Who will buy US debt?

The US House of Representatives approved the deal to raise the debt ceiling by a large majority on Wednesday. A day later, the text also passed the Senate vote. But how will this public deficit be financed?

Winston Churchill is credited with saying: “Americans can always be trusted to do the right thing, once all other possibilities have been exhausted”. The pantomime accompanying the cyclical political tug-of-war of the US debt ceiling debate seems to confirm the words of the indomitable British ‘Bulldog’.

As expected, after tense negotiations, legislators from both parties have approved, at the last minute, the agreement to raise the debt ceiling, avoiding the devastating impact that a default would have on the economy. The deal proposed by Kevin McCarthy and Joe Biden – put to a vote in the House of Representatives on Wednesday – passed with 314 votes in favour (165 Democrats and 149 Republicans) and 117 votes against.

The agreement had until 5 June, when the country is expected to exceed the current debt ceiling, to be ratified with a second vote in the Senate. A mere formality that was consummated the day after, also with a large majority (63 – 36). The bipartisan agreement will suspend the spending limit set by Congress until 1 January 2025, shortly after the presidential elections scheduled for November 2024.

The GOP proposals have forced a reduction in the government deficit by about $1.5 trillion over the next decade by agreeing to essentially freeze funding that does not affect the defence department. This falls short of the 7 per cent increase demanded by Democrats, but, in return, the $369 billion in incentives requested by President Joe Biden for clean energy stay in place.

Major national and foreign creditors

The US government issues Treasury Bonds as its primary method of debt financing. These bonds are debt securities issued by the government under a promise to pay a fixed amount of interest over a fixed period of time. They are considered a safe investment due to the fact that the US government has maintained an impeccable record of debt repayment. Treasury bonds are sold through auctions and are available to both domestic and foreign investors.

Much of the current $31.4 trillion debt is held by the public ($24.6 trillion) in the form of financial securities issued by the Treasury Department. In other words, it is financed by private US investors through mutual funds, pension funds, insurers and banks. As well as through the Federal Reserve and the country’s central bank, or government agencies such as Social Security.

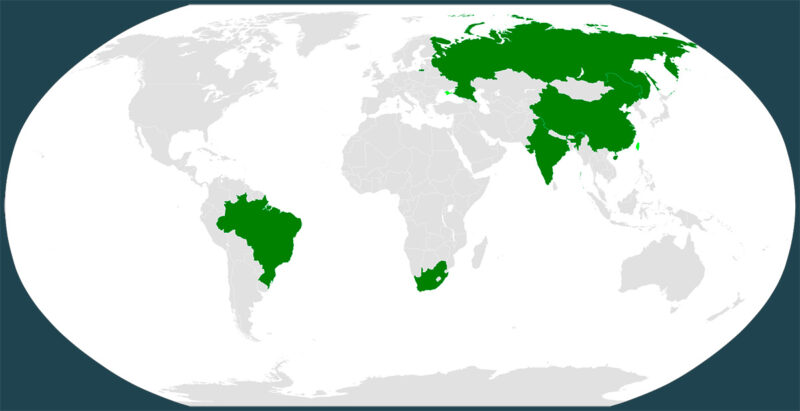

The remainder, some $7 trillion, is split 50/50 between central banks and foreign private investors. Specifically, Japan (1.087 trillion), China (869 billion) and the UK (655 billion) are the largest foreign holders of US debt. Foreign demand for Treasuries fell by 6% over the course of 2022 because of the strong dollar and rising interest rates but has been recovering during the first quarter of this year.

An unsustainable amount of debt?

Despite the current astronomical debt, the Congressional Budget Office (CBO) forecasts that US public spending will increase by $6 trillion to $10 trillion over the next ten years. This would double the fiscal deficit from $1.3 trillion to $2.7 trillion over the same period, reaching a debt figure of about $46 trillion in 2033. This amount of debt will not be easily absorbable given that net interest costs will triple to $1.2 trillion per year.

This increase in debt financing costs could leave out important public investments that drive economic growth, further diminishing the country’s ability to pay its debt. It also leads to higher inflation and an erosion of confidence in the US dollar, a key element in guaranteeing the US giant’s ability to borrow without consequences.

Against this backdrop of distrust in the US government’s ability to control its spending, it is not surprising that central bank gold purchases reached record highs over the past year and show no sign of slowing down in 2023. Other countries are not only buying record amounts of gold as the main safe-haven asset but, despite a slight recovery in recent months, overall they are still reducing their dollar reserves. These actions make it clear that addressing the national debt problem is an essential part of securing the economic future of the United States, but also of the established international monetary system.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Leave a Reply

You must be logged in to post a comment.

Tots els paisos s’estàn endeutant. Mireu Espanya. Segons les teories conspiratives, sembla que vulguin que petin els paisos i que siguin els grans empresaris els qui manin en el món.

Sí, Jordi. En el fons, això ja és una mica així, perquè els grans tenidors del deute sobirà dels països són privats.

Gràcies per la teva reflexió!

Gràcies!

Gràcies, Joan!!!

Anar xutant la pilota (del deute) endavant… fins que peti.

En el títol de l’article:

***Un dia després, el text també ha… (en català jo diria, L’endemà, el text també ha…)***

Moltes gràcies pel teu comentari, Miquel!!!

👍

Gràcies, Manel!!!