“Banking saves money on customer service”

The digitisation of financial services has been accompanied by the massive closure of bank branches and cash machines. Is banking doing enough to prevent financial exclusion? Gemma Vallet, director of 11Onze District, explains in a new episode of Territori 17 of “La Xarxa”.

The financial sector is undergoing a process of unavoidable digital transformation. The digitisation of financial services is one of the economic macro-trends that have been implemented with Industry 4.0. Even so, this new trend, which seems unstoppable, poses new challenges. As Vallet points out, the trend is growing, and “there will be fewer and fewer customer service offices, that’s a given”.

Cashpoints that are in the process of being phased out and the closure of bank branches have led to greater digitalisation of the relationship between banks and their customers. This has meant a change in mentality and habits that not all the population has easily taken on board.

The risk of financial exclusion is real and, despite the government’s directives, the measures taken by banks to alleviate it have been clearly insufficient. “Surely the banks, to which people have given all their trust to provide a service, which they have stopped providing and save money on customer service, have an ethical and moral responsibility,” sums up Vallet.

A hybrid solution

In this context, there are alternatives that combine inexorable digitalisation with good customer service, without forgetting the importance of face-to-face interactions. As Vallet explains, “at the end of 2021 we launched a service, 11Onze at Home, where you can book an appointment through our website and talk to a person face to face”.

At the end of the day, the aim is to stop the dehumanisation of the banking system and for new technologies to serve as tools to bring financial services closer to the people, not to distance them, thus making sure a part of the population does not feel despised by the banking system.

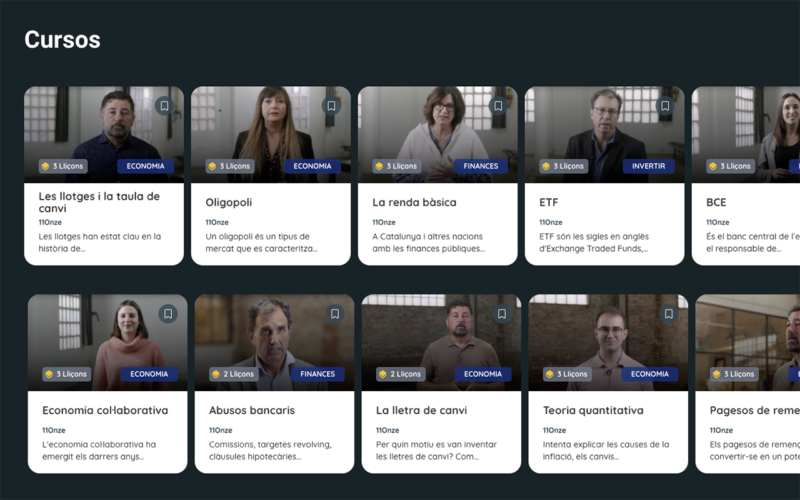

If you want to know more about the economic challenges ahead and how we can prepare to face them, you can listen to the whole conversation below!

Leave a Reply

You must be logged in to post a comment.

gràcies

Gràcies a tu, Joan!!!

👍

Gràcies, Alícia!!!

Es ben cert q la banca tradicional s’ha deshumanitzat, i entre d’altres motius, es per això q estem a 11Onze.

Gracies per ser-hi ✊✊

Gràcies a tu, Manuel, per formar part d’aquest meravellós projecte!