Is your relationship with money healthy?

Has managing the family finances become a nightmare? Do you not know how to share money with your partner? Does the anguish bite you when you realise that you haven’t saved anything? Perhaps your relationship with money is not healthy enough. When this happens you probably need some good financial therapy. Head of agents Lara de Castro, who is also a professional coach, gives us some clues in a new Territori 17 of La Xarxa.

“Financial therapy addresses the link we have with money, when it is not very aligned with what we want in life, when it has a negative impact on our reality,” De Castro summarises. There are many scenarios where financial therapy can be useful. The clearest example is that of all those people who have the habit of making impulsive purchases and, little by little, fall into compulsiveness. Financial therapy can help us to answer what is behind these compulsive purchases and how to deal with a possible lack of money due to debts we have incurred.

“Many decisions we make often go through unconscious circuits,” the head of agents warns. And its effects extend to many spheres of our private lives, including our relationships. “When we share a bank account, the income comes from two different sides. When we spend from that shared current account and we don’t tell our partner or we don’t comply with the agreed planning, the other can interpret it as financial infidelity,” Lara de Castro.

Want to go deeper into the reasons why you might need financial counselling? Who can you ask for help? Listen to the whole conversation below!

If you want to discover the best option to protect your savings, go to Preciosos 11Onze. We will help you buy at the best price the ultimate safe haven asset: physical gold.

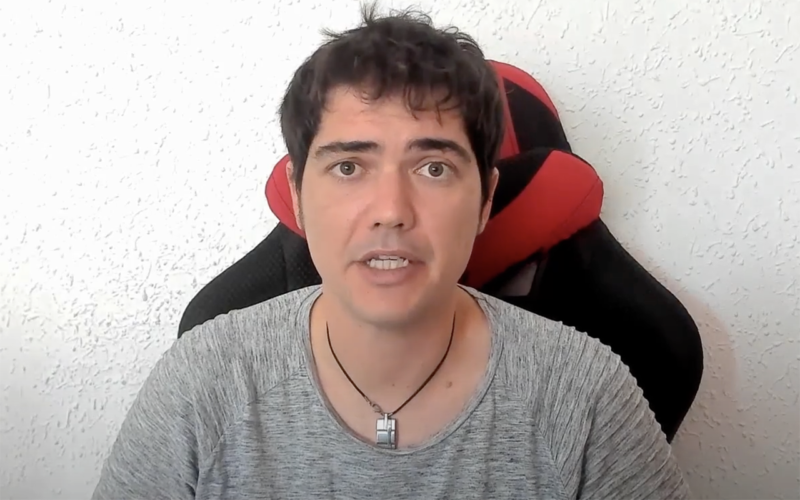

MyRealFood app was launched two years ago and has already had more than two million users. It scans everything we eat to find out if it is healthy, and recommends simple recipes to help us cook more conscientiously. With a single application, consumer rights are defended and, at the same time, new eating habits are promoted. Sofia Belenguer, co-founder of the project, explains it to us in a new episode of People.

Beyond scanning all the products found in supermarkets and supermarkets, Belenguer explains that MyRealFood brings together more than 130,000 recipes, many of them created by the users themselves, who make up an active community where they exchange favourite foods, recommend products and can even sign up for nutritional plans by subscription. “The app works for the community and so that you can lead a healthier life,” the CEO summarises.

The project was born out of the food concerns of a group of young people from different fields: Sofia Belenguer herself, the nutritionist Carlos Ríos, the current CTO David Vicente and Toni Mancha. Belenguer, who is a lawyer by training, began to wonder why, as a consumer, she was unable to tell from the product label whether what she was buying was healthy enough. And she realised that the same thing was happening to her colleagues and friends.

“I realised that I lacked a lot of nutritional training and that I had to educate myself,” she recalls. And that is how the project expanded. Belenguer argues that, on the one hand, there is not enough nutritional education and, on the other, food advertising does not help either. The combination of one thing and the other creates a breeding ground that prevents us from knowing what we eat and how to improve our diet.

The nutritional table, but above all, the ingredients.

And what is important to analyse when we buy a product? “It is crucial to look at what ingredients the product contains, and in what quantities, information that can be found in the nutritional table,” Belenguer answers. This is where the app is of great help: “Using our own algorithm, which marks from 0 to 100, from least to most healthy, we can know whether a product is healthy or not,” the CEO summarises.

Do you want to know how MyRealFood has become a reference app for consumers, but also for food companies? Do you want to learn how to have healthier habits? Listen to the whole conversation!

The cycle of financial crises in recent decades has highlighted the limitations of the current models of banking supervision in ensuring the solvency of banks, the stability of the economy and confidence in the financial system.

Banks play a fundamental role in the economy, therefore good banking supervision is a critical element in maintaining the soundness and integrity of a country’s financial system. Yet, time and again, we see how regulators are unable to prevent the mismanagement of these institutions from having disastrous consequences for the economy.

Essentially, banking supervision involves the regulation and monitoring of banks’ activities by the competent authorities. These supervisory bodies have to ensure that banks comply with regulations and adequately manage the risks inherent in their operations to ensure their solvency.

Yet the promiscuous relationship between the banking and political classes has facilitated deregulation and ineffective supervision of the financial sector, leading to risky and irresponsible practices by the monopolies that control the market. This reveals an unwillingness to serve the public interest that often results in economic devastation that taxpayers end up paying for by bailing out banks with public money.

When banking supervisors fail to do their job

The 2008 financial crisis originated from the 2006 housing bubble in the United States. A credit boom was accompanied by excessive leverage built up by the banking sector fuelled by cheap credit and lax regulation.

Financial institutions offered subprime mortgage loans to people with questionable financial solvency, granting credit to customers with low incomes or without adequate verification of their ability to pay. At the same time, financial derivatives played a key role in amplifying the crisis. These investments were initially considered safe and low-risk, as credit rating agencies gave them a good rating.

The report of a commission of enquiry set up to investigate the crisis’s causes highlighted banks’ excessive risk-taking and negligence by financial regulators. In particular, it criticised the reduction and failure of financial regulation by the Federal Reserve during Alan Greenspan’s tenure.

Deregulation and lack of oversight, however, were not new, as it was the cornerstone of “Reaganomics” during the 1980s. President Reagan’s administration had laid the foundations that inspired the policies put in place by his successors and that culminated in the 2008 financial crisis.

Auditors call ECB banking supervision into question

The collapse of Credit Suisse, accompanied by the failure of Silicon Valley Bank and Signature Bank, raised the spectre of Lehman Brothers and triggered panic in the markets. Governments and regulatory agencies assured us that we did not have to worry about the safety of our savings and the stability of the financial sector because, despite appearances, they had done their job.

Well, it turns out that no, they haven’t done their job this time either. A report published by the European Court of Auditors has called into question the ECB’s banking supervision, warning that the capital requirements for the riskiest banks are insufficient and that supervision was not stepped up for banks with persistent credit management problems. The report notes that the ECB “does not use its supervisory tools and powers effectively to ensure that identified risks are fully covered”.

As with Lehman Brothers, Credit Suisse was given a clean bill of health by regulators and rating agencies shortly before the collapse. In fact, DBRS Morningstar was the first global rating agency to cut Credit Suisse’s credit rating, less than a day after the Swiss central bank was forced to bail out the financial institution. In short, yet another failure on the part of the supervisors and rating agencies that are supposed to look after our interests.

Once again, it seems that the interests of the banks and a select minority have priority over the will to serve the public interest and that the so-called supervisors simply serve to perpetuate the usury of the powers that be that justify their existence. We have all heard Albert Einstein’s famous phrase: “Insanity is doing the same thing over and over again expecting different results”, all, except those in charge of banking supervision, apparently.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

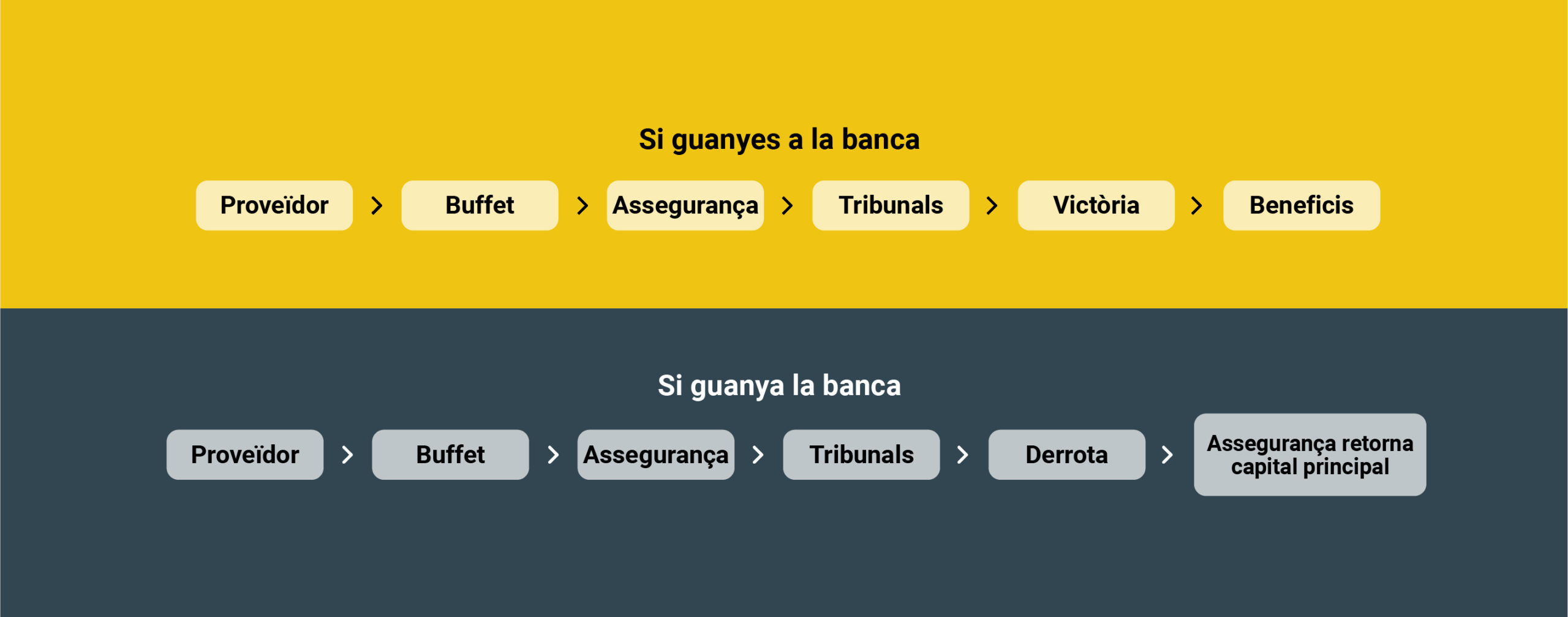

One of 11Onze Recommend’s star products generates high yields by financing the litigations of law firms that pursue claims from citizens who were misled by banks. You can now participate as a group, reducing the amount of capital contributed individually but keeping the percentage of the profits. Farhaan Mir, CFO of 11Onze, explains how it works.

The success of Litigation Funding comes from the concept of providing social justice while obtaining high returns with a low-risk product thanks to the insurance that covers the funds provided by the clients. Since its launch, we have been expanding its scope, while reducing the minimum amount of access capital.

From the minimum initial capital of 25,000 euros, we were able to get our provider to reduce it to 10,000 euros, making this product accessible to a larger number of people in the 11Onze community.

Obviously, the higher the amount of capital provided, the higher the returns. That is why, at the request of our community, we are now also offering the possibility of a group contribution, either among family or friends, so that the financing can be shared while maintaining the percentage of the profits.

“If you have two people who put in 25,000 euros each, this is considered a contribution of 50,000. And the two people get the benefits of the 50,000.”

Group contributions

Litigation Funding generates returns of between 9% and 11%, well above what traditional banks offer for our savings. Even so, not everyone can afford to make a capital contribution of 25,000 or 50,000 euros to obtain maximum returns. By offering the option to contribute money collectively, we multiply the benefits.

As Farhaan Mir explains, “If you have two people who put in 25,000 euros each, that’s considered a 50,000-euro contribution. And the two people get the benefits of the 50,000”. Therefore, instead of getting a return of 9%, which would correspond to 25,000 euros, you will generate profits of 10%, from a contribution of 50,000 euros.

“Any contribution against the cases we are funding is guaranteed. So we have full security for the funds we are providing to the law firm.”

Unfavourable cases covered by insurance

The success rate of the cases to which Litigation Funding has provided funds exceeds 90%. Even so, if there is an unfavourable case, the funds contributed by our clients are covered by insurance, regardless of the amount contributed.

It is therefore a low-risk product. “Any contribution against the cases we are funding is guaranteed. So we have full security for the funds we are providing to the law firm,” says Mir.

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

The European Union is facing political, economic and military decline in the world. The special interests of individual states deprive it of a strong voice on the international stage, where it usually acts at the beck and call of the United States. In this context, Europe’s real sovereignty is almost a utopia.

Turbulent times lie ahead in Europe. The war in Ukraine has heightened tensions with Russia, which is increasingly tightening its ties with China. The conflict has led European governments to strengthen their alliance with the United States and rethink their defence and energy policies. Moreover, the war has provoked tensions within the EU itself, which are likely to grow.

Where can we go from here? It is hard to say. Europe has come a long way since the 1950 Schuman plan and the 1957 Treaty of Rome, which has made it the world’s second-largest democracy and third-largest economy. But after the dream of European Union and prosperity brought about by the fall of the communist bloc in 1989, European idealism has melted like a sugar cube. It has done so in an “international disorder” under US tutelage and marked by economic crises, pandemics, a process of partial deglobalisation and conflicts between the great powers.

Never before has the EU had to face an international situation that is moving towards multipolarity and is plagued by crises that pose numerous threats and challenges. And it has not even been able to develop the long-awaited Common Foreign and Security Policy (CFSP).

One certainty: foreign policy remains one of the least integrated elements of the EU. This was demonstrated, for example, by German Chancellor Olaf Scholz on a trip to China in early November 2022. This visit was met with a barrage of criticism from European partners for denoting unbridled unilateralism, as Germany’s interests clashed with those of the other EU members.

European disunity

It is no secret that each country defends its own interests. As Martin Wolf, economics editor of the Financial Times, recently warned, some main problems facing the EU stem from the fact that it is not a state but a confederation of states. From this stems the difficulties of managing divergent economies within a monetary union, in which the European Central Bank plays an essentially political role to avoid insurmountable imbalances between the different economies.

True integration is lacking. The reality is that the European single market is not integrated in the same way as the American market, for example. The lack of dynamism in a crucial sector today, such as information and communication technologies, is largely explained by this fact. It is symptomatic that only one European company, ASML, is among the ten most valuable technology companies in the world.

There is nothing to be optimistic about. In a more fragmented international context with greater nationalist impulses, even Germany, the real engine of Europe, is finding it increasingly difficult to find markets to absorb its production. High energy costs are a threat to its heavy industry. And then there is the push from China and the United States’ move towards an interventionist and protectionist policy.

This situation means that there is a lack of a real common European policy, weighed down by individual national interests, which even threaten the existence of the single market.

Europe’s role in the world

A vital question for Europe, as Wolf points out, is to define what role it wants to play in the world, whether it wishes to remain a ‘servile’ ally of the United States, become a bridge between blocs or regain the status of a power. The first option seems the most plausible, since to become a power again it would need a much deeper political and fiscal union, as well as overcoming internal mistrust.

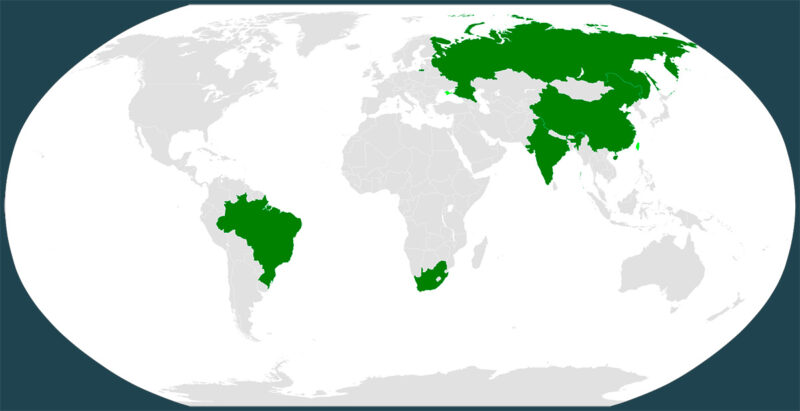

The rise of China, India, Russia, and others as economic and military powers forces the EU to be a single actor with a single voice in matters of global importance if it aspires to be one of the relevant ‘poles’ in the multipolar future. But the more active and independent the EU wants to be, the more crucial it will be to deepen its federalism, a process plagued by nationalist reluctance.

The rise of populism

The rise of populist movements in Europe since the financial crisis of 2008 and the migration crisis of 2016 poses a threat in this regard. Most of them are characterised by Euroscepticism, believing that the root of Europe’s socio-economic problems lies in European integration and Brussels’ decision-making.

This is not a marginal movement: a study by the Pew Research Center shows that Eurosceptic parties already hold 29% of the seats in the European Parliament, the highest figure in history. Thus, a significant proportion of those who make the big decisions on the future of the European Union are also those who oppose further integration. And without such integration, it is difficult for Europe to regain a leading role on the international stage.

Little progress

The EU has set a number of priorities for the period 2019-2024, including the protection and freedom of citizens, the development of a strong economy, sustainability in Europe and the promotion of European values and interests on a global scale. Unfortunately, little progress has been made in these areas.

We live in a world characterised by disorder, growing protectionism and conflicts between great powers. It is certainly not the world of which the founders of the European Union dreamed. But if its current leaders wish to preserve something of the original spirit, they should strengthen the foundations of the project and move towards real European sovereignty. This would require halting deindustrialisation, driving digital transformation, deepening integration and establishing a single voice in the world.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!

Personal Income Tax (IRPF) is a personal and direct tax that plays an essential role in tax collection and the redistribution of wealth. It is a State tax partially ceded to Catalonia, but what are its origins?

We are in the middle of this year’s income tax return campaign, which runs from 11 April to 30 June and which more than 23 million taxpayers will have to complete. Almost everyone knows how to do it and understands the concept of this tax based on the balance of income and expenses we have had during the previous year. What some people may be unaware of, are the origins of this tax and its evolution throughout history.

The first general tax system

Although personal income tax (IRPF), as we know it today, is a relatively recent tax, approved in 1978, its origins date back to the 19th century.

The first income tax dates back to 1845, when the first general tax system was established as a consequence of a tax reform promoted by Alejandro Món and Ramón de Santillán, which simplified the existing tax system and brought about a broad tax unification throughout Spain.

The reasons behind this reform were to remove obstacles to economic growth in the context of industrialisation and a liberal revolution to replace the absolute monarchy of the Ancien Régime. Thus, classic taxes such as tithes and alcabalas were eliminated.

Tax reform during the Second Republic

One of the first modern attempts to impose a personal income tax in Spain took place during the Second Republic (1931-1939). During this period, under the government of Manuel Azaña, a new tax was introduced by the Minister of Finance, Jaume Carner.

The Carner Law, better known as the general income tax, was passed in 1932 and came into force at the beginning of 1933. Although its application was limited and was diluted after the Civil War with Franco’s dictatorship, it included a tax on individual income that set the precedent for what would later be known as IRPF.

The transition and the Moncloa Pacts

It was not until 1977, as a result of the agreements signed at the Moncloa Palace during the Spanish Transition, also known as the Moncloa Pacts, that the foundations of the contemporary tax system were established. Thus, in 1978, the first modern personal income tax was created with a broad political consensus.

This law established the basis for personal income taxation with a progressive tax system, where high incomes paid a higher percentage of tax. In this case, it had 28 brackets and its tax rates were as high as 65.5%. It was a tax that affected all persons with incomes over 300,000 pesetas.

Well into the 1980s, the way of filing a tax return stayed mostly the same, but with the development of new digital technologies, new access channels were added to carry out this tax activity, up to the current possibility of filing the tax return online. It also evolved significantly, incorporating several new features, such as the transfer of 50% of the tax to the autonomous communities.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

The US Federal Reserve will launch this summer a real-time payments system designed to streamline transactions between bank accounts. This is a development that some critics see as a further step towards a digital dollar to counter cryptocurrencies and eliminate cash.

In an increasingly digital and interconnected world, payment systems are evolving to meet the needs of businesses and consumers who demand access to fast payment services to make transactions more efficient and better control their cash flow. The private sector has been at the forefront of this evolution, but governments also want to play a role.

To meet these needs, the US Federal Reserve plans to introduce a new payment system known as FedNow in July this year. This new instant payment platform is designed to enable secure and efficient payments in real-time, 24 hours a day, 365 days a year.

This is a great advantage for businesses and consumers, as they will not have to rely on traditional processing times, which can now be several business days. The new system will allow funds to be transferred instantly between participating bank accounts, and as a non-profit governmental organisation, it will be able to offer more competitive prices.

On the other hand, the adoption of FedNow by US banks, corporations and major financial institutions could result in other foreign entities being forced to use the service. This is significant because it could help the dollar, also in digital form, to perpetuate its reign in international cross-border transactions. This is a possibility that cannot be ruled out in the face of increasing de-dollarisation and the announcement of the launch of a new currency by the BRICS group.

A new payment system linked to the digital dollar?

In parallel with the launch of FedNow, the Federal Reserve is considering the possibility of introducing the digital dollar. As other countries have done already, this would involve putting into circulation a Central Bank Digital Currency (CBDC). This proposal has been criticised on the grounds that it could affect the fundamental freedoms of citizens, increasing the ability of governments to track and control the population.

In this regard, Florida Governor Ron DeSantis and presidential candidate Robert Kennedy Jr, questioned the motives behind the possible introduction of the digital dollar and the new FedNow payment system. Specifically, Robert Kennedy Jr stated that the issuance of a digital dollar will serve as a mechanism to control US citizens, just like the FedNow payment system, declaring that “the distinction between FedNow and a CBDC is important from a technical point of view, but not from a civil liberties point of view”.

As a result of these statements that seek to link the two proposals, yet another controversy has been unleashed on social networks, in which content is circulating that claims that the Federal Reserve will launch a central bank digital currency called FedNow this July, which will give more power to the government to ratify financial slavery and political tyranny.

This misinformation has gone viral to the point that the Fed has deemed it necessary to officially deny it, stating that “FedNow is not related to a digital currency. FedNow is a payment service that the Federal Reserve makes available to banks and credit unions to transfer funds. The FedNow service is neither a form of currency nor a step toward the elimination of any form of payment, including cash.”

Additionally, federal officials – including Fed chair Jerome Powell and former vice chair Lael Brainard – noted that a digital dollar could still be years away from becoming a reality, but that FedNow could emerge as a better alternative to a CBDC. Be that as it may, the controversy is served, and is likely to further boost the case for cryptocurrencies as decentralised digital currencies that can be used as a defence against CBDCs or other state-backed monetary alternatives.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

This year, university admission tests that decide the future of thousands of students will be held from 14 to 16 June. We present ‘selectivitat.io’, the definitive tool to prepare for them and give you the best chance at success.

In 2021, at the age of 22, Jaume Plana created selectivitat.io, a platform that offers all the teaching material to prepare for your GCSE, as well as for university admission tests. The initiative was born from the experience of Jaume and other people around him who had, as he describes, a feeling of abandonment when it came to studying and preparing for these exams.

In just over a year, the platform has collected all the material necessary for the subjects taken in the GCSE: notes sent by the students themselves, notes from academies and professionals, mock exams, grade calculators, courses and podcasts. All with the philosophy of free access, as Plana explains: “It’s free now and forever and ever, we believe that you don’t have to pay for educational material”.

In addition to these basic and free services, there are additional paid services for students who may need the support of a teacher to help them resolve doubts and accompany them in this process.

The grade that decides your future

This is the well-known, and dreaded for some, cut-off mark. The mark that is extracted from the ‘selectivitat’ and which will decide which degree the student can study and at which university, within the range of options that he or she has chosen. A system that Plana himself considers unfair and with a great risk of loss of talent along the way: “There are incredible people who would be perfect in entrance examinations, but they can never get there because the filtering is based on marks” when the employment sector, he remarks, “is not based on marks”.

The current education system focuses on grades from the start. Even in nursery school (from three to five years old) there are schools that initiate students into this selection system that will accompany them for the rest of their academic life. Therefore, they become accustomed to selection by grades.

However, Plana points out that they are not taught the basis of the learning process and take advantage of it. There are thousands of students who, due to a lack of organisational tools, lack of support or fear of not achieving their objectives, end up failing in this system.

Pressure closes doors

Managing pressure can be very important in terms of the results of the university entrance exams. In this sense, the mental preparation of students is relevant, as Plana explains: “Pupils who get a 14 or very good marks are very good students who know how to handle pressure very well”.

Jaume Plana also points out that we are not prepared for failure, as we are not educated to identify it as something natural and even positive. On the contrary, those who fail are singled out.

The pressure when it comes to tackling studies is subsequently transferred to the way we approach the labour market, which becomes a limiting pillar for many young people.

Therefore, in addition to academic preparation for the entrance exam, there is also mental preparation, which includes three main aspects: having the support and accompaniment to be able to face these tests; being aware that it is OK if you fail, as there will be new opportunities, and finally, making it clear that your aptitudes will be more important for your future than any grade.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Driven by geopolitical and economic uncertainty, global gold demand remains firm in the first quarter of the year, reaching its highest level in eight years on a year-on-year basis, according to the latest WGC report.

Global gold demand (including OTC purchases) during the first quarter of the year was up 3% year-on-year to 1,238 tonnes, marking the strongest first quarter since 2016, the World Gold Council (WGC) has announced in its latest Global Demand Trends report.

The strong performance in gold demand comes as persistent central bank buying on the back of geopolitical and economic uncertainty, investment in the OTC market, and increased demand from Asian buyers have driven the gold price in the first quarter to a record average of €1,934 an ounce.

As a reminder, there are two main ways to trade gold in the wholesale market: the over-the-counter (OTC) market and the exchange market. OTC markets are characterised by the fact that market participants trade directly with each other.

Excluding the OTC market, gold demand fell by 5% to 1,102 tonnes in the first quarter, as the jewellery market declined by 2% – although still resilient in the face of record prices – and physical gold-backed exchange-traded funds (ETFs) declined by 114 tonnes. In particular, Europe and North America recorded quarterly outflows, slightly offset by inflows into listed products in Asia.

Increased central bank purchases

Central banks continue to hoard gold at a frenetic pace. During the first quarter, they added 290 tonnes to their reserves, up 1% year-on-year and 69% more than the quarterly average of the last five years.

This is the strongest start to the year in the WGC’s historical series, which dates back to 2000. This increase in gold purchases is led by the central banks of China and India. The Asian giant generated most of the demand. Both Chinese consumers and their central bank are buying gold with renewed investor interest due to the weakening of the local currency and the poor performance of domestic equity markets.

Louise Street, Markets Analyst at the World Gold Council, noted, “We are witnessing shifting behaviour trends from Eastern and Western investors. Typically, investors in Eastern markets are more responsive to the price, waiting for a dip to buy, whereas Western investors have historically been attracted to a rising price, tending to buy into the rally. In Q1, we saw those roles reversed, with investment demand in markets such as China and India growing considerably as the gold price surged.”

However, the WGC expects central banks to slow their purchases slightly in 2024 compared to the previous year. Krishan Gopaul, senior analyst at the WGC, told Reuters, “While central bank buying momentum continues, we are taking a cautious view going forward, waiting to see if recent gold price growth prompts some central banks to slow purchases or some to sell some of their holdings.”

Preciosos 11Onze makes it easy to buy gold, at the best price and with total security. Give us a call and speak to one of our agents without any obligation to clarify any doubts you may have and protect yourself from economic crises with the ultimate safe-haven asset: gold. If you want your savings to keep or increase their value, Gold Patrimony.

May Day was historically associated with pagan festivals linked to spring until the Second International established May Day as a labour holiday. It did so in 1889 to commemorate the bloody struggle of American workers for the eight-hour working day.

The fact that International Workers’ Day is celebrated on 1 May has its origins in the American workers’ struggle for a shorter working day, which in the second half of the 19th century often stretched to 16 hours.

As the capitalist system took hold in the large industrial cities of the United States against a backdrop of high unemployment, workers’ working conditions had become increasingly harsh. Faced with this situation, the American Federation of Labor called for a general strike to begin on 1 May 1886 to demand the eight-hour workday.

Workers’ repression

On 3 May, the protests in Chicago turned violent when the police acted extremely harshly against the workers as they demonstrated. The next day, a rally held in the city’s Haymarket Square turned bloody during police intervention. A bomb exploded among the ranks of the uniformed officers, although historians are unclear whether they or the workers were the target, killing seven policemen. The officers then opened fire on the demonstrators, killing several and injuring hundreds.

As a result, a trial was held and eight men were convicted for the action. Four of them ended up on the gallows, although no evidence was presented linking them to the bombing. Nor was the international campaign to save their lives of any use. The words of August Spies, one of the condemned men, just before his execution were prescient: “There will come a time when our silence will be more powerful than the voices you strangle today”.

Recognition of the workers’ struggle

The Second International established 1 May as a labour holiday in 1889, giving rise to today’s International Workers’ Day. Paradoxically, the United States, the country where the events took place, wanted to dissociate this date from the workers’ movements. That is why President Grover Cleveland had Labour Day celebrated in September.

Prior to the Chicago events, May Day in the United States and parts of Europe was a date marked to celebrate the exuberance of spring in rural areas. The origin of this holiday can be traced to ancient Roman practices of celebrating spring flowering.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!