FedNow: a move towards the digital dollar?

The US Federal Reserve will launch this summer a real-time payments system designed to streamline transactions between bank accounts. This is a development that some critics see as a further step towards a digital dollar to counter cryptocurrencies and eliminate cash.

In an increasingly digital and interconnected world, payment systems are evolving to meet the needs of businesses and consumers who demand access to fast payment services to make transactions more efficient and better control their cash flow. The private sector has been at the forefront of this evolution, but governments also want to play a role.

To meet these needs, the US Federal Reserve plans to introduce a new payment system known as FedNow in July this year. This new instant payment platform is designed to enable secure and efficient payments in real-time, 24 hours a day, 365 days a year.

This is a great advantage for businesses and consumers, as they will not have to rely on traditional processing times, which can now be several business days. The new system will allow funds to be transferred instantly between participating bank accounts, and as a non-profit governmental organisation, it will be able to offer more competitive prices.

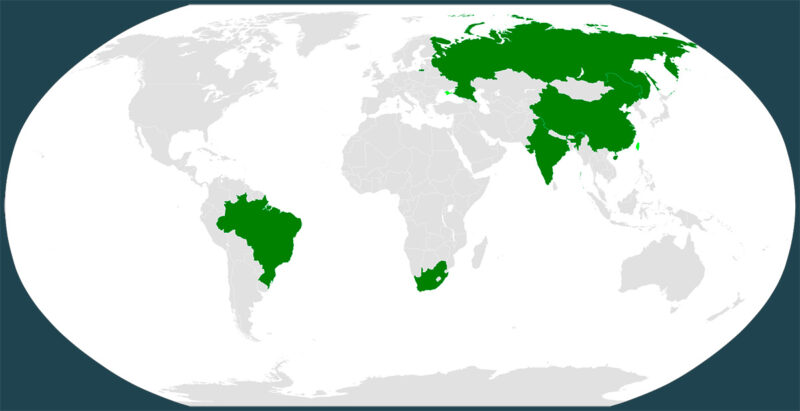

On the other hand, the adoption of FedNow by US banks, corporations and major financial institutions could result in other foreign entities being forced to use the service. This is significant because it could help the dollar, also in digital form, to perpetuate its reign in international cross-border transactions. This is a possibility that cannot be ruled out in the face of increasing de-dollarisation and the announcement of the launch of a new currency by the BRICS group.

A new payment system linked to the digital dollar?

In parallel with the launch of FedNow, the Federal Reserve is considering the possibility of introducing the digital dollar. As other countries have done already, this would involve putting into circulation a Central Bank Digital Currency (CBDC). This proposal has been criticised on the grounds that it could affect the fundamental freedoms of citizens, increasing the ability of governments to track and control the population.

In this regard, Florida Governor Ron DeSantis and presidential candidate Robert Kennedy Jr, questioned the motives behind the possible introduction of the digital dollar and the new FedNow payment system. Specifically, Robert Kennedy Jr stated that the issuance of a digital dollar will serve as a mechanism to control US citizens, just like the FedNow payment system, declaring that “the distinction between FedNow and a CBDC is important from a technical point of view, but not from a civil liberties point of view”.

As a result of these statements that seek to link the two proposals, yet another controversy has been unleashed on social networks, in which content is circulating that claims that the Federal Reserve will launch a central bank digital currency called FedNow this July, which will give more power to the government to ratify financial slavery and political tyranny.

This misinformation has gone viral to the point that the Fed has deemed it necessary to officially deny it, stating that “FedNow is not related to a digital currency. FedNow is a payment service that the Federal Reserve makes available to banks and credit unions to transfer funds. The FedNow service is neither a form of currency nor a step toward the elimination of any form of payment, including cash.”

Additionally, federal officials – including Fed chair Jerome Powell and former vice chair Lael Brainard – noted that a digital dollar could still be years away from becoming a reality, but that FedNow could emerge as a better alternative to a CBDC. Be that as it may, the controversy is served, and is likely to further boost the case for cryptocurrencies as decentralised digital currencies that can be used as a defence against CBDCs or other state-backed monetary alternatives.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Leave a Reply

You must be logged in to post a comment.

👍

Gràcies a tu, Manel!!!

Gràcies

Gràcies a tu, Joan, per ser-hi i per seguir-nos!!!

Dubto molt que puguin contra el Yuan digital, i més ara que els BRICS ja han superat als EE.UU. i els seus aliats.

Encara és aviat per saber-ho ben bé del tot, ja ho anirem veient amb el pas del temps… Moltes gràcies pel teu comentari, Jordi!