European failure in financial literacy

Only one in three adult European citizens has a minimum level of financial literacy, according to a new report by the Organisation for Economic Co-operation and Development (OECD). This means that most people need to gain the necessary knowledge to manage their money effectively.

Financial literacy is a necessary skill that is essential for everyday citizens. It is difficult to make the right decisions when managing a household, planning savings, applying for credit or taking out a mortgage if we do not have a minimum level of financial literacy.

In this context, and amid the debate on the poor academic results of Catalan students in the fourth year of ESO in the PISA tests, the Organisation for Economic Cooperation and Development (OECD) presented a devastating report on financial education in Europe. According to this study, only 34% of European adults have a minimum level of financial literacy. Therefore, a large proportion of citizens do not have the necessary skills to manage their finances effectively.

Only Irish and German citizens achieve the minimum financial literacy threshold of 70 out of 100. This is a worrying result given the pressures on household budgets in the current economic climate, which increases the risk of indebtedness and other economic downturns.

Financial literacy at an all-time low

While 84% of adults in the 39 countries participating in the survey understand the definition of inflation, only 63% know how to apply the concept of the time value of money to their savings. Specifically, how inflation impacts the time value of money by reducing the purchasing power of money over time.

Furthermore, although the results show that around 77% of adults understand the relationship between risk and reward, only 42% of respondents across all countries can correctly answer a question about compound interest (interest that is added to the initial principal and on which new interest is generated). Even among adults with savings products in these countries, only 46% understand the concept of compound interest.

The OECD also warns that the spread of digital financial services, which accelerated during the pandemic, makes it more necessary than ever to equip people with the right knowledge and skills to use these products and services safely. Moreover, the introduction of digital currencies and other crypto-assets into the economic ecosystem, which is leading to an increased incidence and complexity of financial fraud and scams, also highlights the need to strengthen the financial literacy of adults to prevent cybercrime.

11Onze’s financial education plan

Empowering citizens through financial education has been at the heart of 11Onze since its inception. Expanding our community’s knowledge of economics and finance, making all the necessary tools available to them, is one of the founding pillars of the first community fintech in Catalonia.

Since the launch of 11Onze Escola, a project that offers training sessions on the world of fintech so that schools, companies and professional associations throughout the country can teach their students the basics of economics and financial matters, we have a unique platform that complements the school curriculum by educating young people in monetary matters and provides them with tools for the creation of wealth.

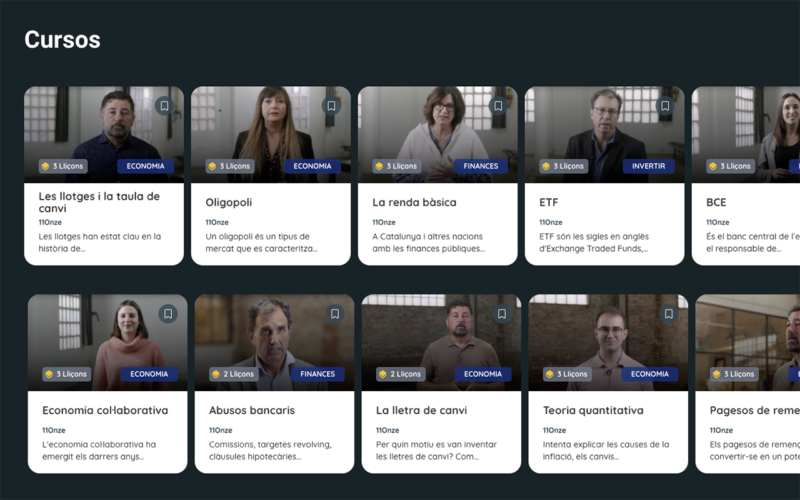

With the same purpose of training our community, we promote the lessons in the Learning section, which offers content such as the series El Diner, the Formacions 11Onze made by the employees themselves or our short Courses. In addition, in the Descobreix section of 11Onze TV you will also find pieces by our agents on topics of interest for our day-to-day work. Because from the very beginning it was clear to us that without a good financial education, we will hardly be a free society that can decide its future.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Leave a Reply

You must be logged in to post a comment.

Gràcies a tu, Joan!!!

Gràcies