Europe trapped in inflation

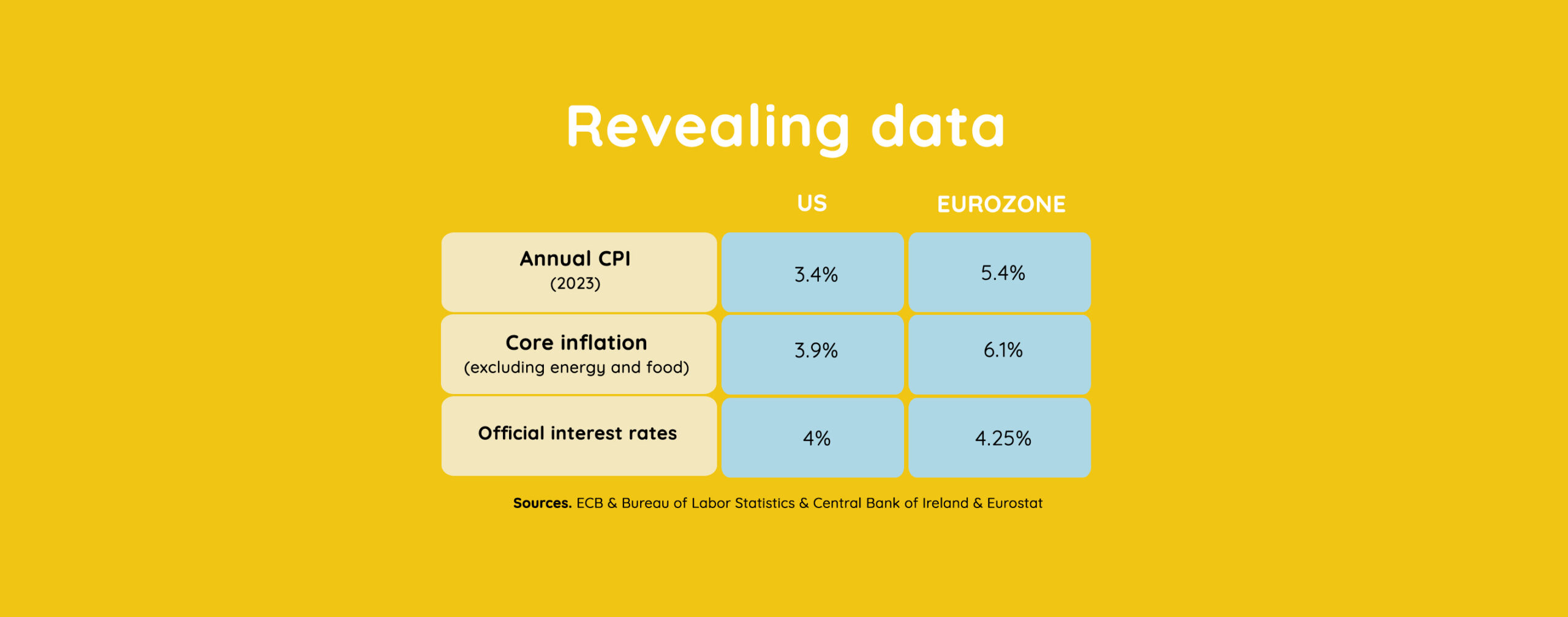

Inflation has once again taken centre stage in the global economic debate. Although prices in the United States have begun to moderate sharply, the slowdown in Europe is much slower and more uneven. What factors explain this difference? Is it just a matter of monetary policy, or are there deeper structural elements that keep Europe trapped in persistent inflation?

Inflation is not a new phenomenon, but how it is managed depends on the institutions and history of each region. In the United States, the Federal Reserve (Fed) has acted decisively and quickly: aggressive interest rate hikes and clear communication to reinforce credibility. In Europe, on the other hand, the European Central Bank (ECB) has had to manoeuvre more slowly and cautiously because it governs a monetary union with very diverse economies: Germany is not Spain, nor is Italy Finland.

In addition, for decades the Old Continent has been heavily dependent on foreign energy, especially Russian gas, which has become the Achilles heel of its price stability.

Key economic factors

- Energy as a driver of inflation in Europe. According to Eurostat data, energy accounted for up to 40% of inflation in the eurozone in 2022. The war in Ukraine and sanctions against Russia caused gas and electricity prices to skyrocket, which was passed on throughout the production chain. In the United States, on the other hand, energy independence thanks to fracking and domestic oil has cushioned the impact.

- Labour market and wages. In the United States, the labour market is more flexible and wages adjust quickly to expectations. This generates a higher initial ‘shock effect’, but prices then tend to stabilise. In Europe, collective bargaining and long-term contracts have led to delayed wage revisions, keeping underlying inflation alive. According to the OECD, real wage growth in Europe has been concentrated mainly in the last two years, prolonging inflationary pressure.

- Fiscal policy. The US government provided substantial aid during the pandemic, but then quickly reduced it. In Europe, many states have maintained subsidies and aid (petrol rebates, energy subsidies, reduced VAT on some products). This support, although necessary to protect families and businesses, has ended up fuelling persistent prices.

- Differences in monetary policy. The Fed began raising rates in March 2022 and within a few months had already exceeded 4%. The ECB, on the other hand, did not begin raising rates until the summer of the same year, and did so more gradually. The result: inflation in the United States fell below 3% in mid-2024, while in the eurozone it still remains around 4-5% in many countries (ECB).

A different social and political impact

Persistent inflation in Europe is not just an economic problem: it is also political and social. Consumers see that their shopping baskets are still much more expensive than three years ago, despite promises of moderation. This unease fuels discontent and, in many countries, reinforces populist rhetoric.

In the US, on the other hand, the official narrative has been able to capitalise on the Fed’s swift action, showing some recovery in confidence in the economic system.

Europe in the mirror

Persistent inflation in Europe reflects structural weaknesses: energy dependence, labour market rigidity and a lack of institutional agility. The ECB has improved its pace, but the real question is whether the European Union is willing to make the fundamental changes that its economies need.

The lesson from the United States is clear: speed and decisiveness can be painful at first, but they prevent longer suffering. Europe, caught between prudence and complexity, is still searching for a way out.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.