The security of deposits in Spanish banks

Having a deposit in a Spanish bank nowadays means not only getting a low return on our savings, given the low-interest rates, but also being covered by the Deposit Guarantee Fund (FGD). Currently, the FGD has about 4.2 billion euros at its disposal, against the 958.9 billion euros that customers have on deposit.

In 2021, according to data provided by the Bank of Spain, the accumulated level of deposits reached 958.9 billion euros at the end of 2021, a new all-time high. Even so, it should be noted that the level of financial resources accumulated by the Deposit Guarantee Fund, and available in the deposit guarantee systems, amounted to 4,191 million euros in 2020, which represents 0.5% of guaranteed deposits to this date.

Clearly, therefore, the DGF is not in a position to cope with bank failures. The monstrous disproportion between money deposited and guarantee is pushing many savers to look for safer options. Even more so when the benefit obtained by having money in a Spanish bank is negligible, as we analyse in this article. Theoretically, the Deposit Guarantee Fund would have to guarantee up to 100,000 euros per individual or legal entity, but it is mathematically impossible for them to do so because the money reserves are exactly half of what they should be. For this reason, given the context of inflation that bites into savings and seeing the low profitability and security offered by traditional banks, it is necessary to look for safer options for our money.

Guaranteed Funds guarantee 100% of capital

Guaranteed investment funds can be a good option if we want to diversify our savings and, at the same time, ensure a certain return. As the name suggests, they guarantee all or part of the capital invested, as well as a predetermined return for a certain period of time. Normally, these are funds that have insurance that guarantees the totality of the money regardless of the amount.

Therefore, the question to ask yourself is: is there any fund that generates high returns and guarantees 100% of the investment and returns? If you want to find out about superior options for making your money profitable, go to Guaranteed Funds. From 11Onze Recommends we propose the best options.

11Onze is the fintech community of Catalonia. Open an account by downloading the super app El Canut on Android and Apple and join the revolution!

In the rarefied world of global banking regulation, a quiet revolution is underway. It doesn’t involve picket lines or protest marches, but vaults—specifically, the vaults of the world’s most powerful financial institutions. The implementation of the final phases of the Basel III accords has cemented a profound shift in how regulators perceive gold, elevating it to its most exalted status in a generation. Reclassifying gold as a tier 1 asset sets a New Golden Rule of Banking.

James Sène, Chairman of 11Onze

For members of the 11Onze Club, who understand that true wealth preservation requires looking beyond the horizon, this isn’t just financial news; it’s a fundamental recalibration of the monetary landscape. But more than that, it demands a new mindset. The common advice to “be your own bank” is no longer sufficient. At 11Onze, we believe you must aspire higher: you must become the governor of your own central bank.

For decades, gold occupied a somewhat ambiguous position on bank balance sheets. Treated with a degree of skepticism by modern financial theory, it was often relegated to a secondary tier, marked down significantly in value for capital adequacy purposes. Under previous rules, physical gold was frequently classified as a “Tier 3” asset, subjected to a punitive 50% markdown from its market value when calculating a bank’s core capital reserve.

That era is now over.

Gold’s Promotion: From Tier 3 to Tier 1

As of the full rollout of the Basel III Endgame—with key effective dates solidifying in 2025 and 2026 across major jurisdictions—gold has been officially promoted. It is now classified as a Tier 1 asset. This is the highest echelon of financial assets, a category reserved for the most secure and loss-absorbing forms of capital, previously dominated by cash and highly-rated government bonds.

For a bank holding physical, allocated gold in its own vaults, this asset now carries a 0% risk weight. In practical terms, this means that gold counts fully, at 100% of its market value, towards a bank’s core capital reserves without requiring the bank to hold additional costly capital against it. The distinction is critical: gold is no longer treated as a mere commodity with fluctuation risk but as a foundational monetary asset, on par with cash.

The Truth About Private Market Demand

According to the World Gold Council, there are approximately 201,296 tonnes of gold above ground, worth more than US$12.2 trillion. The official sector holds 34,211 tonnes (17%), while bars and coins account for 40,621 tonnes (20%). Notably, the Council’s data includes a category for “Other and unaccounted” totaling 29,448 tonnes (15%)—a telling admission that official statistics cannot capture the full picture .

But at 11Onze, we operate on the front lines of the private market, and we know the truth: the volume of gold bought and sold privately is thousands of times superior to the figures reported by authorized organizations. The transactions we witness—the mandates, the family office allocations, the high-net-worth physical purchases—are genuinely far more important than what appears in the press.

This reality is now being validated by major financial institutions. A Goldman Sachs report from January 2026 confirms that “private-sector buyers — not just central banks — are becoming a structural force in price formation.” The bank explicitly highlights “physical purchases by high-net-worth families” and “harder-to-measure channels” as driving the upside surprise in gold prices . Unlike election-related hedges or short-term speculative positioning, these flows are tied to broader concerns about fiscal sustainability, monetary credibility, and currency debasement. They are structurally different—and far more persistent.

Goldman’s analyst Daan Struyven notes that “the perception of these macro policy risks appears stickier“, meaning these private buyers do not liquidate their holdings in 2026, effectively lifting the starting point of price forecasts . The old market rule that “high prices cure high prices” does not apply to gold, because annual mine output accounts for roughly only 1% of the total above-ground stock, leaving little room for production to surge even after sharp rallies .

A “Seismic Shift” for Financial Stability

Industry experts have described this change as “seismic,” a long-overdue recognition of a truth that prudent investors have always known: gold is money. The logic is impeccable. In an era of ballooning sovereign debt, aggressive currency debasement, and persistent geopolitical uncertainty, an asset that is no one else’s liability is invaluable. Unlike a government bond, gold carries no default risk. It cannot be printed into oblivion by a central bank’s fiat.

This regulatory validation is already sending powerful signals through the financial system. Central banks, always the first to move on such structural shifts, have been leading the charge. JPMorgan projects official sector purchases of 800 tonnes in 2026, while Metals Focus expects 700-800 tonnes—levels that remain structurally supportive .

The Urgency: Why You Must Act Now

A market crash is on the horizon. The confluence of geopolitical tensions, unsustainable debt levels, and fragile banking systems points to one inevitable conclusion: those who do not move their assets into liquidity and gold will be left vulnerable.

But here is the critical challenge: if you attempt to purchase gold now, you will likely find the market absolutely packed with demand and very little offer at a discount. Premium purchases are the new reality. Even if buying at a premium feels like a loss in the medium term, it is, in fact, a win.

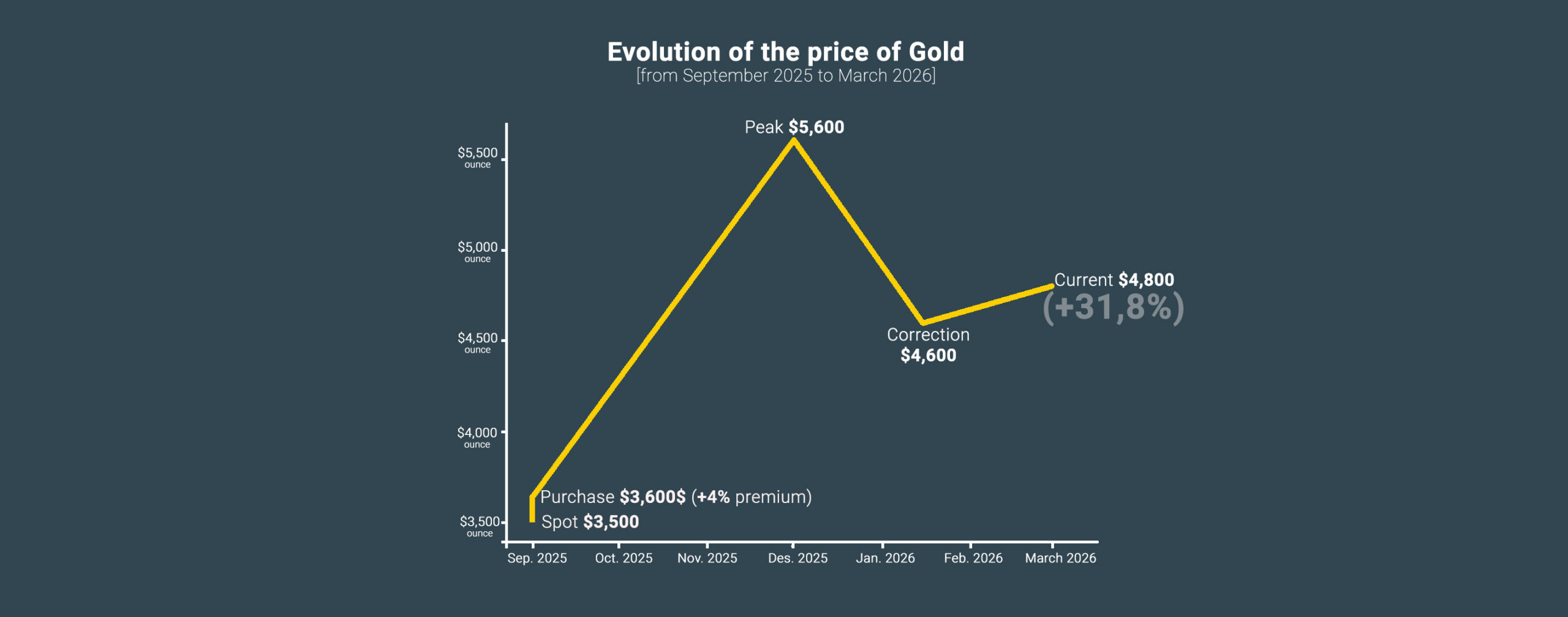

The September 2025 Premium Purchase Simulation

Let us prove this with a real-world simulation. Imagine an investor who purchased physical gold in September 2025 at a +4% premium above the LBMA second price.

- September 2025 context: Gold was already at all-time highs. In India, for example, physical gold (999 purity) was trading near ₹1,09,140 per 10 grams in early September 2025 . Globally, gold had surged past $3,500 per ounce .

- The premium purchase: Our investor acquires physical gold at $3,640 per ounce (assuming a 4% premium on a $3,500 spot price).

- The outcome today (March 2026): Following gold’s historic volatility—including a sharp correction from $5,600 to $4,600—the spot price today hovers around $4,800-$5,000 per ounce. Even selling at the lower end of today’s spot range ($4,800), the investor realizes a gain of approximately 31.8% , despite having paid a premium at the peak of market exuberance.

This simulation demonstrates a crucial principle: in a structural bull market driven by persistent private demand and central bank accumulation, the premium paid at entry becomes irrelevant over time. The only true risk is not owning the asset at all.

Beyond Gold: The Governor’s Duty to Diversify into Essential Sectors

A central bank governor, if he does his job properly, must place the assets of the central bank in sectors that are essential to sustain the price of money in the country. The same logic applies to your personal finances. You must trade not only in gold but also in other sectors likely to grow in case of global crisis.

At 11Onze, our personal advice is clear: FOOD.

Global agricultural markets face another year of uncertainty in 2026. Climate change, geopolitical tensions, and shifting trade flows mean that prices of key commodities like corn, soy, and wheat are no longer experiencing temporary fluctuations. Volatility has become a structural characteristic of the market .

Chris Trant, head of US Agriculture at Hedgepoint, paints a worrying picture: “After years of bumper harvests, farmers are under pressure from low prices and rising costs for loans, seeds, fertilizers, and transport. This could lead to fewer investments and lower production in 2026” . South America remains the main source of uncertainty, with La Niña potentially bringing drier conditions to Brazil and Argentina—the leading exporters of soy and corn .

Meanwhile, innovative financing models are emerging to fill the gap left by traditional banks. The “missing middle” of food infrastructure—mills, processors, storage facilities—is too capital-intensive for grants, too steady for venture capital, and too risky for traditional bank lending. Yet these assets are essential for giving farmers access to higher-value markets and an alternative to commodity systems.

The 11Onze Initiative: Financing the Food Ecosystem

At 11Onze, we are taking action. We are looking into creating Special Purpose Vehicles (SPVs) to help finance local farmers and the entire ecosystem that depends on them.

It is crucial that we seize the opportunity left by banks and big pockets. FOOD is going to become scarce and expensive. We must work with our local farmers to keep it abundant and profitable for the whole community. As demonstrated by projects like the Blue Mountain Mill—which secured over $50 million in funding through tribal ownership, mission-aligned lenders, and community investors—the “remarkable middle” of food infrastructure is viable when capital aligns around long-term outcomes .

A Call to Action: Join the Movement

In a financial world increasingly defined by complexity, leverage, and counterparty risk, the new golden rule of Basel III is a return to first principles: safety, stability, and the unprinted value of real money. For the 11Onze community, that is a rule worth following.

But we must go further. We must build resilience in our communities.

- If you are a farmer in need of financial support, please contact us. We want to help you access the capital you need to sustain and grow your operations.

- If you are a member of 11Onze interested in food security investments please fill out this form. Join us in building a portfolio that feeds our community while preserving wealth.

As one seasoned market observer aptly put it, the old advice was “be your own bank.” At 11Onze, we upgrade that mandate: Be the governor of your own central bank. Allocate to gold for monetary stability. Allocate to food for physical survival. The two together form the foundation of true wealth sovereignty.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Són 17 metalls, de la família dels lantànids, i estan sent cabdals en la fabricació de noves tecnologies. Se’ls coneix com a terres rares. I perquè són un bé difícil d’extraure de la natura, el seu valor no ha deixat de créixer. Per això, són productes susceptibles de convertir-se en la nova tendència d’inversió. Ens ho explica l’agent 11Onze Sergi Colell.

Segons l’Agència Internacional de l’Energia, es preveu que la demanda de terres rares augmenti un 7,3% el seu volum l’any 2040. “Les terres rares no són difícils de trobar a la natura, però sí que ho és la seva extracció. Quan es troba un jaciment d’un d’aquests metalls, el material només hi és present en el 2% del conglomerat. I, per tant, costa molts diners extraure’l de la roca”, il·lustra Colell.

L’agent explica que, si són tan importants aquests 17 metalls, és perquè s’estan fent servir per a la fabricació de noves tecnologies d’economia verda. “Per exemple, el neodimi es fa servir en la construcció d’imants per als cotxes elèctrics que estan sortint darrerament al mercat. També el tuli, que es fa servir en aerogeneradors i plaques fotovoltaiques. O l’europi, que és imprescindible per a la tecnologia led i la indústria armamentística”, relata Colell.

La majoria d’aquests materials, concretament el 75%, es troben a la Xina, país que també controla la cadena de subministraments. Al darrere, com sempre, hi ha interessos geopolítics. Com ha acabat la Xina controlant aquests metalls tan necessaris per al desenvolupament del món tal com el coneixem? Acaba de veure el vídeo de sota i descobreix-ho de la mà de l’agent Sergi Colell!

Si vols descobrir la millor opció per protegir els teus estalvis, entra a Preciosos 11Onze. T’ajudarem a comprar al millor preu el valor refugi per excel·lència: l’or físic.

While media attention swings with the price of gold and silver, another battle is being fought in silence. It does not appear in candlestick charts nor fuel crypto euphoria. It is decided in technical committees, in regulatory annexes, and in acronyms that seem innocuous.

There are no promises of explosive returns here. There are ratios. There is fine print. And there is a concept that may sound dull, but explains a great deal: the Net Stable Funding Ratio (NSFR). Because when regulation pulls the lever of bank funding, the market adapts — often faster than it seems.

When Basel is mentioned, many people picture the beautiful Swiss city with fond football memories for some. Yet the city of Basel does not exercise global executive power. That role belongs to the Bank for International Settlements (BIS) — headquartered there — which designs prudential standards. In fact, the BIS develops recommendations that each jurisdiction later adapts — or nuances — according to its political and economic pace.

This is the first point often distorted in viral narratives: a global standard is not a worldwide decree that enters into force simultaneously. Financial regulation does not operate with switches, but rather with timelines, interpretations and national adaptations.

And it is precisely in this technical terrain, far from the noise, that a significant part of the future of “paper gold” is being decided.

NSFR: the rule that penalizes short-term funding

In the United States, when discussing the “Basel III Endgame,” the debate mainly focuses on capital and risk weightings for large institutions. But the timeline is not homogeneous, and regulatory development is subject to political tensions and pressure from the financial sector.

Regulation is not a switch turned on overnight. It is a mosaic of technical decisions, national adaptations and power balances. And within that mosaic, the key piece directly affecting the metals market is the Net Stable Funding Ratio (NSFR).

In plain language, the NSFR seeks to prevent banks from funding long-term or less liquid assets with volatile, short-term money. It is a lesson learned in 2008, when the problem was not only asset quality but funding fragility. And this is where gold enters the picture.

According to the World Gold Council, certain gold exposures on balance sheets may require 85% Required Stable Funding in the ratio calculation. In other words: maintaining certain gold positions requires stable funding — and stable funding has a cost.

This does not prohibit gold, but it changes its economics. If certain “paper metal” operations were previously efficient because funding was cheap, they may now be less attractive from a regulatory standpoint.

And here lies the real debate: allocated gold — identified bars with clear ownership — versus unallocated gold — a credit claim against an institution. The difference is not ideological, it is structural. When a rule such as the NSFR makes maturity transformation more expensive, the system tends to reward what is more transparent and less dependent on funding leverage. Regulation does not destroy a practice overnight, but it does modify incentives. And when incentives change, markets change.

The mirage of “Tier 1”

One of the most recurrent traps in this debate is the idea that “gold becomes Tier 1 like cash or Treasuries.” The phrase is striking but technically imprecise. Here, three boxes that are often deliberately mixed must be separated:

- Tier 1 regulatory capital (CET1 or AT1), which is a bank’s own capital.

- High Quality Liquid Assets (HQLA) used for calculating the LCR.

- Risk weightings that determine capital requirements.

They are not the same. That gold may receive a certain prudential treatment does not automatically make it top-tier bank capital. Therefore, when someone claims that “it is now like Treasuries,” the question is not whether you like gold, but: in which ratio, in which country, and under which legal text?

That said, there are real consequences. If holding certain positions becomes more expensive from a regulatory standpoint, the market adjusts behavior. There may be less banking interest in unallocated products, higher collateral requirements, fee revisions, or adjustments in clearing and metal lending services. This is not a conspiracy nor a sudden “slam of the door.” It is balance sheet management. Prudential regulation does not destroy markets, but it redistributes costs. And when costs change, behavior changes.

For savers, the debate ceases to be technical and becomes practical. If you have exposure to “gold” through a financial product, the essential question is simple: what exactly do you own? Allocated physical metal, or a claim against an institution?

The difference is not philosophical — it is legal. In an environment where certain structures may become more costly for banks, contractual conditions may change, prices may adjust, or certain lines may be reduced. It is not an apocalypse. It is adaptation. But it is also a lesson in financial literacy: what seems cheap and liquid “for no reason” often involves a risk we do not see.

Finally, grandiose comparisons should be avoided. 1971 represented a structural shift in the global monetary system. The NSFR is prudential regulation, but it is nowhere near the same level of rupture.

However, central banks strengthening gold reserves amid high debt levels and geopolitical tensions signals something clear: gold acts as a thermometer of the system, not as the trigger of a conspiracy. Regulation does not tell you what to buy, but it does signal which promises become more expensive to maintain. And in a world of complex products and inflated balance sheets, the true luxury is clarity: knowing what you own, how it is stored, and what legal risk you assume.

Controlling the asset, not the promise

If this debate serves any purpose, it is to remind us of an elementary principle too often forgotten: owning is not the same as holding an accounting entry. In an environment where regulation redefines costs and incentives, the difference between a real asset and a financial promise becomes central.

At 11Onze we have long insisted on this idea: transparency, traceability, and control over what truly belongs to you. Viral noise will fade, but ratios will continue shaping the system. Protecting savings is not about believing in myths, but about understanding financial plumbing and deciding with discernment.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Despite a 10% reduction in the price of raw materials, the CPI for food in Catalonia rises to 4.7%. Experts point out that the sector in Europe is taking advantage of this to pass on part of the cost increases of recent years, and other parts of the chain could be expanding margins.

According to data from the Consumer Price Index for February, food is now 4.7% more expensive in Catalonia than it was a year ago. The statistics from the National Statistics Institute for Spain as a whole are even worse, with food prices rising by 5.3% in February compared to the same month last year.

According to INE, over the last twelve months, the foods that have experienced the biggest rises in Spain are olive oil (67%), fruit and vegetable juices (18.8%), potatoes (11.6%), pork (11%), confectionery (10.8%), chocolate (10%), fresh or chilled fruit (9.1%), salt, spices, and herbs (8.8%), sheep and goat meat (8.1%) and, finally, ice cream (7.9%).

Less supply?

The Spanish government blames part of this price rise on a temporary reduction in supply due to “unfavourable weather conditions” in many EU countries, which is reducing production. In fact, as we indicated in another article, Catalonia is suffering the most severe drought since 2008. And it is true that this winter greenhouses have been closed in several European countries because the price of gas is making them loss-making.

However, this argument is not very solid when it comes to justifying the high prices if we take into account that the data of the FAO (The Food and Agriculture Organization of the United Nations) food price index stood at 117.3 points in February 2024, 0.9 points (0.7%) below its revised January level, and 14 points below its February 2023 level of 131.

Impact of costs

Many analysts point out that the price rises have served to offset part of the increase in production costs suffered by the agri-food sector in recent years. These affect such important items as seeds, fertilisers, animal feed and energy.

Fertilisers tripled in price, although they subsequently became 40% cheaper from spring onwards, when they reached their highest price; it is estimated that feed has risen by more than 80% since 2019; and, as for energy, the price per megawatt-hour reached more than 300 euros and the price of a barrel of Brent oil reached 120 euros.

In any case, it is not clear that higher food prices always translate into higher incomes for producers. In this sense, there is much debate about which actors in the food chain are taking advantage of the situation to increase their margins. What is certain is that even the president of Mercadona, Juan Roig, has just admitted that his chain has raised prices “a huge amount”.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!

All economic forecasting rates indicate that we are heading for a global financial crisis. For at least a year now, renowned economists such as Nouriel Roubini, Robert Kiyosaki and Mervyn King have been warning that government debt is growing too high. This runaway debt now comes on top of rampant inflation and a galloping energy crisis. In 11Onze we summarise the keys to understanding the inevitable global debt crisis.

Uncertainty, uncertainty, uncertainty. Possibly the most repeated word since the beginning of 2022. The leading economic newspapers, prestigious economists and investors, and economic analysts all agree: an unprecedented financial crisis is approaching —”a historic crisis,” in the words of Kiyosaki— and there are several indicators that, combined, are a real time bomb: debt, inflation and rising fossil fuel prices.

As Nouriel Roubini, professor of economics at New York University and one of the few economists who previewed the 2007 crisis, has explained, the current scenario adds up to worse ingredients than those that gave rise to the inflationary crisis of the 1970s and the debt crisis of 2007. The result, he warned, could be a crisis that mutates into an economic depression that could last for years.

Public debt sets off alarm bells

To begin with, says Roubini, there are record levels of private and, above all, public debt. Moreover, he explains that the context of stagflation, i.e. a scenario of high inflation, a slow rate of economic growth, and high unemployment, together with unprecedented fiscal and monetary policies is further increasing this debt of states. And he argues why this debt crisis, coupled with inflation and rising prices, has never happened before.

He argues that, during the inflation crisis of the 1970s, advanced economies and most emerging markets had much lower public debt than they do now. In any case, that inflation did not have a negative impact on debt, because “unexpected inflation in the 1970s wiped out the real value of nominal debts at fixed rates, thus reducing many advanced economies’ public-debt burdens.” Now, however, in order to reduce debt, states need such high levels of inflation that they may become unaffordable for citizens, who may lose purchasing power and thus become impoverished.

If we take the financial crisis of 2007 as a reference, Roubini recalls that the levels of public and private debt led to a major global debt crisis, which was aggravated by the bursting of the real estate bubble. However, the recession that followed that debt crisis led to low inflation, almost deflation. Today, by contrast, the runaway debt crisis coincides with stagflation that is beginning to look alarming.

Roubini’s hypothesis coincides with the view of former Bank of England governor Mervyn King, who early last year warned of a possible eurozone financial crisis. Already then, in an interview in ‘El País’, he stated forcefully: “A new debt crisis is coming, and it will be soon.”

In that conversation, King argued that global debt is indeed above 2007 levels, a debt that has not stopped growing with the pandemic. “When the crutches of the state are withdrawn, there will be corporate bankruptcies, and most likely sovereign debt crises in emerging countries,” he said. And he warned that having all this happen at the same time could cause a “serious problem.” “It is impossible to know when and where it will happen, because of the radical uncertainty, but the system is creaking on the debt side,” he said.

The collapse of emerging markets

Just a few days ago, economic analyst Bill Dudley made the same forecast as King ‘Bloomberg’. The expert warns of the possible bankruptcy of emerging countries, due to the impossibility of assuming their public debt. Even so, he points out some ways out. Dudley considers it very likely that 2022 will be a “very difficult” year for low-income countries and emerging markets, because they have been the big borrowers in the sovereign debt market.

“A series of crises concentrated in these countries seems almost inevitable,” he says. And he predicts that as the US Federal Reserve begins to tighten monetary policy, funding costs will rise and less credit will be available, because interest rates reduce the incentive for investors to seek the kind of returns offered by these countries.

Added to this situation is the fact that the debt moratorium agreed during the pandemic by the International Monetary Fund (IMF) and the World Bank with the G-20 countries will soon come to an end. And this will mean that these emerging countries will need to get into debt again. Dudley therefore proposes that the IMF increase aid, but also admits that the measure only “postpones the day of reckoning” and subordinates these emerging markets to “private lenders” and large state lenders, such as China.

As such, Dudley believes that the best thing to do is a far-reaching reform of the sovereign debt regime, to make it more robust and resilient to the adverse economic backdrop. And he calls for much more transparency. “In many cases, it is impossible to judge how large the obligations are, when they will come due, their interest cost and other terms and conditions, including what collateral that may have been pledged to secure the borrowing,” he says.

The year of the big crisis, how to prepare for it

The president of 11Onze, James Sène, agreed with this analysis. In a conversation that you can revisit on the 11Onze Podcast, he detailed how to face the onslaught of a debt crisis on an international scale. Public debt and inflation, he explained, make it essential to seek refuge for people’s savings, so that citizens do not once again have to pay the price of an economic crisis.

If you want your business to make a giant leap, use 11Onze Business. Our business and freelancer account is now available. Find out more!

Food prices are still skyrocketing and have grown by 15.4% although the overall inflation has decreased. Is it possible to eat well and well priced? At 11Onze we propose 11 dishes to get the most out of your budget.

Data from the INE (National Statistics Institute) reveal a fact that people had already noticed, for sure, when shopping: that food prices do not stop rising. This has caused, according to the OCU, that 90% of the citizens modify their shopping habits, that they buy 23% less food, that they have reduced by 18% the purchase of fruit and vegetables and that 3 out of 10 have limited the purchase of meat and fish.

This may cause families’ diets to shift towards cheaper and perhaps less healthy purchases. Reviewing the data, there are basic products such as milk that have risen by 33.4%, eggs by 22.9% or potatoes by 18.9%. Meats went up between 13% and 25%, while legumes and vegetables went up between 11% and 15%. Fruit has risen by 4%, but it should be borne in mind that it is one of the most expensive products.

Freezing, the great ally

So what to do? There is a risk of tending to a diet based on processed foods, pasta and flour, which have better prices but are worse for our health. For this reason, it is advisable to take advantage of the offers to buy in bulk, which allows to reduce the cost per unit and to freeze the leftovers. Obviously, it is necessary to take advantage of the offers of fresh meat and fish at a discount due to a near expiration date, because we can freeze them directly. But this can also be done with other products. Cheeses such as cheddar or mozzarella can be frozen if you plan to use them for melting. You can also freeze butter, or boiled eggs. And as far as fruit is concerned, it is best to use it to make compote or cakes that can be frozen.

Traditional recipes against inflation

If you don’t want to give up traditional flavors or healthy cooking, you can dive into the Corpus of Catalan Culinary Heritage. You’ll find recipes that make the most of the most expensive ingredients. We have selected 11.

- Omelette with juice. An omelette stuffed with vegetables or potatoes and accompanied by sofrito. A simple dish, to dip bread.

- Chicken with chanfaina. One of the least expensive and healthy meats, accompanied by one of the most common resources of Catalan cuisine.

- Chickpeas with cod and spinach. The legumes are the base product, the cod and spinach complement them.

- Onion soup. A good way to take advantage of the dry bread and make a tasty soup.

- Sausage with pears. With some ripe pears we can prepare a dish of contrasting flavors with one of the classic meat dishes in Catalonia.

- Scudella of pumpkin and beans. Little meat and a good spoon dish.

- Escudella Montserrat. Conger eel (or similar) and cauliflower are the stars of this dish that also has rice, chickpeas and noodles.

- Rice in the casserole. A classic of Catalan cuisine and a good way to serve very good dishes with a modest investment.

- Cut-up rice. If you buy a whole chicken to roast, take advantage of the trimmings to make this dish.

- Rice a la Piula. With a base of anchovies, a good rice with a seafood flavor.

- Sardines with potatoes and smashed eggs. If you like the famous “huevos estrellados”, here you have a version with sardines.

This is just one of the thousands of recipes in the Culinary Corpus of Catalan Heritage. Very often, our ancestors used to cook making the most of a small portion of meat or fish. Accompanied with legumes, potatoes, vegetables or rice, the portions that could be served with that more expensive ingredient multiplied. What they did not know then, perhaps, is that this also made the dish a nutritionally more complete and healthier meal.

Now, with food inflation rising to 15.4%, perhaps it is a good time to recover this way of cooking. Surely, in addition to saving money, we will gain health.

And you, what recipes do you prepare at home?

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

The BRICS group, which brings together the two big emerging economies (China and India) and three major commodity producers (Brazil, Russia and South Africa), is working on its own currency. China is the driving force behind a currency that, unlike the dollar or the euro, could be backed by gold and other commodities.

During a visit in Shanghai to the New Development Bank, created by the BRICS, Luiz Inácio Lula da Silva, President of Brazil, insisted a few days ago on the idea of finding an alternative to the dollar in international payments. “Why can’t an institution like the BRICS bank have a currency to finance trade relations between Brazil and China or between Brazil and all the other BRICS countries,” he said.

China and Russia have been the main promoters of this idea, which has been well received by the rest of the BRICS and other emerging countries.

Vladimir Putin announced in the middle of last year that the BRICS group was working on the development of a new reserve currency based on a basket of currencies for its member countries. And Russian Foreign Minister Sergei Lavrov indicated in January that the issue would be discussed at the BRICS summit in South Africa at the end of August.

First steps in a multipolar world

These statements should be seen in the context of Russia’s new foreign policy, recently announced by Vladimir Putin, which places India and China at the forefront and aims to boost Moscow’s role in groupings such as the BRICS in order to “adapt the world order to the realities of a multipolar world”.

For the time being, Beijing has intensified its efforts to use its own currency in foreign trade. A few weeks ago, the presidents of China and Russia agreed to encourage the adoption of the Chinese yuan as a settlement currency with emerging economies. And Brazil and China took steps last month to facilitate the settlement of their transactions in each other’s currencies. The goal is to reduce financial costs by eliminating a third currency from transactions.

A new currency for a new world

The Deputy Chairman of Russia’s State Duma, Alexander Babakov, said a few days ago that “the transition to settlement in national currencies is the first step”. According to him, the next move would be “to put into circulation a digital currency or any other fundamentally new form of currency in the near future”.

The fact is that in recent times there have been increasing contacts between representatives of Brazil, Russia, India, China, and South Africa to launch a new currency which, according to Russian sources, would be backed by gold and other commodities.

In this respect, it should be borne in mind that in November and December last year alone the Chinese central bank announced the purchase of 62 tonnes of gold, bringing its total reserves to more than 2,000 tonnes for the first time in history, according to data from the World Gold Council. And it seems that the pace of gold purchases by various central banks has intensified so far in 2023.

A very heterogeneous group

Critics of this new currency project point to the great differences that exist between the five countries in the group in terms of production, growth and financial openness. Suffice it to say that real GDP per capita at constant prices between 2008 and 2021 increased by 138% in China, 85% in India, 13% in Russia and 4% in Brazil, while it contracted by 5% in South Africa.

Another distorting factor is China’s overwhelming weight in the group. The most recent data from the International Monetary Fund indicate that the Asian giant accounts for 72% of the combined GDP of the five countries. And China’s dominance is reinforced by the fact that it is a key trading partner for commodity exporters.

Moreover, the strategic interests of the five members of the group are not closely aligned precisely because of the vast differences in their economies.

However, the idea of a new currency is taking shape. And other countries such as Argentina, Iran, Indonesia, Turkey, Saudi Arabia and Egypt have already expressed their interest in joining this economic bloc. The international financial system could be on the verge of a radical change, perhaps back to the gold standard or something similar.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

The gold market is one of the largest and most liquid in the world. Every day, billions of dollars are traded between London, New York, Zurich, Dubai, and Shanghai. It is an asset with more than five thousand years of history, present in central bank reserves and in the portfolios of institutional and retail investors. However, in 2020, one of the world’s largest banks, JPMorgan Chase, admitted to having manipulated precious metals markets for years.

How was it possible to manipulate a market of this magnitude? Are we facing a systemic conspiracy or a more subtle technical mechanism? Understanding the “how” is key to avoiding both naivety and sensationalism.

When we think about the price of gold, we imagine stacked bars inside a vault. But the global price is not primarily determined by the physical metal, but by the financial contracts traded around it.

The reference market is in London, coordinated by the London Bullion Market Association, which sets the “Good Delivery” standard and concentrates a large share of global OTC trading. In New York, the COMEX futures market allows trading contracts with future maturities and plays a key role in price formation through derivatives.

But the map does not end there. Zurich is one of the main global refining and custody centers, hosting some of the world’s largest refineries. Recently, Dubai has consolidated itself as a strategic hub between Africa and Asia, especially in the trade of Dore gold and OTC markets outside the traditional London circuit. In Asia, the Shanghai Gold Exchange has emerged as a key player in the internationalization of gold pricing in yuan, reinforcing China’s growing weight in the physical market.

The global gold price, therefore, is not the result of a single center, but of a dynamic balance between these financial hubs, where physical and derivative markets constantly interact.

The reality is that the volume of futures contracts far exceeds the volume of physical gold that changes hands each day. This phenomenon, often referred to as “paper gold,” means that the price is largely formed in derivative markets. And this is where vulnerability appears.

What is spoofing?

To understand how the gold market can be manipulated, we must first understand how a modern electronic market works. Today, prices are not decided in a crowded trading pit, but on digital platforms where thousands of buy and sell orders compete in fractions of a second.

Each order is recorded in what is called the order book. This book shows, in real time, how many contracts are willing to buy or sell at each price level. It reflects not only executed trades, but also intentions. In financial markets, the perception of intention can move prices just as much as actual supply. This is where spoofing appears.

The 2020 JPMorgan case

In September 2020, the U.S. Department of Justice and the U.S. Commodity Futures Trading Commission demonstrated how JPMorgan Chase and several traders, between 2008 and 2016, carried out systematic manipulation practices in gold, silver, platinum, and palladium futures markets through the technique known as spoofing on COMEX.

The mechanism consisted of placing large buy or sell orders with no real intention of executing them. These orders temporarily altered the visible balance of the order book and created the perception of strong imminent buying or selling pressure. When other participants — algorithms, funds, or traders — reacted to this apparent pressure, the price moved slightly. At that moment, the traders cancelled the false orders and executed real trades in the opposite direction, taking advantage of the generated movement. It was not about controlling the global price of gold, but about gaining an advantage from very brief and repeated distortions in market microstructure.

For these actions, JPMorgan Chase agreed to pay approximately 920 million dollars in penalties, while several involved traders were criminally convicted. It was not a suspicion or a speculative theory: it was a judicial resolution with economic and criminal consequences.

Manipulation is not control

The JPMorgan Chase case proves that manipulation is possible, but it also forces us to set boundaries to the narrative. Manipulating short-term movements through microstructure techniques is not the same as structurally controlling the global gold price.

The global gold market has a colossal scale. According to the World Gold Council, the total value of existing gold exceeds 12 trillion euros, and central banks hold more than 35,000 tons as reserves. No private entity can indefinitely sustain a massive distortion without being arbitraged by other actors. In deep and liquid markets, inefficiencies tend to correct themselves.

This does not mean the market is pure or perfect, but it does mean we must distinguish between temporary influence and systemic control. Power in financial markets exists, but it is not omnipotent, and confusing technical manipulation with absolute domination only distances us from rigorous analysis.

It is also true that influence is not always technical. Large banks publish forecast reports that can alter expectations and capital flows. This is part of the market game. The limit appears when conflicts of interest or opaque coordination between research and trading arise. But even here, we speak of influence, not permanent control — and the difference is crucial.

A lesson for the community

The gold market is not a stage of constant conspiratorial engineering. Nor is it a neutral space where all actors compete on equal footing. It is a complex ecosystem where global banks, central banks, refineries, funds, algorithms, and retail investors coexist.

The J.P. Morgan case leaves us with a clear lesson: concentration of financial power can generate distortions. But it also demonstrates that regulators, sanctions, and consequences exist. The manipulation was detected and penalized.

For the 11Onze community, the reflection is even more relevant. Investing in gold is not just buying a metal, but understanding where and how the price is formed. It is distinguishing between physical gold and derivatives. It is knowing that short-term movements may respond to complex financial dynamics, not necessarily to structural changes in real value. The best protection is not fear or viral narratives. It is knowledge.

In an environment where information circulates rapidly and extreme narratives gain audience, preserving wealth also requires preserving judgment. Gold has withstood centuries of monetary instability. But we must learn to withstand misinformation. Because understanding the system is the first step to moving freely within it.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

El reconegut economista Robert Kiyosaki ha pronosticat “una crisi històrica”. Però, davant la incertesa, ell hi veu una oportunitat per a diversificar els estalvis. Què vol dir diversificar? Diversificar ens ajuda a invertir? L’agent 11Onze Xavier Esteve ens ho explica en quatre claus.

Kiyosaki, que és un inversor molt influent als Estats Units, i autor del bestseller ‘Padre rico, padre pobre’ (Debolsillo, 2016), afirma que la crisi que ve els pròxims mesos ens pot arrossegar a una “situació de col·lapse”, no només en el mercat de divises, sinó també en el de les criptomonedes i en el de metalls preciosos. Tanmateix, ell es mostra optimista: està convençut que tota crisi és una oportunitat per a qui ho sàpiga aprofitar.

Alerta amb el deute, perquè pot provocar inflació

Segons l’agent 11Onze, Xavier Esteve, la crisi que ve té com a principal factor “el gran deute acumulat que hi ha al món, especialment als Estats Units”. Esteve explica que la relació entre el deute i el producte interior brut (PIB), és a dir, la capacitat de generar riquesa “no és, ara per ara, coherent”, o, en paraules de Kiyosaki, “no està sincronitzada”. De fet, Kiyosaki defensa una tesi alarmant: que el Departament del Tresor i la Reserva Federal dels Estats Units “estan inflant artificialment” el mercat de valors amb decisions “desconnectades” de l’economia real.

Esteve reconeix que inflar el mercat d’aquesta manera “no és gens bo”, i mira d’explicar-nos-ho: “S’està imprimint diner sense tenir en compte el que la gent gasta i, per tant, aquest diner se’l pot titllar de fals, en tant que no entra dins l’economia. En canvi, sí que té efectes en la pujada de preus, en una possible inflació transitòria els pròxims mesos”. Aquesta inflació transitòria, diu Esteve, pot enfonsar el castell de cartes que és el mercat i fer que els béns perdin el seu valor fins a cotes mai vistes. “La possible bancarrota de la immobiliària xinesa Evergrande també pot afectar a aquesta devaluació transitòria”, assevera. En aquest context, Esteve ens recorda que Kiyosaki adverteix que “els rics es faran més rics, però la classe mitjana i pobra cada vegada serà més pobra”.

L’agent 11Onze també ens explica que les declaracions de Kiyosaki s’entenen pel fet que les preocupacions financeres dels EEUU pengen d’un fil de fa temps i, “sobretot ara, amb la inseguretat de l’economia real, i havent sortit de dos anys de pandèmia, que han afectat, entre d’altres, als ritmes de producció del petroli i gas”. Tot i que Esteve recorda que “l’economia no és una ciència exacta ni pot predir el futur”, sí que observa “símptomes preocupants”. “És preocupant, avui dia, la manca de determinades matèries primeres i l’alça de preus del gas, la llum o la benzina. El gran dubte és si la por i la manca de confiança s’apoderaran del mercat, o no”, assenyala.

“S’està imprimint diner sense tenir en compte el que la gent gasta i, per tant, aquest diner se’l pot titllar de fals, en tant que no entra dins l’economia”.

Quan es desplomen els valors, toca invertir

Davant aquest possible escenari de crisi, com Kiyosaki, l’agent 11Onze es mostra optimista. Considera que les crisis, en tots els àmbits, són el pa de cada dia i “ofereixen moments de canvi”. “És llavors quan pots crear o cercar noves maneres per a millorar la teva situació financera”, afirma Esteve.

“No vull ser alarmista —segueix Esteve—. Kiyosaki ens diu que aquesta caiguda de preus ens donarà una oportunitat per a invertir en actius considerats de reserva de valor, com el bitcoin, l’or o la plata”. De fet, l’eminència de l’economia aconsella als petits inversors el que ell mateix farà quan els preus hagin caigut prou: “Soc optimista sobre l’or, la plata i el bitcoin, no sobre les accions. Quan es desplomin els seus valors, és quan jo en compraré”.

“No és bo posar tots els ous al mateix cistell”

En situacions de crisi econòmica, sobretot si es preveu transitòria com ho sembla aquesta, “preocupar-se no és la solució”, ens diu Esteve. La resposta demana mantenir la calma i “tenir una bona planificació que ens ajudi a superar qualsevol entrebanc financer”. “Fins i tot, si ho fem bé, aquesta planificació ens pot ajudar a millorar els nostres estalvis”, assegura.

Esteve s’anima a donar resposta als neguits del petit inversor amb dues dites, una d’elles molt catalana: “No és bo posar tots els ous al mateix cistell”. I la segona, atribuïda a Harold Macmillan, exprimer ministre del Regne Unit: “Hauríem de fer servir el passat com a trampolí, no com sofà”. “I tant que es pot diversificar. És una de les millors maneres d’invertir”, resumeix Xavier Esteve sense pensar-s’hi. Però, ben bé, què és això de diversificar?

“Soc optimista sobre l’or, la plata i el bitcoin, no sobre les accions”.

Font imatge: Gage Skidmore

Distribuir els estalvis, arriscar petites quantitats

Diversificar vol dir distribuir els estalvis en diferents actius, sigui en moneda, metalls preciosos, productes d’inversió en borsa com els ETF, patrimoni immobiliari o criptomonedes, entre d’altres. Les noves tecnologies faciliten encara més aquesta diversificació. La nostra app El Canut oferirà pròximament aquesta possibilitat. I com que el valor d’aquests actius canvia en el mercat, diversificar et pot ajudar, no només a assegurar els teus estalvis, sinó també a invertir, tal com diu Esteve.

El nostre agent explica que, tot i que molts es pensen que la inversió és només per a professionals o persones que disposen de molt capital, “no és ben bé així”. “És evident que tothom té les seves dificultats i circumstàncies i, primer de tot, hem de tenir les necessitats vitals cobertes, sempre ho dic, però una de les virtuts d’11Onze és justament que, a través de La Plaça i de l’atenció 24 hores, intentem que els nostres clients disposin de tota la informació per a prendre les decisions encertades”, afirma Esteve, que recorda que 11Onze permetrà als clients invertir “amb quantitats petites, que no suposin un trasbals”. Com deia el divulgador científic Eduard Punset: “Quan l’ecosistema no existeix, s’ha d’inventar”. “Ens hem de moure amb la marea”, rebla Xavier Esteve.

Si vols descobrir la millor opció per protegir els teus estalvis, entra a Preciosos 11Onze. T’ajudarem a comprar al millor preu el valor refugi per excel·lència: l’or físic.