The power map: a $94 trillion world

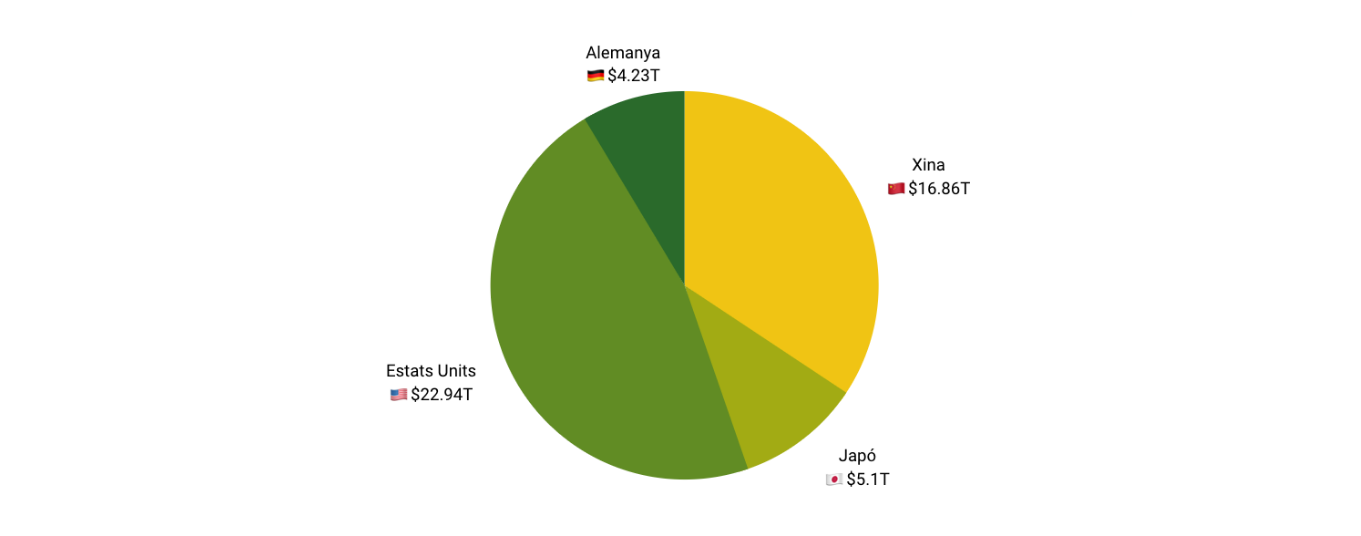

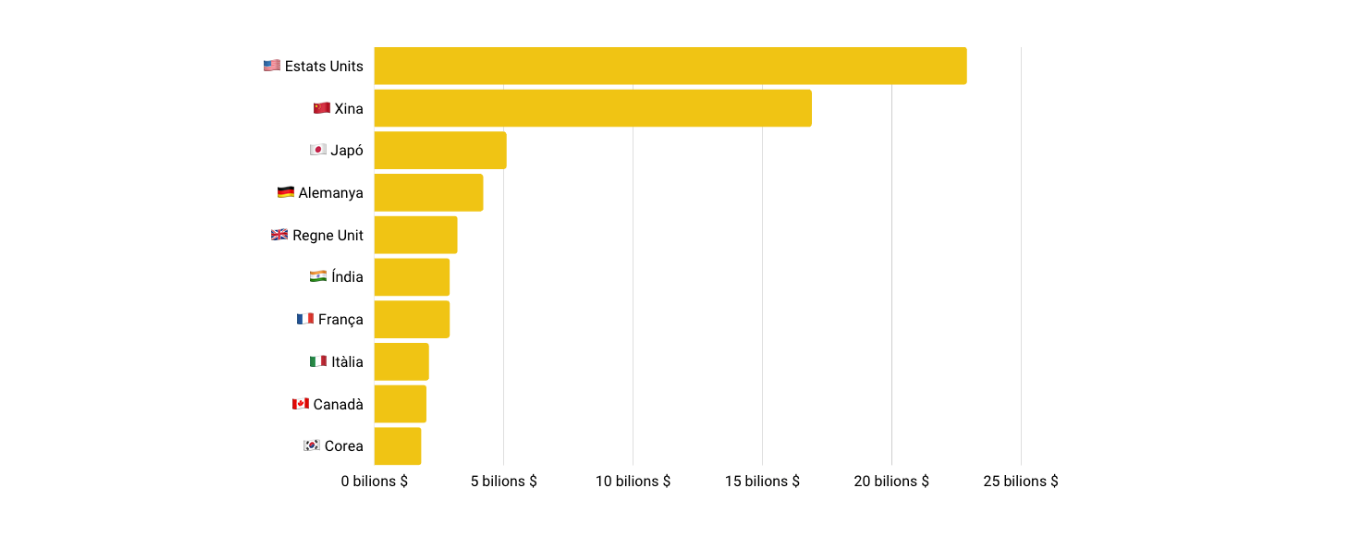

The world economy is worth 94 trillion dollars. For ordinary mortals, the figure can be staggering, if we have only just grasped its magnitude. Especially when we realise that just four countries, the United States, China, Japan and Germany, account for more than half of the world’s economic output in terms of gross domestic product. In 11Onze we take a look at how the global map of power is distributed.

To compare the various economies of the world, experts usually use the gross domestic product (GDP) of each country, with estimates made by the International Monetary Fund (IMF). This is what we have done, based on data produced by ‘Visual Capitalist’, to analyse the distribution of the world’s wealth in 2021.

GDP is a general indicator that measures all the country’s production, i.e. all the goods and services produced in a given period of time, quarterly or annually. Although GDP does not reflect the well-being of citizens, experts do believe that if a country’s GDP increases, it means that there is more economic activity, and that this benefits workers and businesses as a whole.

Although the figure of 94 trillion dollars may seem like a beastly figure, it should be borne in mind that in 1970 the world’s GDP was only three trillion dollars. Moreover, the figure is expected to double in the next 30 years. By 2050, according to experts, global GDP could reach $180 trillion. And by 2022 it is expected to exceed 100 trillion.

The countries that rule the planet

At $22.9 trillion, the GDP of the United States represents 24.4% of the world economy, although it is fair to say that this percentage is the lowest in its history, as 11Onze’s chairman James Sène explained. Finance and insurance are the biggest contributors to its economy, followed by services and public administration.

Below the United States, and at an increasingly smaller distance, is China, with $16.9 trillion, which accounts for 17.9% of the world economy. The country achieves most of its wealth because it is the world’s largest manufacturer of steel, coal, electronics and robotics. At a considerable distance behind it are Japan and Germany, which is Europe’s largest economy, thanks mainly to motor vehicle exports. In total, it exports around 20% of its production.

Thus a map of power is configured, the axes of which are divided between the United States on the American continent, China on the Asian continent and Germany on the European continent. And where is Spain on this list, if it does not appear among the first ten countries? Well, with a GDP of 1.4 trillion dollars, i.e. 1.5% of the world economy, it is in 14th place, just below Russia, Brazil and Australia, and just above Mexico, Indonesia and Iran.

The fastest growing economies

But there are countries that, although not in the best positions, are expected to grow a lot in the coming years. At the top of this list is Libya, as the IMF forecasts that it could grow by up to 123%, thanks mainly to oil exports and a depressed currency.

Also high on this list in Europe is Ireland, with a growth forecast of 13%. The key, according to experts, is that it is hosting large global technology companies, such as Facebook, Tik Tok, Google, Apple and Pfizer, because it has a very low corporate tax rate compared to other countries in the world. A rate that, unfortunately, will have to rise due to the agreements signed with the OECD. Macao is another growing economy and political tensions are becoming more and more evident. Macao is considered to be within China’s sphere of influence.

On the other side of the scale is Tuvalu, which has the world’s smallest economy at only $70 million. The business that brings the most wealth to this country located between Hawaii and Australia is very curious: as Tuvalu is allocated the .tv web domain, it receives huge revenues from audiovisual companies, such as Twitch.tv. The list of countries with the smallest economies includes many small islands in Oceania, such as Nauru, Palau and Kiribati, many of which are dependent on tourism.

11Onze is the fintech community of Catalonia. Open an account by downloading the super app El Canut on Android and Apple and join the revolution!

Espero amb delit veure la posició de Catalunya i encara més dels Països Catalans en el mapa global del PIB mundial.

Sobretot amb la relació PIB/habitants.

Tot arribarà.

Veurem…. Moltes gràcies pel teu comentari, Mercè!!!

Molt interessant. Gràcies.

Celebrem que ho hagis trobat tant interessant. Moltes gràcies pel teu comentari, Pere!!!

Molt interessant l’article, gràcies. El PIB de Xina encara no supera el dels EUA comparant en dòllars. En algun lloc he llegit que si la comparació es fa en paritat de poder adquisitiu, el Purchasing Power Parity, l’economia de Xina ja ha superat la dels EUA. D’altra banda, desconeixia que Tuvalu rebés una part important d’ingressos a causa del domini .tv, espero que els puguin mantenir els ingressos quan, degut al canvi climàtic, els seus 10 mil i escaig d’habitants hagin de deixar-les pel nivell creixent de les aigües.

Ben interessant, Jaume. Si uséssim, doncs, el Purchasing Power Parity, fora bo veure com quedarien tota la resta de països també.

Els imports per dominis d’Internet es cobren de cop; és a dir, és una compra d’un actiu, i, després, se sol pagar anualment una renovació. De manera que, probablement, a la gent de Tuvalu els interessarà vendre tants nous dominis .tv com sigui possible, abans no desaparegui el seu país. Gràcies per la reflexió, Jaume!

👍

🙏

M’ha cridat molt l’atenció de Tuvalu per veure com un país petit ha trobat un detall que el fa gran dins l’actual context d’Internet. Article, tot ell, molt interessant

La necessitat sembla que estimula solucions imaginatives.

Gràcies pel teu comentari, Francesc.

Ok 👍

🙏

👍

🙏

Es interessant veure la diferència entre els béns i serveis que conformen el PIB d’ Estats Units i el de la Xina. EE.UU. el basa en el monetarisme (finances i assegurances ) i la Xina fabrica. Potser hi té a veure l’abundància de mà d’obra barata en aquest gegant asiàtic.

Crida l’atenció que un dels causants del creixement del PIB xinès sigui el carbó, i també que el PIB de Líbia pugui créixer fins un 123% degut a l’exportació de petroli. No lliga gaire amb el discurs de la lluita contra el canvi climàtic i la disminució de la petjada de carbó.

Molt interessant la teva reflexió, Mercè.

Tot plegat, sembla mostrar que som massa lluny encara de les emissions zero i de la petjada de carboni neutra, que és el que hauríem de cercar, i exigir. Gràcies per comentar-ho!

👏

🙏

👌

🙏