Is housing rising because of foreign demand?

A significant proportion of tenants and homebuyers in Catalonia are foreigners, who are tending to increase their presence in the market. In the face of rising prices, does it make sense to restrict the purchase of housing to this group, as Canada or New Zealand are doing? There are more effective alternatives to “cool” the market.

Despite the crisis and rising interest rates, the real estate market continues to soar. The price of housing in Catalonia rose by 5.4% in 2022 compared to the previous year and the square metre has already reached 1,980 euros, according to data from the General Council of Notaries. The trend in the rental market is very similar.

One element contributing to the inflated cost of housing is the foreign demand, be it investment funds or individuals looking for quality of life and more affordable prices than in other European countries, especially now that teleworking allows many people to live away from their company.

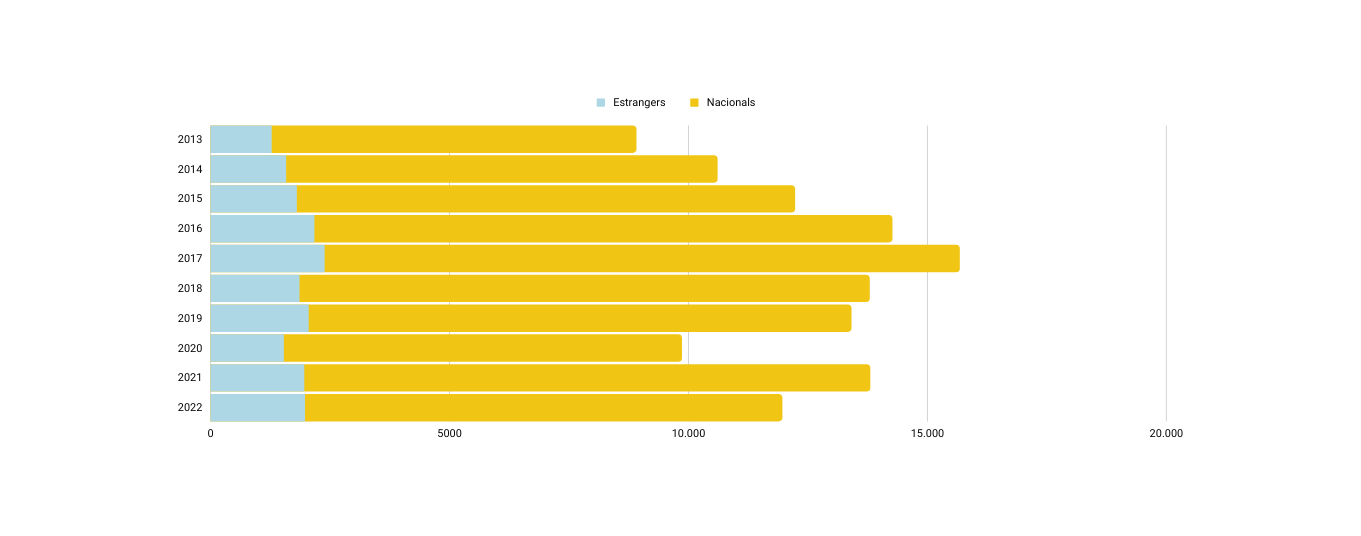

In the city of Barcelona, for example, 16.5% of homes bought in 2022 were purchased by foreigners, according to the City Council. This is the highest percentage in the last decade and is more than two percentage points higher than in 2013.

If we analyse the rental data, foreign demand is even more relevant. According to the real estate portal Idealista, foreigners rented 19.5% of the properties rented in the province of Barcelona in 2022. The percentages in Girona (17.1%) and Tarragona (13.8%) were also significant. Lleida, with 8.1%, was the only province with a single-digit percentage. The international attraction of Barcelona is enormous, as foreigners rent practically one out of every four properties.

Limits for non-residents?

Faced with the pressure exerted by foreign demand on prices, there are already voices that propose taking measures such as the one recently adopted by the Canadian government, whereby non-resident foreigners are prohibited from buying homes in that country for the next two years.

Along these lines, a few weeks ago the Balearic government proposed limiting the purchase of housing to non-residents, especially foreigners, who have been registered in the territory for less than five years. However, the Madrid government has already warned that the Treaty on the Functioning of the European Union prohibits “all restrictions on the movement of capital between member states and between member states and third countries”.

Any such restrictive measure would represent a 180-degree turnaround from current state policy. Since 2013, foreign real estate investment has been promoted with the so-called “Golden Visa”, which grants residency to any foreigner who buys a property worth more than 500,000 euros.

In Catalonia, the Sindicat de Llogateres has emphasised the role of investment funds, both national and international, which speculate in the real estate market and drive up prices. In this sense, it proposes copying legislation such as that applied in Amsterdam and Rotterdam, where foreigners who buy a property must live there for four years to prevent speculative acquisitions.

Conflict of competence

Another sensitive issue is who is responsible for each decision since the powers over the property market are divided between the central government, the autonomous regional governments and the local councils. In theory, the central state can draw up the guidelines, as shown in the land law or the law on urban leases. Still, then it is the autonomous communities and town councils who divide up the competencies in spatial planning, town planning and housing.

Hence the controversy generated by the Law on the Right to Housing, which is currently pending approval in the Senate. The General Council of the Judiciary issued a report opposing the bill presented by the central government because some aspects addressed by this law, such as the declaration of stressed areas, ceilings on rental prices or the surcharge on empty flats, should remain in the hands of the autonomous communities and town councils.

Beyond conflicts of jurisdiction, the fact is that one of the biggest problems in curbing the rise in prices is the lack of social housing in Catalonia. Not even Barcelona City Council’s regulation, which obliges 30% of new developments to be reserved for social housing, has led to a considerable increase. The City Council hoped that this measure would result in the construction of more than 300 social flats per year, but the reality is that since the approval of the regulation at the end of 2018 the total has not reached 60.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Leave a Reply

You must be logged in to post a comment.

Gràcies

Gràcies a tu, Joan, per ser-hi i per seguir-nos!!!

El que no te sentit es que els habitatges de la ciutat de barcelona no siguin accessible per als barcelonins veïns residents de tota la vida, com fou el cas d’un article que fanfarronejava per la venta d’un pis de passeig de gràcia q va batre el record de venta de tota la península amb un cost de 40milions d’euros, no cal que digui que el que va comprar-lo fou un extranger. Si no fan més polítiques per baixar el cost dels habitatges d’acord amb els salaris eels veïns aconseguiran fotre fora a tots els veïns residents de barcelona i convertiran la ciutat en un parc temàtic Barcelona Port Aventura i que als veïns els bombin😵💫

Malauradament és la llei de l’oferta i la demanda, i vivint en la societat actual o s’aplica a tot o a res. És molt cert el que dius, Jordi, és totalment desmesurat, però cadascú té el negoci i la inversió allà a on hi ha posat els diners i és igual de lícit invertir en immobles com amb qualsevol producte de la borsa, bitcoins o divises… Personalment penso que ens ha fet molt mal la globalització, no ben bé al principi, però ara, amb el pas dels anys sí que ens està passant factura. Moltes gràcies pel teu comentari, Jordi!!!

Lleis i més lleis, i més reglaments poc intel·ligibles que només es fan complir a segons qui i quan convé. Legislen per a satisfer sectors determinats i hi passen de puntetes per no molestar els qui s´hi oposen. Es el “Sistema”, del qual viuen els polítics professionals. Es corrupció.

Totalment d’acord, Mercè, i després tot va com va… Cada dia més controlats, vigilats i adoctrinats, en una societat el la qual cada cop ens hi costa més identificar-nos. Moltes gràcies pel teu comentari.