What the new self-employed quotas will be like

From 2023, the minimum fixed contribution of 294 euros for the self-employed will give way to a progressive system of 13 tranches depending on earnings, whose quotas will vary each year until 2025. This has been agreed between the Spanish Government and the main self-employed associations ATA, UPTA and UATAE.

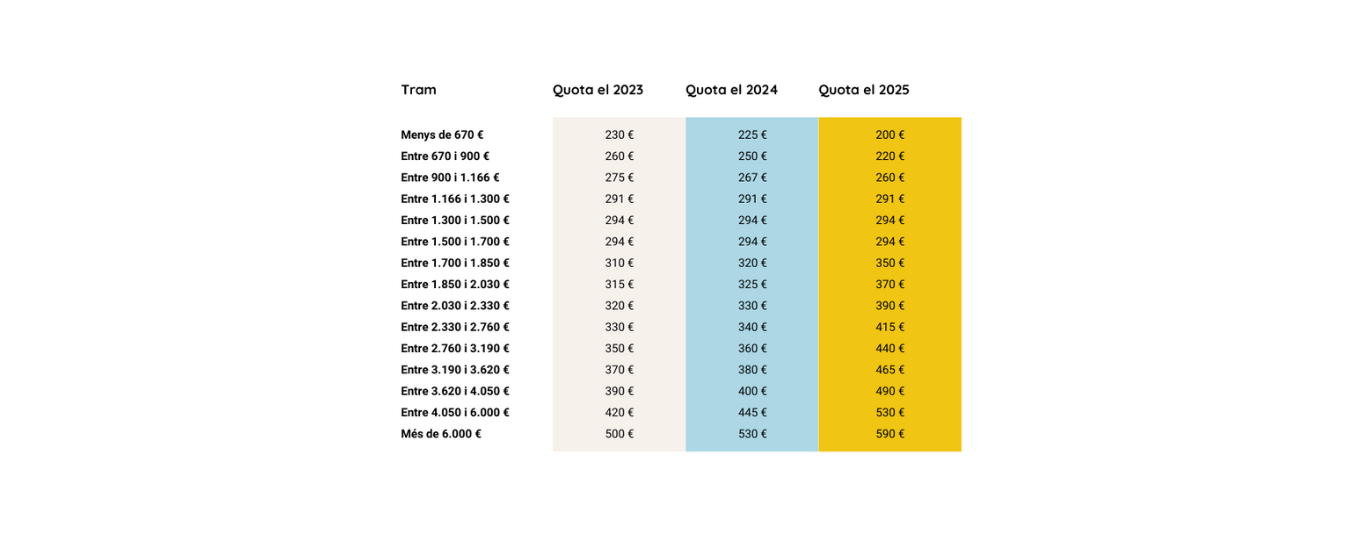

The self-employed contribution in 2023 in Spain will range from 230 to 500 euros, depending on the annual income of each self-employed person. The range will be extended in the following two years. The biggest beneficiaries of the reform will be the self-employed with the lowest incomes.

The agreement envisages that the self-employed who earn less than 670 euros per month will pay 230 euros per month in 2023, which will save them 767 euros a year; 225 euros in 2024, which will save them 827 euros; and 200 euros in 2025, which will save them 1,127 euros.

The self-employed with earnings of more than 6,000 euros per month, the ones with the highest contribution, are at the opposite end of the table. In this case, the contribution will be 500 euros a month in 2023, 530 euros in 2024 and 590 euros in 2025.

A simple calculation

To determine the contribution, the self-employed must calculate the net annual income, subtracting deductible expenses from net income, and then add the Social Security contribution and subtract 7%, which is the estimated percentage for expenses that are impossible to justify. From there, divide it by the 12 months of the year to check the amount to be paid to the social security authorities. The amount may be modified up to six times a year depending on the evolution of income.

The reform of the self-employed quota was one of the commitments made by the Spanish government to receive the next tranche of Next Generation funds and still has to go through the parliamentary process. With the new Special Regime for Self-Employed Workers, self-employed workers will now pay contributions on the basis of what they earn, just like salaried workers.

The self-employed associations have welcomed the change from a system with a minimum contribution of 294 euros, which until now could be increased voluntarily to improve benefits, to this progressive system, which establishes contributions according to net income. Currently, nine out of ten self-employed currently pay the minimum contribution.

One of the few drawbacks of the new system is that it could encourage the underground economy, as some self-employed workers could hide part of their income in order not to jump from one bracket to another.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Leave a Reply

You must be logged in to post a comment.

gràcies

Gràcies a tu, Joan!!!

Com es pot viure amb aquests números ???

“L’acord contempla que els autònoms que guanyin menys de 670 euros mensuals passin a pagar 230 euros de quota al mes en 2023”

670-230 fan 440 € mensuals.

Doncs sí, Mercè, per a molts autònoms continuarà sent difícil sobreviure en aquestes condicions… Seguim!

👍

Gràcies, Manel!!!