What is the SWIFT code for?

What is the SWIFT code and why is it so important in the financial world? What are the implications of expelling a country’s financial institutions from this banking messaging network? Iu Alemany, 11Onze’s Back Office and Customer Service Manager, reveals all the keys.

SWIFT stands for Society for World Interbank Financial Telecommunication, “a cooperative society based in Belgium that was founded in 1973”, as the 11Onze Back Office and Customer Service Director explains. Alemany points out that it is not a payment system, but a messaging system, which speeds up international transfers and “allows the parties involved to be identified in a standardised, secure and error-free manner”.

Some 12,000 institutions in more than 200 countries, both financial and non-financial, are connected through the SWIFT system, which facilitates “some 32 million messages on average” to be exchanged every day.

The SWIFT code normally consists of eleven characters, although sometimes it can be as few as eight. The first four letters identify the bank or institution. The next two letters indicate the country. The next two correspond to the location of the institution, for example, “BB would mean Barcelona”, as Alemany explains. And the last three digits identify the bank office or branch. In this case, “if three ‘Xs’ appear, it means that the branch carries out the settlement centrally”, explains the 11Onze’s Back Office and Customer Service Manager.

A tool for political pressure

Seven Russian banks were excluded from the SWIFT system in March to put pressure on Russia with its conflict with Ukraine. As Alemany explains, cutting off communication between a country’s banks and the rest of the global financial system makes it impossible for that country to carry out “most of its financial transactions around the world, blocking exports and imports”. Ultimately, the aim is to hinder “its ability to operate globally”.

Iran was excluded from the SWIFT system in 2012 as part of sanctions over its nuclear programme. As a result, it lost almost half of its oil export revenues and 30 per cent of its exports. And Russia had already been threatened with this measure in 2014, when it annexed Crimea.

Iu Alemany warns that this measure could be detrimental in both ways, not only for the sanctioned country: “If we are thinking of applying this measure to a strong economy, highly interconnected to the rest of the world and which has a series of basic products for the rest of the world, we must be careful”.

As we explained in the article “SWIFT: use and abuse of an alphanumeric code”, the exclusion of some Russian banks from the SWIFT system will be an incentive for China, Russia and even the European Union to look for alternative systems that can shield their economies from this political pressure measure.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Are you preparing your tax return? Have you taken into account all the deductions you can take advantage of? From 11Onze we detail eleven deductions that allow some type of saving when it comes to sorting your accounts with the Tax Agency.

In the income tax return we can take advantage of various tax deductions depending on the type of taxpayer we are, whether we are an individual or a legal entity. It should be borne in mind that, as well as state deductions, there are also regional deductions, depending on the autonomous community where you live and work. In the case of Catalonia, the Tax Agency provides the relevant information on its website.

It is important to bear in mind that deductions are limited by age, income, and other circumstances. Therefore, we cannot forget to read the small print. Having said that, here are the main state and regional deductions that are in force:

1. For large families or disabled dependents.

As detailed by the Tax Agency, among the state deductions for families, there is the specific one for large families, which is 1,200 euros for three children, 1,800 euros for four children, and 2,400 euros for five children. Even so, in some cases, a deduction of 1,200 euros can be applied for each of the descendants or ascendants with a disability or a spouse who is not legally separated and has a disability. These last deductions are only applicable if the annual income does not exceed 8,000 euros.

2. For maternity, birth, or adoption

Working mothers can apply a deduction of 1,200 euros per year for each child under the age of three, provided that they live with them. Childcare expenses can increase this amount by up to 1,000 euros. For residents in Catalonia, a deduction for birth or adoption of 300 euros is recognised in the case of a joint declaration by the parents, or 150 euros for each of the parents if this is done individually.

3. For donations to foundations and associations declared to be of public utility

Donations to NGOs, foundations, and public research bodies dependent on the General State Administration have deductions ranging from 10% to 80% of the amounts paid. At the regional level, deductions are also available for donations to organisations that promote the use of the Catalan or Occitan language, as well as for entities that promote Y+D+Y and environmental conservation.

4. For membership fees and contributions to political parties

A deduction of 20% is applied for membership fees and contributions to political parties, federations, coalitions, or groups of voters, with a maximum limit of 600 euros per year. It should be borne in mind that contributions made once you have ceased to be a member do not form part of the base on which the aforementioned deduction has to be calculated.

5. For investment in new or recently created companies

It is possible to deduct 30% of the amounts paid for the subscription of shares in new or recently created companies. The maximum deduction base will be 60,000 euros per year and will be formed by the acquisition value of the shares or holdings subscribed.

6. For building work to improve the energy efficiency of housing.

There are three types of possible deductions:

- Deduction of 20%, with a maximum of 5,000 euros, for reforms to improve the energy efficiency of a property that reduces energy consumption by at least 7%.

- Deduction of 40%, with a maximum of 7,500 euros, for improvement works that reduce the consumption of non-renewable primary energy by 30%.

- Deduction of up to 60%, with a maximum of 15,000 euros, for home improvements that reduce the primary energy consumption of a residential building by at least 30%.

7. For renting the main residence

These are deductions under a transitional regime and are to be abolished, which only apply if you are the holder of a rental contract dated prior to 1 January 2015. We can deduct 10.05% of the amounts paid in the tax period, provided that the taxable base is less than 24,107.20 euros.

8. For investment in the main residence

As in the previous case, this is a deduction that was abolished in 2013, but which is maintained on a transitional basis for taxpayers who acquired or paid amounts for the construction of their main residence before 1 January 2013. We have to bear in mind that the maximum deduction base for investments in the acquisition, rehabilitation, or extension of the main residence is 9,040 euros per year.

9. For investment by a ‘business angel’ for the acquisition of shares or stock holdings

- Deduction of 30%, up to a maximum of 6,000 euros, on amounts invested during the year in the acquisition of shares or holdings in companies as a result of agreements for the incorporation of companies or capital increases in commercial companies.

- Deduction of 50%, up to a limit of 12,000 euros, in companies created or owned by universities or research centres.

10. For taxpayers who were widowed in 2020, 2021 or 2022

A general reduction of 150 euros can be obtained, and of 300 euros if the person who becomes a widow or widower has one or more descendants who qualify for the application of the minimum for descendants.

11. For income obtained in Ceuta and Melilla

Taxpayers can deduct 60% of the state and regional tax liability corresponding to income obtained in Ceuta and Melilla. This deduction is also applicable for periods of residence in these cities of no less than three years for income obtained outside Ceuta and Melilla if at least one-third of the net assets are located in the aforementioned cities.

If you want to know more about superior options to make your money profitable, go to Guaranteed Funds. From 11Onze Recomana we propose you the best options in the market.

Some market analysts predict that the price of gold could rise to $3,000 by the end of the year after hitting its third record high so far in 2024. Geopolitical tensions, strong central bank buying and growing demand from China are driving up the price of the golden metal.

Following gold’s strong March, thanks to the fact that futures investors and US gold ETFs helped push prices to new all-time highs, April is shaping up to be even stronger and all indications are that the price will remain elevated throughout the year.

Furthermore, the price of an ounce of gold has broken new records this week. The maximum of 2,384.35 dollars (2,196.18 euros) reached this Tuesday leaves behind the record set on Monday, according to market data consulted by Europa Press, although it has contained its advance and has been losing strength throughout the day to 2,358.30 dollars (2,172.19 euros) at the closing time in Europe.

Geopolitical tensions, armed conflicts and tighter monetary policy sent gold prices soaring in 2023, and we have started this year with an unprecedented gold rush. Investors are turning to gold for its historical value as a safe-haven asset and as a hedge against economic instability.

Likewise, the sanctions imposed on Russia have boosted the demand for gold by some central banks, following the trend seen in recent years. According to IMF data, central banks’ global gold reserves increased by 39 tonnes in January.

This represents more than double December’s net purchases and the eighth consecutive month of net purchases. This is the case of China’s central bank, which expanded its holdings in March for the 17th consecutive month. Moreover, central banks have purchased more than 1,000 net tonnes of gold for two consecutive years, according to the World Gold Council.

Will it reach $3,000 an ounce by the end of the year?

Gold’s meteoric rise could also be boosted by the US presidential election in November, which Donald Trump has a good chance of winning and which presents a very favourable backdrop for gold prices to reach $3,000 an ounce much sooner than expected.

On the other hand, the US Federal Reserve has indicated that there could be three interest rate cuts during 2024, which could push gold prices even higher. Investors were concerned that the Fed might make fewer than three rate cuts this year, as economic reports in recent months have shown that inflation remains high and the labour market strong.

There are growing signs that this is a special moment for the precious metal or, as the analysts at GSC Commodity Intelligence call it, “the beginning of a new historic super-cycle for gold”. Interestingly, real-time data obtained by GSC reveals a strong correlation between increased searches for “stock market bubble” and inflows of “gold capital”. This reinforces gold’s reputation as the best hedge for diversifying an investment portfolio.

Similarly, Aakash Doshi, head of commodities research at Citi, forecasts that the gold price could soar 50% to 3,000 per ounce in the next 12 to 18 months: “The most likely wildcard path to $3,000 per ounce gold is a rapid acceleration of an existing, but slow-moving trend: de-dollarisation in emerging market central banks, which in turn leads to a crisis of confidence in the US dollar”.

Preciosos 11Onze makes it easy to buy gold, at the best price and with total security. Protect yourself from economic crises with the ultimate safe-haven asset: gold. If you want your savings to keep or increase their value, Gold Patrimony.

Although reducing the weight of packaged products to mask a price increase is not new, persistent inflation has led many brands to use this practice to subtly make their products more expensive. In this episode of La Plaça, Gemma Vallet, director of 11Onze District, and Carolina Rafales, Product Manager, talk about the current economic situation and explain what downsizing is.

When applied to products sold in supermarkets, the term downsizing refers to offering less quantity of product for the same price, subtly reducing the amount of product to mislead consumers. This practice is also known as shrinkflation, a term credited to the British economist Pippa Malmgren.

As Gemma Vallet explains, In a situation where the CPI or inflation is getting out of hand, brands ‘use strategies to make you pay more for products’. Although, in this case, this is not an illegal marketing practice, consumer organisations warn that it is questionable and unethical because it is done with the intention of raising prices without the consumer realising it.

A drop in inflation that is not noticeable in food prices

Luis Planas, the Spanish Minister of Agriculture, Fisheries and Food, says he is “absolutely convinced” that food prices will go down, but asks consumers for “patience”, as the reduction in inflation will still take time to be reflected in the prices of supermarket products.

Given the rising cost of the shopping basket, the measures to limit the impact of inflation on consumers’ pockets have proved to be totally insufficient. The VAT reduction on foodstuffs seems to have served more to increase the commercial margins of distribution chains than to alleviate the precariousness of many families. “The situation is worrying, but despite the measures that have been taken, the market is the market, and it is difficult to foresee its impact in the short term”, stresses Carolina Rafales.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!

When we inherit, we are often concerned about the legal and tax consequences. Sometimes, once all the legacies have been distributed, the main heir is left with a remainder so low that it does not even reach the minimum that the law recognises. That is why, in Catalonia, the heir can claim the fourth falcidia or minimum inheritance quota. Agent 11Onze Jordi Coll summarises what this consists of.

Coll explains that the fourth falcidia, also known as the minimum inheritance quota, is regulated by article 427.40 of the Inheritance Code of Catalonia. It is a legal figure whose purpose is to guarantee the heir a minimum share of the inheritance, at least a quarter of the estate, when this is disproportionately encumbered by legacies or by rights in rem, such as mortgages or other assets.

Imagine, for example, that there are many beneficiaries in an estate and the main heir, with so many legacies to be distributed, realises that he or she will have almost nothing left. In this case, the heir is entitled to the fourth falcidia, i.e. he or she has the right to secure a quarter of the inheritance, even if this means reducing the inheritance of the other beneficiaries a little. The fourth falcidia is, therefore, a guarantee offered by Catalan law.

“If the heir sees that what has been left to him or her in inheritance does not cover 25% of the 75% of the inherited assets, he or she can claim the fourth falcidia. The other 25% is for the corresponding legitimacy rights of the persons to be inherited, whether or not they are the same heir or heirs,” the agent explains. Thus, the fourth falcidia acts as a limiter of the testator’s powers. This protects the principal heir and prevents him from having to renounce the inheritance for a small bequest.

Even so, it must be borne in mind that, if he or she accepts it, he or she will not only have to assume the responsibility for the payment of the bequests or legitimate, among other burdens, but, in the event that there is any debt of the testator, he or she will also have to take care of it. Therefore, before accepting an inheritance laden with legacies and obligations, it is necessary for a legal expert to carry out a study to assess whether it is really worth it. In this sense, the fourth estate provides some certainty that the heir will be able to pay all these expenses.

Do you want to know what requirements have to be met to be able to claim the fourth falcidia and how it is calculated? Just watch the video below!

El Tribunal de Justícia de la Unió Europea ha tombat la norma que obliga a declarar a Hisenda el patrimoni a l’estranger, perquè la considera “desproporcionada”. Per això, ara, el govern espanyol haurà de modificar la llei. Però, mentrestant, què exigeix exactament el Reial decret 1065/2007? A 11Onze fem un resum de la normativa.

Efectivament, segons el Reial decret 1065/2007, ara per ara no cal declarar el patrimoni a l’estranger que no sigui superior a 50.000 euros. Així ho especifica l’article 42 bis, punt 4, quan anuncia que “no existeix l’obligació d’informar sobre cap compte quan els saldos […] no superin, conjuntament, els 50.000 euros”. Tanmateix, en cas de superar aquesta quantitat, sí que s’ha d’informar de tots els comptes a l’Agència Tributària a través del Model 720.

Aquest model 720 es va introduir el 2012 quan l’aleshores ministre d’Hisenda del Partit Popular, Cristóbal Montoro, va decidir perseguir els patrimonis a l’estranger per augmentar la recaptació de l’Estat durant els pitjors anys de crisi financera. Montoro va defensar la mesura com una “regulació fiscal necessària”.

És precisament aquest Model 720 el que el Tribunal de Justícia de la Unió Europea (TJUE) considera “il·legal”, perquè imposa un sistema de sancions massa alt. La sentència del tribunal europeu és demolidora. Argumenta que l’Estat espanyol persegueix la lliure circulació de capitals reconeguda per la Unió Europea amb una “restricció desproporcionada”.

Per això, l’actual ministra d’Hisenda del PSOE, María Jesús Montero, que fins ara mirava cap a una altra banda a l’espera de la decisió del TJUE, ha afirmat que l’Estat reformarà la llei. Si no ho fes, Espanya podria ser multada per Brussel·les. La sentència, que no és explícita en aquests termes, també obre la porta a reclamacions de totes aquelles persones que s’han vist obligades a pagar les sancions que recull la normativa.

Però què diu, exactament, el Reial decret 1065/2007? A continuació, recollim els tres dubtes més freqüents. Alhora, sobretot ara que la norma ha estat impugnada, recomanem resoldre qualsevol dubte amb l’assessorament d’un expert legal.

- Quina informació exigeix presentar a Hisenda? Ara per ara, cal informar de la raó social de l’entitat financera o de crèdit, així com del seu domicili. També s’ha d’entregar la identificació completa dels comptes, amb la data d’obertura i cancel·lació o les dades de concessió i revocació de l’autorització d’un crèdit. A més, cal presentar els saldos dels comptes a 31 de desembre i el saldo mitjà corresponent al darrer trimestre de l’any, tal com recull l’article 4 de la Llei 10/2010 de prevenció del blanqueig de capitals i finançament del terrorisme.

- Quan s’ha de presentar el Model 720? Segons queda recollit a l’article 42 bis, punt 5, el model s’ha de presentar entre l’1 de gener i el 31 de març de l’any següent al qual es refereix la informació a aportar. Aquesta informació s’ha de presentar cada any si, tal com recull la normativa, “qualsevol dels saldos conjunts […] hagués experimentat un increment superior als 20.000 euros respecte dels que es van determinar en la presentació de la darrera declaració”.

- Em poden sancionar si no ho faig? Sí, i de forma “desproporcionada”, segons ha considerat el TJUE. Per això, cal demanar ajuda al teu assessor jurídic, que analitzarà si es pot incórrer en alguna sanció, segons la Llei 58/2003, de 17 de desembre.

Per tal de gestionar bé el teu patrimoni i esvair dubtes, recomanem sempre buscar assessorament legal especialitzat. En qualsevol cas, se superin o no els 50.000 euros, la ciutadania ha de continuar fent la declaració de la renda al país on resideix fiscalment.

11Onze és la comunitat fintech de Catalunya. Obre un compte descarregant la super app El Canut per Android i Apple. Uneix-te a la revolució!

When you ask for information to assess whether to make an investment, the first step is to sign a document certifying you as a qualified investor. This document does not compel you to make any investment, but it is a legal requirement for them to inform you.

It is highly recommended that you never make an investment without understanding it. We make investments with the intention of making a profit, but all investments involve risk. Sometimes the risk may be losing the capital, sometimes it may be not making a profit, and sometimes it may even put your assets at risk if you use them as collateral for the investment. In any case, before making an investment, it is essential to sign a document stating that we are aware of the risks and of our skills as investors.

11Onze Recommends Litigation Funding

In the case of 11Onze Recommends, the fact that the provider offering Litigation Funding is British means that it must comply with UK regulations. Therefore, before the provider can give you the full details of the product, what is known as a Self-Certified Sophisticated Investor document must be completed. Self-Certified Sophisticated Investor is the concept that the regulator responsible for supervising financial services in the UK, the Financial Conduct Authority (FCA), defines as an investor who meets certain criteria of knowledge and experience in financial matters.

In other words, it is the way in which the investor communicates to the investment firm or platform that they know what they are doing and are comfortable being informed of the risks involved in the investment. It is a requirement for investors in certain investment products or services offered from the UK, so that the business can be assured that its client understands the transaction.

What does self-certification require you to do?

Signing the document self-certifying you as an investor does not compel you to do anything. It only authorises the company to provide you with information about a sophisticated investment product. This allows clients to access certain types of investments that are not available to the general public, such as private company shares and other unlisted securities. Likewise, it helps protect less experienced investors from making potentially risky investments that they may not fully understand and to make better-informed decisions.

But filling it in does not mean you end up making the investment. In any investment, once you have the information you have to analyse it, ask all the questions you need to, understand the risks (if any) and decide if it is worth it. In the case of Litigation Funding, the provider is supervised by 11Onze to ensure quality and transparency in the management. Likewise, the 11Onze community can make any suggestions it deems appropriate. It was at the request of the community that 11Onze Recommends renegotiated the terms and conditions of Litigation Funding, simplifying them.

To invest or not to invest

All investments require investors, but not all investors are the same. Investing can be a complex decision, especially for beginners, so before making an investment it is important to know our investor profile and whether we have the basic knowledge to invest in a given product. We need to tailor investments to our possibilities and always understand what we are doing with our money. At a time of low yields on bank deposits and high inflation, it is necessary to learn how to invest safely so as not to lose purchasing power. At 11Onze we try to ensure that our community can do this with as little risk as possible, which is why 11Onze recommends 11Onze Litigation Funding to its community.

If you want to find out how to get returns on your savings with a social justice product, 11Onze recommends Litigation Funding.

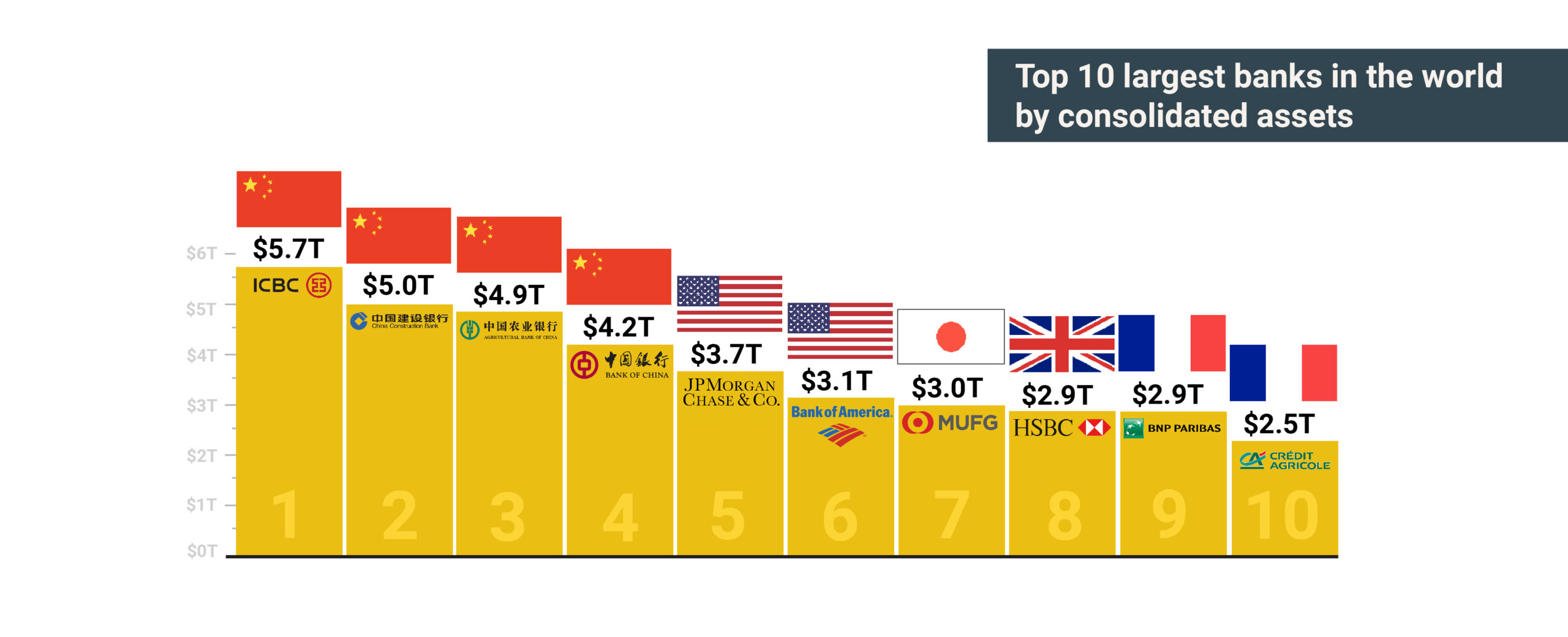

For yet another year, Chinese banks top the global ranking of the world’s most valuable banks, extending their dominance over their Western counterparts amid rising interest rates and slowing global economic growth.

The world’s major banks play a crucial role in the global economy, facilitating international trade, lending to businesses and providing financial services to millions of customers around the world.

This is particularly relevant in the current economic climate where many countries are trying to revive their economies while improving their fiscal balance sheets remains a challenge for their banking systems, given declining business volumes and lower demand for credit.

The combined value of the world’s 500 most valuable banking brands reached a record $1.44 trillion in 2023, almost double what it was a decade ago, according to a report by Brand Finance, the world’s leading brand valuation consultancy.

As every year, the main economic analysis and research entities compile data to publish the ranking of the best-positioned financial institutions according to their market share, turnover or consolidated assets.

The dominance of Chinese banks

Beyond brand value, the ranking of the world’s largest banks varies according to the parameters we take into account. Even so, the dominance of Chinese banks extends not only to the value of their assets, but they are also leaders in other parameters of banking activity such as deposits, loans, and the number of customers and employees.

Thus, the Industrial and Commercial Bank of China (ICBC), China Construction Bank, Agricultural Bank of China and Bank of China once again top the list compiled in a report by S&P Global Market Intelligence.

According to S&P, these four Chinese banks increased their assets by 4.1% in 2022, to a combined total of 19.8 trillion dollars. Moreover, Chinese banks already account for more than a third of the assets of the world’s largest banks.

Two US banks, JPMorgan Chase & Co and Bank of America, are next in the ranking, with the top six US banks accounting for $13.7 trillion in assets. They are followed by Japanese and European banks. In Spain, Banco Santander is in 17th position and BBVA in 46th.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

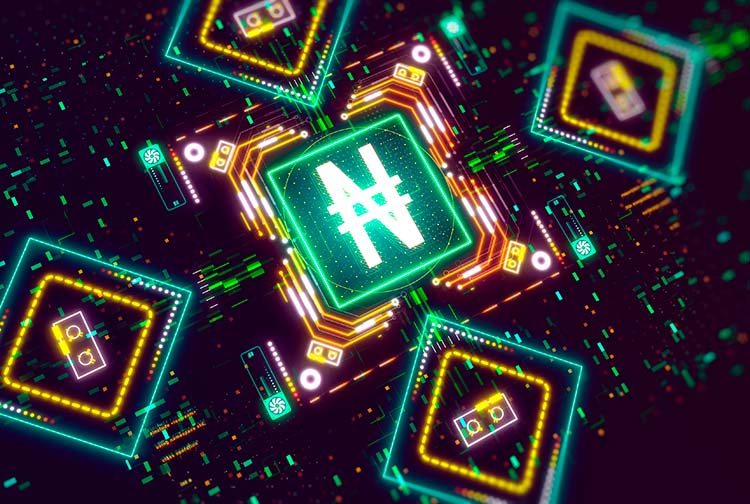

Cash payments, less susceptible to being controlled by the government than digital payments, are being completely replaced by card payments, transfers or other electronic means. Should we be concerned? What options are there on the market? We talk about it with Iu Alemany, Head of Customer Service at 11Onze, in a new episode of La Plaça, Territori 17’s radio show.

Advances in technology, the rise of online shopping and the digitisation of finance have led to the popularity of electronic means of payment. Many countries have already started a transition process with the aim of phasing out cash payments to the point of their possible total disappearance in the not-too-distant future.

On the one hand, the new generations of digital natives are more used to paying via mobile phone or smartwatch than with cash. On the other hand, governments see a good opportunity to fight the black economy and tax fraud by restricting cash payments that are more difficult to trace.

Thus, more and more limits are being imposed on cash payments, such as the European Union limiting cash purchases to 10,000 euros, or the Spanish state going much further by banning cash transactions of more than 1,000 euros in cases where one of the parties is acting in a professional capacity.

An economy subordinated to the banking system

The elimination of cash payments facilitates the bankarization of the economy, i.e. the State’s control over the transactions carried out by individuals and companies through the information provided by the financial system. Cryptocurrencies and blockchain technology have positioned themselves as an alternative to this centralisation of finances, but states have also increased scrutiny and limited the use of such transactions.

In this context, several countries around the world have begun to explore the possibility of issuing central bank-issued digital currencies (CBDCs) – the European Central Bank has for some years now been working on the creation of the digital euro – which would give them unprecedented control over citizens’ money.

Increasing citizens’ dependence on the banking system will reduce the shadow economy, but it may also put our freedoms at risk and affect those most at risk of social exclusion. As Iu Alemany points out, “behind all this, there is a desire to have more control over the economy and the population and, if necessary, at any given moment to open or close the tap”.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Despite a 10% reduction in the price of raw materials, the CPI for food in Catalonia rises to 4.7%. Experts point out that the sector in Europe is taking advantage of this to pass on part of the cost increases of recent years, and other parts of the chain could be expanding margins.

According to data from the Consumer Price Index for February, food is now 4.7% more expensive in Catalonia than it was a year ago. The statistics from the National Statistics Institute for Spain as a whole are even worse, with food prices rising by 5.3% in February compared to the same month last year.

According to INE, over the last twelve months, the foods that have experienced the biggest rises in Spain are olive oil (67%), fruit and vegetable juices (18.8%), potatoes (11.6%), pork (11%), confectionery (10.8%), chocolate (10%), fresh or chilled fruit (9.1%), salt, spices, and herbs (8.8%), sheep and goat meat (8.1%) and, finally, ice cream (7.9%).

Less supply?

The Spanish government blames part of this price rise on a temporary reduction in supply due to “unfavourable weather conditions” in many EU countries, which is reducing production. In fact, as we indicated in another article, Catalonia is suffering the most severe drought since 2008. And it is true that this winter greenhouses have been closed in several European countries because the price of gas is making them loss-making.

However, this argument is not very solid when it comes to justifying the high prices if we take into account that the data of the FAO (The Food and Agriculture Organization of the United Nations) food price index stood at 117.3 points in February 2024, 0.9 points (0.7%) below its revised January level, and 14 points below its February 2023 level of 131.

Impact of costs

Many analysts point out that the price rises have served to offset part of the increase in production costs suffered by the agri-food sector in recent years. These affect such important items as seeds, fertilisers, animal feed and energy.

Fertilisers tripled in price, although they subsequently became 40% cheaper from spring onwards, when they reached their highest price; it is estimated that feed has risen by more than 80% since 2019; and, as for energy, the price per megawatt-hour reached more than 300 euros and the price of a barrel of Brent oil reached 120 euros.

In any case, it is not clear that higher food prices always translate into higher incomes for producers. In this sense, there is much debate about which actors in the food chain are taking advantage of the situation to increase their margins. What is certain is that even the president of Mercadona, Juan Roig, has just admitted that his chain has raised prices “a huge amount”.

11Onze is the community fintech of Catalonia. Open an account by downloading the app El Canut for Android or iOS and join the revolution!