These are the world’s biggest banks

For yet another year, Chinese banks top the global ranking of the world’s most valuable banks, extending their dominance over their Western counterparts amid rising interest rates and slowing global economic growth.

The world’s major banks play a crucial role in the global economy, facilitating international trade, lending to businesses and providing financial services to millions of customers around the world.

This is particularly relevant in the current economic climate where many countries are trying to revive their economies while improving their fiscal balance sheets remains a challenge for their banking systems, given declining business volumes and lower demand for credit.

The combined value of the world’s 500 most valuable banking brands reached a record $1.44 trillion in 2023, almost double what it was a decade ago, according to a report by Brand Finance, the world’s leading brand valuation consultancy.

As every year, the main economic analysis and research entities compile data to publish the ranking of the best-positioned financial institutions according to their market share, turnover or consolidated assets.

The dominance of Chinese banks

Beyond brand value, the ranking of the world’s largest banks varies according to the parameters we take into account. Even so, the dominance of Chinese banks extends not only to the value of their assets, but they are also leaders in other parameters of banking activity such as deposits, loans, and the number of customers and employees.

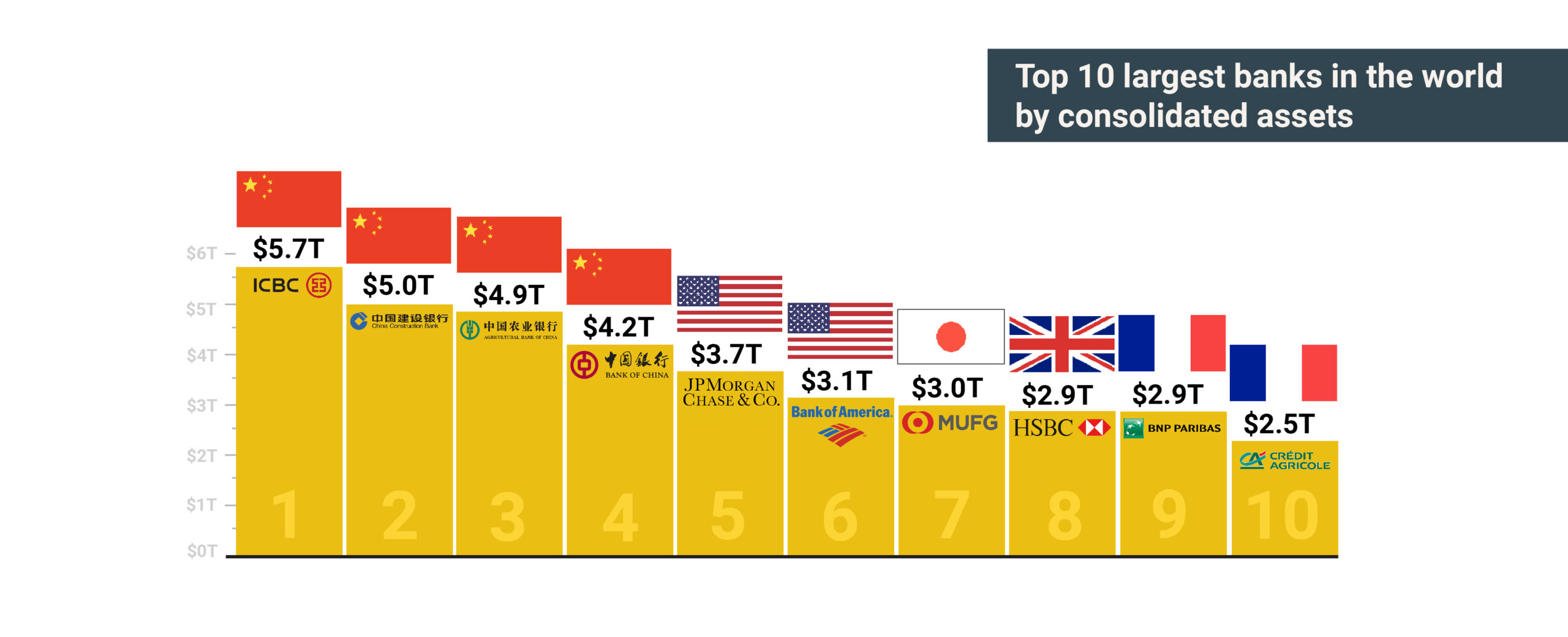

Thus, the Industrial and Commercial Bank of China (ICBC), China Construction Bank, Agricultural Bank of China and Bank of China once again top the list compiled in a report by S&P Global Market Intelligence.

According to S&P, these four Chinese banks increased their assets by 4.1% in 2022, to a combined total of 19.8 trillion dollars. Moreover, Chinese banks already account for more than a third of the assets of the world’s largest banks.

Two US banks, JPMorgan Chase & Co and Bank of America, are next in the ranking, with the top six US banks accounting for $13.7 trillion in assets. They are followed by Japanese and European banks. In Spain, Banco Santander is in 17th position and BBVA in 46th.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Leave a Reply

You must be logged in to post a comment.

👍

Gràcies, Jordi!!!

Crec que aquestes entitats financeres ja fa temps que s’estan fent amb el deute de països del sud de la UE, amb el que això pot suposar,…

Cert, ball de titellaires

Mica en mica van canviant els equilibris entre les grans potències econòmiques

Està claríssim. Encara que no ho vulguin, els EEUU, a la llarga, aniran perdent força… Moltes gràcies pel teu comentari, Francesc!!!