What would happen if the dollar lost its hegemony?

Although the US dollar is nowhere near losing its reserve status, the growing trend towards de-dollarisation is gradually eroding its place at the top of the global financial pyramid. What would be the consequences of ending the dollar’s supremacy as a trading currency?

Since the end of World War II, the US dollar has held the privilege of being the world’s main reserve currency. Even so, in recent years, several countries have redoubled their efforts to move away from the ties that come with relying on the greenback for all trade and financial exchanges.

According to IMF data, the dollar has gone from representing more than 70 per cent of global official reserves in the last two decades to 58 per cent today. This decline has accelerated dramatically over the last year as a result of the growing trend towards de-dollarisation as a defence mechanism against the abuse of economic sanctions by the United States.

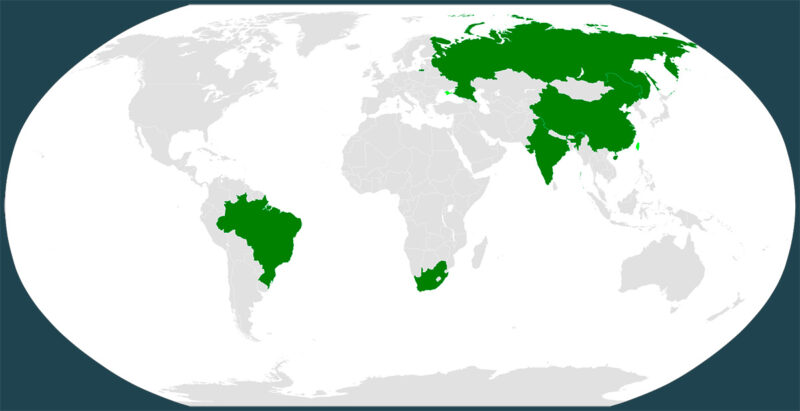

This has translated into other global actors encouraging the use of their currencies in bilateral trade and exponentially increasing their gold reserves. In this context, the group of emerging countries that form part of the BRICS economic bloc have not only promoted their own financial institutions with the aim of becoming an alternative to those of the West but are also working on the creation of a new single currency as a counterpart to the dollar for international transactions.

The importance of the petrodollar

The dollar’s status as the world’s reserve currency predates the creation of the petrocurrency known as the petrodollar, essentially, oil export revenues denominated in US dollars.

This currency standard was born in 1973 through an agreement, initially between the United States and Saudi Arabia, later extended to other OPEC countries, whereby oil-producing countries agreed to sell their oil in dollars in exchange for protection from the US and to reinvest their surplus in oil exports by purchasing US weapons and debt through Treasury Bonds. This is what is known as petrodollar recycling.

Put another way, after an oil crisis called into question the future of the dollar as a reserve currency, the US military became a de facto mercenary military force for theocratic regimes in the Persian Gulf in exchange for ensuring the dollar became the currency of choice for oil trading around the world, perpetuating its demand and value.

The cost of breaking off the monetary cartel

President Richard Nixon and Secretary of State Henry Kissinger had devised a perfect plan to keep the United States as the world’s only hegemonic power, but this arrangement depended on the loyalty of the producing countries to sell their oil exclusively in dollars and on the willingness of the United States to deal with these countries’ enemies in the region.

This explains many of the conflicts and wars that have taken place in the Middle East over the past 50 years. Any leader of the region who opposes selling his oil in the American currency – as Saddam Hussein and Muammar al-Ghadafi did – poses a direct threat to the petrodollar, i.e. to US hegemony, therefore these countries have to be “liberated or democratised” by military intervention.

The same interventionist foreign policy that years ago both the UK and US secret services had used against Iran. With the 1953 coup d’état, they overthrew the government by Prime Minister Mohammad Mosaddegh when the Iranian parliament voted to nationalise oil exploitation after the Anglo-Persian Oil Company (APOC) – now British Petroleum (BP) – refused to participate in an audit to verify it paid the contracted royalties and limiting its control over Iran’s oil reserves.

Saudi Arabia turns its back on the dollar

After nearly five decades of an exclusive relationship with the dollar, Saudi Arabia’s finance minister, Mohammed Al-Jadaan, announced at the 2023 Davos Forum that the kingdom is open to accepting local currencies for oil trading and reaffirmed his decision on his visit to India last September.

The fact that the petrodollar’s main supporter is joining BRICS countries that are already trading oil in local currencies, at a time when US imports of Saudi oil are at historic lows and Chinese purchases of the same crude continue to grow, suggests that the kingdom may be preparing for a paradigm shift in the international order.

To be clear, even if oil-producing countries accept other currencies, the dollar will not lose its relevance and international appeal overnight, but if the dominance of the US currency is diluted towards multipolarity, the current geopolitical and economic order could change considerably. Especially when we consider that Russia, Iran and Venezuela, which are under strict US sanctions, hold 40 per cent of the proven oil reserves of OPEC+ members.

Losing the unlimited credit card

Having the world’s reserve currency has allowed the US to run large deficits, both in international trade and public spending, without consequences. Losing the dollar’s hegemony would mean higher financing costs, reduced access to capital, a shock to the stock markets and a devaluation of the currency caused by a decline in demand for Treasury bonds. In other words, the United States, for the first time in many decades, would have to tighten its belt to avoid the collapse of a highly indebted economy.

On the other hand, the impact of a dollar devaluation would likely increase exports and decrease imports, thereby reducing the US trade deficit. In addition, other currencies and safe-haven assets such as gold would likely increase substantially in value in a context in which global capital rushes out of the greenback.

This de-dollarisation could help rebalance the world order and economies not aligned to the West. However, with the threat of the dollar’s possible demise as the world’s reserve currency, it is more than likely that the US and its client states will continue to use their military power to prevent, or at least prolong, the inevitable collapse of the empire.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

No estic en contra dels estats Units, però va sent hora que sigui mes equitatiu amb la resta del món. I no sigui la seva moneda la principal en intercanviar-se. Veure’m l’evolució d’aquest procés que com podem veure, no serà immediat.

Clar que no, serà un procés lent, però el món va canviant, i pel que sembla, els EEUU, per més que vulguin, no podran mantenir la seva hegemonia, al menys com ara estan fent… Moltes gràcies pel teu comentari, Cristian!!!

Estaria bé algun article sobre les possibilitats que el bitcoin pugui agafar embranzida gràcies a la desdolarització o a d’altres factors

https://www.11onze.cat/magazine/halving-bitcoin/

Gràcies pel teu suggeriment, Jordi. És un tema interessant que hem tocat indirectament en alguna peça, però ens ho apuntem i mirem d’escriure un article més concret sobre aquest tòpic.

👏

Gràcies, Daniela!!!

Bon article. Merci

Gràcies, Manel. Seguim a La Plaça!

Els imperis no duren eternament. Llàstima que perque petin normalment se’n necessita un altre igual o superior que prendrà el seu lloc.

Correcte, Mercè! Tot plegat forma part de la naturalesa humana i de la nostra pròpia evolució! Seguim a La Plaça!

Agraïda de les vostres anàlisis de l’actualitat

Gràcies, Laura! Seguim a La Plaça!

gràciess

Gràcies a tu, Joan!!!