Mobilize the savers to finance NATO

Military spending is at the centre of the debate because conflict is increasing. At the same time, the public debt of the Member States far exceeds the limits of the EU Stability Pact. Will the military necessity drive the union of European capital markets? Are they looking to capture citizens’ savings for the war?

The North Atlantic Treaty Organization was born in 1949 with a very clear objective: to protect the member countries of the Soviet Union. The current situation, with the entry of Sweden and the interest of most of the countries bordering Russia, forces us to have a look at the military spending of the member states. The war in Ukraine has turned Europe into a powder keg and the EU seems determined to maintain the onslaught with or without the help of the United States.

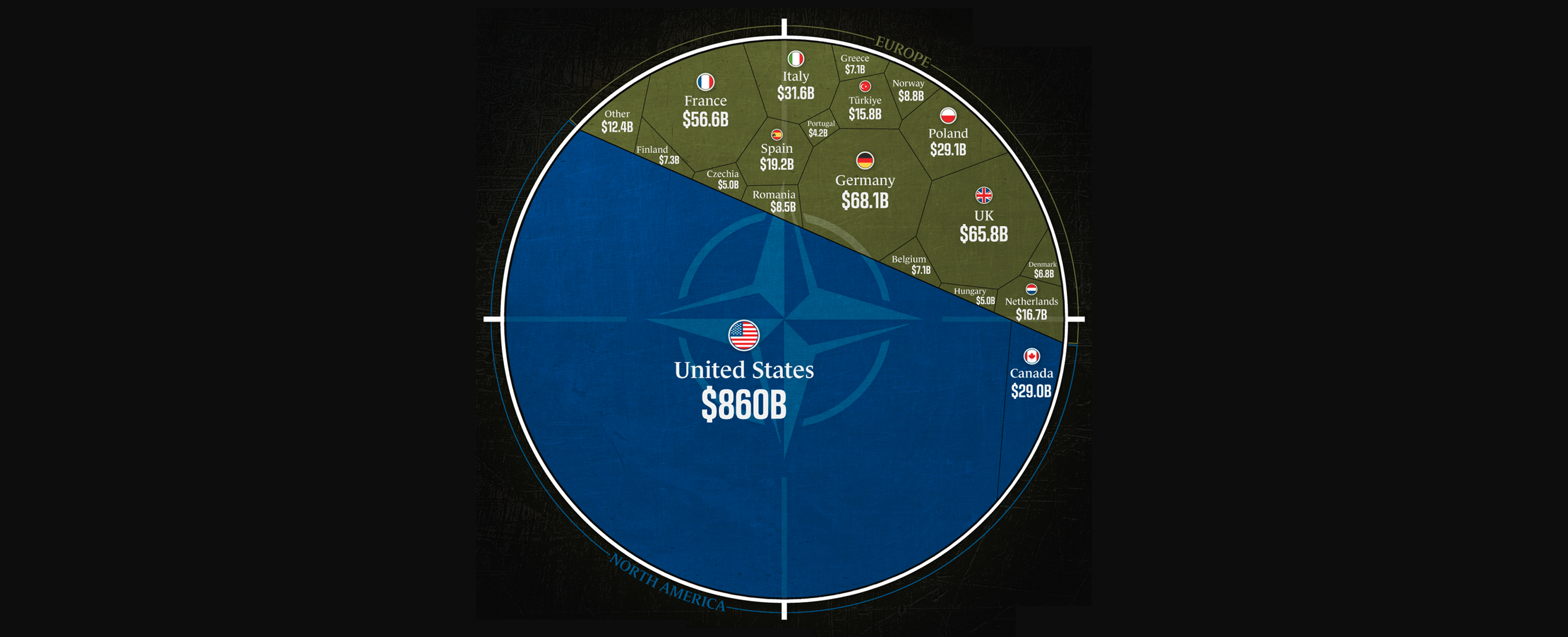

At this point, it is necessary to pay attention to who finances NATO since, the candidate for the presidency of the United States Donald Trump, announced that if he were to become president again he would not protect the countries that do not pay their part of the budget of the Atlantic Alliance. And it is true that around 69% of the budget is provided by the United States, reaching 860,000 million dollars. Therefore, it is true that the American contribution is much higher than the 68,000 million of Germany, the 66,000 of the United Kingdom or the 19,000 of Spain.

Who tries harder?

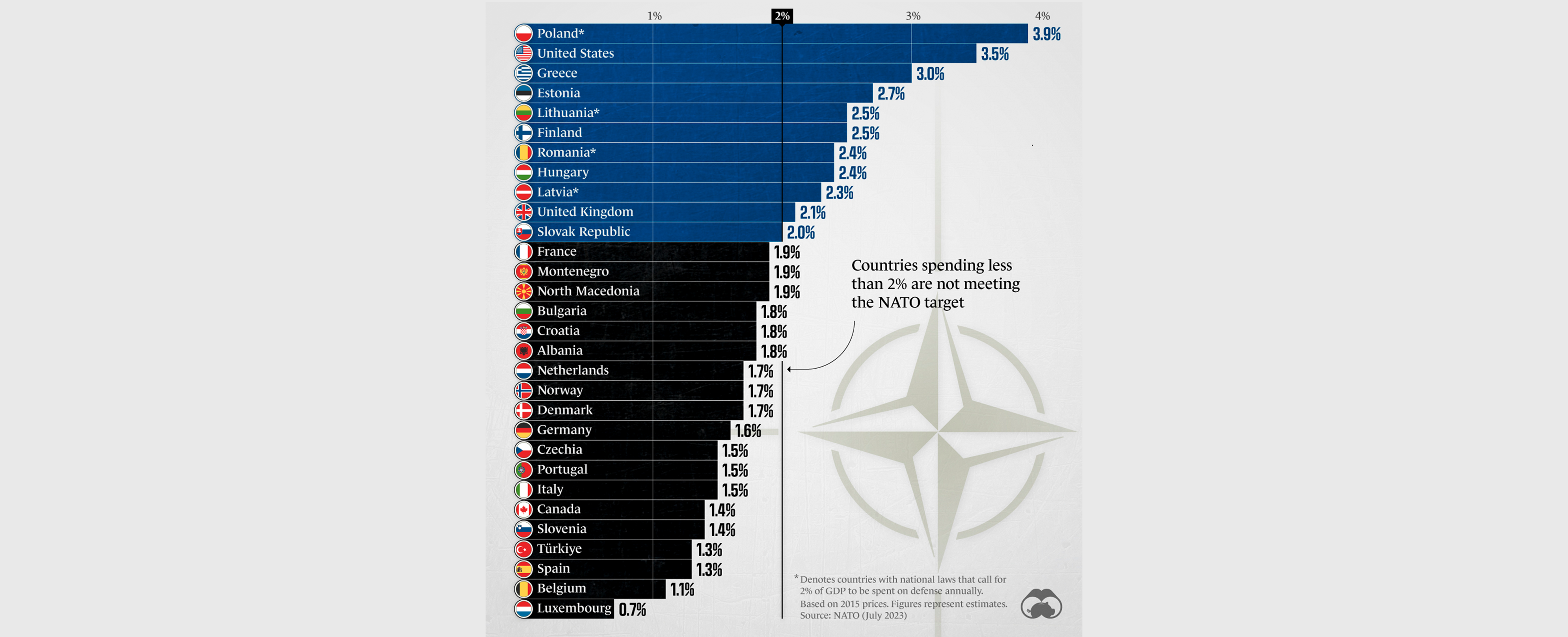

But it is necessary to put in context the contribution of the Member States because the effort is not the same for all economies. The objective is for each member to contribute at least 2% of their GDP. As we can see in the graph, there are many countries, including Spain, that do not inherit. But we also see interesting facts: Poland contributes, proportionately, more than the United States. And some of the countries that struggle the most border Russia and many were part of the Soviet Union, that is to say, they fear Putin based on common history.

European public debt

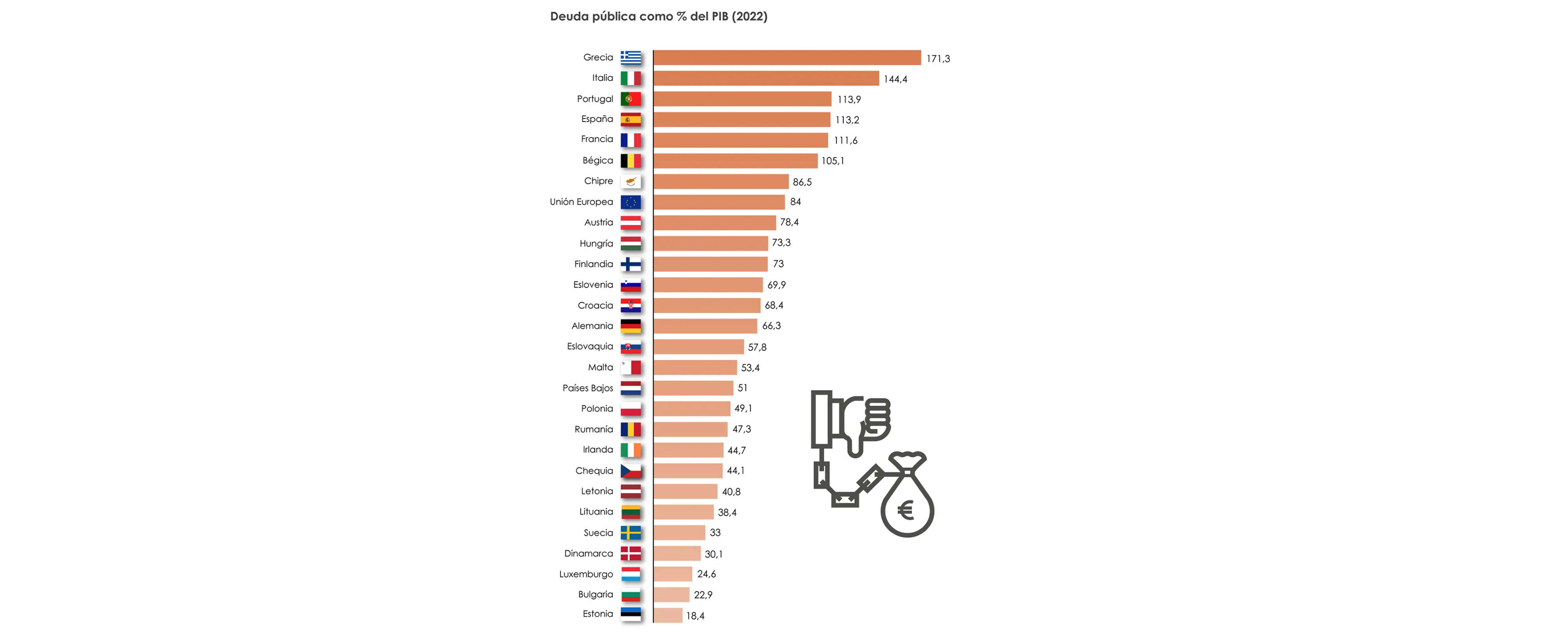

Given this situation, it should be remembered that the president of the European Commission, Ursula von der Leyen, announced her intention to continue increasing defence spending in the countries of the European Union. And here is another problem: most countries exceed the 60% debt allowed by the renewed Stability Pact. In other words, European countries must reduce their public debt at the same time that they are obliged to increase their military spending. Is it possible to square the circle?

Where will the money come from?

Although it is true that the Stability Pact of the EU includes the exception to deviating from the debt objectives for reasons such as defence, it is also true that large deviations would affect the credibility of the European countries in the markets, so it would be more difficult to finance.

In this context, a piece of news that has gone largely unnoticed, which is the intention to promote the union of European capital markets, gains particular importance. This is an old proposal that the French government is leading and that has Spanish support, but still does not have the German approval. Germany wants the 27 countries to join the union of capitals suddenly, while France sees it as impossible and plans to do it in phases.

The idea is to launch a common savings product to attract private capital. In other words, they want to attract the deposits of the citizens of the European Union. According to the French finance minister, Bruno Le Maire, it is necessary to “put the Europeans’ savings to work” to boost the massive investments that the European Union must make in the coming years. The official discourse is that capital must be obtained so that European startups do not end up asking American or Persian Gulf investors for money to advance their projects. Therefore, the idea would be to promote a certain economic independence from the EU. But the truth is that these massive investments have two-star themes: the energy transition and defence.

In this way, everything points to the fact that, during 2024, we will see the birth of a European investment product that will serve for EU countries to increase their participation in NATO without damaging much more their already punished public debt. The mobilization of savings for the war has already begun.

Leave a Reply

You must be logged in to post a comment.

Una anàlisi punyent. Una vegada més caldrà preguntar-nos què en fem dels nostres estalvis.

M’,han agradat les reflexions que planteja aquest article.

Nosaltres hem de poder fer el que ens sembli dels nostres estalvis, l’estat i la generalitat se n’haurien de guardar prou de fotrel-hi mà i atracar-nos, que ja prou que ens roben amb impostos, multes i d’altres…

“Llei Orgànica de Seguretat Nacional” (LOSBN), aprovada el 2015 a Espanya. Aquesta llei estableix els principis bàsics i les disposicions generals de la seguretat nacional espanyola. Una de les disposicions que potser estàs mencionant és la possibilitat que contempla aquesta llei perquè l’Estat prengui el control o faci servir els recursos privats en situacions excepcionals, com ara en cas de crisi o emergència nacional.

Estem ben arreglats si l’estat nacional de “ñ” pretén fer servir els nostres recursos privats (estalvis / diners per viure) per als seus fins, interessats…. Aquesta llei existeix, ja estem tardant en sortir tots al carrer!

Malhauradament la guerra va amb l’humanitat,i és un negoci lucratiu,ens hem de preguntar quins son els pisos europeus amb mes deute

Molt cert, Alícia. Aquests depravats no haurien de rebre ni un sòl cèntim dels nostres estalvis… Moltes gràcies pel teu comentari!

gràciess

Gràcies a tu, Joan!!!