The future currency of the BRICS

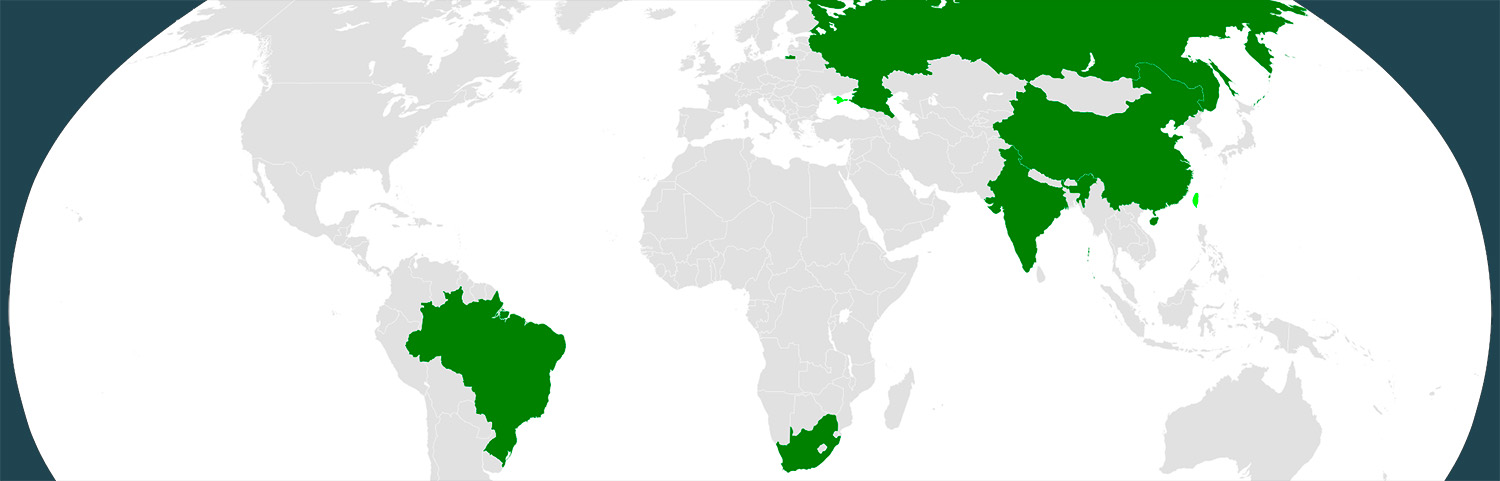

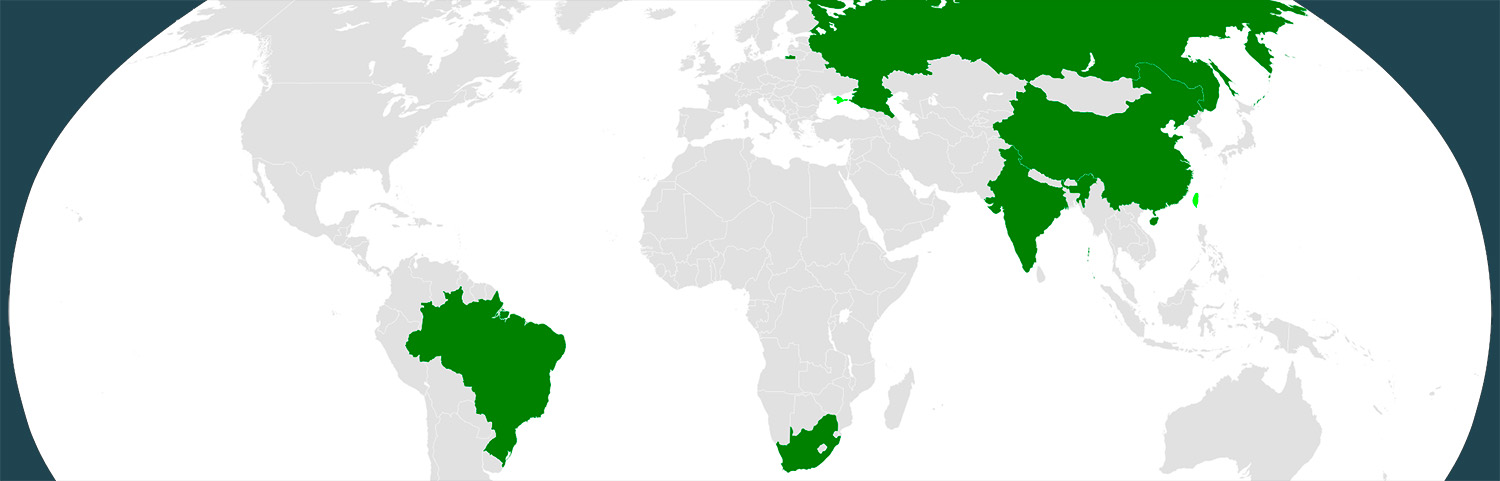

The BRICS group, which brings together the two big emerging economies (China and India) and three major commodity producers (Brazil, Russia and South Africa), is working on its own currency. China is the driving force behind a currency that, unlike the dollar or the euro, could be backed by gold and other commodities.

During a visit in Shanghai to the New Development Bank, created by the BRICS, Luiz Inácio Lula da Silva, President of Brazil, insisted a few days ago on the idea of finding an alternative to the dollar in international payments. “Why can’t an institution like the BRICS bank have a currency to finance trade relations between Brazil and China or between Brazil and all the other BRICS countries,” he said.

China and Russia have been the main promoters of this idea, which has been well received by the rest of the BRICS and other emerging countries.

Vladimir Putin announced in the middle of last year that the BRICS group was working on the development of a new reserve currency based on a basket of currencies for its member countries. And Russian Foreign Minister Sergei Lavrov indicated in January that the issue would be discussed at the BRICS summit in South Africa at the end of August.

First steps in a multipolar world

These statements should be seen in the context of Russia’s new foreign policy, recently announced by Vladimir Putin, which places India and China at the forefront and aims to boost Moscow’s role in groupings such as the BRICS in order to “adapt the world order to the realities of a multipolar world”.

For the time being, Beijing has intensified its efforts to use its own currency in foreign trade. A few weeks ago, the presidents of China and Russia agreed to encourage the adoption of the Chinese yuan as a settlement currency with emerging economies. And Brazil and China took steps last month to facilitate the settlement of their transactions in each other’s currencies. The goal is to reduce financial costs by eliminating a third currency from transactions.

A new currency for a new world

The Deputy Chairman of Russia’s State Duma, Alexander Babakov, said a few days ago that “the transition to settlement in national currencies is the first step”. According to him, the next move would be “to put into circulation a digital currency or any other fundamentally new form of currency in the near future”.

The fact is that in recent times there have been increasing contacts between representatives of Brazil, Russia, India, China, and South Africa to launch a new currency which, according to Russian sources, would be backed by gold and other commodities.

In this respect, it should be borne in mind that in November and December last year alone the Chinese central bank announced the purchase of 62 tonnes of gold, bringing its total reserves to more than 2,000 tonnes for the first time in history, according to data from the World Gold Council. And it seems that the pace of gold purchases by various central banks has intensified so far in 2023.

A very heterogeneous group

Critics of this new currency project point to the great differences that exist between the five countries in the group in terms of production, growth and financial openness. Suffice it to say that real GDP per capita at constant prices between 2008 and 2021 increased by 138% in China, 85% in India, 13% in Russia and 4% in Brazil, while it contracted by 5% in South Africa.

Another distorting factor is China’s overwhelming weight in the group. The most recent data from the International Monetary Fund indicate that the Asian giant accounts for 72% of the combined GDP of the five countries. And China’s dominance is reinforced by the fact that it is a key trading partner for commodity exporters.

Moreover, the strategic interests of the five members of the group are not closely aligned precisely because of the vast differences in their economies.

However, the idea of a new currency is taking shape. And other countries such as Argentina, Iran, Indonesia, Turkey, Saudi Arabia and Egypt have already expressed their interest in joining this economic bloc. The international financial system could be on the verge of a radical change, perhaps back to the gold standard or something similar.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Leave a Reply

You must be logged in to post a comment.

Em sembla molt bé aquests canvis. Gràcies per l explicació

Doncs sí, Carme, és una notícia força interessant, i moltes gràcies pel teu comentari.

👍

Gràcies, Manel!!!

Gràcies

Gràcies a tu, Joan!!!