Banking’s responsibility in regard to inflation

L’activitat bancària té un paper fonamental en la inflació. Quan el crèdit no es dedica a l’economia productiva, a la generació de nous productes o serveis, augmenta artificialment la capacitat de compra, la qual cosa trenca l’equilibri entre oferta i demanda i impulsa l’increment dels preus.

El negoci bancari no funciona exactament com la majoria de la gent creu. Tendim a pensar que els bancs són simples intermediaris financers que reben diners de part dels seus clients en forma de dipòsits per prestar-los a altres clients en forma de crèdits. I se suposa que els seus beneficis provenen del diferencial entre els interessos que paguen pels diners dipositats i els interessos que cobren pels diners prestats.

La realitat és molt més complexa. El que anomenem “dipòsits” no són tals perquè no es mantenen sota custòdia, sinó que hauríem de considerar-los préstecs que fem al banc. Al seu torn, els crèdits que concedeix una entitat bancària no són en realitat préstecs tal com els entenem.

Quan signem un préstec, el que fa el banc és comprar el nostre compromís de devolució de l’import nominal concedit, la qual cosa seria com un pagaré. No existeix necessàriament una transferència de diners físics del banc al nostre compte perquè el que denominem “dipòsit” no és més que l’anotació comptable d’un import que el banc deu al titular d’aquest compte.

Així és com els bancs comercials creen diners artificialment, com explica el mateix Banc d’Espanya. De fet, la immensa majoria dels dipòsits es generen a partir del no-res quan els bancs concedeixen crèdits, sense que estiguin recolzats per diners reals.

Crèdit productiu o improductiu?

Quan aquesta creació fictícia de diners serveix per finançar l’economia productiva, fent possibles inversions que generen nous béns i serveis, es manté l’equilibri entre oferta i demanda. Existeixen més diners nominals, però també més productes i serveis que es poden adquirir, amb la qual cosa no augmenta la inflació.

En canvi, si el banc genera artificialment diners per al consum i això no va acompanyat d’un augment en el volum de productes i serveis disponibles en el mercat, es trenca l’equilibri entre oferta i demanda. Com hi ha més diners disponibles per comprar el mateix volum de productes i serveis, es genera inflació. I, per desgràcia, la majoria dels préstecs no són productius, sinó que es dediquen a transaccions financeres que simplement permeten la transmissió de drets de propietat.

D’aquí la conveniència que la regulació contemplés una categorització del crèdit per evitar un excés de préstecs especulatius que disparin la inflació. Si la major part del crèdit bancari es dediqués a fins productius, tindríem un sistema financer més estable i una economia sana i sense inflació.

El marc normatiu actual fa aigües perquè es basa en la premissa que els bancs són simples intermediaris financers, quan en realitat creen diners artificialment i provoquen una espiral inflacionària, que moltes vegades acaba en l’esclat de les lògiques bombolles financeres.

Una possible solució

Alguns països han aconseguit evitar aquest problema gràcies a sistemes financers dominats pels bancs comunitaris, que no prioritzen l’especulació financera sinó el crèdit productiu. A Alemanya, per exemple, aquest tipus de bancs petits dominen el mercat i destinen la major part dels seus crèdits a les pimes.

Sens dubte, gran part de l’èxit econòmic alemany dels últims 200 anys es deu al seu sistema financer, que mai ha necessitat diners públics per rescatar a algun dels seus bancs ni ha fet perdre dipòsits als seus clients.

Per estabilitzar i millorar l’economia catalana, seria convenient trencar amb l’actual lògica del nostre sistema financer i impulsar la creació de bancs comunitaris que prioritzin el finançament de l’economia productiva.

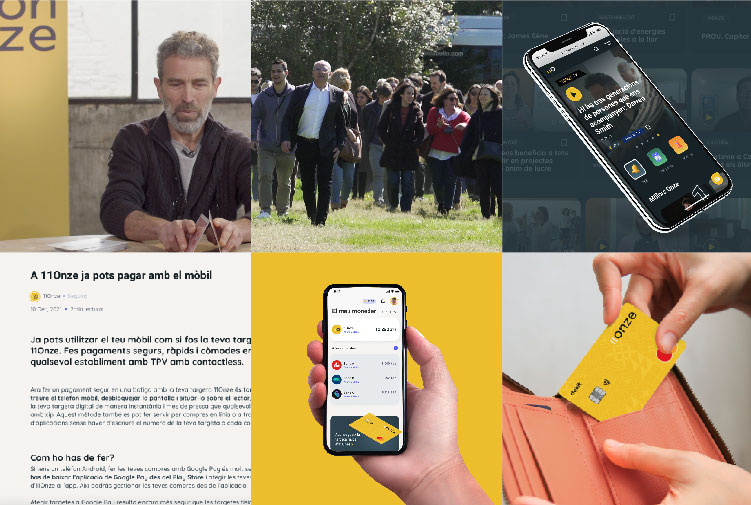

Si vols que el teu negoci faci un gran salt, utilitza 11Onze Business. El nostre compte d’empresa i autònoms ja està disponible. Informa-te’n!

Leave a Reply

You must be logged in to post a comment.

Prioritzar l’economia productiva amb comunitats financeres, aquest es el vertader aprenentatge, ara bé abans cal parlar o apendre a diferenciar les economies productives de les que no ho són. Gràcies per l’article👍

Com sempre, l’aprenentatge i el coneixement és la base de tot, per poder prendre bones decisions. Gràcies pel comentari Jordi.

Gràcies!

👍

Molt necessari a la nostra vida el corporativisme, el servei comunitari i el compartir coneixament, expertesa sabiesa, recursos i guanyar-hi tots. Treballar a petita escala amb proximitat i per a les necessitats eeals del col.lectiu

Doncs sí, Laura, és així mateix, i moltes gràcies pel teu comentari!!!

Crec que no vaig errada si dic que la sèrie “Els diners” ens va deixar bocabadats a una majoria pel que fa a la idea que teníem de com es creen els diners. El desgavell financer mundial fa necessari tornar-ho a explicar, i no hi ha dubte, s’entén perfectament. Com també s’entén perfectament la visió de futur i la clarividència al crear 11Onze, la primera fincom catalana, la banca comunitària que necessita Catalunya.

Diagnòstic, solució explicada, i aplicada en un any. 👌 Grans arguments per confiar-hi.

És exactament això el que pensem des d’11Onze. Moltes gràcies pel teu comentari, Mercè!!!