electro, an alloy of gold and silver. From then on, virtually all the great states of antiquity created gold or electro coins.

For centuries, gold and silver became the materials from which coins of the highest value were made. This was because they are solid metals, easy to handle and relatively scarce, which prevents overabundance.

Of the two, gold has always been more prized for its greater resistance to rust and corrosion. In addition, its golden colour and lustre have made it very attractive to most civilisations, which have made this precious metal a symbol of wealth and status.

A new concept of gold coinage

In the second half of the 20th century, the concept of the bullion coin appeared. This is a coin minted in precious metal, the value of which is fixed not by the face value of the coin, but by the value of the metal contained in it, to which a premium is added for the coin’s manufacturing process.

In these cases, what is important is the amount of precious metal it contains and its purity, rather than the possible numismatic value it may have because of its design. Of course, when the price of gold rises, the value of the coin also rises.

Bullion coins or gold bars?

Although the premiums or surcharges on the price of contained gold are lower for bullion and bars than for coins, many investors prefer the latter.

One reason is their collectable potential. Gold coins that are preserved in good condition become somewhat more coveted as they age, which is not the case with gold bars, which are valued purely for the amount of gold they contain.

Moreover, because their weight per unit is generally lower, they do not require the investment of a large amount of money, which makes them accessible to small investors.

Finally, the process of verifying their authenticity when selling them is simpler. Thanks to their particular design, weight and dimensions, each type of gold coin is very difficult to counterfeit.

A bit of history

The first modern investment coins were minted in South Africa in 1967. They are the Krugerrand, which are still in production today. Investment coins became popular between the late 1970s and the 1980s, when the Maple Leaf in Canada (1979), the American Eagle in the United States (1986), the Britannia in the United Kingdom (1987) and the Philharmonic in Austria (1989) began to be minted.

Some of these coins have a face value. For example, in the case of the Britannia coin, it is £100. However, as this value is lower than the value of the gold it contains, the real value at any given moment is determined by the price of gold and its numismatic value. In this sense, as the Fábrica Nacional de Moneda y Timbre indicates, the rarity and the degree of conservation of the piece are essential.

Some pieces are often coveted for reasons that go beyond a mere investment mentality. The numismatic value of the craftsmanship, design, historical significance, commemorative value and physical condition of a piece can drive collector demand. This means that, proportionately, the price of some coins is considerably higher than that of bullion.

Up to now, with Preciosos 11Onze, it has been possible to purchase gold bullion. From now on, we also offer the option of buying Krugerrand and Britannia gold coins. Gift gold, for tomorrow’s future.

Gold is traditionally regarded as the best asset for inflation protection, a reliable hedge against the risk of losing purchasing power. However, some investors see government bonds as a safer alternative to invest their money in the face of market uncertainty. We analyse the advantages and disadvantages of these two options.

Gold purchases over the past three years have had a stellar performance with record highs for investors and have seen a 40% rise in value. The safe-haven status generally attributed to gold has been confirmed by the uncertainty caused by the pandemic and subsequent inflation, which has penalised the performance of other assets. Once again, gold has provided a valuable hedge against an uncertain future.

Some economists argue that gold only increases in value when a currency is devalued or in a context of high inflation, and that it does not offer adequate returns in other market scenarios. While it is true that gold tends to increase in value in times of financial instability or currency devaluation, these are not the only factors that increase its valuation above average. For example, in the period from 2013 to 2020, inflation was very low, and the most damaging effects of the crisis and economic instability had already been overcome in much of the world, yet the value of gold rose steadily.

Even so, we have to bear in mind that, if we choose to invest in gold through an investment fund or ETF, we will not own the precious metal, which means it loses much of its intrinsic value, and it is a model that gives more versatility, but requires basic stock market knowledge that requires professional intermediaries in the sector. When you buy physical gold, you own the metal, whereas when you invest in digital gold, you have a right or an option. Moreover, because it is not a book entry, you cannot suspend payments. Unlike other financial assets, gold can always be on hand.

Government bonds

The biggest attraction of buying government bonds is that we are assured of a certain return, positive or negative, on the investment. This may seem contradictory, because historically, when someone lends money to someone else, they charge them interest, and therefore it may seem difficult to understand why some bonds are trading with a negative return.

This apparent inconsistency is due to the fact that some large investors seek safety in safe-haven assets, such as government bonds, during times of financial market turbulence. The 2008 crisis, with the collapse of Lehman Brothers and other banks, showed that the Deposit Guarantee Fund, which in Spain covers 100,000 euros per customer and institution, is nothing more than a consolation prize if we are talking about deposits of millions of euros.

Therefore, when we are talking about investment groups with large amounts of money, it may be preferable to buy bonds from countries with the highest credit rating (AAA), even when they offer a negative yield, since, unlike banks, this guarantees us pretty much all of our assets. Still, there may be a speculative motive: buying debt with a negative yield in the expectation that this yield will fall further so that the price of the bonds will rise.

This is a scenario that is hardly applicable to the medium or small investor, who tends to buy securities issued with a nominal value and which pay an explicitly determined interest on the investment, quarterly, every six months, or at maturity. And yet, they can also be traded on the stock market to offer investors the possibility to sell or buy before their maturity.

Security and profitability

Before investing, there are many factors to consider when deciding which financial asset is most suitable for us. And it is vital to assess the risk we are willing to take and to clearly define our investment objectives. As a general rule, the higher the return on an investment, the higher the risk. Conversely, if we want a very safe investment, we will have a low return.

Precious metals, especially gold, break this rule somewhat, with very high returns in times of economic crisis, given their status as safe-haven assets, and relatively stable prices when there is less demand in times of economic growth. But they always maintain a long-term upward trend, which is also accompanied by high liquidity thanks to their intrinsic value.

On the other hand, the risk-return trade-off is evident when it comes to government bonds. Fixed income securities issued by governments are considered risk-free as long as we are talking about developed countries with solvent economies, and with a practically non-existent probability of defaulting on payments to creditors. Even so, they are always accompanied by relatively low or even negative yields in the case of Germany.

This low yield can be affected by inflation, if we take into account that the coupons paid on fixed income are nominal over time. Therefore, when inflation rises, their real value falls and the return on these bonds is also lower. This is a scenario in which the purchase of gold offers better inflation protection, thanks to a higher yield, while maintaining high security and liquidity. If you are interested in buying gold, 11Onze will help you do so starting next week.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. will help you buy at the best price the safe-haven asset par excellence: physical gold.

Registered with the Dutch Central Bank and headquartered in Amsterdam, Bitvavo is one of Europe’s leading digital asset exchanges. It launched in 2018 offering reasonable fees, security and a simple and easy to use platform that has made it an ideal choice for beginners and experienced users alike.

In the five years since its market launch, Bitvavo has been driven by its founding pillar of making cryptocurrencies accessible to everyone. It was entering a sector dominated by US-based exchanges that were pioneers in facilitating the exchange of digital assets, but which needed to be more intuitive for people inexperienced in trading cryptocurrencies and had some shortcomings in terms of the security they offered to their users.

As Mark Nuvelstijn, CEO and co-founder of Bitvavo, explains: “The high threshold for buying and selling cryptocurrencies concerned us. Of course, there were large international traders, but you could only deposit euros in some places, and you couldn’t trade in altcoins. It was also not possible to store them securely.”

Buying and selling cryptocurrencies securely

Bitvavo is regulated and registered with the Dutch Central Bank, its depositors have access to the Deposit Guarantee Fund, so up to €100,000 could be recovered in the event of the exchange’s bankruptcy. In addition, the platform uses cold wallets so that in the event of a cyberattack, Bitvavo could restore deposits. In other words, customers’ digital currencies are regularly downloaded to physical devices without an internet connection.

However, Bitvavo wanted to take it a step further and offers additional protection: “Bitvavo’s cryptocurrencies are insured up to 250 million. As for the euro funds, they are also stored in a separate secure entity. In addition, we are working on account insurance to guarantee up to 100,000 euros,” Nuvelstijn notes.

Access to a wide range of cryptocurrencies

Bitvavo allows you to store, buy, sell and withdraw more than 190 digital currencies. When trading cryptocurrencies, you will have the option to store tokens in the exchange’s own wallet, which is free to use.

The process of signing up to the platform is simple, you can do it via the 11Onze Recommends link. In addition, until 15 August, Bitvavo is rewarding €500 to Binance and OKX users who transfer their funds from these exchanges, which can be used for the purchase of digital assets. Here is a tutorial on how to do it.

11Onze Recommends Bitvavo, cryptocurrencies easily, securely and at a low cost.

If you already trade cryptocurrencies through the Bitvavo platform that 11Onze Recommends, we give you 6 tips to increase the security of your account. Take advantage of Bitvavo’s tips and promotions and learn how the world of cryptocurrencies works.

During this month of July Bitvavo is offering two promotions for those users who sign up to the platform. But not only this, it also gives us ideas to improve the security of our account.

1. Enabling two-factor authentication

The first step in securing your Bitvavo account is to enable two-factor authentication (2FA). This adds an extra layer of security in a very simple way: by requiring a unique code generated by an authentication application. This makes unauthorised access much more difficult, so it’s a great barrier against hackers.

Another thing: if you use an authentication application, one of those that recognise you on all devices, do not synchronise Bitvavo codes with your personal account. Keep them only on your device.

2. Use a strong password

How can you create a strong password? Well, it’s not complicated: avoid using common words, phrases or personal information that can be easily guessed. A combination of upper and lower case letters, numbers and special characters is always recommended. But do yourself a favour and write it down somewhere so you don’t forget it!

3. Keep your account information private

It’s a no-brainer, but it’s worth remembering: never share your Bitvavo account details with anyone. This includes your password, security question and API keys. Also, beware of phishing scams and fake emails that may try to steal your personal information. Remember, neither Bitvavo nor 11Onze will ever ask for your account information via email or a phone call.

4. Secure your email

Your email is linked to Bitvavo, so it would be a good idea to enhance your security as well. That’s why you can activate two-factor authentication and regularly check for account leaks. There are tools to check for this such as haveibeenpwned.com. Another option is to create an email address just for your Bitvavo transactions.

5. Use the anti-phishing code

If you activate the anti-phishing code, it will be included in all automatically generated emails sent by Bitvavo. With this code, you can check if the email really comes from Bitvavo. You can change your anti-phishing code by following the instructions here. Or by watching the video linked below.

How to use the anti-phishing code.

6. Try to stay informed

Regularly check your accounts, the official blogs and La Plaça. This will help you stay informed about any security issues or updates to the platform.

EXTRA: Blocking fund withdrawals

Bitvavo also allows you to totally block withdrawals. This way you can only trade in cryptocurrencies, but you can never withdraw money in euros. This prevents the possibility that someone can impersonate the user and download the money. The Dutch platform explains in this article how to block deposit withdrawals and how to re-enable them when necessary.

11Onze Recommands Bitvavo, cryptocurrencies easily, safely and at a low price.

How much do we spend on beauty products? What is the impact of natural cosmetics in this sector? We talk about all this and more with Esther Vallès, co-founder of El Mirall Blau Perruquers, and Gemma Vallet, Director of 11Onze District, in a new episode of La Plaça of Territori 17.

The recovery of the perfumery and cosmetics sector is consolidating after the slowdown caused by the health pandemic. Last year’s turnover was 9,205 million euros, 11.3% more than the previous year, according to data from the National Association of Perfumery and Cosmetics (STANPA).

Per capita consumption has set a new record, approaching 185 euros per person per year. Even so, Esther Vallès thinks that the real figure is much higher, at over 250 euros: “I think we spend a little more because we are increasingly aware that we have to put quality products on our skin“. In fact, the data shows that all product categories have grown and exceeded pre-pandemic levels for the second year in a row.

Natural cosmetics are gaining market share

People have become aware of the advantages of natural cosmetic products. More and more people are joining the trend to buy cosmetics made traditionally and with ingredients that are less harmful to the environment and our skin.

As Vallès explains: “If you use a type of cosmetic that contains parabens and silicones, what it fixes on the one hand, it undoes on the other”. Moreover, these are products that are more sustainable because they are made with plant-based ingredients, so they do not generate chemical residues that are harmful to the environment.

Beyond the possible benefits of natural cosmetics, the co-founder of El Mirall Blau points out that customers value, above all, honesty and that the benefits of the product are palpable. “Often, modern cosmetics can give good immediate results, but in the long run they are damaging your hair”.

If you want to wash your clothes without polluting the planet, 11Onze Recommends Natulim.

Binance is under pressure amid a spate of legal issues that have severed many of its key banking relationships around the world and eroded its market share. After announcing it would leave the Dutch market, tens of thousands of users have transferred their funds to other exchanges such as Bitvavo, which protect their customers’ money with a guaranteed fund. We explain the process step by step.

The problems at Binance, one of the world’s leading crypto exchanges, continue to pile up. Several senior executives have already left the company at a time when it is facing immense regulatory pressure.

In addition to the US Securities and Exchange Commission’s (SEC) lawsuits against the platform and its CEO, accusing them of violating laws, failing to have the necessary registrations and selling unregistered securities, there have been regulatory problems in Europe.

On the one hand, financial regulators in Germany and the Netherlands denied Binance’s application for a licence to hold crypto-assets and, shortly afterwards, Binance announced that it would leave the latter market because it could not obtain registration as a virtual asset service provider.

On the other hand, Belgium ordered the company to immediately cease its operations in the country on charges of non-compliance with existing regulatory rules. At the same time, Paysafe, a British digital payments platform, announced that it was ceasing to support Binance’s euro-denominated transactions, leaving the crypto exchange unable to transact within the SEPA area.

The alternative that 11Onze Recommends

Thousands of users have already transferred their funds to other exchanges that comply with the European regulatory framework and offer more security. This is the case of Bitvavo, which 11Onze Recommends, a cryptocurrency management platform that is registered with the Dutch Central Bank, where its depositors have access to the guarantee fund and which uses cold wallets to prevent cybercrime. That is, Bitvavo customers’ digital coins are regularly downloaded onto physical devices that are disconnected from the internet.

According to Bitvavo, the inflow of capital from Binance to Bitvavo is already in the tens of millions of euros and growing every day. Bitvavo expects total deposits of digital assets to reach a value of hundreds of millions of euros. The process of transferring funds between the two crypto-asset management platforms is not complicated but requires a number of steps, which we explain below.

Transfer cryptocurrencies from Binance to Bitvavo

From the app

At Bitvavo

- Log in to our app

- Tap on the digital currency you want to deposit

- Tap on the three-dot menu, at the top right of your screen

- Tap deposit

- Select the network to see your address

Note: Deposits via the Binance Smart Chain (BSC) result in the loss of your assets (excluding BNB). - The address of your Bitvavo wallet is now displayed. You can use this address to transfer your digital currency.

At Binance

- Navigate to ‘Spot’ on your Binance account

- Select the appropriate cryptocurrency

- Select ‘Withdraw’ and then ‘Send via Crypto Network’

- Paste in the Bitvavo cryptocurrency deposit address

- Choose the suitable network (this is critical!)

- Select the desired amount and press the ‘Withdraw’ button

- Confirm the transaction by following the on-screen instructions

- Your transaction has been confirmed and sent to Bitvavo.

Source: Btivavo

From the webb

Log in to your Bitvavo account

- Navigate to the digital currency you want to deposit and click on it

- Navigate to ‘Deposit’ and click on it

- Select the network to see your address

Note: Deposits via the Binance Smart Chain (BSC) will result in the loss of your assets (excluding BNB). - The address of your Bitvavo wallet is now displayed. You can copy this address to transfer your digital currency.

At Binance

- In your Binance account, go to Spot withdrawals

- Choose the relevant cryptocurrency

- Paste the Bitvavo deposit address for this cryptocurrency

- Select the appropriate network (very important to do so!)

- Choose the desired amount and confirm the transaction

Source: Bitvavo

11Onze Recommands Bitvavo, cryptocurrencies easily, safely and at a low price.

In addition to the €20 welcome to register from 11 Onze Recomana, Bitvavo launches two other promotions. You will be able to buy and sell coins commission-free up to €10,000 and you will receive €500 to transfer funds from Binance or OKX.

Since mid-June 11Onze has brought cryptocurrencies to its community thanks to an agreement with Bitvavo. The leading digital currency exchange house in the Netherlands now also dominates 50% of the Spanish market. And it achieves this thanks to the ease of use and the security it offers its users. The reception by the people of La Plaça has been extraordinary, taking advantage of the 20 euros welcome offered by Bitvavo. But during this month of July there are two other promotions active.

Security and €500!

Bitvavo is registered with the Central Bank of the Netherlands, its depositors have access to the guarantee fund and, in addition, it uses cold wallets to prevent cybercrime. That is, the digital currencies of Bitvavo clients are regularly downloaded to physical devices disconnected from the Internet.

Other cryptocurrency platforms are having problems. This is the case of Binance and OKX which, as explained by Bitvavo’s affiliate manager for the Spanish and French market Oriol Blanch, “will not be able to operate in the Netherlands or Belgium because they have not obtained a license”. This is bad news for its users, who have already seen the vetoes of other countries such as Cyprus, Germany, the forcefulness of Belgium and the withdrawal of Binance’s main banking partner in Europe.

Given this scenario, Bitvavo offers itself as a refuge and to stimulate the arrival of users of these platforms, it will reward them with €500. To transfer funds from Binance or OKX to Bitvavo, just follow the tutorial offered by the Dutch platform. There is no minimum deposit of funds, but the euros cannot be withdrawn. On August 15, Bitvavo will deposit the €500 that will have to be used to purchase digital assets. You will find all the information about the promotion at this Bitvavo link.

European regulators are investigating international exchange platforms. Bitvavo allows users to operate in a more secure environment.

According to Oriol Blanch, “now is a good time to trade cryptocurrencies through Bitvavo because international exchanges are being investigated by European regulators. Bitvavo offers these facilities to help users operate in a more secure environment.”

€10,000 without commissions

The second active promotion in Bitvavo during this month of July is the one that allows you to buy and sell up to 10,000 euros in cryptocurrencies. Of course, it must be in the first 7 days of account activity. This will allow users to save about 25 euros in commissions.

All this, advantageous options that are added to the 20 euros welcome for signing up from 11 Onze Recomana. But is it worth having some of the cryptocurrency savings? How does this platform really work? Recover the podcast where we talked about these issues with the representative of Bitvavo, Oriol Blanch.

11Onze Recommands Bitvavo, cryptocurrencies easily, safely and at a low price.

Cryptocurrencies come to La Plaça from the hand of the leading exchange house in the Netherlands. An easy and secure proposal with a €20 gift for 11Onze people to start getting into the world of the crypto-economy.

Cryptocurrencies are a very interesting alternative to regulated currencies, whether they are the current fiat currencies or the CBDCs that several countries are starting to implement. They are primarily a space for freedom in the digital world. And, despite often trying to fuel the idea that anonymity facilitates criminality, cryptocurrencies are much more traceable than physical money. They are, therefore, becoming a real and attractive alternative as a store of value and as a digital currency.

Bitvavo in La Plaça

You can already find all the information about Bitvavo at 11Onze Recommends. It is an exchange house registered with the Central Bank of the Netherlands and offers an easy and intuitive platform. There are more than 190 currencies available and the process is very simple: register on the platform via the 11Onze Recommends link.

“Our goal is that everyone can access cryptocurrencies,” explains Oriol Blanch, affiliate manager for the Spanish and French markets at Bitvavo. Oriol acknowledges that young people are more interested in crypto economics, but that they have tried to make the platform accessible to everyone. “My parents use it,” Oriol confirms. However, no one hides the volatility of cryptocurrencies.

At a time when the sector is maturing, there are cases of coins that gain a lot of value very quickly, but which are not really solid. In this sense, Oriol recommends being informed and buying reliable cryptocurrencies: “Bitcoin, because it is the first and because of the way it is mined, and Ethereum, because of what it provides with smart contracts, are probably the most reliable. For the rest, you have to be informed and look at what is behind them”.

Online exchange house

Bitvavo allows you to exchange euros for any other digital currency. And it is cybercrime-proof because users’ money is kept in “cold wallets”. “This means,” Oriol explains, “that what you deposit is stored in a physical device that is disconnected from the network. Therefore, in the event of an attack by cybercriminals, Bitvavo could restore the deposits. Moreover, in the event that a user is impersonated and funds are lost, being registered with the Dutch Central Bank offers access to the Deposit Guarantee Fund, so that up to €100,000 could be recovered. It represents a very safe option in an environment that sometimes creates a sense of insecurity for users.

Will cryptocurrencies end up being a substitute for current currencies? We asked Oriol Blanch and he is convinced that “they will be a very important alternative”. They will be if users want them to be. An alternative to the central banks’ digital currencies (CBDC), which will make it possible to monitor and manipulate the economy according to the interests of regulators. “Cryptocurrencies and CBDCs will coexist,” says Blanch, “because there is no doubt that states will force us to use CBDCs and they have the power to do so. But there will also be cryptocurrencies. We will have to see how regulation progresses”.

In the meantime, you can find out more about cryptocurrencies and Bitvavo at 11Onze Recommends and by listening to this conversation with Bitvavo’s representative in our country.

11Onze Recommends Bitvavo, cryptocurrency trading made easy, safe and at a good value.

In this episode of La Plaça, Oriol Blanch, Affiliate Country Manager of Bitvavo, analyses the current situation of the cryptocurrency market and gives us some tips to keep in mind before investing.

The emergence of Bitcoin in 2009 marked the birth of a new financial paradigm that uses blockchain technology as the basis for the creation and operation of decentralised digital currencies. The immense popularity and rapid expansion of cryptocurrencies have made them the leading investment product for the under 30s.

However, it is crucial to know the risks associated with this market and the importance of having the right information before investing, “it is essential to educate yourself, to really understand what you are investing in and what you are buying”, says Oriol Blanch, Affiliate Country Manager of Bitvavo, one of the most important cryptocurrency exchange platforms in Europe.

Crypto assets are stored in digital wallets, so cyberattacks can compromise the security and privacy of the funds. Hackers seek to exploit vulnerabilities in exchange platforms and digital wallets to steal cryptocurrencies. In fact, Blanch recommends “having an ‘offline’ or ‘cold’ wallet, so that you can store cryptocurrencies under your own passwords”.

Regulating a high-risk asset

Cryptocurrencies are highly volatile and their prices can undergo drastic changes in short periods of time. This volatility can generate significant gains, but also significant losses.

Moreover, the cryptocurrency market is still not fully regulated in many countries, so investors are exposed to possible fraudulent practices, scams and market manipulation, thanks to the ease of anonymity that characterises crypto-assets.

In this regard, last Thursday the European Parliament approved the new regulation for crypto-asset markets, known as the “MiCa” Regulation, which seeks to regulate the issuance, supply and trading of cryptocurrencies. A measure that, as Blanch states, “should help these assets to be implemented in many institutions and increase their value”.

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

11Onze Recommends Finança Litigis, a product that allows you to profit from the compensation that banks in the UK have to pay for having committed wrongdoing against their clients. We explain how it works.

A few weeks ago, 11Onze Recommends presented Finança Litigis to its community for the first time. Now, it is time to publicise this amazing product throughout La Plaça. What is it about? Profit by fighting the abuses committed by the big banks.

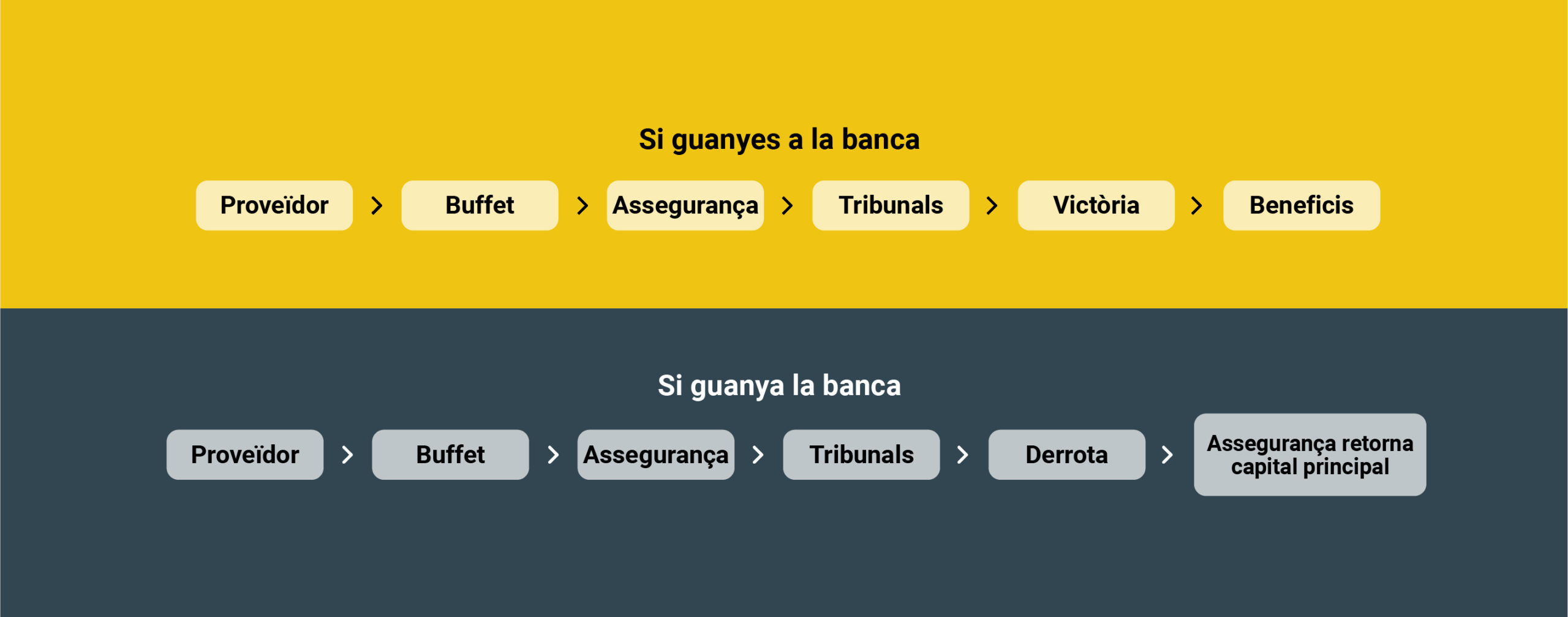

The first location to do this is the UK where, for years, banks sold personal insurance policies to their customers using all kinds of malpractice. Those abuses have already been condemned by the courts and have opened the door to more than 60 billion euros in claims with a success rate of more than 90%. Shocking figures for the banking industry.

In this context, 11Onze Recommends works with an English provider that offers financing to the law firms that carry out these lawsuits, in exchange for part of the profits. You thought that the banks would always win? Well, not any more!

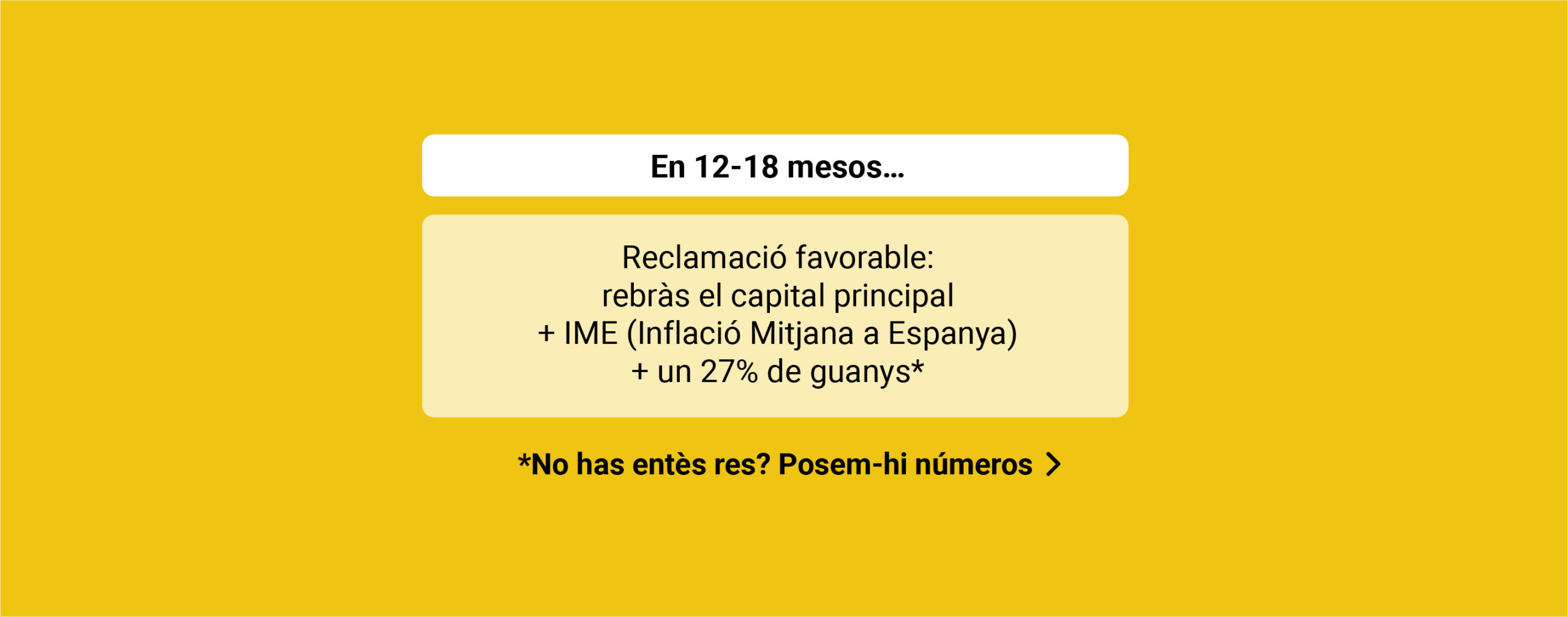

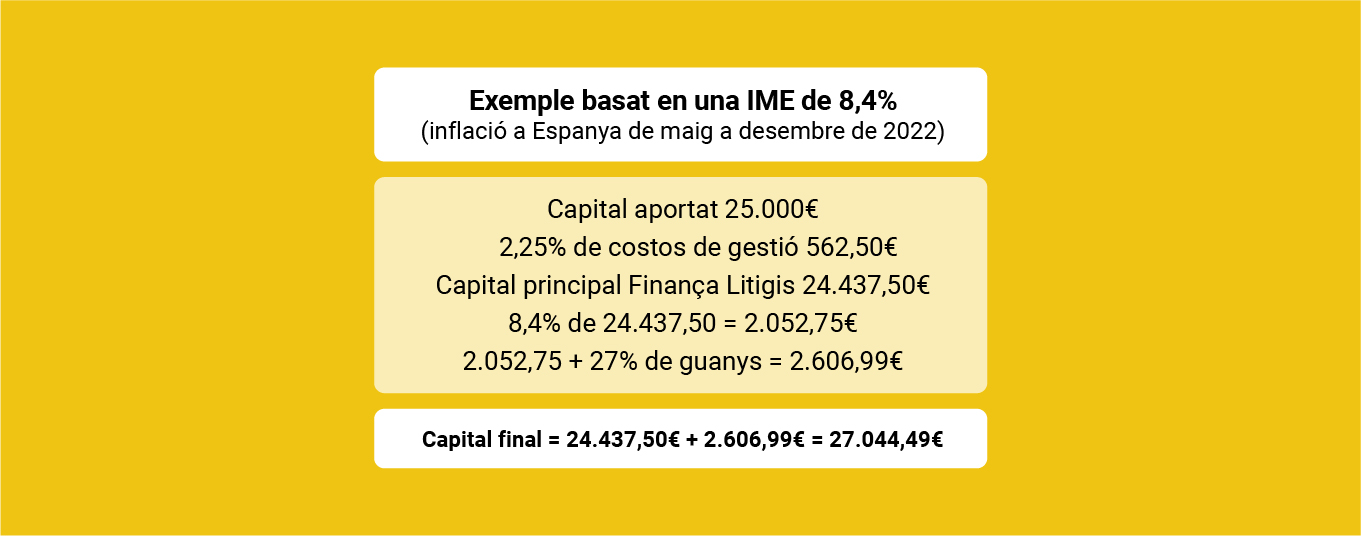

What profits can be obtained?

You can find all the information about Finança Litigis on the 11Onze Recommends website. The objective is to achieve a profit of more than 27% in relation to the average inflation in Spain. It is, therefore, a product that lets your money appreciate much more than inflation, allowing you to gain purchasing power. All this, in a context of low profitability and high volatility, which makes Finança Litigis a very valuable product. Standard & Poor’s A insurance covers the litigation capital.

All the information about Finança Litigis can be found at 11Onze Recommends.