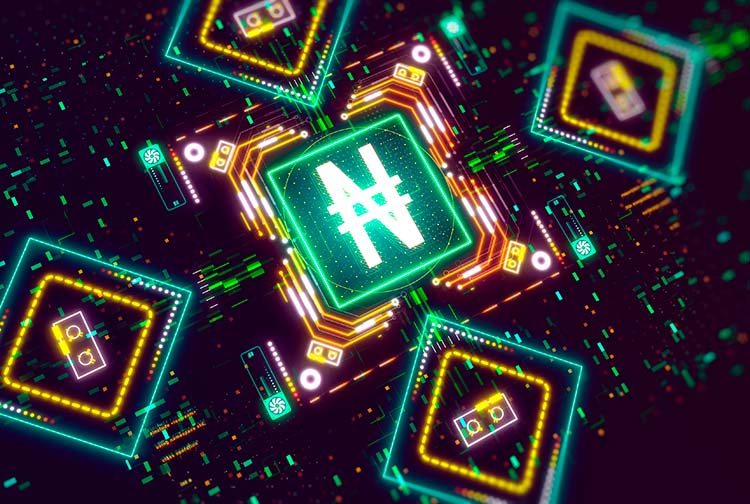

UDPN: cross-border payments for stablecoins

Una empresa xinesa va presentar a Davos l’Universal Digital Payments Network (UDPN), un nou sistema de pagaments transfronterers dissenyat per facilitar la interoperabilitat amb stablecoins i monedes digitals emeses pels bancs centrals (CBDC).

La Xarxa Universal de Pagaments Digitals (UDPN) es va presentar oficialment en el Fòrum Econòmic Mundial de Davos (Suïssa). L’objectiu d’aquesta nova xarxa, desenvolupada per Red Date Technology amb la col·laboració d’altres empreses del sector, és oferir a particulars i empreses una forma segura i sense fissures d’efectuar pagaments digitals amb stablecoins i CBDC.

L’empresa xinesa ho explicava d’aquesta manera: “Així com la xarxa SWIFT va crear l’estàndard comú original per a la missatgeria entre institucions financeres a través de diferents sistemes de liquidació, la UDPN tindrà el mateix propòsit per a la generació emergent de CBDC i stablecoins”

Compatible amb la majoria de CBDC i stablecoins

Les stablecoins o monedes estables, són un tipus de criptomoneda vinculada al valor d’una moneda fiduciària, com el dòlar estatunidenc. Això significa que el seu valor no fluctua tant com el d’altres criptomonedes, la qual cosa les fa més atractives per al seu ús en pagaments digitals. Per altra banda, les CBDC són monedes digitals emeses i controlades pels bancs centrals de cada país, que emulen a la moneda fiduciària del país on circulen.

La UDPN facilitarà l’intercanvi de stablecoins i CBDC entre diferents plataformes i moneders, la qual cosa permetrà a particulars i empreses fer-les servir per a una àmplia gamma de transaccions. La xarxa també proporcionarà un alt nivell de seguretat, utilitzant l’última tecnologia blockchain per a garantir que les transaccions siguin segures, ràpides i barates.

La xarxa ja està sent adoptada per grans empreses i institucions financeres, i s’espera que continuï guanyant tracció en els pròxims mesos i anys. Alguns dels principals bancs, HSBC, Standard Chartered, Bank of East Asia i Deutsche Bank, ja han anunciat la seva intenció a participar en la fase de proves.

Un gran interès del sector financer que demostra el potencial d’aquesta nova xarxa per a revolucionar la forma en què efectuem els pagaments digitals. Però que també posa en relleu la importància de la col·laboració internacional en el desenvolupament de noves tecnologies i plataformes.

Si vols que el teu negoci faci un gran salt, utilitza 11Onze Business. El nostre compte d’empresa i autònoms ja està disponible. Informa-te’n!

👍

Gràcies, Manel!!!

👍

Gràcies, Jordi!!!

Gràcies!

Agrair-te el comentari, Joan!!!

👌

Gràcies, Carles!!!

De nou tornem a la centralització dels bancs?

Ja veurem què s’inventaran, segur que alguna en porten de cap… Moltes gràcies pel teu comentari, Alícia!!!

Si volem tenir vot i veu com a país tan imprescindible és saber d’on venim com cap on anem. 🙏🏽

Molta raó, Mercè, i no tothom ho té tant i tant clar… Moltes gràcies pel teu comentari!!!

Molt bon article i esperem que tingui millor utilitat que no contratemps.

Celebrem que t’hagi agradat, Cristian, i moltes gràcies pel teu comentari!!!