Window of opportunity in the financial sector

Digitization and new regulation have opened up the opportunity to transform the banking system so that new players can enter, gaining in efficiency and customer service. In addition, the new European regulation of payment systems, especially the so-called “open banking” and the PSD2 standard, open the door to the “Passporting” of banking services under the principle of single authorization.

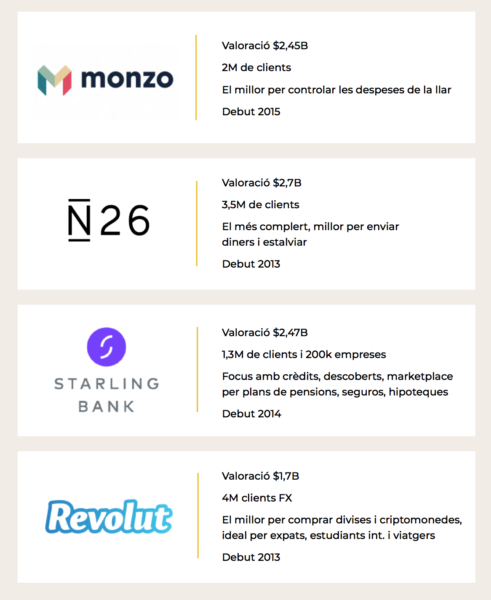

The new banking services platforms (BaaS, or banking as a sevice), which incorporate banking licenses from a member country of the EU or directly from the regulatory body of the banking sector at European level (EBA), allow the creation below cost and tailored to the needs of potential customers, the so-called “challenger” banks.

Major banks around the Catalan and Spanish cross currently a crisis in the market and market capitalization compounded by negative interest rates which must operate as a business model.

This has led to a massive capital flight into real estate investment and the financing of riskier projects that are projected to have low-digit returns. But also, these traditional banks have an obsolete business model, which makes it difficult for them to update and take advantage of new technologies and adapt these business models to them to be more efficient and customer-oriented.

This situation has opened a window of opportunity for the creation of new generation banks, more competitive and profitable, thanks to the reduction of barriers to access to the sector, encouraged by new technologies and the positive impact of the same in the new regulation of the sector.

Leave a Reply

You must be logged in to post a comment.

👍