What returns are banks offering?

Interest rates offered by traditional banks for savings remain at historic lows. The European Central Bank continues to inject money into banks at no cost and to charge for excess liquidity. As a result of this monetary policy, attracting customer liabilities is not a priority for large banks. But what returns do financial institutions offer? Let’s compare them!

The record savings of households due to the Covid-19 pandemic has led to an increase in the liquidity of financial institutions, for which large banks have to pay large sums of money to the European Central Bank (ECB). We are facing a situation with no hope of change in the medium term: savings products are no longer a priority, and the deposits that offered a return of 5% just a few years ago are a long way off.

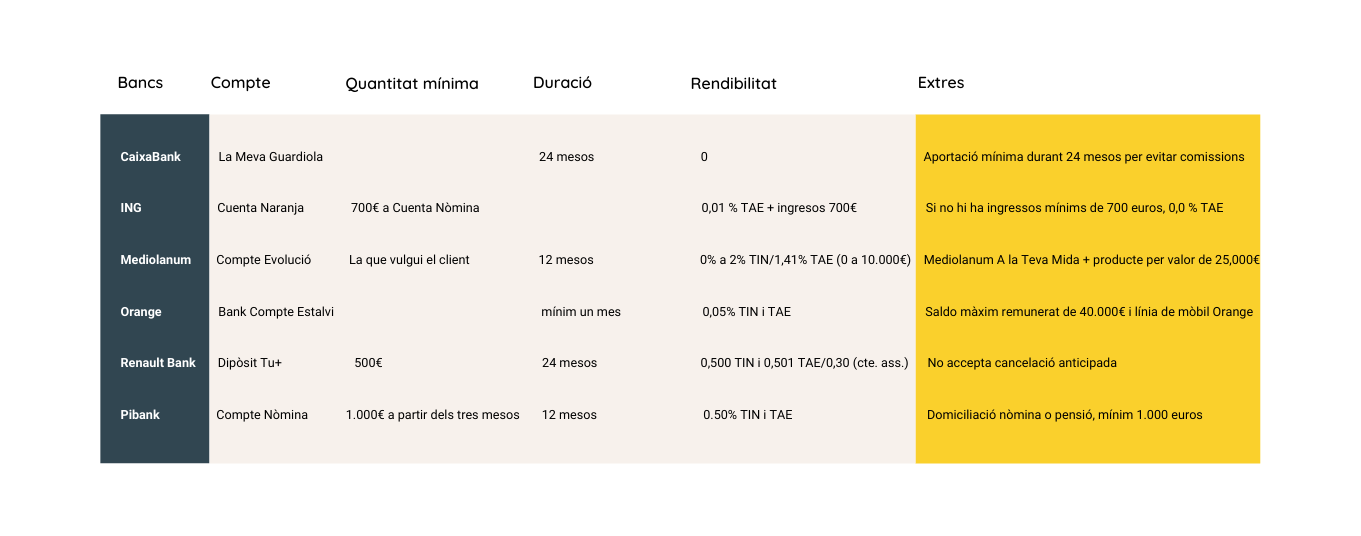

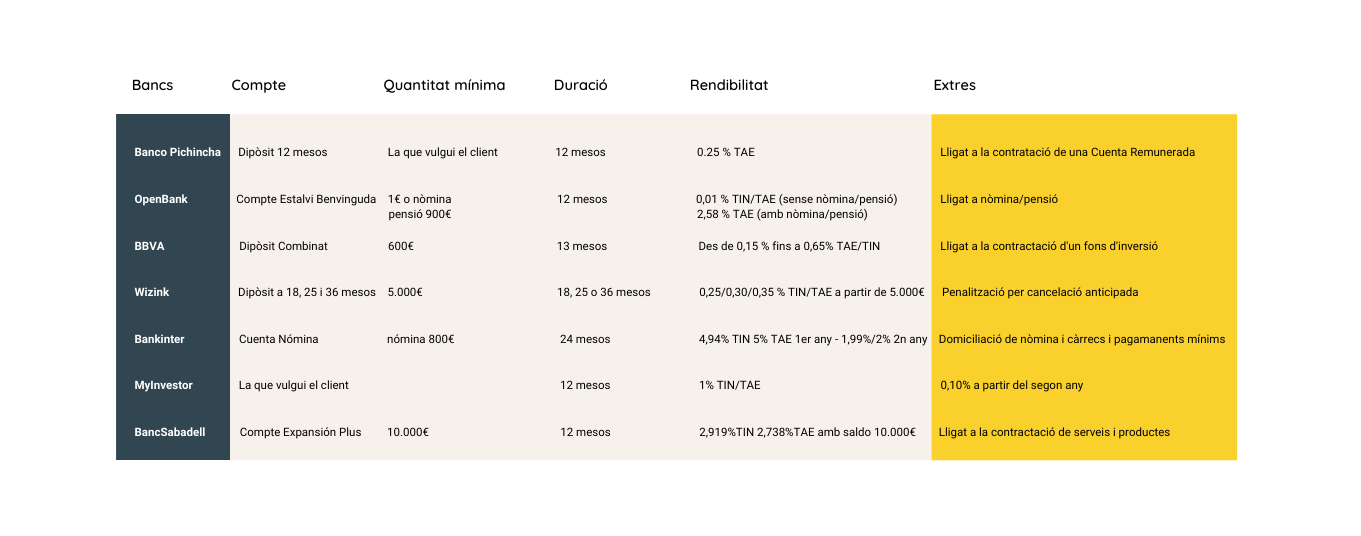

Although some institutions continue to offer minimum returns, between 0.01% and 0.5%, there are some differences between their products. And we note that when they offer higher returns, they are often linked to taking out insurance or other financial products. And, in spite of everything, if financial institutions want to increase their market share they have to offer some incentive to attract new customers, and the profitability of deposits is key at a time when we have broken a savings record.

In this context, fintechs, which use new technologies for a new digital banking experience, are taking advantage of the savings achieved thanks to the lack of physical branch networks and face-to-face staff, and greater efficiency and agility in financial management, to offer more competitive and more profitable products. Even so, in the comparative table below, there are few differences between institutions.

But it is not worth getting discouraged. If bank deposits do not yield enough, and we want to make the most of our money and compensate for inflation, there are other options, such as investments in precious metals, ETF packages, fixed assets such as housing and other trends that will be in vogue in 2022.

If you want to discover the best option to protect your savings, go to Preciosos 11Onze. We will help you buy at the best price the ultimate safe haven asset: physical gold.

Gràcies

Gràcies a tu, Joan!!!

Bona!👍

Moltes gràcies pel teu comentari, Jordi!!!

Ok 👍

Moltes gràcies, Josep

dificil prespectiva si no t’agrada el risc

Per això és interessant l’or en l’aspecte de la gent adversa al risc. Ben aviat hi haurà notícies a la plaça!

Expliqueu bé per poder triar el que ens convé. Gràcies.

Moltes gràcies, Pere!

Esta clar q haurem de cercar alternatives als dipòsits

Cal buscar la millor alternativa per cada un. Gràcies, Manuel pel comentari!

👏

🙏

Bon informació i explicada de manera ckara,ens pot ajudar si volem invertir

Celebrem que ho valoris així de bé, Alícia!

Gracies x l,informacio

No es mereixen! I moltes gràcies a tu, Esther, per ser-hi, llegir-nos i enviar-nos el comentari.