China and the US, rivals facing the global crisis

The two great world powers, China and the United States, know that they will have to face an imminent global debt crisis, but each has decided to take opposite paths. While Beijing needs to continue stimulating the economy of emerging countries, Washington believes that interest rates must be raised to control inflation. Behind these two divergent strategies, there are strong geopolitical motives. At 11Onze, we take a closer look.

Behind the scenes of the economy, there are always political motives that we are often unaware of. If Xi Jinping and Joe Biden want economic conditions to stabilize, it is not only to safeguard the economy of their respective countries, but also because both of them will have to face a re-evaluation of their political leadership in the autumn of 2022. To achieve this, they know that important interest rate decisions must be made. Yet each is approaching this challenge from very different perspectives and strategies.

While the United States (US), like the UK and the European Union, is concerned about an economy under pressure from high inflation and supply constraints, which has pushed up prices and sent the purchasing power of citizens plummeting; China is worried that a rise in interest rates will hurt the sovereign debt of the emerging economies with which it has trade deals —and there are many of them, as we shall see— which could trigger an unprecedented global crisis. Which of the two hegemonic economies will emerge as the winner in this contest?

US: controlling inflation to withstand the onslaught

This is how, at one end of the planet, US President Joe Biden will have to face the elections to renew Congress in November. If this contest does not favor the Democrats, he will lose the ability to manage the inflation crisis, in a context in which his popularity continues to fall. For this reason, Biden is convinced that public opinion must be satisfied by attacking the disproportionate increase in the prices of basic consumer products due to inflation.

In this sense, and in line with classic economic movements, he considers it an essential strategy to raise interest rates. And this task, it is clear, falls to the US Federal Reserve. In fact, leading economic analysts are certain that the Fed wants to start raising interest rates in March.

Moreover, the US is not alone in tackling this runaway rise in inflation. The decision is in line with what the Bank of England wants to do. And, likewise, it remains to be seen what decision the European Central Bank will finally take, which has decided, for the moment, to leave interest rates at 0%. Despite this, it is under increasing pressure to raise them to at least 0.5% to show that the eurozone also has enough determination.

But the balances in the economy are precarious: if action is taken to lower inflation at a time when most countries, especially in emerging markets, have off-limit sovereign debt, this could lead to a debt crisis of biblical proportions. As we have explained in 11Onze, analysts such as Bill Dudley in ‘Bloomberg’ warn that as the Federal Reserve begins to tighten monetary policy, “funding costs will rise and less credit will be available.” This is because interest rates reduce the incentive for investors to seek the kind of returns offered by these emerging countries.

And all this has to happen at the same time as the moratorium by the International Monetary Fund (IMF) and the World Bank agreed with the G-20 countries during the pandemic comes to an end. Dudley proposes that the IMF leave the aid tap open, so that emerging countries can assume their sovereign debt and no longer continue to be subjugated to private lenders and large lenders such as China.

China: the risks of colonizing the emerging market

On the other side of the world, Xi Jinping needs the US Federal Reserve and the European Central Bank to continue their soft monetary policy, which has stimulated the world economy throughout the pandemic. And he needs it, first, because he wants to get to the fall National People’s Congress through the big door, since it is the political event that has to endorse his leadership for a third five-year term. And, second, because the Asian giant’s colonizing economy is faltering.

“If the major economies slow down their trajectory or make a U-turn in their monetary policies, it will have serious negative repercussions and challenge global economic and financial stability. Emerging countries will bear the brunt,” the Chinese leader said at the last Davos conference.

In fact, if China’s GDP has shown signs of recovery after the pandemic, it has only been thanks to exports, which have increased by 30% throughout 2021. In contrast, wholesale and retail sales within the same country do not exceed 1.7% and 3.9% respectively, compared to 2020, the year in which the Asian leader’s growth came to a screeching halt due to the effects of Covid-19.

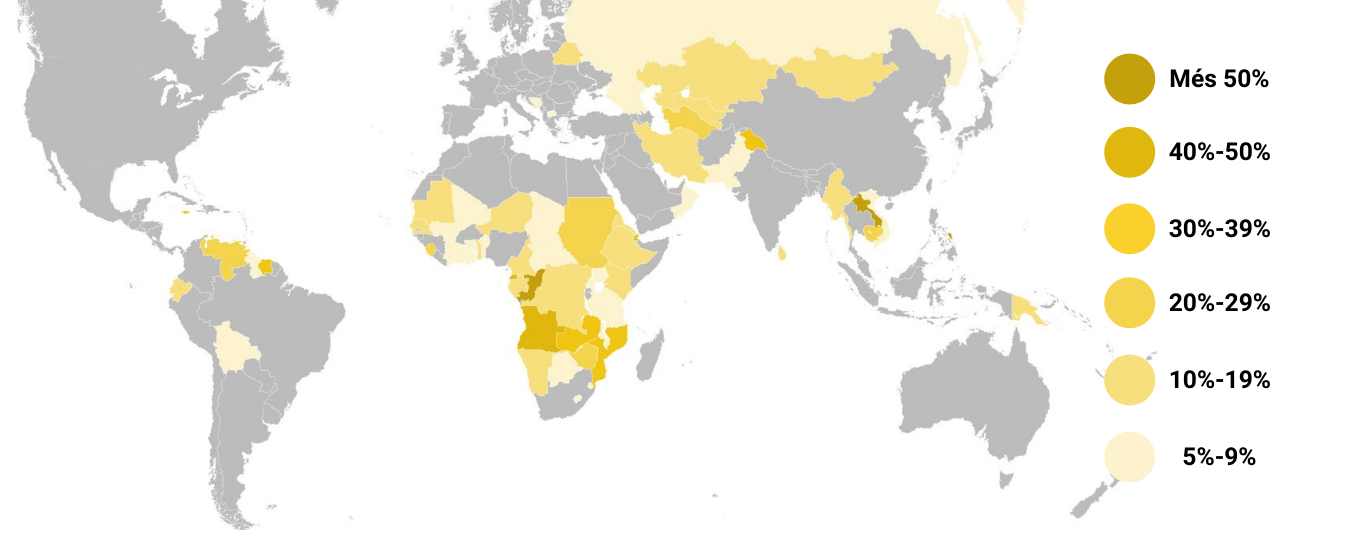

As things stand, it is much more in China’s interest to continue exporting smoothly than to control inflation. And it has good reason to want to do so. According to a report by the College of William & Mary, China has literally colonized the emerging market in recent years. As the chart above shows, nearly 70 developing countries have incurred debts to China in excess of 5% of their GDP.

If a combined action by the US Federal Reserve, the European Central Bank and the Bank of England raises interest rates, this threatens the strength of these emerging economies, which will have serious problems repaying sovereign debt, as Dudley explains. In this context, the main loser is China, which has granted many of these debts.

A chain crisis of unknown dimensions

Experts warn that the first effects of this chain debt crisis will drag down the entire Chinese real estate sector, which has already shown good signs of tension in recent months with the bankruptcy of the country’s second largest real estate group, Evergrande, due to dubious financial policies that have given wings to sovereign debt – and now put it at risk.

As the World Bank predicts, “the risks and potential costs of contagion from a sharp deleveraging of large firms, especially in the real estate sector —with combined onshore and offshore liabilities amounting to almost 30 percent of GDP and strong linkages to various parts of the economy— far exceed any potential damage from the collapse of a typical large industrial company.”

Be that as it may, and provided that the monetary policy decisions of the capitalist West are confirmed, complicated months lie ahead, both for the emerging economies and for the Asian giant —and, therefore, for the entire planet—. If the most pessimistic predictions come true, we will have to start taking measures to face this debt crisis that already seems inevitable.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Molt interessant. Geopolítica, de vegades el resultat no és competir per millorar sinó per enfonsar i tot acaba malament.

Gràcies, Pere pel teu comentari!

Veurem en q acaba tot plegat. La Xina s’ha fet amb molt deute espanyol, por em fa.

Molt cert, veurem com aniran aquests pròxims mesos i com es gestionarà aquesta crisi global que sembla que ja està aquí mateix… Moltes gràcies pel teu comentari, Manel!!!

A veure què en sortirà de tot plegat

El temps ens ho dirà, Francesc, i moltes gràcies pel teu comentari.

Molt bon article. Això de Xina “ha colonitzat” ha causat impacte a d’altres lectors, però. Potser ha mancat matissar sota quina colònia som al autoanomenat “món lliure”. De totes maneres, ha estat un article molt ben redactat i molt interessant. Gràcies de nou per aquesta gran tasca formativa i informativa.

Celebrem que t’hagi agradat l’article, Antoni. Moltes gràcies pel teu comentari!!!

Ok 👍

Gràcies, Josep!!!

La geopolítica és apassionant. S’ entenen moltes coses tot i que l’únic que podem fer és posar-nos a aixopluc quan cau el xàfec. Com a mínim cal haver comprat paraigües.

Occident ha badat permetent que la Xina colonitzés econòmicament els països emergents? 🤔

La Xina ha colonitzat per tot arreu on ha pogut! Han colonitzat el $.. suposo que com dius no és una cosa de badar…. Sinó que quan plou poca cosa es pot fer… simplement plou.

👏

Gràcies, Joan!!!

👏

Gràcies, Daniela!!!