Kakebo: the Japanese budgeting system

Do we really know how we spend our money? And, are we aware of what is important and what is not? Càrol Rafales, senior sales specialist at 11Onze, explains what the Kakebo budgeting system consists of and how we can adapt it to our personal situation.

The Kakebo budgeting system, which translates as “household ledger“, was devised in 1904 by Japanese journalist Motoko Hani. At a time when women depended on the money given to them by their husbands, Motoko wanted to provide Japanese women “with a tool that would allow them to manage their household finances efficiently”, says Càrol Rafales.

What do we need to put this budgeting system into practice? Very little, because it is designed to be very simple. As Rafales explains, “a blank notebook, a pencil, and a lot of perseverance“. Even so, we can buy a Kakebo book, specifically designed as a diary where we can keep track of our income and expenses.

Conscious consumption

In addition to managing our money, the Kakebo system helps us to avoid unnecessary purchases that we sometimes make irrationally. Only by focusing on analysing how money disappears from our account, will we become truly aware of our consumption habits. The graphs and tools found in the book will help us make decisions before making purchases and control recurring expenses.

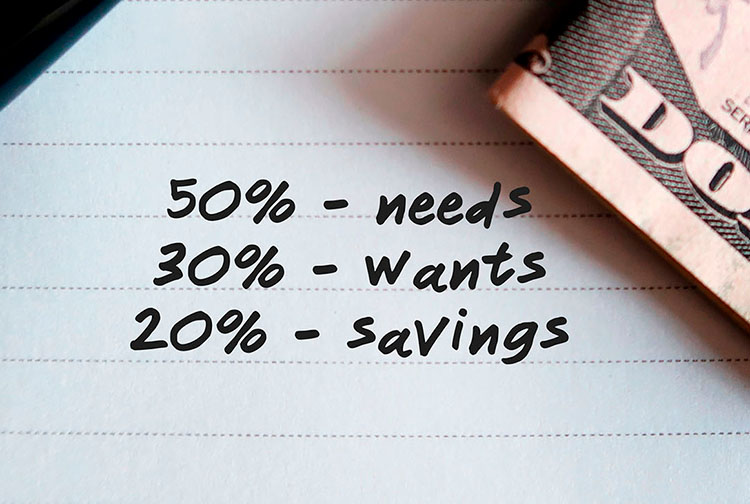

Kakebo divides monthly expenses into four categories: survival, leisure, culture, and other (non-anticipated). Based on these blocks, Rafales points out the basic premise of the method, “we write down the expected income for the month, subtract fixed expenses, and from the remaining amount we take out the savings target we have. What is left over is the budget for variable expenses. For a more detailed explanation of how Kakebo works, take a look at the video above.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Jo fa anys que em faig un excel no es ben bé aquest metode,però m’ajuda

Sí, hi han forces mètodes per poder-ho fer i cadascú tria el seu. Moltes gràcies pel teu comentari, Alícia!!!

Gràcies

Gràcies a tu, Joan!!!

Faig servir un sistema semblant de notes, amb bastants bon resultats. Bon article

La veritat és que hi ha molts mètodes per estalviar i alguns s’assemblen molt entre ells. Però al final, el que compta és que funcionin, oi? Gràcies per comentar, Francesc!

Molt bon mètode👌

Ho és, Jordi. Una de les millors maneres de prendre consciència del que gastem i de si és realment imprescindible fer-ho.

Molt ben explicat i agradable d’escoltar. Convenç !!

Moltes gràcies, Mercè!

Molt ben explicat!! Constancia i rigor…

Exactament això, Laura! Gràcies pel teu comentari!

Molt interesant, jo ja fa anys q utilitzo una fulla de càlcul amb el detall de cada sortida i entrada, i va molt bé per fer un seguiment.

Sí, molt cert, però estalviar, si es té un bon sou i les necessitats bàsiques més o menys cobertes, és possible aconseguir-ho mirant de gastar en allò que només és estrictament necessari. Malauradament, amb sous mileuristes o una mica més amunt del mileurisme, és totalment impossible, i a més a més, si hi ha imprevistos, que sempre n’hi ha… Moltes gràcies pel teu comentari, Manel!!!