Analysis: what is the best business account?

We have tried to make 11Onze Business the most attractive proposition for businesses in the Catalan Countries. Have we succeeded? We compare business accounts from various entities so that you can choose the one that best suits your business situation.

Everyone knows that time is money, especially for people who run businesses. That is why it is important to have a business account that lets you manage your business cash flow quickly and easily, avoiding errors and limiting costs. It is an essential tool for the good financial health of any business. And, today, it is even more so for those businesses operating abroad, with a complex economic situation.

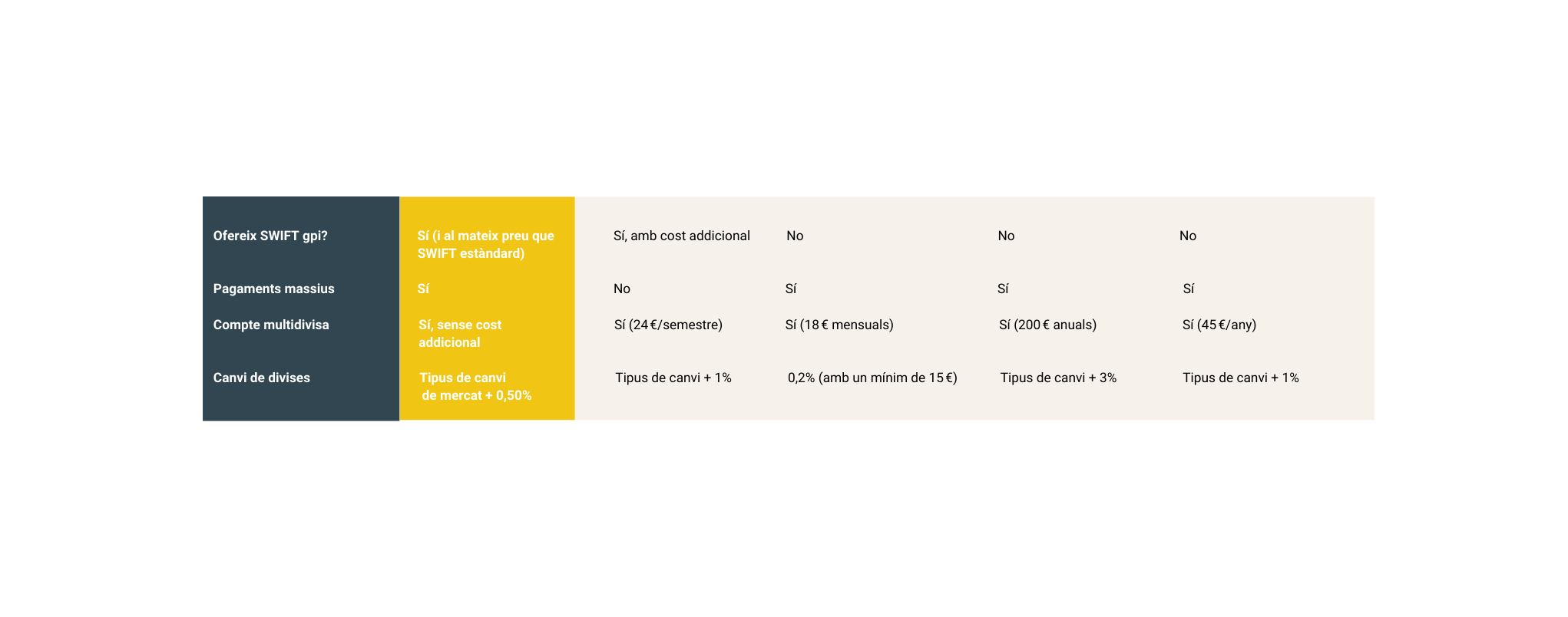

Therefore, the first thing to ask of a business account is that it should be agile. For this reason, many business accounts have been digitised. Even so, there are significant differences between the different offers on the market. We analyse some of the best proposals in the following table.

Monthly quote and minimum conditions

The number of financial institutions offering this service is extensive and varied, but community banking tends to offer a closer and more personalised service than traditional banks. It is important that we concentrate on choosing the services that can be most useful for our needs. But what should we look for?

For example, if we only look for the cheapest monthly fee, we may be asked to maintain a very high minimum balance if we do not want to incur penalties or be compelled to take out other services and products, such as insurance, recurring direct debit payments, etc.

Another important factor to bear in mind when weighing up the price of the monthly fee is which management tools we have access to without having to pay a premium service: real-time control of the operations executed in the account, subaccounts or the possibility of granting various levels of permissions between users of the same account are not always available in the most basic business accounts.

Transfers and multi-currency accounts

Flexibility in payments and collections is essential in the day-to-day running of a business. A platform that allows us to make bulk payments and recurring payroll and dividend payments is important, but we cannot forget about the cost of transfers.

Although any business account will allow us to make SEPA and SWIFT transfers, the costs and fees can vary significantly between the different options. Even so, not all financial institutions will offer the option of the SWIFT gpi service, through which you can track money transactions in real-time.

Likewise, not all corporate accounts let you open multi-currency accounts or access the Forex market. These options can be particularly interesting for companies that have international customers or suppliers and would therefore be able to protect their capital against the depreciation of the euro or other currencies.

How does 11Onze Business compare?

As you can see in the comparison table, 11Onze Business is one of the cheapest business accounts in the sector, even though it offers premium features that others do not offer or charge extra for. Also, right now, the first two months with 11Onze Business are free because it is still in the development phase. This means that it will continue to expand its functions. What else will it offer? Product manager Isaac Sène explained this a few days ago in this conversation.

If you want your business to make a giant leap, use 11Onze Business. Our business and freelancer account is now available. Find out more!

Es una eina fàcil I que recull moltes avantatges per al empresaris

Enhorabona

Gràcies Alicia 💛

Endavant!! Bona feina.

Moltes gràcies, Pere!!!

Gràcies!

Gràcies a tu, Joan!!!

La veritat una proposta digital molt competitiva e interessant. Si Puc ho recomanaré ja que estic content del compte individual que tinc amb vosaltres.

Ens alegra molt que ho vegis així, aquest era l’objectiu! Moltes gràcies Cristian!

Els números canten, però també i molt la qualitat del producte.

Números + bon servei=👌🙌

Moltes gràcies, Mercè!!!

L’anàlisi es determinant en cada cas i el cop de mà que ens dona 11onze ens ajuda molt per no dir essencial i no sols per resoldre dubtes sinó per evolucionar i avançar-se front l’adversitat que pugui arribar.

🙏🏿

11Onze va creixent, poc a poc però amb pas ferm, fins asol.lir el 100% del seu potencial ✊✊

🙏🏿