The first anniversary of Preciosos 11Onze

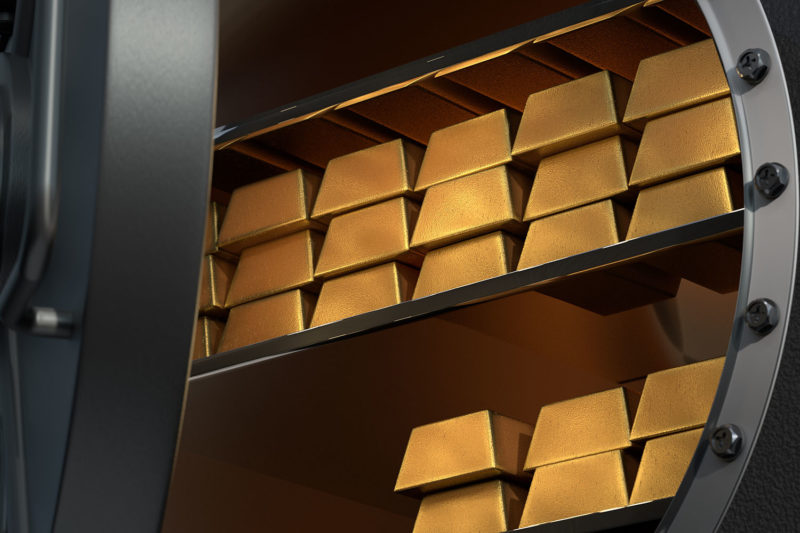

In February 2022, we launched Preciosos 11Onze to offer members of our community the opportunity to buy gold to protect themselves against inflation. One year later, the evolution of the gold price proves why this precious metal is the ultimate safe-haven asset when it comes to securing our savings.

Although 2022 was presented as the year to consolidate the economic recovery, the disruption of the supply chain, the rise in the price of raw materials, the debt crisis and the international geopolitical situation ensured an inflationary context that would reduce the purchasing power of many families.

Faced with this scenario, at 11Onze we advised diversifying savings, converting money into assets that would not lose value. It was clear to us that buying gold was one of the few resources people had to safeguard their money. Thus, with the launch of Preciosos 11Onze we provided our community with the best option to protect their savings.

The loss of credibility of the international monetary system triggered a surge in demand for physical gold at major mints around the world. Not only were central banks buying gold to secure their capital reserves in the face of economic uncertainty, but small investors were also buying large amounts of gold to protect their wealth. This has led some gold dealers to deplete stocks of coins and bullion, extending delivery times when new orders are placed.

The antidote to inflation

One year on, rising prices, together with the loss of the real value of the currency, have led to a large reduction in the monetary wealth of the population, who have seen their savings vanish without even leaving the bank. Even so, the upward trend in the price of gold confirms our forecasts.

While year-on-year inflation in Spain in 2022 was 8.4%, Preciosos 11Onze gold has risen by 10.25%. From €1,599 per ounce of gold on 1 February 2022, it has risen to €1,762.86 today. Or in other words, the strong performance of the gold price has counterbalanced the currency stress caused by the loss of value of the euro.

This means that if we had left €10,000 in the bank, these savings would have lost 8.4% of their value, and would be worth €9,160 today. Whereas if we had invested them by buying gold, their current value in gold would have increased by 10.25% to €11,025.

Widespread economic slowdown

According to a report published by the World Bank, global growth in 2023 is expected to slow for the second year in a row and experience its third-weakest pace in almost three decades. This sharp slowdown in growth will be broad-based, stagnating at 1.7% in 2023, and improving slightly to 2.7% over the course of 2024.

It also predicts that investment in emerging markets and developing economies will remain below the average of the past two decades. It points to monetary policies and tight global financial conditions as one of the main causes of the slowdown in growth.

Although economic analysts expect Spain to avoid recession, GDP growth will fall back to 1% in 2023, mainly because most households no longer have a savings cushion to sustain their consumption spending. However, this trend is expected to change in 2024, thanks to the global economic upturn.

In any case, the almost zero growth forecast for the eurozone economy as a whole, and the recession that some of the main exporting countries, such as Germany, will experience, lead experts to agree that the demand for gold will continue to rise in 2023. Perhaps this is why Forbes magazine has published a report explaining why, even today, owning gold is better than owning money.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Leave a Reply

You must be logged in to post a comment.

Gràcies, seguim endavant!

Jo vaig comprar ara fa un any, tot i q no va ser fins a l’abril q es va materialitzar la operació.

Ara fa un dies vaig tornar a omplir el formulari per fer una altra compra. Per cert quant trigueu aproximadament en contactar?

Gràcies!!!!! 💛

Hola Manel! Just l’endemà de rebre el teu formulari et varem trucar en 3 ocasions. Avui el nostre company Joan et torna a trucar. Salut!

Hola, Manel, bon dia! Ja estem altra vegada en activitat!! Ho estem gestionant! Gràcies a totes per tan alta participació!

El titular és mol enlluernador. Però compte, aquest 10% queda diluït amb el que va suposar el cost de l’operació de compra, per la qual cosa, només en el moment d’adquirir l’or es van perdre uns 10€ per gram de mitja, segons el que vaig calcular en el seu moment.

Si la compra es fa encarregar al febrer, amb tot el procés no es va fer efectiva fins el 21 d’abril en el meu cas, moment en qual va costar uns 64€ per gram de mitjana (segons el gramatge dels lingots tenen un preu o un altre), la cotització del mateix dia era de 54 €, i a dia 1 de febrer d’engauny estava a 57 €

Per tant, paciència. Que encara no hem recuperat el cost de l’adquisició i hi haurem d’afegir el cost de la custòdia del segon any. I quan s’hagi de vendre, també s’haurà de comptar el cost de la venda.

Gràcies Quico. Només 2 apunts. El primer és que aquest article fa un analisi general anual i agafa per referencia les dades que corresponen per poder donar un analisi. No és u cas per cas mes a mes. Per si de cas com dius en el teu cas hauries de com parar les dades despres de 1 any de la compra efectiva. Es a dir finals d’abril.

El segon punt molt important és entendre bé el rol primordial de l’or d’inversió. Que és el de reserva de valor que permet lluitar contra la perdua de valor del diner que pot ser ocasionat per l’inflació o pitjor la devaluació de la moneda. Aquests dos factors precisament el 2022 s’han donat a la vegada . L’Euro ha baixat un 15% respecte al dollar i l’inflació a reduit el poder adquisitiu d’aquests mateixos euros un 8%. Amb aquestes dades sobre la taula no hi ha cap dubte de l’or ha resistit millor que qualsevol altre reserva de valor a la perdua de valor adquisitiu dels estalvis. Aquesta es la seva feina. Un altra cosa es la compra venda d’or amb l’objectiu de guanyar plusvàlua en l’operació. Per entrar en aquest tipus d’operació és recomanable tenir un mercat secondari segur i transparent.. hI estem treballant.🙏🏿

Sii, el titular promet!! Però realment això de l’or costa acceptar també els costos de la compra – venda, la custodia i les revaloritzacions… Quan toques petites quantitats de diners, personalment em va fer enrera tot plegat

👏👏👏👏👌