Year-end taxation in Catalonia

As the last week of December approaches, the calendar seems to speed up. Between lunches, shopping and year-end closures, the same uncomfortable question reappears once again: am I still on time to reduce my 2025 tax bill?

The answer is that maybe yes. And the surprising part is that one of the most powerful tools is still the great unknown: early repayment of the mortgage. An option that only makes sense for those who still have the right to the tax deduction for the purchase of their main residence at the state level and/or can apply the transitional tax-relief scheme of Catalonia.

A deduction inherited from the past

The state deduction for the purchase of a main residence —both interest and principal repaid— has not generated new rights since 1 January 2013. Only taxpayers who bought before this date, who met the requirements set by the regulations at the time and who had already applied this deduction in previous years, have access to it. Without this last point, you cannot apply the transitional scheme.

In Catalonia the situation is similar, where the regional deduction for investment in a main residence remains, but only under the transitional scheme. Therefore, if you bought your flat or house after 31 December 2012, neither the State nor the Generalitat of Catalonia allow you to apply this deduction.

In many cases the idea has been repeated that “you can deduct up to 1,500 euros per year”, but this is a simplification. In Catalonia, the reference to 9,040 euros corresponds to the limits established for certain deductions within the transitional scheme. The exact applicable amount depends on the specific case and on whether it concerns the state portion, the regional portion, or special cases.

When early repayment makes sense… and when it is useless

The key is as simple as this: if the interest you pay each year already exceeds the deductible limit, repaying principal will not give you any additional tax benefit. Early repayment, in these cases, is invisible to the Tax Agency.

This often happens with older mortgages at 3%, because if you still owe around 120,000 euros, annual interest may range between 2,800 and 3,300 euros. If the deductible limit is lower, you have no margin left. Early repayment adds nothing.

In Catalonia, if you qualify for the transitional scheme, the regional portion percentages are 7.5% or 15% in cases of disability. But always within the maximum base allowed. In short, early repayment only makes sense if three conditions are met:

- You have not yet reached the deductible limit (interest + principal repaid).

- You qualify for the transitional scheme, both state and regional.

- Financially, immobilising capital makes sense within your economic profile.

If any of these pieces fail, the tax benefit may be minimal or non-existent.

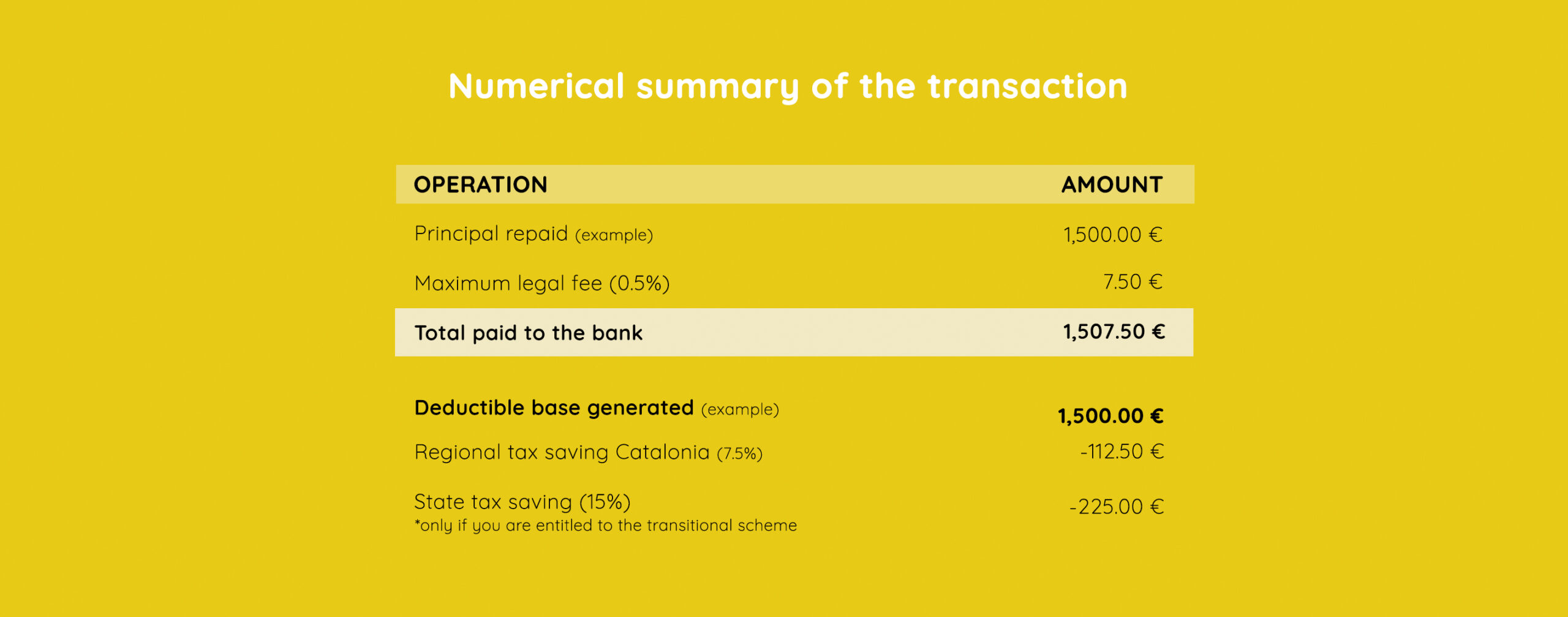

Arithmetic so we don’t fool ourselves

If you still have margin to deduct, the strategy is clear: you need to put numbers on the table, see what you have really paid during the year and compare it with the limit allowed by the regulations. Only when you have this precise picture can you decide whether early repayment gives you a real tax return… or just the illusion of savings. Therefore, you should do the following:

- Calculate what you have already paid in interest + principal during the year.

- Check whether this amount reaches the deductible limit.

- If you have margin, decide how much you want to repay before 31 December.

And a fundamental point: the deduction never equals the total repaid. The common mistake is to think that every euro allocated to reducing principal is directly transformed into tax savings, but it does not work that way. With the state deduction of 15%, for example, repaying 1,500 euros would only return 225 euros, a modest fraction of the real effort. And in the case of the regional deduction, where percentages are 7.5% or 15% depending on the case, the return is even smaller, reinforcing the idea that the operation is only worthwhile when you truly have margin within the deductible limit.

Catalonia: what you must check, without exception

Before making any move, make sure you clearly understand whether you really fit within the transitional scheme and what limits the regulations set for your case. Only by reviewing dates, requirements and taxable bases in detail will you avoid mistakes that can turn a good fiscal intention into a useless operation. Only then will you know whether early repayment really works in your favour. Therefore, before making any move, make sure that:

- The main residence was purchased before 1 January 2013.

- You can apply the state transitional scheme and, if applicable, the regional portion of Catalonia (7.5% or 15%).

- You do not exceed the limits established for income and taxable base (in some cases, a maximum of 30,000 euros after minimums).

- Your mortgage and its conditions comply with the required regulations.

- Repayment does not leave you without liquidity or reduce your flexibility in the face of unforeseen events.

Remember that the deduction only applies to amounts actually paid during the year —neither future commitments nor agreed-upon but unpaid repayments.

A tax decision or a life decision?

Early repayment can be appropriate if you are just short of a small amount to reach the deductible limit, and only in these cases is where the tax benefit exists and compensates. But if the mortgage interest already exceeds the limit, repayment brings no tax benefit. And it may reduce your liquidity, investment capacity and savings cushion.

The last week of the year is a good time to ground yourself in the reality of the numbers: compare interest + accumulated repayment with the real deductible limit. And only then decide whether early repayment fits your situation and Catalan regulations.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!