Which are the most valuable banks in the world?

The enormous size of the Chinese market has facilitated the take-off of the Chinese banking sector. Two of its banks have been at the top of the ranking of the world’s most valuable banking brands for years and are leaders in revenue and net income. The United States and, above all, Europe have lagged behind.

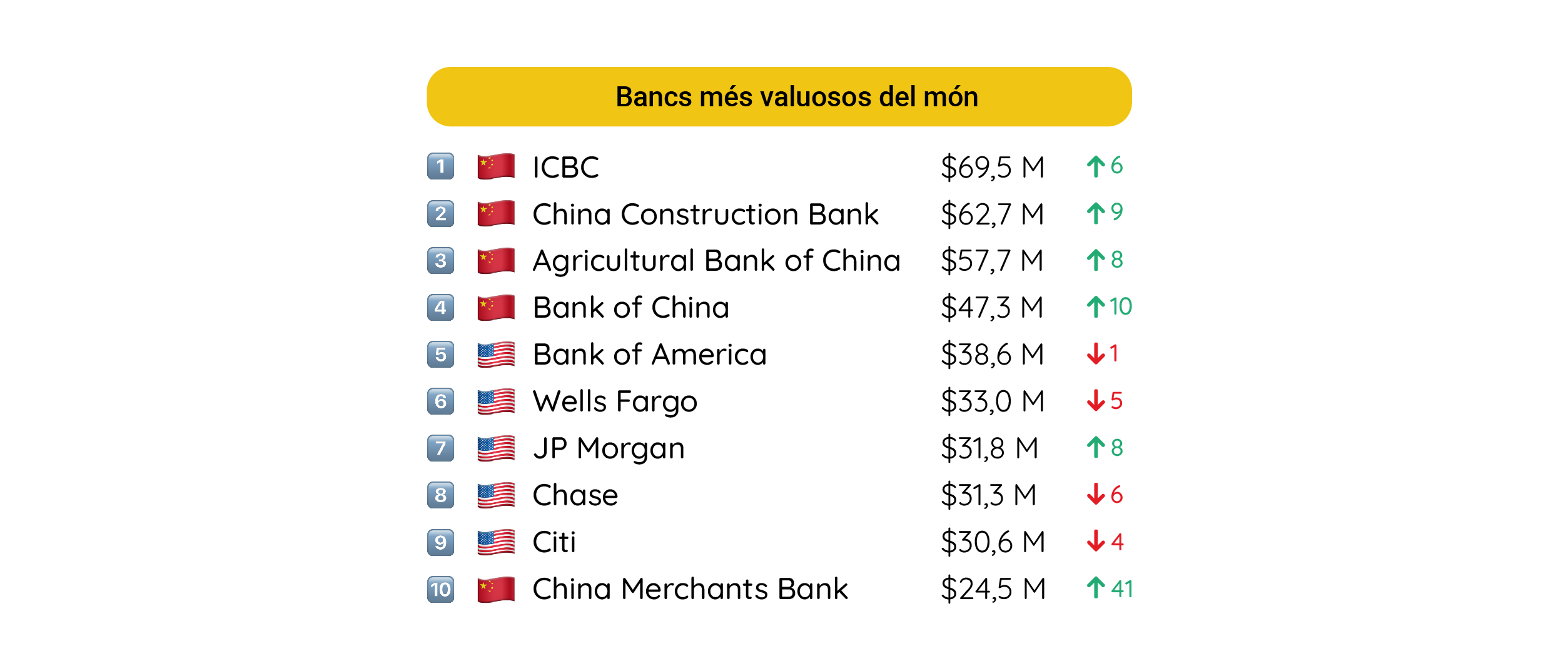

For yet another year, four Chinese banks have once again topped the ranking of the world’s most valuable banking brands, according to the “Banking 500 2023” report. This study, carried out by the consultancy Brand Finance, measures the value of the brand and not that of the business itself.

These are the Industrial and Commercial Bank of China (ICBC), China Construction Bank, Agricultural Bank of China and Bank of China. They are followed by the US brands Bank of America, Wells Fargo, J.P. Morgan, Chase and City. China Merchants Bank completes the top 10.

The dominance of Chinese and US brands has been undeniable in recent years. Europe, which a decade ago had HSBC, Santander and BNP Paribas in the top 10, has now been without representatives in this select group for five years.

The Chinese ‘sorpasso’

Although the four main Chinese banking brands have seen their value fall slightly over the last year, the fact is that the advance of the Asian giant’s banks has been spectacular over the last decade. In 2013, four US brands (Wells Fargo, Chase, Bank of America and Citi) and one British brand (HSBC) topped Brand Finance’s list, while the top Chinese bank (ICBC) did not appear until seventh place.

Since then, ICBC’s brand value has grown from less than $20 billion to almost $70 billion. Today, the financial institution founded in 1984 has several subsidiaries around the world and serves more than 500 million individuals and several million businesses.

Interestingly, the Brand Finance report noted that Silicon Valley Bank was the fastest-growing banking brand in the world, with its value increasing by 148% over the previous year. The bank, which specialises in providing banking services to venture capital firms to support the startup ecosystem, was considered to be worth $2.8 billion before its collapse.

Rise of the neobanks

In addition to the general recovery of the banking sector after the COVID-19 crisis, the report highlights the growth of neobanks or digital banks, whose representatives on the Brand Finance list have risen from a valuation of $795 million to almost $1.612 billion. This type of financial institution has achieved success in recent years, thanks in large part to the integration of technology and sustainability in a sector as immobile as banking.

The study notes that digital banking brands such as Tymebank and Discovery Bank in South Africa, Nubank in Brazil and Maya Bank in the Philippines are revolutionising the sector. It also highlights the emergence on the list of Revolut, whose brand value has increased by 57% and now stands at 194 million dollars. The neobank’s growth strategy has resulted in 25 million customers internationally.

The restrictions and confinements of recent years have pushed both old and new financial institutions to create banking services based on easy-to-use mobile applications, which has improved customer satisfaction and customer acquisition.

Different criteria, different rankings

Beyond brand value, the ranking of the world’s largest banks varies according to the parameters we take into account.

Whether we look at revenue or net income, ICBC and China Construction Bank hold the top two positions. The former has a turnover of $143 billion and a profit of $55 billion, while the latter has a turnover of $126 billion and a profit of $48 billion. However, based on these criteria, the following places on the list would be occupied by four US institutions: the merged J.P. Morgan Chase, Bank of America, Wells Fargo and Citigroup.

US banks are even more important if we look at their market capitalisation figures. Two of them, J.P. Morgan Chase, with 376 billion dollars, and Bank of America, with 225 billion, lead the ranking. They are followed by the four big Chinese banks, with a stock market value ranging from 154 billion for the Agricultural Bank of China to 224 billion for ICBC.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

👏👏

Gràcies, Daniela!!!

Que Europa hagi perdut el tren en aquesta cursa podria ser degut a la manca d’un mercat únic bancari. Cada país ha volgut preservar el seu espai, cosa que ha donat lloc a una banca més petita i menys competitiva. A corregir, “tamaño” en català és mida.

Potser una de les explicacions, però no pas l’única. Al cap i a la fi, aquí a Europa, amb les seves polítiques força vegades incomprensibles i com a subordinats dels EEUU, molt probablement tampoc ajuda a fer-nos valdre com a continent… Moltes gràcies pel teu comentari, Josep!!!

Gràcies per aquest article

Gràcies a tu, Manel, per ser-hi i per seguir-nos!!!

Gràcies!

Gràcies a tu, Joan!!!

Sempre pensant que els europeus són millors.🤷

Moltes gràcies pel teu comentari, Carles!!!

🙏🏿

Bona novetat👍

Celebrem que t’hagi agradat, Jordi!!!