Key facts about the gold market

What is the size of the gold market, what are the keys to the supply of this precious metal and how is demand for it evolving? Discover the key elements of a growing market.

Gold is not the most expensive precious metal in the world, a privilege that belongs to rhodium, but mankind has used it for centuries as a currency and a store of value. It is estimated that over 200,000 tonnes of gold have been mined throughout history. Although that sounds like a huge amount, all that gold can practically fit into three Olympic-sized swimming pools.

Despite the relative scarcity, the rate of mining has greatly intensified in recent decades, with two-thirds of the total mined since 1950. Today, the pace of mining production is adding about 3,500 tonnes of gold each year to the total, according to the World Gold Council, an annual increase in reserves of about 2 per cent.

Three-quarters of the gold supply comes from mines scattered across most of the world. No single country accounts for 10% of world production, which helps to reduce price volatility relative to other commodities such as lithium, where production is much more concentrated. In addition, the recycling of gold from jewellery and technological devices, which accounts for a quarter of the supply, also helps to stabilise prices in times of high demand.

Twelve trillion in gold

Of all the gold on the market, valued at around 12 trillion, around half (46%) has been used in jewellery, two-fifths have ended up in the financial system, either in central bank deposits (17%), in the form of investment bullion and coins (21%) or as ETFs backed by physical gold (2%), and the rest is split between industrial and other secondary uses.

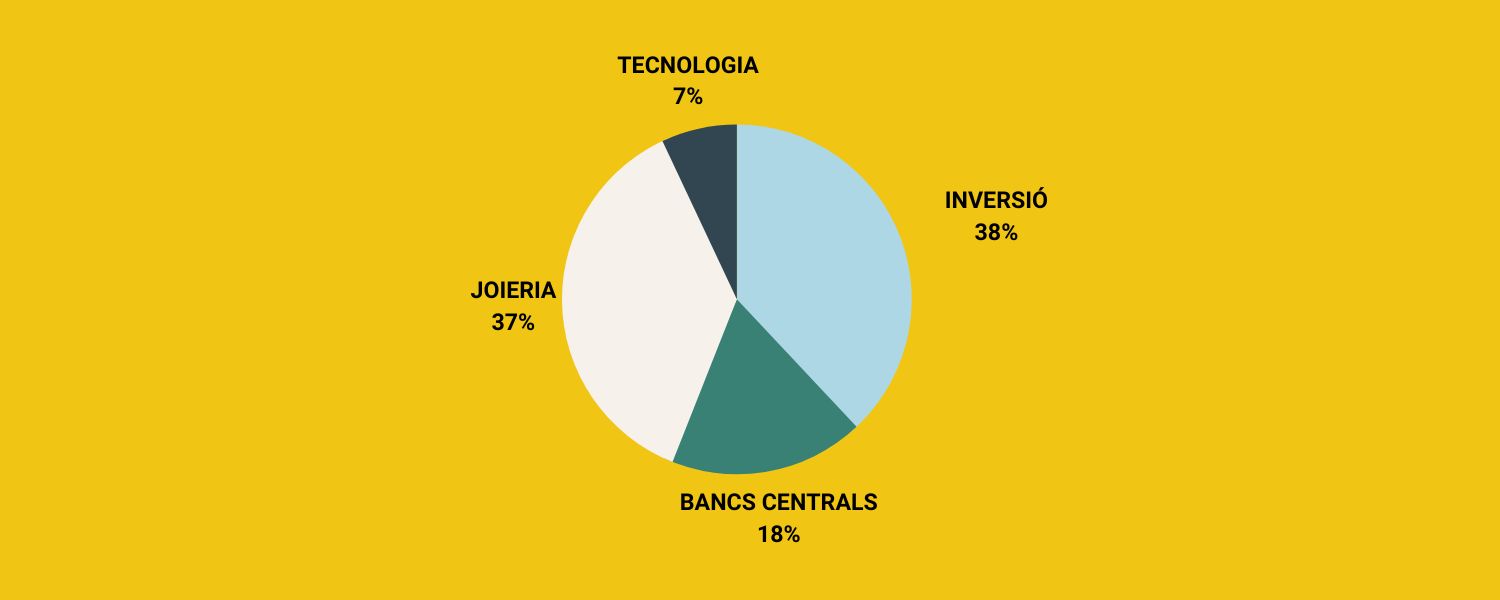

However, the shape of demand has changed significantly in recent years. The main destination of gold today is already investment (38%), followed by jewellery (37%), central bank reserves (18%) and technological devices (7%).

Emerging countries, led by China and India, already account for about 75% of the annual global demand for gold, while the rest is accounted for by developed countries.

The sheer size of the financial gold market, at close to five trillion euros, gives it considerable stability. Even large purchases and sales by central banks and institutional investors do not tend to have a major impact on price movements.

Central banks’ voracity

Central bank reserve managers are tasked with investing large sums of money in financial assets. And although the investment strategies of each of them are nuanced, they all follow the principles of safety, liquidity and profitability, qualities associated with gold.

This is why this precious metal has been one of the traditional reserve assets for central banks. According to the IMF, by the end of 2022 these institutions would hold more than 35,000 tonnes of gold. The approximate value of all this gold is 2 trillion euros, making it the third most important asset for central banks, after their dollar and euro reserves.

The demand for gold by these institutions has intensified since 2010. However, the weight of gold reserves in their portfolios varies considerably among them. In the case of developed countries’ central banks, gold is estimated to account for 21% of their assets, while in emerging countries it is only equivalent to 10%.

One per cent of global financial assets

Despite the voracity of central banks in the gold market in recent years, their gold reserves remain smaller than those held by investors in the form of bullion, coins and ETFs, which are worth $3 trillion.

On average, gold is estimated to account for just over 1% of global investment portfolios, although the World Gold Council has concluded that investors could benefit enormously from a share of between 2% and 10%, depending on their profile.

It should not be forgotten that, in addition to security, one of the great virtues of gold is its liquidity, which has nothing to envy to that of other major assets. As an example, suffice it to say that in the last five years the average daily volume of gold transactions has almost reached 150 billion euros, a figure higher than that of the Dow Jones Industrial Average.

Protecting savings with physical gold has been one of 11Onze’s main contributions to its community, and now the range of products is expanding. This is why, in the face of volatility, still high inflation and the growing crisis of confidence in the banking system, gold is once again strengthening its position as a safe-haven asset. Discover Gold Seed at Preciosos 11Onze.

Leave a Reply

You must be logged in to post a comment.

Jo gràcies a vosaltres, he pogut invertir en or patrimoni (inversió a llarg plaç) i or llavor (a curt termini).

Gràcies per pensar en la comunitat

Moltes gràcies a tu, Manel, per ser-hi i per seguir-nos, i també per fer-nos cas i acceptar els nostres consells.

Gràcies!

Gràcies a tu, Joan!!!

M’han comentat que l’or encara ha de pujar més de preu del que està ara. Això sembla la febre de l’or.

De fet, l’or sempre ha tingut una línia ascendent, però això no treu de que sigui una inversió a mig / llarg, termini. Moltes gràcies pel teu comentari, Jordi!!!