Inflation devalues bank deposits

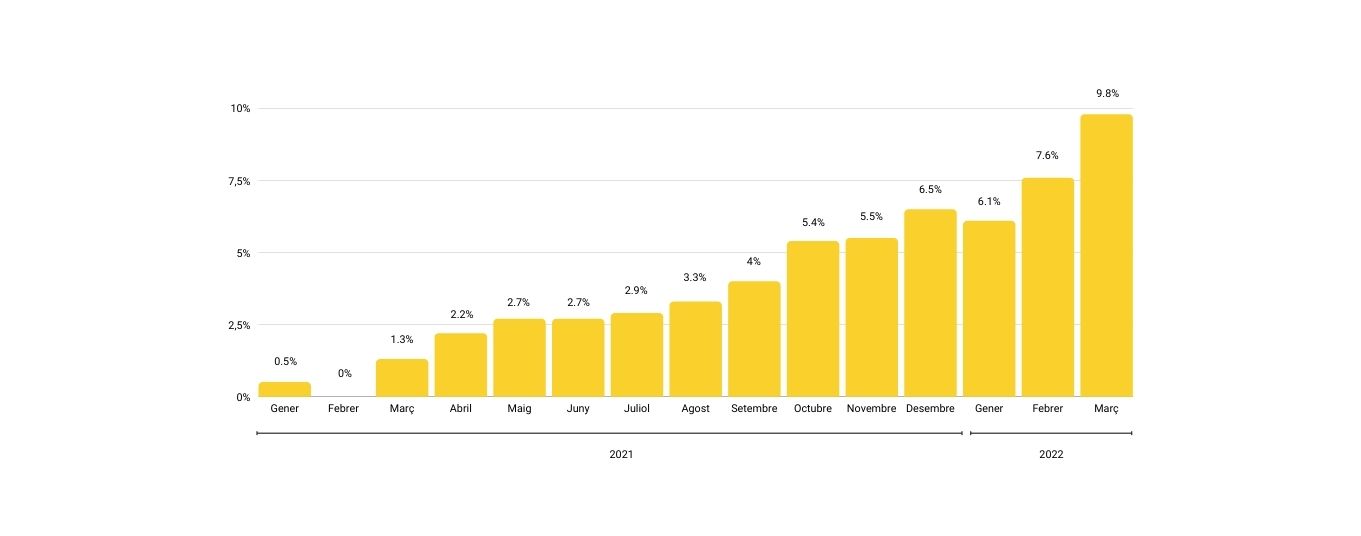

The March CPI stood at 9.8%, the highest rate since 1985. This means that in the last year we have lost almost 10% of purchasing power. But also, the savings we have in bank deposits have been devalued by the same percentage.

The Consumer Price Index (CPI) for March stood at 9.8%, the highest year-on-year rate since 1985. Prices rose by 3% in March compared to February, according to the leading indicator of the CPI published by the National Statistics Institute (INE). This is the biggest monthly increase since the 1970s.

The main culprits for this runaway inflation were electricity, fuel and food. It should be noted that the price of electricity generation stood at 283 euros/MWh at the end of March, compared with 45 euros/MWh a year earlier.

Core inflation, which does not take into account energy products and fresh food, stood at 3.4%. Although this is significantly lower, it is the highest since September 2008.

The last time year-on-year inflation in Spain exceeded double digits was in 1984, also driven by oil and energy prices. At that time, the government resorted to devaluing the peseta to halt the inflationary spiral, something that is not possible today.

Worse than expected

The CPI data worsen the forecasts that had been made by different organisations. For example, Funcas had calculated a year-on-year CPI of 8.6% for March.

Although the impact of the war in Ukraine is evident in this negative evolution, the increase is higher than in other European countries that are also suffering its consequences. German inflation in March, for example, is estimated to have been around 7% despite the fact that Germany is particularly affected by the energy crisis.

Inflation has developed very negatively with the recovery in consumption in recent months, which has coincided with some problems in supply chains and a significant increase in the cost of maritime transport.

Devaluation of bank deposits

The almost 10% increase in the CPI is equivalent to the de facto devaluation of bank deposits of households and firms. At the end of 2021, these accounted for 958.9 billion euros in case of households and 322.7 billion euros in the case of companies, according to the Bank of Spain. This means a loss of more than 90 billion for the former and some 30 billion for the latter.

Household and corporate savings reached record levels in 2021. In the case of individuals, the total volume increased by 4.6% compared with the previous year and in the case of companies, growth was close to 9%.

While deposit holders are being hit hard by inflation, at the other end of the equation are those with mortgages. The former have seen their savings lose almost 10% of their value, but those who pay mortgages benefit from the appreciation of their assets due to inflation without any increase in their repayments.

If you want to know more about superior options to make your money profitable, go to Guaranteed Funds. From 11Onze Recomana we propose you the best options in the market.

Leave a Reply

You must be logged in to post a comment.

gràcies

Gràcies a tu, Joan!!!

Sort que tinc plaques fotovoltaiques, i el preu de la llum no m’afecta gaire.

Sort que tens, Pere, i moltes gràcies pel teu comentari!!!

Com això continuï així, entrarem en col·lapse cap a finals d’any. Tant debò estigui equivocat.

Veurem, Manuel, però no pinta massa bé. Gràcies per la teva reflexió!

Nivells històrics sense precedents 😱 que està passant a l’economia?😅

Doncs jo diria que conflueixen diversos factors negatius que ho converteixen en la “tempesta perfecta”. Factors com ara la pandèmia, l’excés de diners en circulació i l’elevadíssim deute públic (i, per descomptat, la guerra a Ucraïna), convergeixen amb fenòmens com la “greenflation”, que és l’augment de preus pel fort increment en la demanda de minerals usats en les energies alternatives.

Gràcies pel teu comentari, Jordi!