How much money should you keep in the bank?

Amb l’actual inflació, els diners al banc no fan més que perdre valor dia rere dia. Però sempre és necessari mantenir una mica de liquiditat per si sorgeix algun imprevist. Per això els experts recomanen tenir un “matalàs” d’efectiu en els teus comptes d’estalvi que cobreixi com a mínim tres mesos de despeses.

La vida està plagada d’imprevistos. També en el pla econòmic. A vegades són positius, com un augment de sou, però a vegades hem d’afrontar sorpreses desagradables que fan mossa en la nostra butxaca. Pot ser des d’una despesa puntual extraordinària, com quan hem de reposar un electrodomèstic vell de casa, fins una cosa més seriosa, com patir una malaltia incapacitant o quedar-nos sense treball.

Per fer front a aquestes eventualitats, és necessari disposar d’un fons d’emergència. L’antic costum de guardar els diners en el matalàs o en qualsevol altre amagatall de la casa et permet disposar d’ells de manera immediata, però és poc recomanable pel risc de robatori i la nul·la rendibilitat.

És preferible recórrer a les entitats bancàries, tot i que has de tenir en compte el límit del Fons de Garantia de Dipòsits d’Entitats de Crèdit per a que els teus diners sempre estiguin protegits.

Assegura els teus estalvis

Com detalla el seu web, aquest organisme “té per objecte garantir els dipòsits en diners i en valors o altres instruments financers constituïts en les entitats de crèdit, amb el límit de 100.000 euros per als dipòsits en diners”.

Això desaconsella tenir més de 100.000 euros en comptes i dipòsits a termini d’una mateixa entitat, ja que el fons només cobrirà fins a 100.000 euros per titular en cas que el teu banc faci fallida.

Si, per exemple, tinguessis 120.000 euros en una entitat que ha fet fallida, encara que fora en diversos comptes o dipòsits, aquest organisme només et retornaria 100.000 i perdries els altres 20.000. D’aquí la conveniència de repartir els diners entre diverses entitats per a que els comptes i dipòsits no superin el límit garantit en cap d’elles.

De quant parlem?

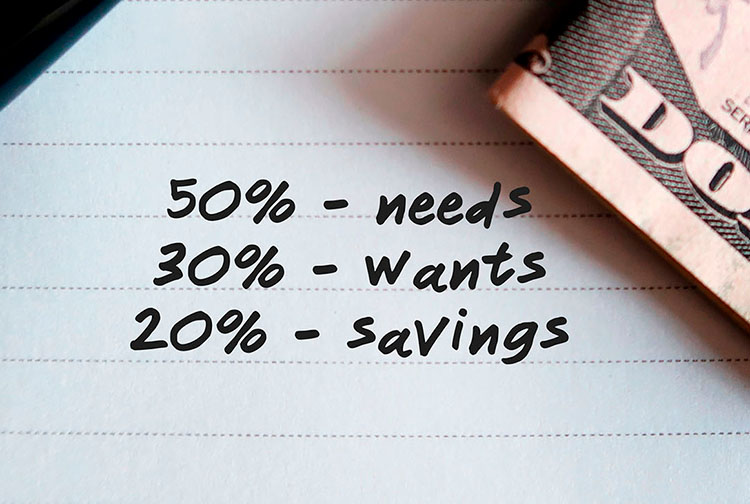

Només en casos molt excepcionals el nostre fons d’emergència hauria d’assolir aquests 100.000 euros, especialment en un moment com aquest, en el qual l’elevada inflació fa que els diners dipositats al banc perdin valor mes rere mes. De totes maneres, l’import òptim dependrà en última instància de les nostres circumstàncies personals: bàsicament, quines són les nostres despeses previstes i amb quins ingressos podríem comptar en cas d’un esdeveniment negatiu.

Els experts solen recomanar que el coixí financer cobreixi com a mínim tres mesos de despeses. Cal tenir en compte que mantenir un saldo massa baix en el nostre compte ens pot fer entrar en números vermells amb facilitat, la qual cosa generaria despeses financeres pel descobert.

L’OCU, per exemple, indica que una quantitat prudent en els comptes corrents “pot ser l’equivalent a tres mesos del teu salari”. No recomana més perquè aquests comptes “no són el millor lloc per a mantenir els nostres estalvis, ja que pràcticament cap entitat les premia amb interessos”.

Quant al màxim, no sol recomanar-se més del necessari per a cobrir sis mesos de despeses. De fet, el portal ‘Finances per a tots’, una iniciativa del Banc d’Espanya, la Comissió Nacional del Mercat de Valors i el Ministeri d’Assumptes Econòmics i Transformació Digital, aconsella “acumular un fons equivalent a entre tres i sis mesos de despeses”. A partir d’aquí es tracta de buscar inversions que garanteixin una bona rendibilitat.

11Onze és la fintech comunitària de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!

Ho tindré en compte.

Molt bé, Pere, tu mateix…., i moltes gràcies pel teu comentari.

Gràcies!

Moltes gràcies a tu, Joan!!!

Per a tenir en compte tot i que per a molts això és molt dificil d’aconseguir

Doncs sí. Moltes gràcies pel teu comentari, Alícia!!!

A dia d’avui, alguns bancs ofereixen interessos per l’estalvi de l’ordre de 0,25% no és gaire però estan garantits fins als 100.000€

Són propostes a contemplar, tot i que no són suficients, ni de bon tros, per a combatre les altes inflacions actuals… Seguim!

Molt bó aquest. 👌

Moltes gràcies, Carles!!!

Bon article, merci

Moltes gràcies, Manel!!!

Està bé aquests article, posa xifres als consells. Gràcies.

Sí! Les xifres aclareixen molt la situació. Gràcies Mercè!

D’acord, ho tindrem en compte👍

Seguim! 😉